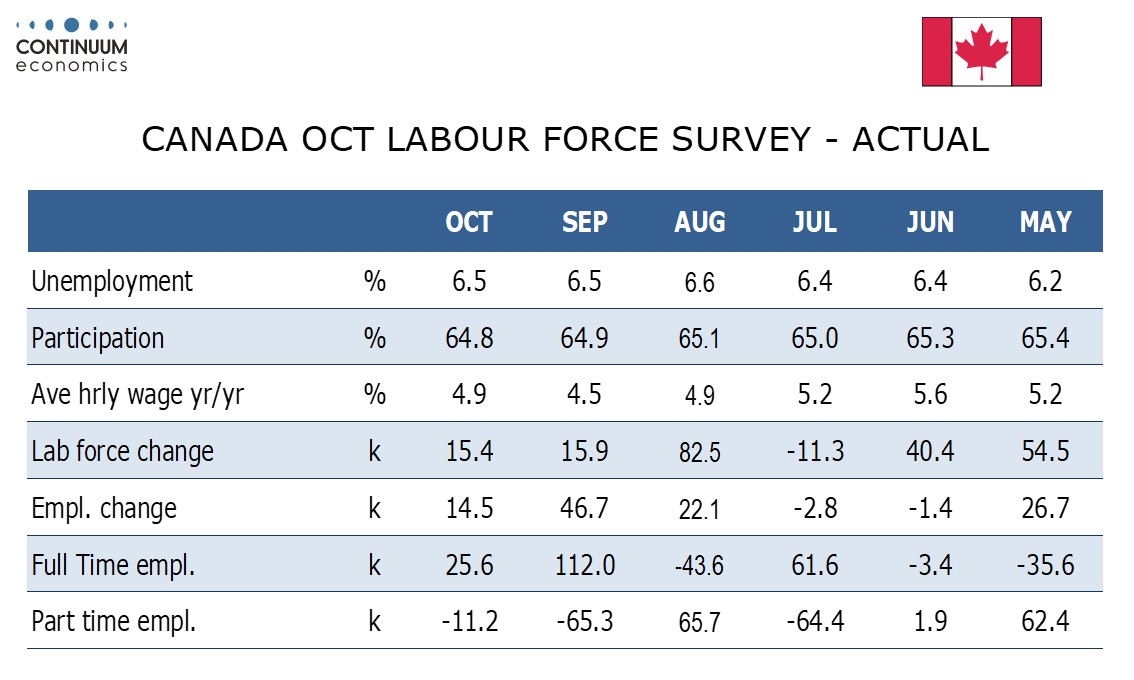

Canada October Employment - Details mostly positive, suggesting economy regaining momentum

