This week's five highlights

Trump's Policy and Market

China/U.S. Trade Relation

BoJ Hikes by 25bps

And Should Support JPY

Norges Bank's Head Stays in the Sand

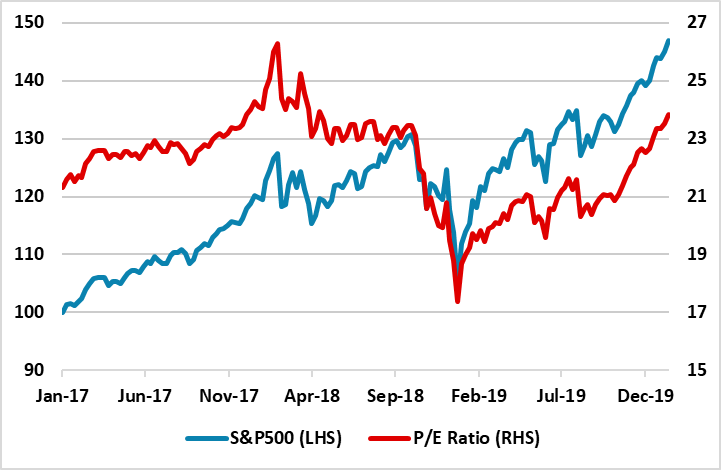

Figure: S&P500 and Trailing P/E Ratio (Jan 1 2017 = 100 and ratio)

Global markets will be driven by policies and current valuation in 2025, especially new Trump administration policies. Trump could jawbone markets for a lower value of the USD and lower oil prices, which could have a temporary modest impact (joint US/Japan FX intervention is possible) but the structural drivers are much more important. Meanwhile, an overvalued U.S. equity market is vulnerable to a 2018 style correction on any major bad news that could then trigger Trump pressure on the Fed to ease more – which in itself could amplify volatility.

Global financial markets have taken on a positive risk tone after Trump’s initial policy announcements and meetings, with tariff policy seen to be transactional. The market hopes that tariffs will not get serious before new trade deals are agreed (see here for our article on U.S./China). For U.S. inflation this is less of a worry than a universal structural tariff scheme. Additionally, the president is already getting annoyed with congressional leaders. Conservative GOP members are reluctant to grant Trump’s wish for a 2yr extension to the debt ceiling and push back is being seen in the House on extra tax cuts beyond renewing lapsing 2017 tax measures. This has helped long-dated U.S. Treasury yields move lower and combined with a controlled core CPI figure has soothed the bond market. Less high bond yields, plus a transactional approach to trade has helped U.S. and global equities. While markets will be dominated by policy this year, will Trump respond to markets and will it matter?

Trump is keen on a rising U.S. equity market as a measure of his success, which worked smoothly in the first 18 months of his 1 term (Figure 1). However, a sharp correction in Q4 2018 prompted Trump first to first blame Fed tightening for hurting the market and subsequently to blame them for not cutting interest rates aggressively. We remain concerned that a sharp correction could occur in U.S. equities in 2025 given that the market is clearly overvalued in equity terms and against bonds and any bad news could trigger a reversal (here for Dec Equity Outlook). Trump’s response could be to blame the Fed for slowing or pausing the easing cycle, which would reopen a battle between Trump and the Fed and this could amplify volatility and a risk off phase in markets. Though the Fed will act independently it is possible it could bend to Trump’s desires, especially if core PCE/CPI are tracking back to 2%. However, the U.S. equity market big picture view is mainly a question of whether the good news keeps coming or bad news arrives.

Secondly, Trump has a bias to a lower value for the USD, though he understands the mantra that the US wants a “strong” USD in terms of inflation control. This could produce bilateral exchange rate frustration if a country responds to tariffs with a weaker currency just like China did in 2018 – highly likely again in China’s case (here). Trump could jawbone that the EUR or the JPY are too low and produce a temporary short squeeze. Though relative yield spreads remain the structural support for the USD, it is feasible that the U.S. could agree joint FX intervention with Japan that could produce an extended temporary squeeze on JPY shorts. Trump could also jawbone that the (overall) USD value is currently too high (Figure 2), which could likely have a temporary effect without changing the structural USD picture.

