FOMC Minutes to Show Caution Even Ahead of Subsequent Strong Data

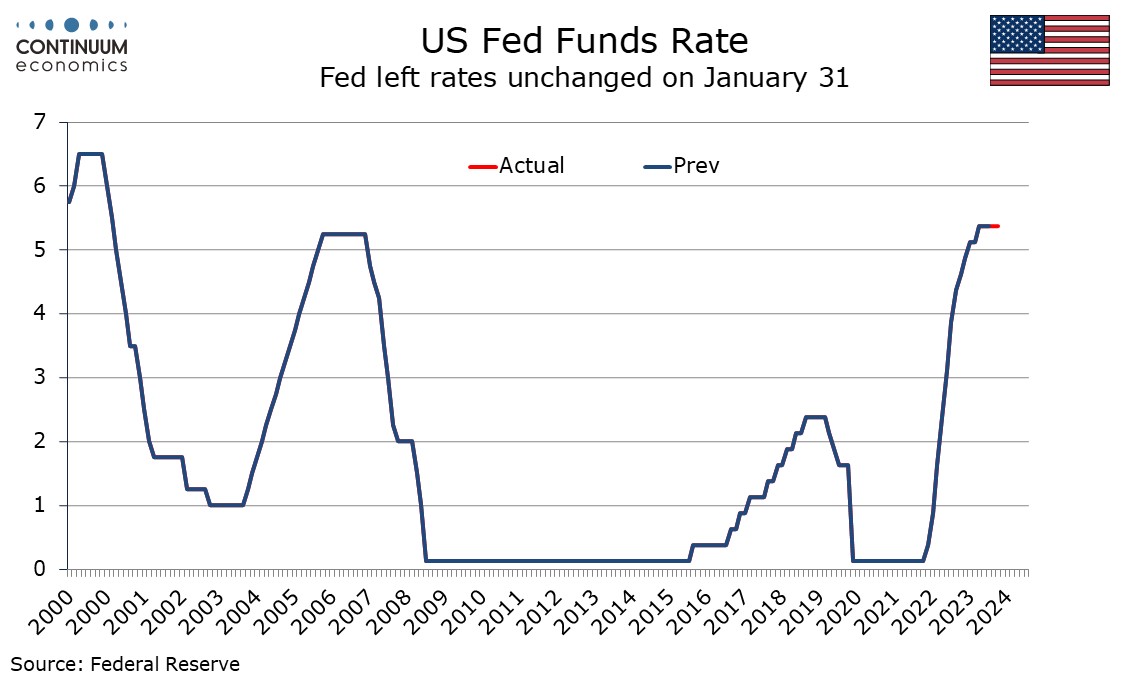

FOMC minutes from January 31 are due on February 21. The meeting saw the Fed moving away from a tightening bias but the minutes are likely to show no rush towards easing. The minutes are likely to note progress on inflation and resilience in activity. If the latter is seen as a risk to continued progress on inflation it will be significant given the strong payroll and CPI data been released since the meeting.

The picture the minutes will see

The most significant change to the January 31 statement was replacing a reference to any additional policy firming that may be appropriate to a more balanced reference to any adjustments to the target rate, while adding that easing was not expected to be appropriate until the FOMC had achieved greater confidence that inflation was moving sustainably to 2%.

