JPY flows: JPY marginally firmer, but scope for bigger gains on BoJ

JPY not much affected by Finance minister Suzuki's comment tha deflation is over, but JPY upside risks are increasing

A fairly quiet overnight session for currencies, with not much movement in spite of some regional equity weakness. AUD/USD lost some ground early in the session, but has recovered most of it by European open, and USD/JPY was also firm in early Asian trading, but has finished the session slightly lower.

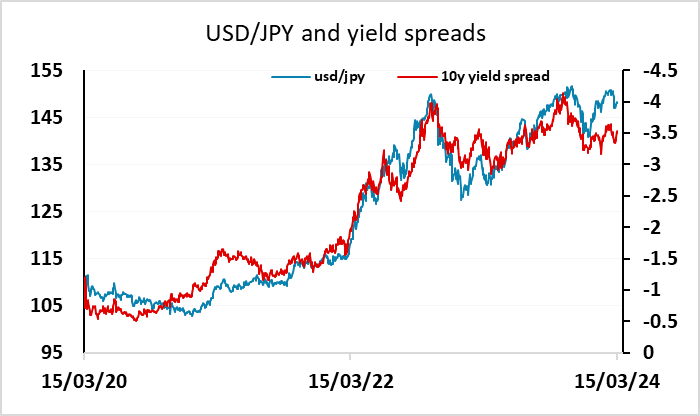

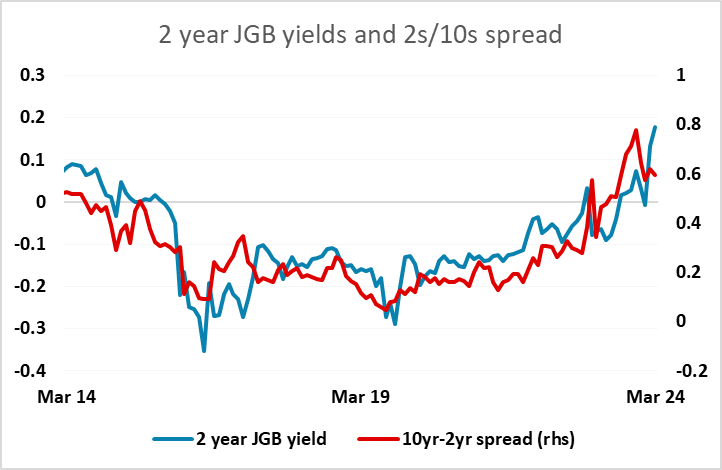

The comments from finance minister Suzuki, saying Japan is no longer in deflation due to the strong trend of wage hikes now happening, failed to have a major impact on the JPY, in part because such comments had been trailed in the press earlier in the week. But JGB yields have edged higher in recent days, and the expectation of a significant policy announcement at next week’s BoJ meeting has increased. We feel the market is underestimating the potential for USD/JPY declines here. While we agree with the market view that a policy rate hike is more likely in April than in March, USD/JPY tends to be driven more by 10 year spreads than the short term policy rate, and this is already signalling downside risks. 10 year yields also haven’t quite kept up with the rise in 2 year yields, and there is scope for a move back above 1% in the coming weeks, which would suggest USD/JPY scope towards 140.

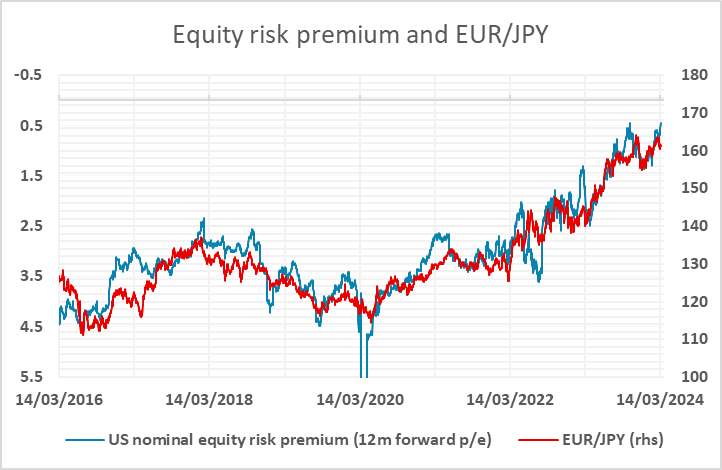

The scope for JPY gains may to some extent still be hampered by the correlation of yen crosses with equity risk premia, which continue to decline. EUR/JPY if anything looks low compared to this measure. But there is little fundamental support for this correlation, and we would not expect it to hold up in the face of BoJ tightening.