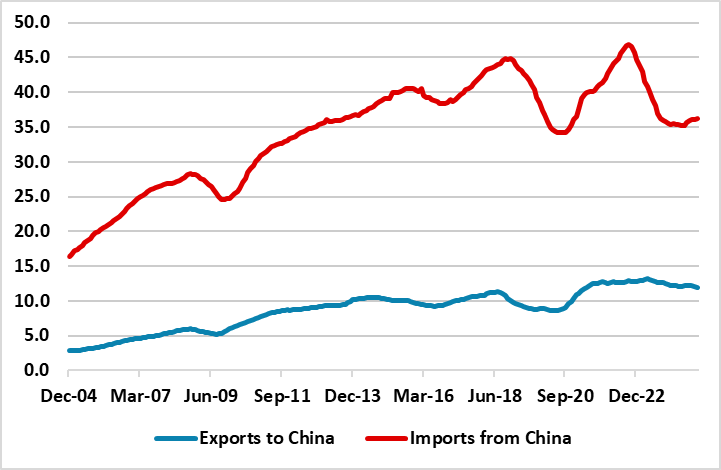

Figure: U.S./China Exports and Imports (12mth MA USD Blns)

We see the April 1 review of the phase 1 U.S./China trade deal being adverse and President Trump’s carrot and stick approach leading to a 10% rise in tariffs on China imports by the summer. We eventually see a phase 2 U.S./China trade deal being reached in Q4. The main alternative scenario is that China could show goodwill to resolve illegal Fentanyl movements from China to the U.S. and a sale of Tik Tok U.S. sale. This could then lead to spring hopes that a phase 2 U.S./China trade deal can be reached and a trade war avoided.

There are mixed signals on China/U.S. trade relations in the early days of the new President Donald Trump administration. The threat of a 10% tariff against China if it does not stop illegal Fentanyl going to the U.S. could now be imposed as early as February says Trump. However, the recent Trump/Xi call appears to have been cordial and reports suggest an invite has been extended for Trump to visit China. China’s VP visit to the inauguration also saw warm briefings afterwards. Is this heading to trade war or trade deal? A number of points are worth making.

The BoJ hiked by 25bps to 0.5% in the January meeting by an 8-1 vote. The only dissent, Nakamura, is favoring a hike in February. The BoJ cited the alignment of economics development and wage growth with forecast to support their rationale of the rate hike. They also revised ex fresh food CPI inflation higher for 2024 to 2.7% (0.2% higher) and 2025 to 2.4% (0.5% higher) as import prices will be more expensive due to weak Yen. Market participants are viewing the January hike to be hawkish as forecast open the path for more tightening but we are viewing such with a pint of salt.

The December headline CPI has shown a jump to 3.6% y/y with ex fresh food at 3% y/y and ex fresh food & energy 2.4% y/y. However, looking into the details we could see a big chunk of inflationary pressure comes from fuel prices as ex fresh food & energy CPI is 0% m/m. Energy prices are likely to rotate lower with geopolitical tension eases in 2025, OPEC+ cuts expire and a moderate demand growth. Unless the JPY stayed exceptionally weak, import prices may disappoint the BoJ.

Moreover, even when unions are asking for larger than 2024 wage hike, SMEs are unlikely to keep up given their tight profit margin. SMEs were already lagging behind the wage growth of larger business and will likely stay that way until the gradual change in business price setting behavior accumulates to a certain extent. Combined with the slow acceptance/reluctance for Japanese consumers to consume at high price, the incoming inflation picture is likely to be cooler than BoJ's current forecast.

The rate hike from BoJ will likely support the JPY for a while. However, the lack of hawkish cue nor commitment from Ueda's press conference does not give market participants confidence and may cap the gains for JPY. On the other side of equation we have Trump's impact towards inflation and see the Fed to be less dovish, which has kept yield differential between U.S. Treasury and JGB wide. Without further hawkish committment, it maybe difficult for the JPY to turn unless there is a landslide in the equity space.

