FX Weekly Strategy: January 27th-31st

Fed and ECB unlikely to deliver surprises

USD may continue to edge lower as Fed will struggle to commit to a more hawkish view

Further USD downside will depend on Trump’s tariff stance remaining more benign

JPY upside still favoured but gains will be modest if risk sentiment stays posiitve

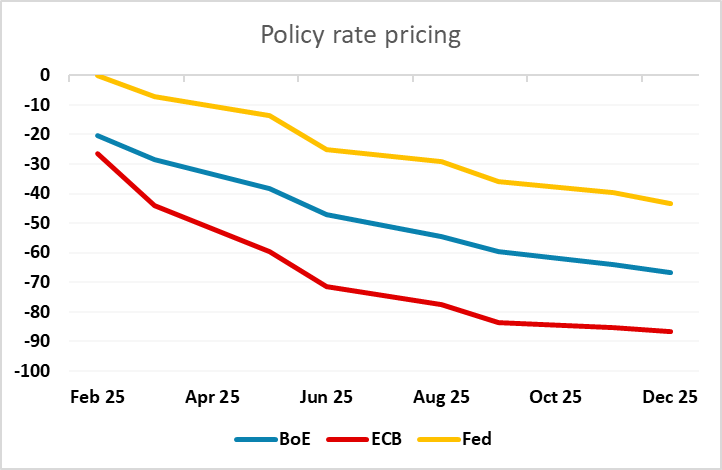

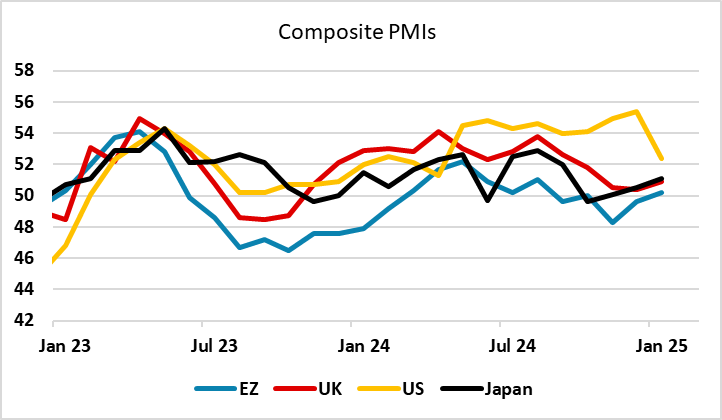

While the Fed and ECB meetings are the most obvious events of the coming week, they are unlikely to contain any major surprises. In both cases the question is less about what they do than what they say, but with no Fed dots due this month any increased hawkishness would have to be conveyed in the statement rather than in the data. While there may be some fine tuning of the statement, the risk may be that the statement is less hawkish than feared, given that the market is currently pricing less than two Fed rate cuts this year. The PMI data on Friday showed some evidence of slowing in the services sector, although such data is very preliminary at this stage, and the continuing claims data hit the highest since 2021, so while in general the evidence from the economy is positive, there are still enough signs of slowdown to prevent anything significantly hawkish from the Fed. This may mean the USD continues to slip lower.

In any case, it is still hard for the Fed to make any confident assessment of the economy given there is huge uncertainty surrounding policy, both on tax cuts and tariffs. Trump appeared to perform an about turn on Friday, saying that he didn’t want to raise tariffs on China, but there can be no confidence that his position won’t change again. Indeed, further tariff threats are near certain, but it remains unclear whether the threats will translate into action and if so what the size, timing and scope will be. Tax cut proposals beyond the extension of the 2017 cuts also appear to be hitting some problems in Congress. So the Fed is likely to change very little, given the lack of new information, and this will tend to be USD negative unless we see some more explicit tariff threats from Trump in the meantime.

