Published: 2023-11-22T12:56:33.000Z

Chinese Yuan Bounce Overdone

Director of Research , Macroeconomics and Strategy

-

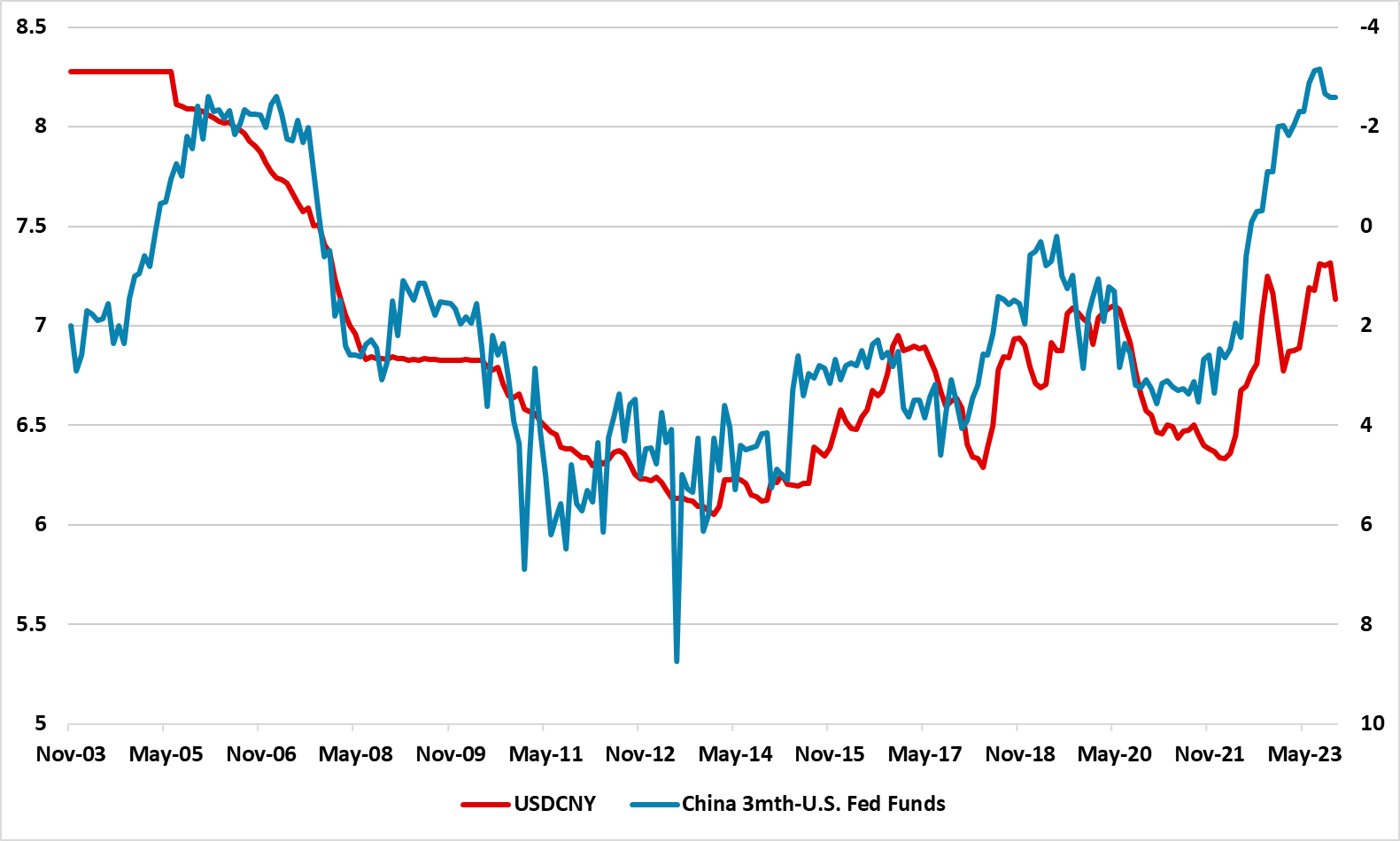

Bottom Line: USDCNY should run out of steam around 7.00, both as interest rate differentials remain wide and concerns over China will likely cap the technical rebound.

The CNY recent rally against the USD is largely driven by the softer tone of the USD across the board. However, interest rate differentials will likely remain at current wides until Q3 2024 and will then only narrow slowly. Meanwhile, foreign investors continue to liquidate China assets on concerns about long-term growth and Taiwan geopolitical uncertainty, which are unlikely to reverse. Additionally, China will not want too much of a Yuan rebound, given the weakness in exports. Finally, we see some scope for growth disappointment in 2024, as China consumers post COVID pent up demand ebbs. Thus we see the squeeze on Yuan shorts running out of steam around 7.00. We would not be surprised to see PBOC FX intervention to curtail the Yuan rise and then USDCNY could settle around 7.10 into year end.