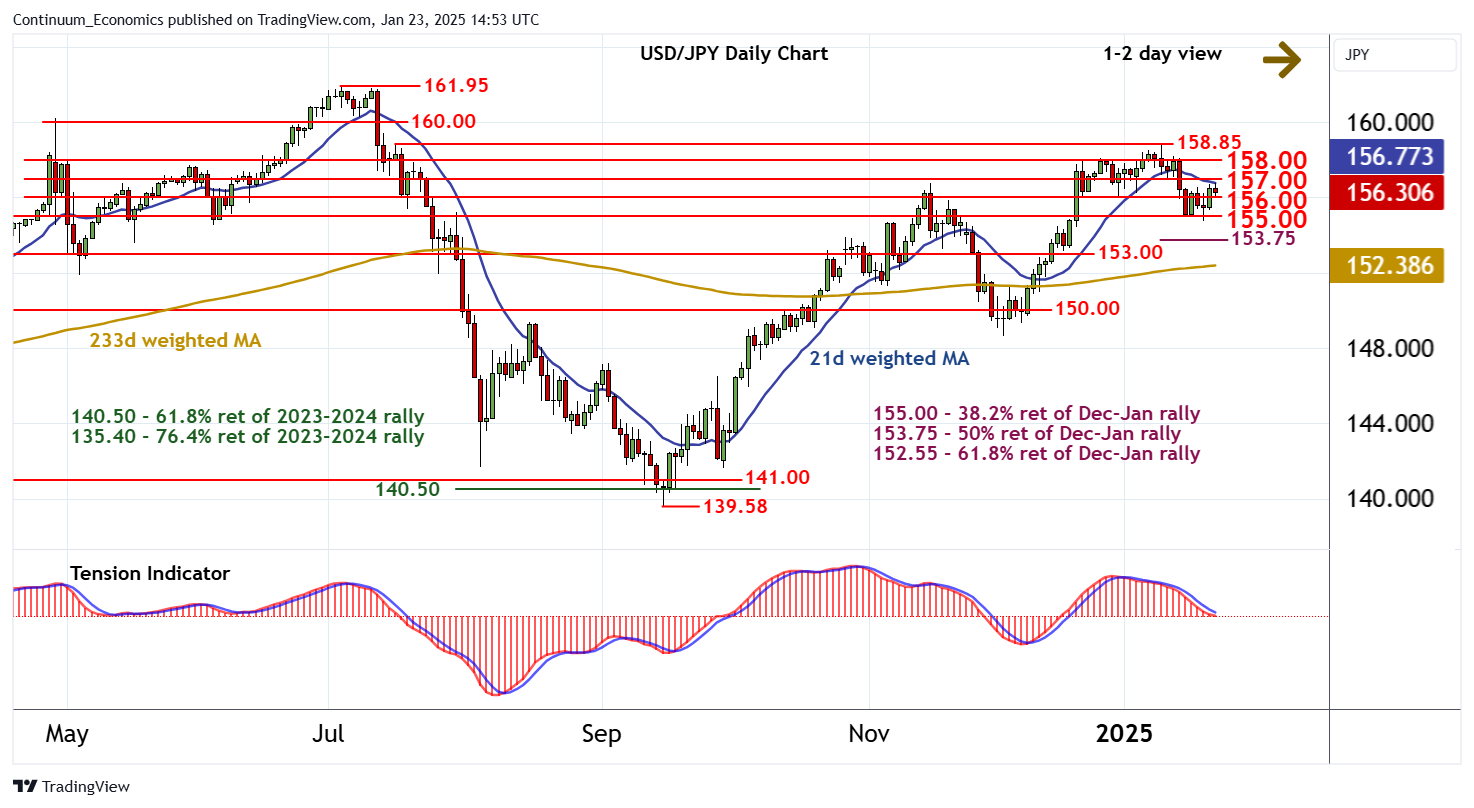

On the chat, the anticipated break above 155.00 is meeting selling interest beneath congestion resistance at 156.00, as intraday studies turn down, with prices currently consolidating around 156.35. Daily readings are mixed, suggesting a cautious tone. But broader weekly charts continue to deteriorate, pointing to room for fresh losses in the coming sessions. A break back below 156.00 will add weight to sentiment. But a further close below 155.00 is needed to turn sentiment negative and extend January losses initially towards the 153.75 Fibonacci retracement.