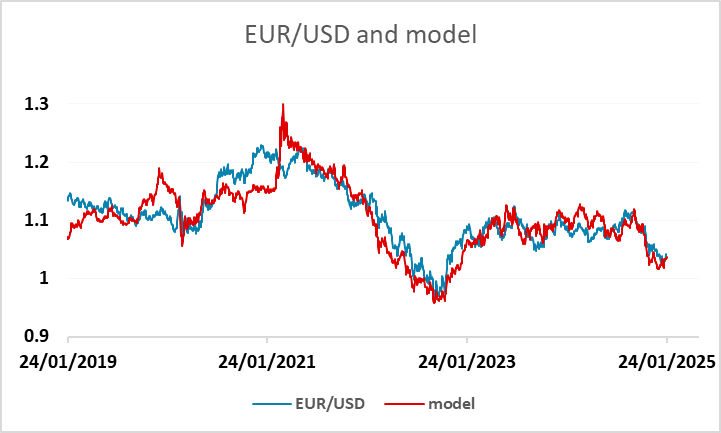

The EUR performed well on Friday, benefiting from better than expected PMIs and a generally positive risk tone engendered by Trump’s more benign comments on tariffs. We wouldn’t expect much impact from the ECB meeting. Although if anything there may be scope for a little more easing than the market is pricing in, there are three cuts priced in for H1 and it’s unlikely that the statement or Lagarde will be clearly dovish enough to justify more than that, so there is limited downside scope for EUR front end yields. Our models still suggest that EUR/USD is broadly fair at current levels, but there is scope for gains from here if European equities continue to outperform the US. This looks possible, given the relatively low European valuations, but it is still unlikely o be a dramatic outperformance unless we see US equities sell off sharply, and that would, initially at least, tend to favour the USD against the riskier currencies.

The JPY underperformed on Friday in spite of the BoJ rate hike, which had of course been widely expected. But Japanese yields did also edge higher on the day, and yield spreads continue to suggests some downside risks for USD/JPY. JPY weakness was in part due to the risk positive tone to Friday’s trading and consequent selling of JPY on the crosses, but this may well peter out this week, especially if Trump once again decides tariffs are a good idea. There should be scope for USD/JPY to trade down sub-155, but although we favour medium term JPY gains, they are still unlikely to come fast unless we see a significant turn lower in US equities.

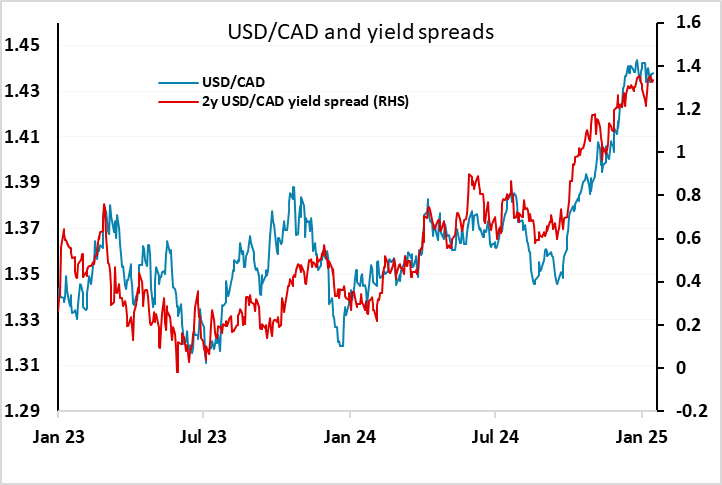

The BoC meets on Wednesday ahead of the Fed, and is widely expected to cut rates 25bps. This is around 90% priced in, so there shouldn’t be much impact on the CAD. The CAD is more likely to be affected by any developments in the tariff discussions between the US and Canada. USD/CAD is already at high levels, and it seems unlikely that any increase in tariffs on Canada would have a major impact on trade, given that most of the Canadian trade surplus is relatively inelastic energy exports. But sentiment would benefit if Trump dialled down his threats, so risks look to be mostly on the CAD upside.

