FX Daily Strategy: N America, June 20th

Data Dependent Easing Bias Makes BoE Decision Unclear

Another Cut Likely for SNB but How Large an Inflation Target Undershoot

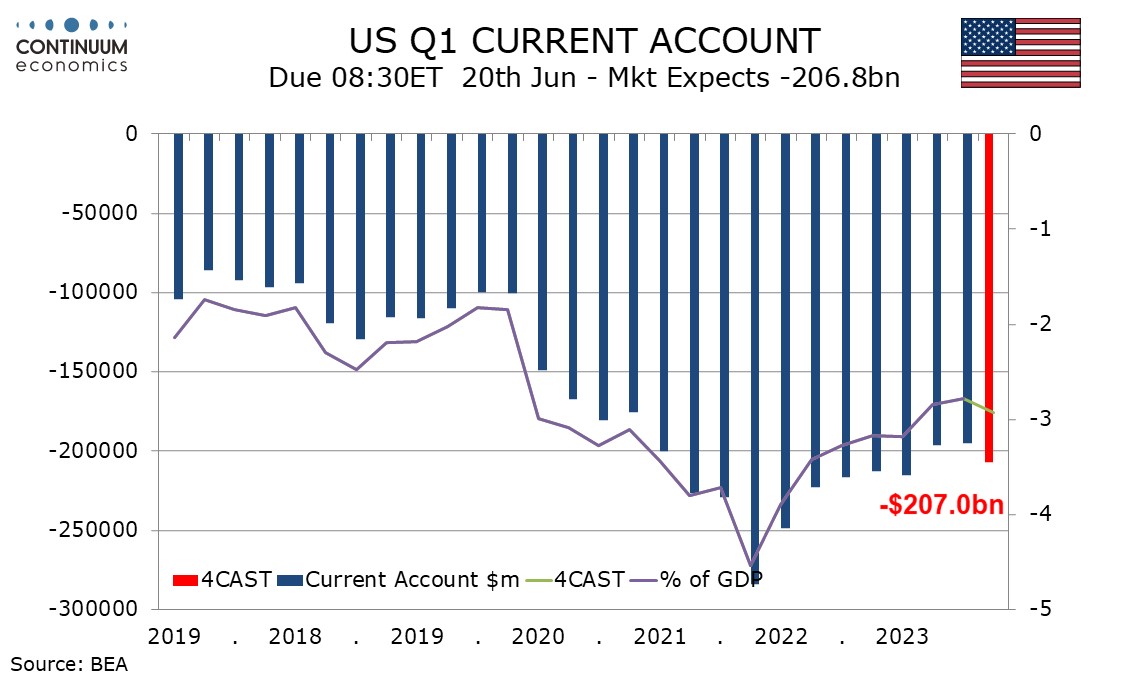

U.S. Q1 Current Account Deficit to correct higher

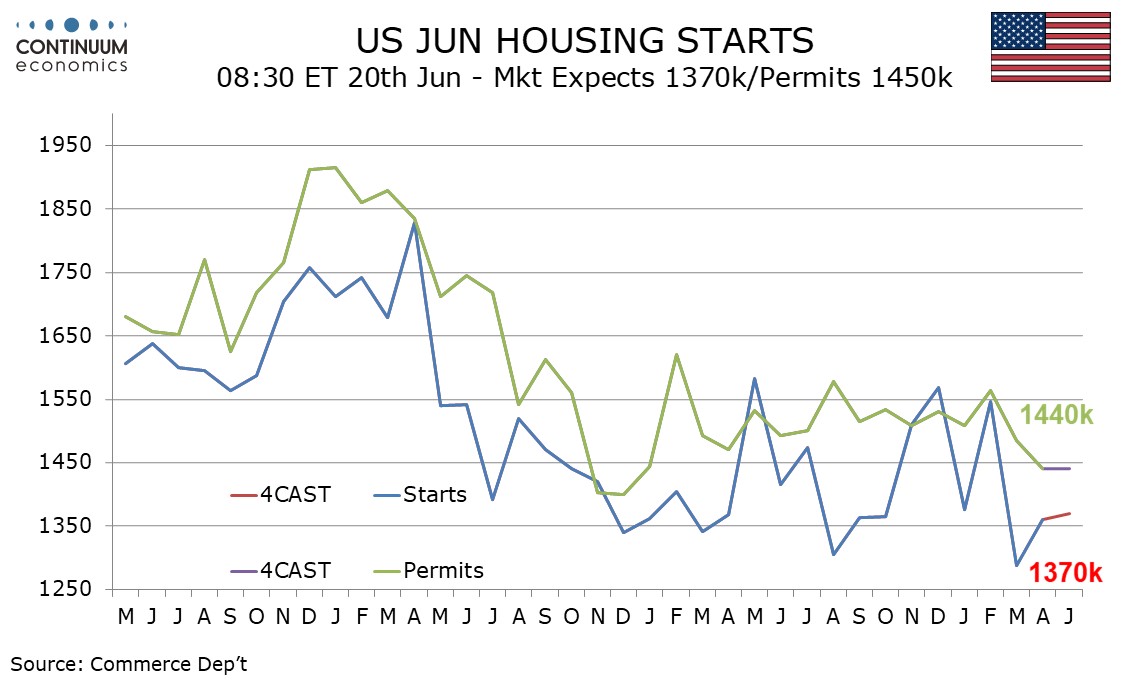

U.S. May Housing Neutral month within a slowing trend

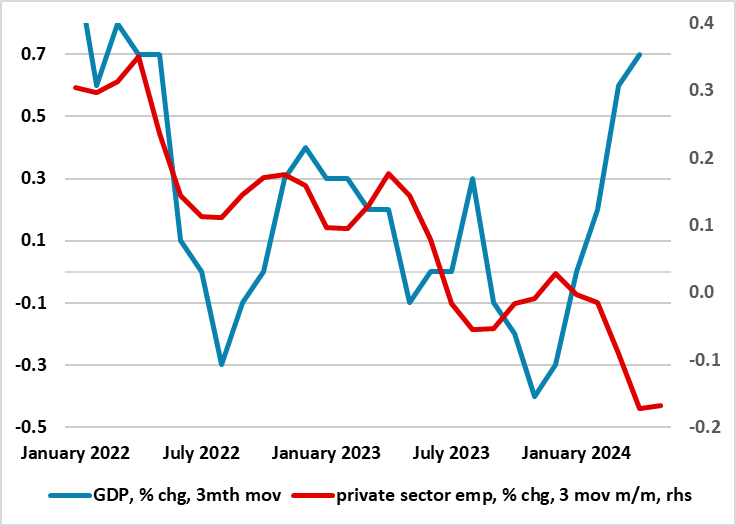

Figure: Softer Jobs Market Suggest Weaker Picture Than GDP Trends?

After Bank Rate was kept at 5.25% for the sixth successive MPC meeting last month, Governor Bailey remarked that then market rate pricing may be too cautious. He also accepted that a rate cut at the next MPC verdict on June 20 was a distinct possibility, but underscored the importance of the data due in the interim. In this regard, it is quite possible that the key May CPI data due on June 19 could largely reverse the upside surprise see in April’s numbers released last month. In addition, labor market numbers have offered both signs of softer wage pressures as well as implying a softer GDP picture than official national account numbers have (Figure 1), this adding to divergent trends in other perhaps even more key data that the BoE also has to assess. Thus we see a 25% chance of the BoE easing next week as opposed to the near zero possibility flagged by markets. But with the BoE verdict now coming during a surprise election campaign this perhaps being the main factor arguing for another stable policy decision.

Even if policy is again unchanged, there may be even more dissent in favor of an immediate rate cut after of Dep Gov Ramsden confirmed his more dovish leanings last month. But the picture of BoE thinking is unclear after the MPC went into effective purdah once the general election was called and we do not know to what extent this may also affect any willingness to make actual near-term policy changes. What remains the case is that the updated BoE projections offered last month at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves then seen through this year. This is something that chimed with the cumulative reduction of 100 bp by year end we have been forecasting and still largely adhere to.

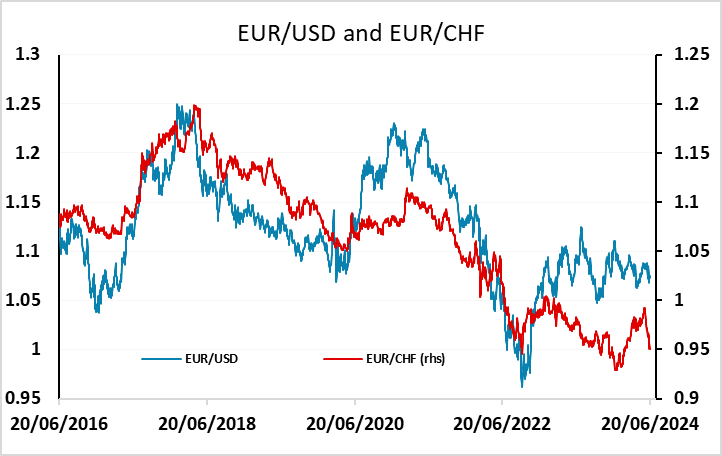