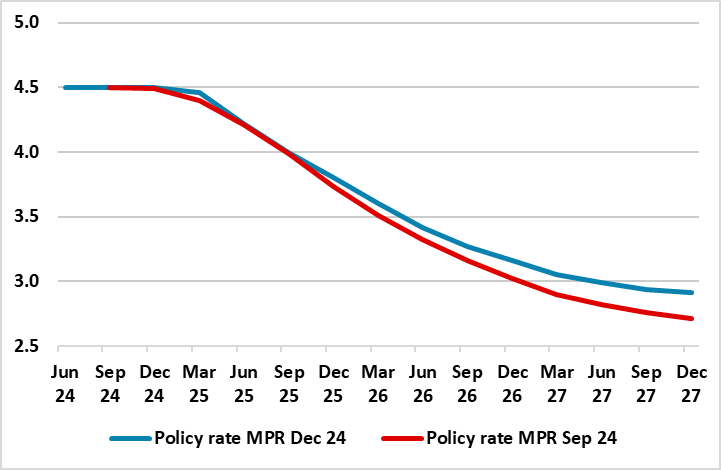

Figure: Is Existing Policy Outlook Intact?

In its first meeting of the year, the Norges Bank kept rates on hold in what was both an expected and unanimous Board decision. But calling this a decision is possibly a misnomer as nothing was actually decided over and beyond waiting for new information and updated forecasts by the time of the next meeting in March. Admittedly, it was suggested (again) that policy could start to be eased at that next (March) meeting but nothing was hinted at to suggest that the policy outlook beyond then and what was offered in December (Figure 1) was intact given how market rate expectations have shifted in the interim. Indeed, we think the Norges Bank had the choice of cutting rates at this juncture, both to reflect what it admitted have been weaker price pressures and also to signal to markets that the recent repricing of policy ahead and inter-related rise in bond yields is very much unjustified. The economic impact of cutting two months earlier would be minimal. Instead, the overly cautious Norges Bank Board, still overly fixated on the weaker currency despite the latter still seeing falling imported inflation, decided on no action so that the policy rate at 4.5% has now been in place for over a year.

Indeed, the Board chose not to be more vocal about the scale and timing of easing ahead, having had the opportunity to suggest the outlook was largely unchanged from the projections made last month (Figure 1). In fact, it instead possibly reinforced limited easing ahead by underscoring a continued need for policy to remain on the restrictive side. We still see rates falling faster and more sizably with some 150 bp of rate cuts in 2025 – 50 bp-plus more than the Norges Bank is advertising!

Nonetheless, and as Figure 1 also shows the Board anticipates that policy will continue easing all the way out to 2027, albeit basically settling at just under 3%. It is unclear if this is regarded as a neutral or terminal rate. How this policy outlook arises is unclear as targeted inflation (CPI-ATE) is seen staying above target through the forecast horizon, ie around 2.4% in 2027.

To us this is overly pessimistic. Admittedly, recent price dynamics have stated to suggest that disinflation may have started to flatten out. But this is only against a backdrop where monthly adjusted core readings are largely consistent with the 2% target already being met with m/m CPI-ATE and core outcomes of around 0.2%. And this is in spite of the impact of rental inflation (around 17% of the CPI) running still at well over 4% y/y, implying headline inflation ex-rents now at around 1.7%% (Figure 2). This begs the question whether Norges Bank policy is actually buttressing inflation as higher interest rates therefore mean higher inflation as rents are largely being driven by landlords facing (high) mortgage rates and increased demand for rental accommodation. Moreover, the resilience in rents may help explain the puzzling manner in which consumer confidence has developed of late, ie where households perceive a better financial position but are not willing to consider spending more.