Data and events for the week ahead

USA

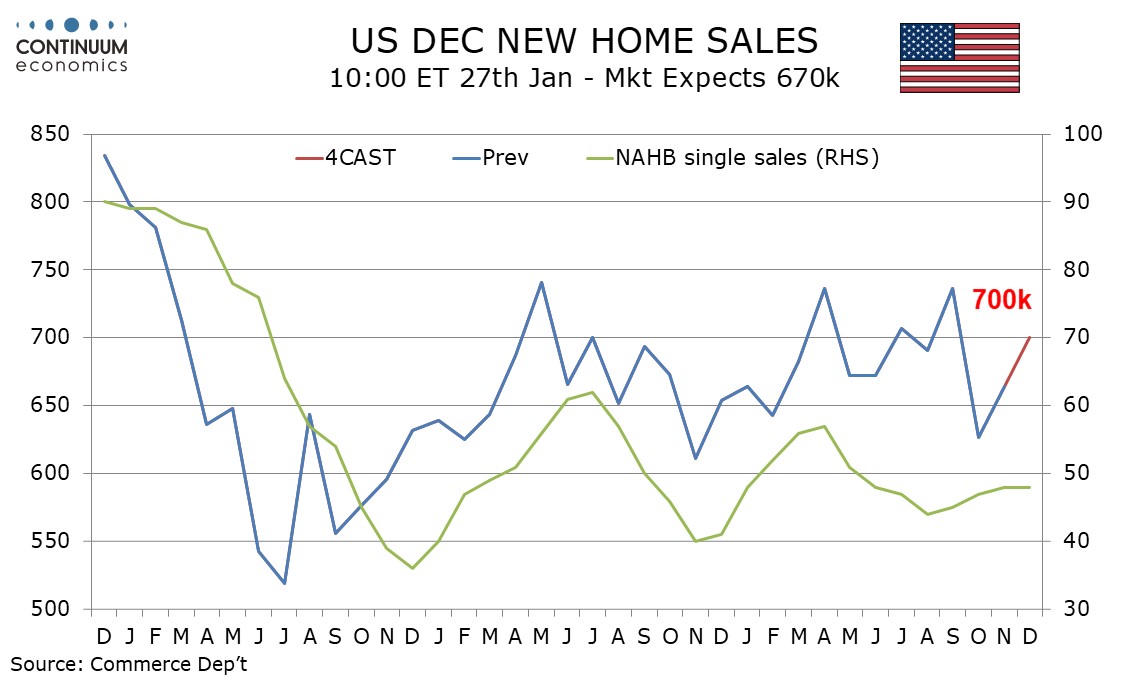

On Monday we expect December new home sales to rise by 5.4% to 700k, and on Tuesday we expect December durable goods orders to rise by 2.2% with a 0.5% increase ex transport. Also due on Tuesday are November house price data from FHFA and S and P Case-Shiller, and January consumer confidence. On Wednesday we expect an advance December goods trade deficit of $109.9bn, up from $103.5bn in November. This release together with advance December wholesale and retail inventory data due at the same time could see some fine tuning of Q4 GDP expectations.

Later on Wednesday comes the FOMC rates decision, though policy looks set to remain unchanged with a 4.25-4.5% Fed Funds target. The statement may see some fine tuning in a hawkish direction, particularly regarding the labor market, but Powell is still likely to express cautious optimism that inflation will fall further, and thus imply scope for further easing. He is however likely to note the highly uncertain policy picture, and the data-dependent nature of future rates decisions.

