Gold Rush: RBI Bolsters Reserves Amid Global Uncertainty

Despite a slight decline from its peak, India's reserves remain robust at US$ 652.8bn as of June 14. The RBI has followed a proactive approach in managing and diversifying these reserves, which now provide the central bank with sufficient room to stabilise the rupee amid recent volatility. It would appear for more recent data that the RBI has joined the gold rush and is increasingingly diversifying its reserves.

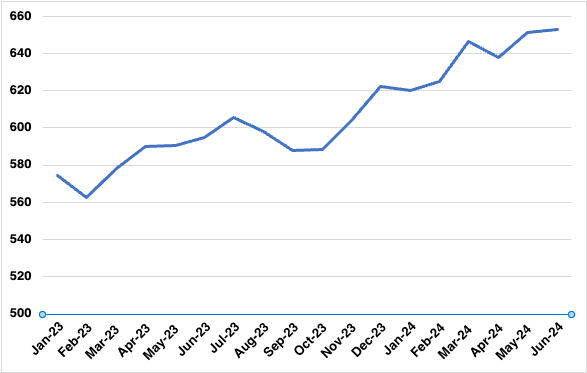

As of June 14, 2024, the Reserve Bank of India (RBI) reported a decline in the reserves to US$ 652.8bn, marking a decrease of $2.9bn from the previous week. Despite this drop, the reserves recently hit an all-time high of US$ 655.8bn on June 7, showcasing a significant buildup over the past year. India’s foreign exchange reserves are comprised of foreign currency assets (FCA), gold reserves, special Drawing Rights (SDRs), and the reserve position with the International Monetary Fund (IMF). The latest data reveals that FCAs, a major constituent of the reserves, decreased by US$ 2.1bn to US$574.2bn. Gold reserves also saw a reduction, falling by US$1bn to US$ 55.9bn. Conversely, India's reserve position with the IMF increased by US$ 245mn to US$4.6bn.

Figure 1: India Foreign Exchange Reserves (US$ bn)

Source: Reserve Bank of India

What is noteworthy though is the accumulation of high foreign exchange reserves by the RBI over the previous few months. The RBI has been actively absorbing foreign inflows, which has contributed to the rise in foreign currency assets over 2024. The domestic debt market saw a net inflow of US $710mn in the first week of June, coinciding with a 0.1% appreciation of the rupee during the week. However, the rupee touched a record low of 83.66 against the US$ on June 20, prompting the central bank to sell dollars from its reserves to stabilise the currency. The RBI's intervention in the domestic currency market has been crucial amid pressures on the INR. We anticipate foreign exchange reserves to decline slightly over the next few weeks, as the RBI intervenes in the market to stabilise the INR. The RBI releases data regarding the sale / purchase of USD with a lag. According to the RBI's last monthly bulletin released earlier in June, the RBI sold US$ 3.6bn in April in the onshore offshore currency segment.

The large foreign exchange build up provides the RBI with a cushion to mitigate excessive volatility in the INR. In recent months, the RBI has been proactive in managing the country's forex reserves. Governor Shaktikanta Das has emphasised the central bank's commitment to building a strong buffer of foreign exchange reserves to prepare for potential future economic downturns. In addition to foreign currency assets, the RBI has been diversifying its reserves by increasing its gold holdings. As of early June, gold reserves accounted for 8.69% of the total reserves, up from 7.76% at the end of 2023. Since December 2017, the RBI has steadily increased its gold reserves, a trend that has accelerated over the past two years due to global geopolitical uncertainties, such as the war in Ukraine and tensions in West Asia. Recently, the RBI acquired another three tonnes of gold in May, bringing the total for this year to 28 tonnes. This move aligns with global trends, as central banks around the world have also been increasing their gold reserves, reducing their exposure to U.S. Treasury securities in response to geopolitical instability. The RBI's decision to repatriate over 100 tonnes of gold from the UK last year and its plans to add similar quantities to its reserves further reinforce this approach.