USD flows: USD generally weaker after employment report

US employment report clearly on the weak side with downward revisions to August and September as well as the weaker (but weather and strike affected) October number. USD risks on the downside but major move unlikely ahead of the election

The US employment report is clearly weaker than expected, with non-farm payrolls only rising 12k. While this weakness may well be related to hurricanes Helene and Milton and the Boeing strike, there were also downward revisions to both August and September employment, so the payroll rise is clearly weaker than expected. Against this, average earnings rose 0.4%, a little more than the 0.3% expected, the workweek was up, and the unemployment rate was unchanged at 4.1%, despite a 368k decline in employment in the household survey.

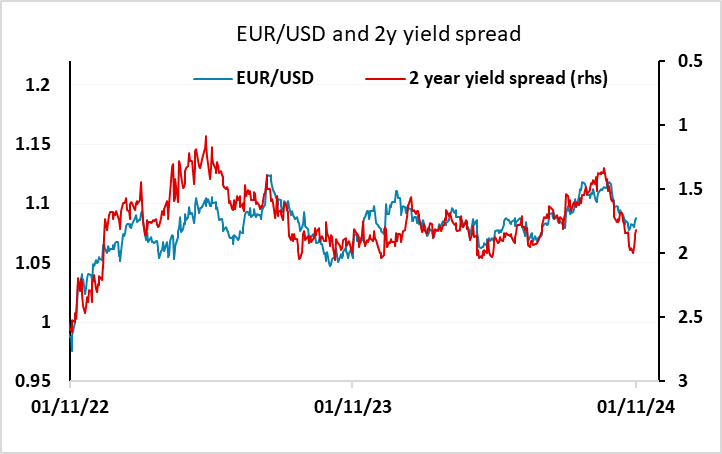

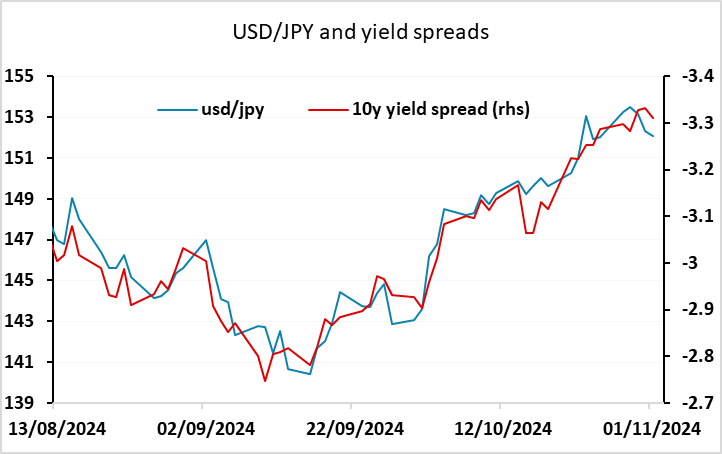

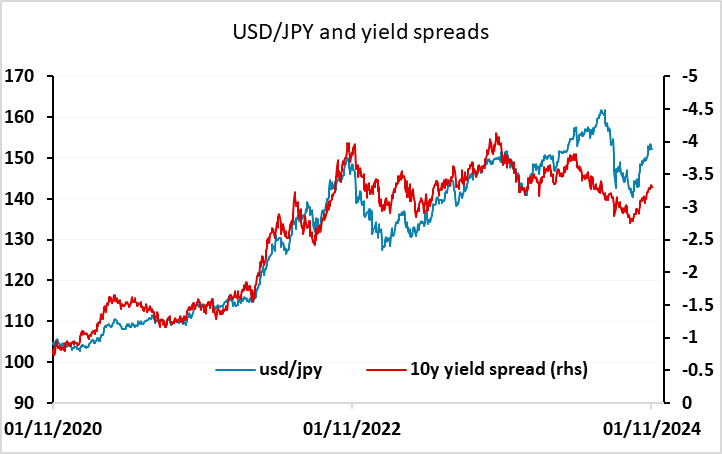

While a USD negative response is justified, with US yields generally lower, yield spreads haven’t moved enough to suggest a large USD decline. At the front end, there is potential to fully price in a December cut as well as the cut next week, but this wont mean very much more of a decline from current levels. At the back end, weaker growth expectations are likely required to pull 10 year yields much below 4.2%. So based on recent yield spread correlations, we probably won't see significant near term EUR/USD gains above 1.09 or USD/JPY declines below 152.

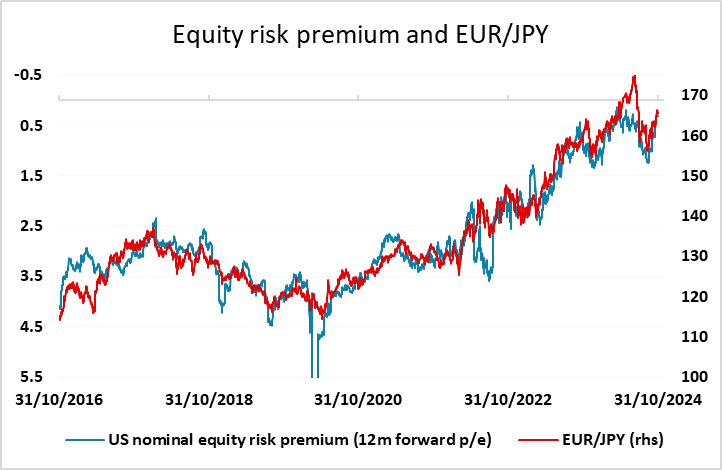

Of course, bigger picture we still see substantial scope for JPY gains across the board, but this still looks likely to depend on a turn weaker in equity markets. There is also potential for a paradigm shift after the US election next week. For now, while the USD is likely to remain slightly on the back foot, we would only expected fairly modest moves.