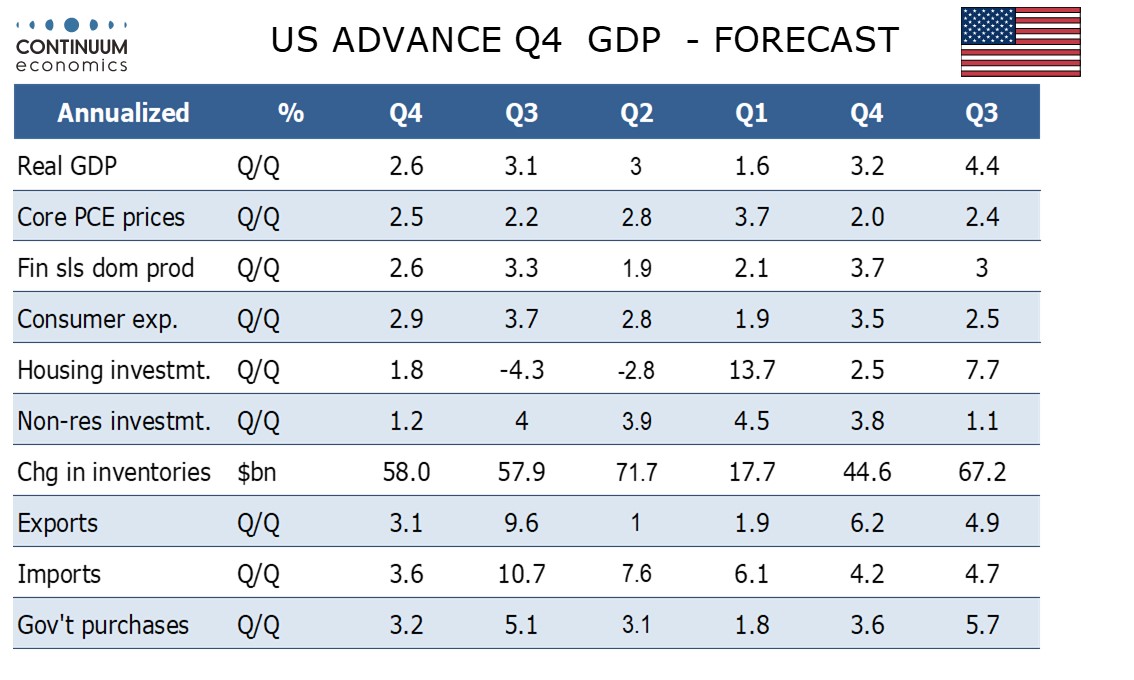

Thursday sees the advance estimate of Q4 GDP, where we expect continued solid growth with a rise of 2.6%, with a 2.5% core PCE price index. Weekly initial claims are due at the same time, and December pending home sales follow. Friday’s personal income and spending report for December will be largely old news with Q4 totals due with the GDP report, but ahead of GDP we expect a 0.2% rise in core PCE prices, and 0.4% gains in both personal income and spending. At the same time we expect a 0.9% increase in the Q4 employment cost index.

Canada

Ahead of the FOMC decision, the Bank of Canada meets on Wednesday and we expect they will see the economy as weak enough to justify a 25bps easing, taking the rate to 3.0%, though the pace will slow after two straight 50bps moves. November GDP is due on Friday, and we expect a decline of 0.1%, in line with a preliminary estimate made with October data, which saw an above trend rise of 0.3%.

UK

There is an appearance by BoE Governor Bailey in parliament (Wed) as he testifies regarding the Bank of England Financial Stability Report. Datawise, there is nothing of note until Thursday when BoE data on money and credit arrive.

Eurozone

There is certain irony that for an ECB Council that has evidently shifted its main concern away from broadly falling inflation to real economy weakness, its next policy decision arrives on the day of the next GDP release, next Thursday. We see the ECB cutting a further 25 bp but with some Council members again calling for a larger move but with clear pointers that additional easing is on the cards. Regardless, it is unlikely that the Q4 GDP outcomes will make much difference to the ECB’s thinking, not least as the figure will come with no breakdown and will be liable to marked revision. ECB thinking may be more moulded perhaps by survey data (eg Monday’s IFO and its own expectations survey on Friday and Tuesday’s bank lending surveys). Notably, the latter provided some better signs last time around. Indeed, while still suggesting banks remain cautious about lending, the data suggested a clear improvement in the demand for loans (Figure 1) and very much reflecting an increasing perception that interest rates have started to fall! There will also be the monthly update on money and credit (wed) for the ECB to chew over.

