EUR/USD, USD/JPY, EUR/SEK flows: USD weaker after FOMC, focus on ECB and BoE

USD slumps, notably against the JPY, after more dovish FOMC. Focus on ECB and BoE

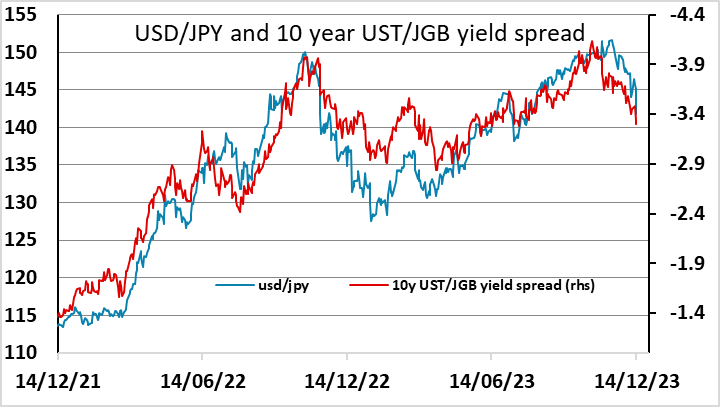

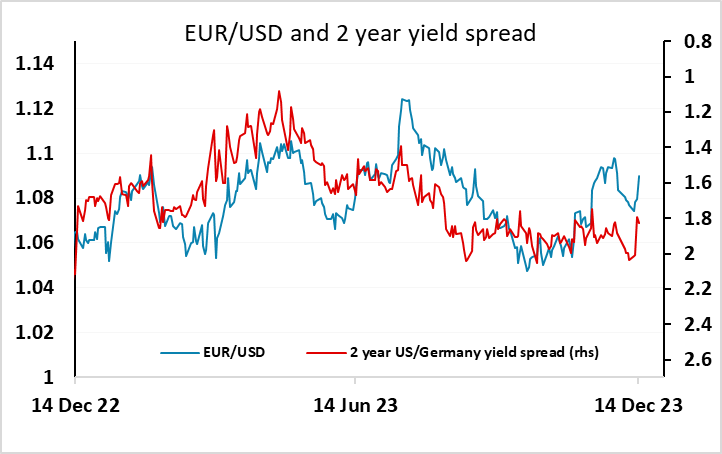

The big move overnight was the USD drop, particularly against the JPY, with USD/JPY losing more than 3 figures and hitting its lowest since July after the FOMC meeting. The lower Fed “dots” and Powell’s more dovish comments have sent US yields lower across the curve, with 10 year yields below 4% for the first time since August and 2 year yields at their lowest since May. We still see further JPY upside both against the USD and on the crosses, although there is unlikely to be much more USD/JPY downside today. However, the ECB and BoE meeting offer the prospect of further significant moves. The market will now be expecting similarly dovish takes from the ECB and the BoE, and certainly there is still scope for the market to price in more aggressive BoE easing, even after the increase in easing expectations seen since the FOMC. But this is less the case for the ECB with the market already pricing in more than 150bps of easing for next year. We also doubt the ECB will be notably more dovish than expected, even though they will certainly shift dovishly relative to previous statements. This may mean some more upside for the EUR against the USD and GBP.

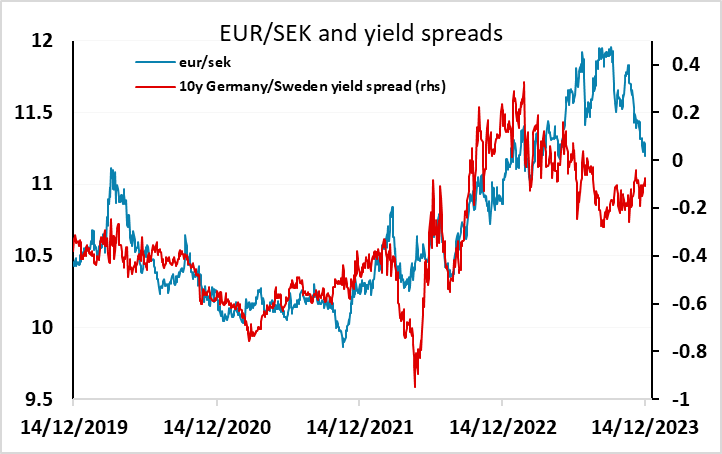

Otherwise, Swedish November CPI has come in on the weak side of expectations at 5.8% headline and 3.6% core. There has been little net impact on EUR/SEK, which continues to hover close to 11.20, although there is a mild bid. We still see some modest downside risks medium term, but the lower inflation numbers may prevent that for today, although the positive equity market reaction to the FOMC meeting overnight might be seen as mildly SEK positive.