The SNB have cut rates a further 25bps as most forecasters expected (although some platforms have been indicating that no cut was expected). The market was 65% priced for a cut, so EUR/CHF has risen half a figure on the decision. The bounce has come from a significant retracement level near 0.9480 and we should now see a period of consolidation above 0.95. The SNB also indicate that they are prepared to be active in the FX market where necessary, suggesting the may move to shut off any further CHF appreciation. Their inflation forecast going forward is little changed after the rate cut (but would have been lower without the cut) and leaves the possibility of a further cut in September. This is now priced as around a 70% chance. All in all, we would favour some further CHF downside provided that the risk tone elsewhere remains reasonably positive. If geopolitical factors undermine growth and risk appetite, which the SNB highlights as a risk, the CHF may see some upside pressure, but the SNB may act to prevent gains, and we would still see the JPY as representing the better value as a safe haven.

We expect a Q1 US current account deficit of $207.0bn, or 2.9% of GDP, up from $194.8bn in Q4 when the deficit was 2.8% of GDP. Trend in the deficit has been narrowing since Q1 2022 and it is unclear whether Q1’s deterioration marks a turning of trend. The deterioration in the deficit will be largely due to an increase in the goods trade deficit for which data has been already released. This was largely due to a rebound in imports from a weak Q4. The services surplus saw a modest improvement.

Still to be released are data on primary (investment) income and secondary (unilateral transfers) income. We expect Q1’s totals to look similar to the respective Q4 totals of a $36.1bn surplus and a $39.0bn deficit. However Fed flow of funds data suggest Q4’s primary income surplus may be revised lower, leaving the Q1 outcome improved from a weaker Q4 outcome.

We expect little change in May housing starts, where we expect a rise of 0.7% to 1370k, or permits, which we see unchanged at 1440k. This is likely to be a pause before renewed slowing. Most housing sector signals have been pointing lower recently, but non-farm payroll details on construction were more positive in May after a weaker April, suggesting May’s data may outperform the underlying picture.

We expect starts to show a modest rise in singles after two straight declines while multiples show a modest rise after a steep April decline that corrected a sharp increase in May. We expect permits to show a rise in multiples after two straight declines but a fourth straight decline in singles. The four straight declines in single permits will come after thirteen straight gains. Single permits tend to be consistent with underlying trend, which appears to have peaked.