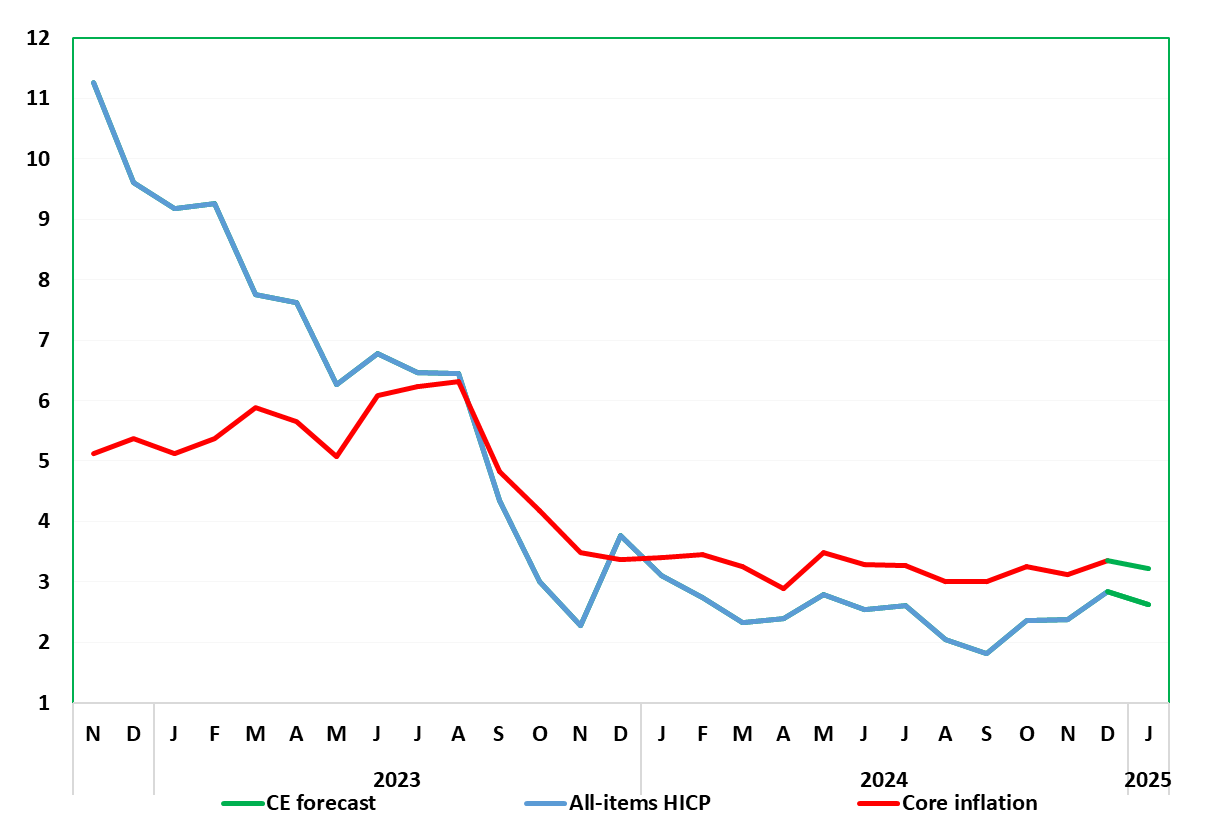

Services Inflation Persistence Less Evident?

Source: German Federal Stats Office, CE, % chg y/y

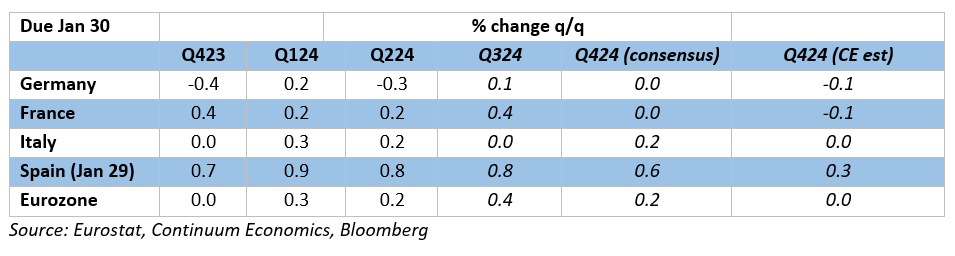

As for EZ GDP, we see a below ECB and consensus outcome of zero in q/q terms for Q4 GDP, including a small fall in Germany and even France. There are also January CPI/HICP data from Spain, France and Germany (Fri). As for the latter, after a largely energy but a still relatively broad rise to an 11-mth high of 2.8% in December, we see the rate down 0.2 ppt to 2.6% in the preliminary January reading. The core rate may drop 0.1 ppt reversing half the rise to 3.3% see last time around.

Figure 1: Divergent EZ GDP Picture Still Clear in Q3?

Rest of Western Europe

There are only some key events in Sweden, most notably the Riksbank decision (Wed). Having delivered the widely-expected fifth successive rate cut at the December Riksbank meeting, the Riksbank hinted that the easing cycle is drawing to an end. But the minutes to that last meeting showed that the Board majority favoured exercising a further cut at either the (looming) Jan 23 or Mar 20 meetings. We favor a move this month and still suggest that the Riksbank growth assumptions are far too optimistic, something GDP indicator numbers (Wed) may corroborate. In Switzerland, there is the KOF survey (Thu), likely to remain sub-par.

Japan

The BoJ policy minutes will be released on Wednesday and could pick their brain on why they decided to hike 25bps and perhaps some forward guidance. Tokyo CPI will be on Friday and will preview whether the heat in inflation continues. Else, consumer confidence on Wednesday will be interesting to see as its crucial for consumption to pick up for BoJ’s forecast to be in line.

Australia

The critical CPI is on Wednesday and is expected to continue stay within the target range. There will likely be an Aussie reaction as the low tick in CPI will trigger the RBA to ease earlier than they currently suggest in May 2025. We also have Business confidence on Tuesday and PPI on Friday.

NZ

Trade balance on Thursday would be the most important economics data for NZ. Consumer confidence is on Friday.