Published: 2023-12-15T07:59:16.000Z

EUR/USD, GBP/USD flows: Focus on PMIs after hawkish European central bank statements

Senior FX Strategist

-

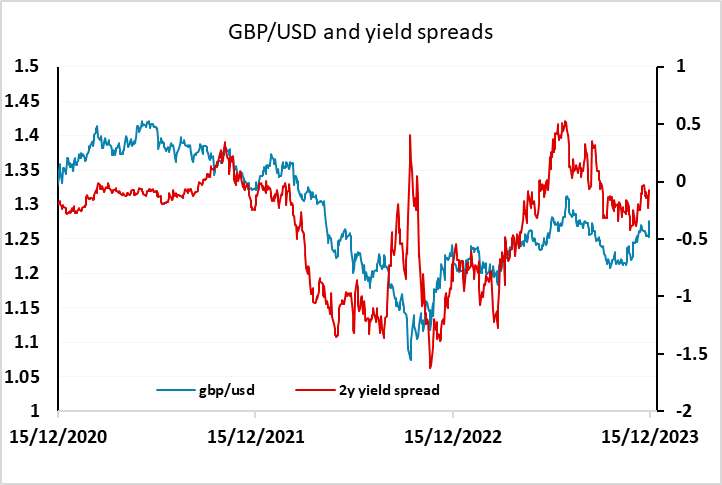

GBP may have scope for further recovery as BoE retains its hawkish stance

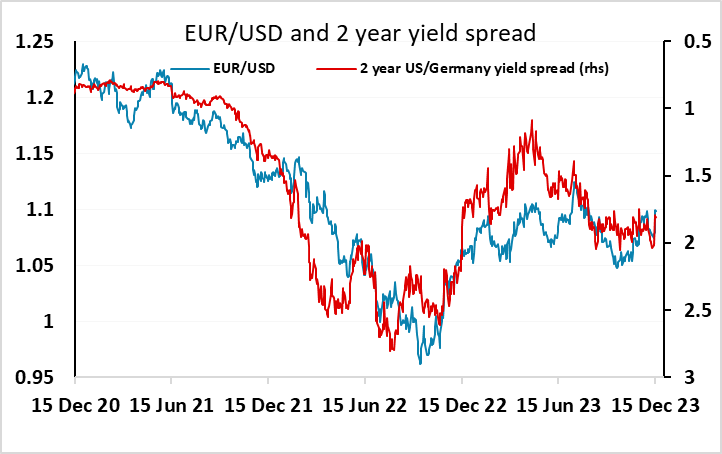

A relatively quiet overnight session sees most of the majors return to Europe little changed from Thursday closing levels. The clearly hawkish tone from the ECB and the BoE has given European currencies a boost, and the bounce is likely to be sustained as long as risk appetite remains positive. The markets are still pricing in sharper and earlier rate cuts in both the Eurozone and the UK than the comments from the BoE and ECB suggested, with cuts in the Eurozone priced in by April and in the UK by June. This could be affected by today’s PMI data, with evidence of recovery likely to lead to a further rise in rate expectations, while weak data could undermine the credibility of the hawkish stance. If UK PMIs retain their relative improvement seen in November, we may see GBP extend its gains, particularly against the USD. There seems to have been a significant risk premium attached to the pound since last year, which may start to be unwound if the USD is generally weaker.