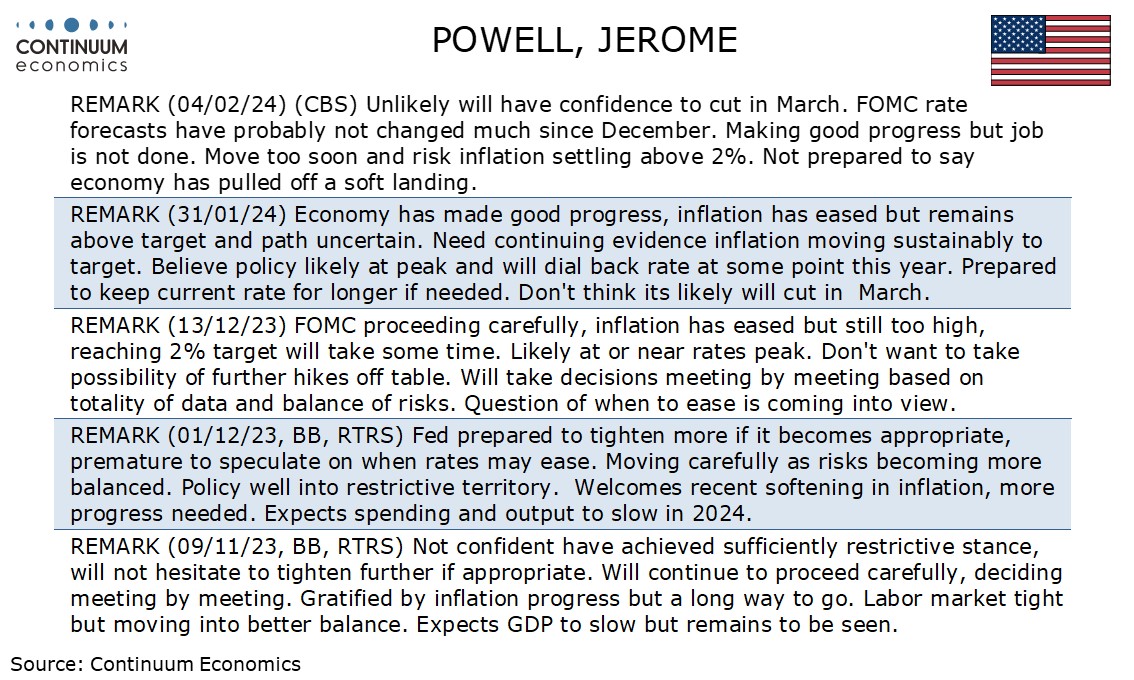

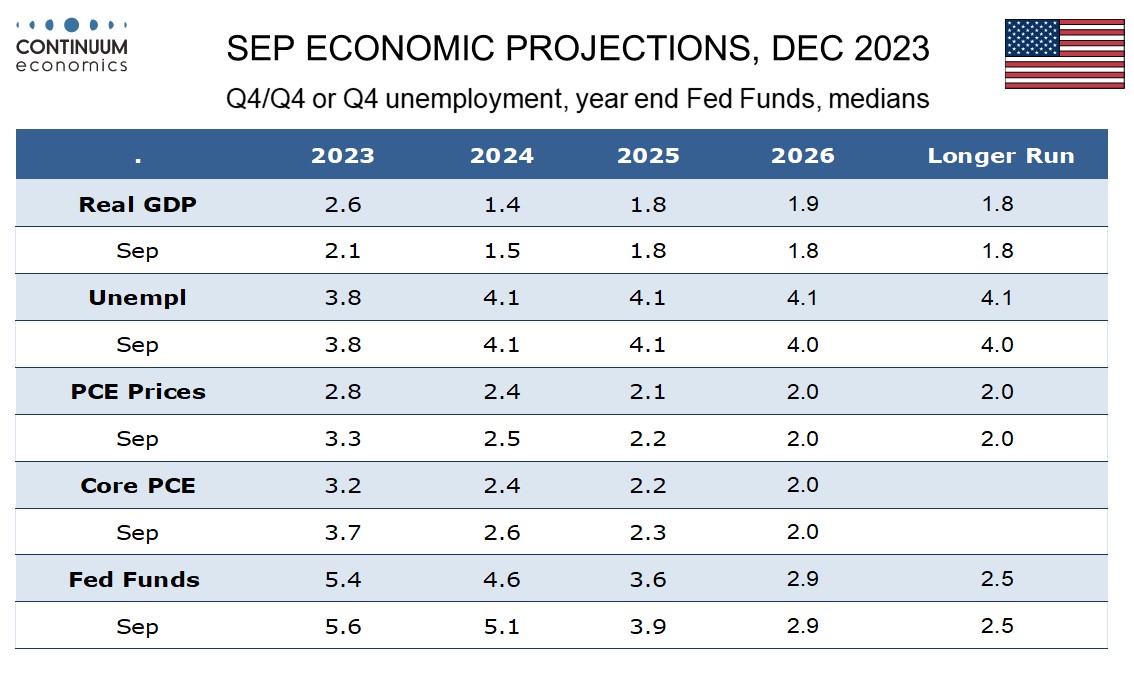

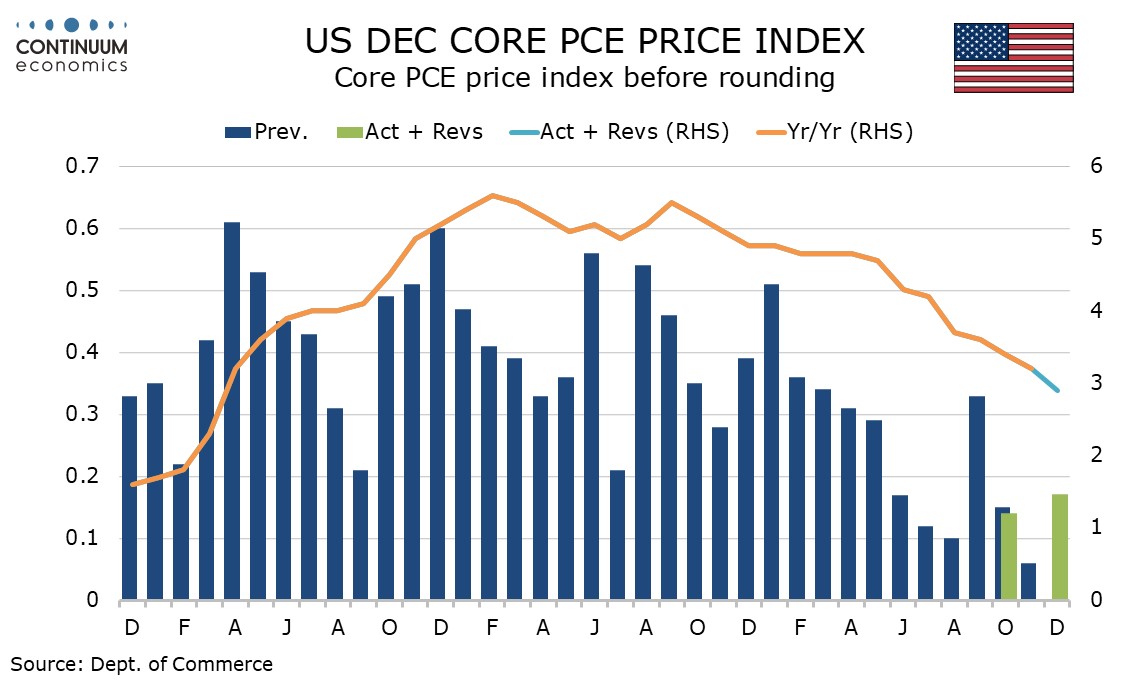

The minutes are likely to welcome the progress on inflation, with Q4 core PCE price data released shortly before the meeting showing two straight gains of 2.0% annualized, consistent with a return target if sustained for two more quarters. This has been achieved despite surprisingly strong GDP growth in each of those quarters. Q4 GDP at 3.1% Q4/Q4 compared to a 2.6% December FOMC forecast while core PCE prices at 3.2% Q4/Q4 were as the Fed had forecasted in December. December’s dots looked for 75bps of easing in 2024. On February 4, Chairman Jerome Powell, after payrolls but before the CPI, said the view had probably not changed much since then.

Inflation falling despite the economy exceeding expectations will surely be welcomed in the minutes which are likely to show greater confidence in a soft landing, and less need for a period of below potential GDP growth to curb inflation. Powell stated in his press conference that he was not so worried about the economy being too strong. However he also stated that anecdotal evidence showed that the economy was picking up a bit. The minutes are likely to show at least some concern that the unexpected resilience of activity could put further progress on inflation at risk, and if so that would be significant given upside surprises in both inflation and employment in January’s data released in early February.

What subsequent data showed

We doubt the Fed will be overreacting to the latest data. The strong employment gain was balanced by a weaker workweek, and January has a particularly strong positive seasonal adjustment. CPI is running increasingly ahead of PCE prices, and it is the latter the Fed targets. One strong month does not make a trend. Six of the last seven core PCE price indices have risen by less than 0.2% before rounding. January’s data will probably look similar to the sole exception in September which rose by 0.33%. Still the CPI suggests its strength will come in services, which are more dependent on demand than supply changes, and sensitive to labor costs. January’s employment report showed an acceleration in wages.

Powell stated after January’s meeting that a March rate cut was unlikely and with only one set of key data, rather than two, now due before that meeting, such a move now looks highly unlikely. If data slows significantly easing is still possible in Q2, but that would probably require Q1 to see a significant slowing in GDP momentum as well as another subdued quarter from core PCE prices. Finally, Powell on January 31 stated the Fed would start in-depth balance sheet talks in March. These minutes may see some limited discussion on how long QT should continue once easing in the policy rate starts.