GBP, JPY, EUR flows: Little net change as equities bounce - GBP a focus

German orders marginally firmer but trend softening. JPY reverses initial gains in Asia as equities bounce. GBP a focus as EUR/GBP makes new 2 year high

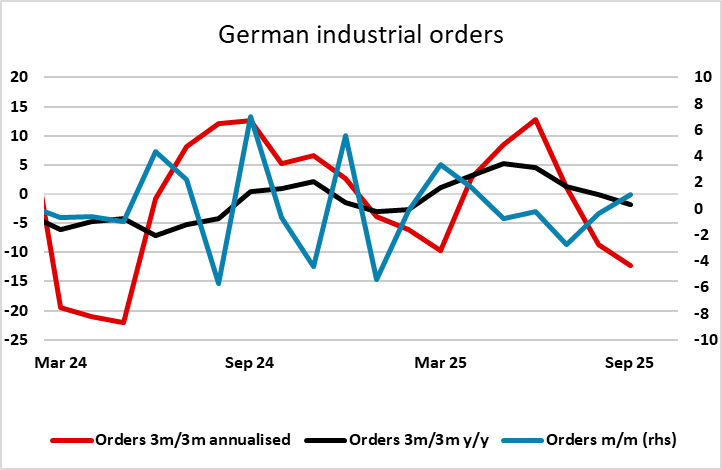

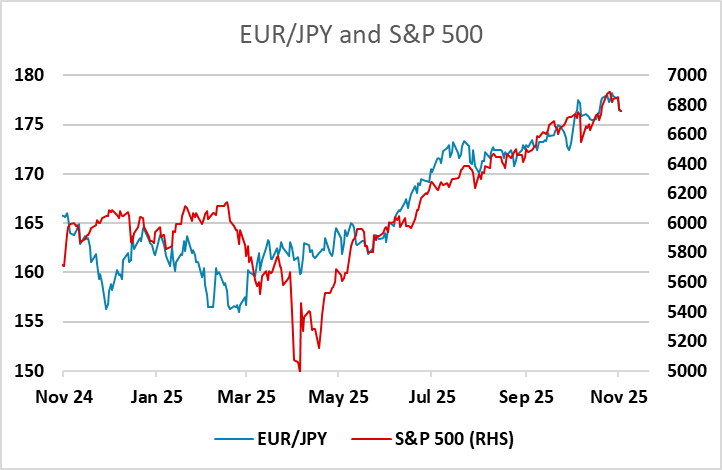

German orders data this morning is slightly stronger than expected at 1.1% m/m, but the trend looks to be weakening so it’s hard to make a case for this data to be EUR supportive. Overnight there has been little net movement in the major currencies, but the Asian session started with a significant risk negative move, which has been reversed as most equity indices have recovered to near US closing levels. There was no obvious trigger for the equity weakness other than the momentum carrying on from yesterday’s decline and the high level of valuation. Today’s US ADP and ISM services numbers will likely set the tone, with strong data likely to be equity and risk currency supportive even if it leads to some gains in US yields.

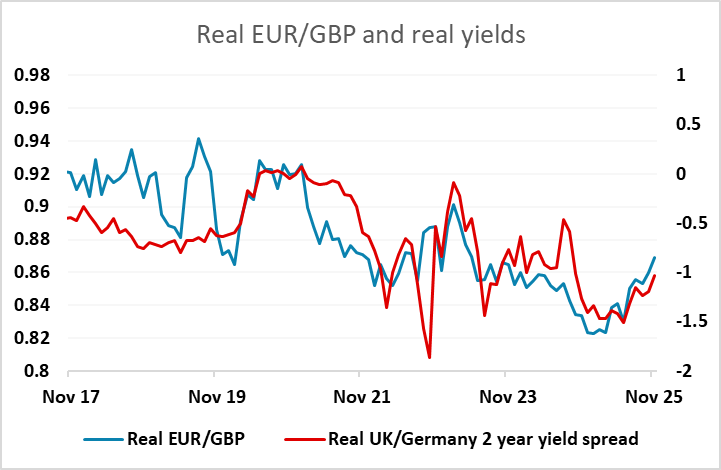

For this morning, there is little on the calendar, and we wouldn’t expect major FX moves. GBP will be a focus with EUR/GBP having made another new post May 2023 high overnight. We don’t expect a rate cu at tomorrow’s MPC meeting, and that may mean some short term decline in EUR/GBP is possible this week. But the clear signal of significant tax hikes in the November 26 Budget from Chancellor Reeves yesterday suggests to us that a cut is very likely by December, with even 50bps a possibility, so any GBP recovery is likely to be short-lived.