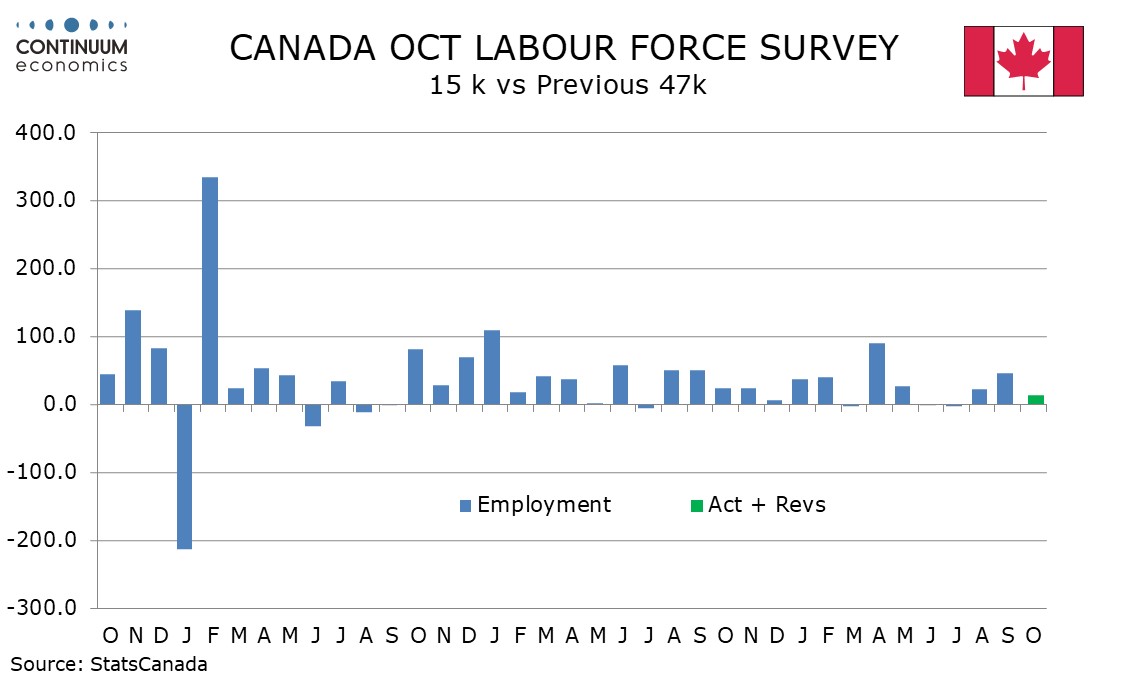

While Canada’s 14.5k October rise in employment was not very impressive on the headline, the details are mostly positive and support a view that the Canadian economy is starting to regain momentum now that the Bank of Canada is easing monetary policy.

The gain follows a strong 46.7k increase in September which has not been corrected. Full time work added another 25.6k jobs after surging by 112k in September while part time work saw a second straight decline. The gain in employment came despite a 17.2k decline in the public sector, with private sector employment up by 20.5k and self-employment up by 11.3k. Job growth was led by goods, up by 13.5k with manufacturing at 9.7k and construction at 6.3k. Services, up by only 0.9k, were generally subdued.

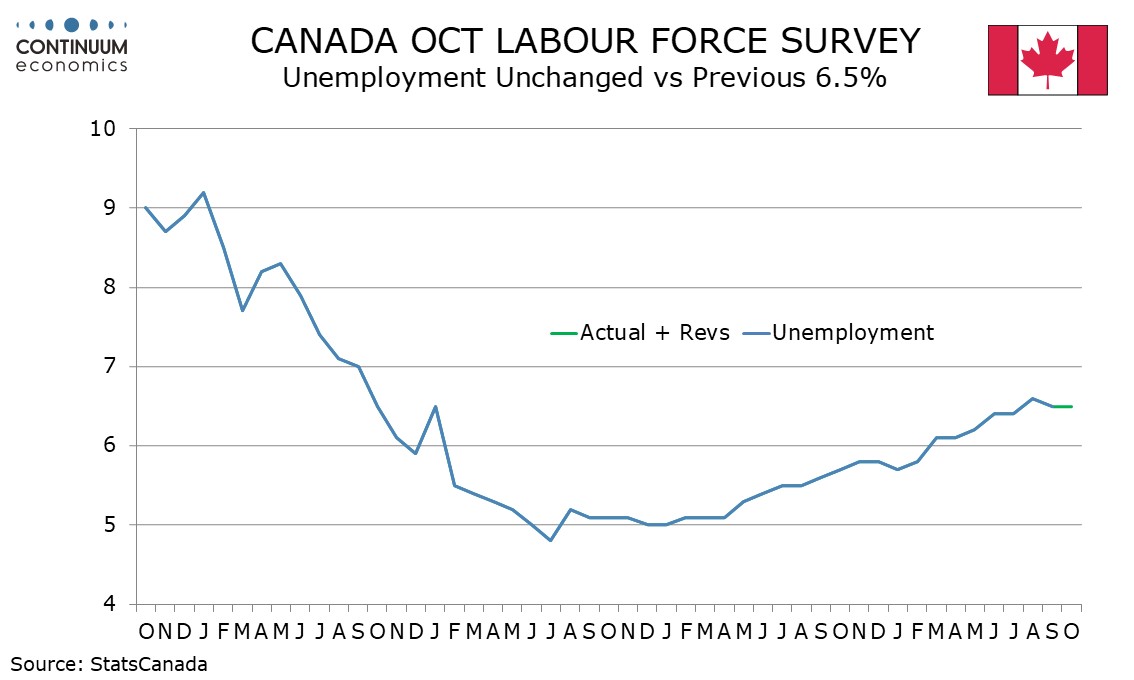

With a 15.4k rise in the labor force similar to that of employment, unemployment was unchanged at 6.5%. It is too early to say that August’s 6.6% will be a peak, but the uptrend from 5.0% in January 2023 now seems to be losing momentum.

Wage growth for permanent employees at 4.9% yr/yr from 4.5% in September reversed a September slowing but appears to have peaked. Wages are running well ahead of inflation, which will support consumer spending, though raises some questions as to how far inflation can fall as the economy starts to regain momentum.