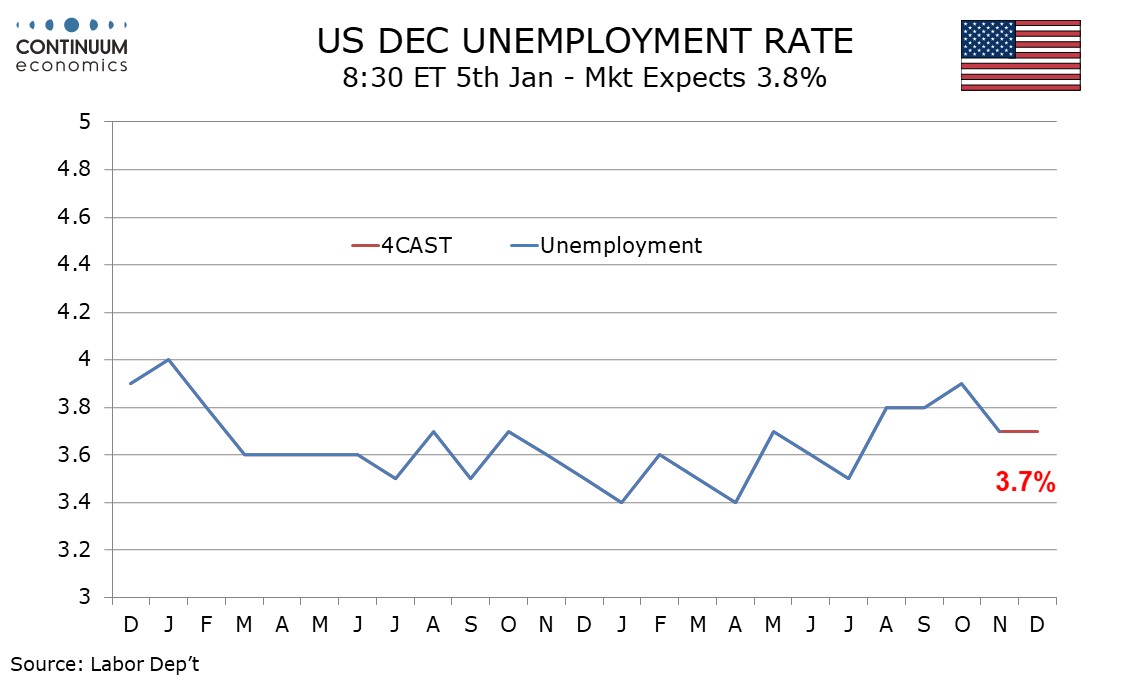

Preview: Due January 5 - U.S. December Employment (Non-farm Payrolls) - Maintaining trend

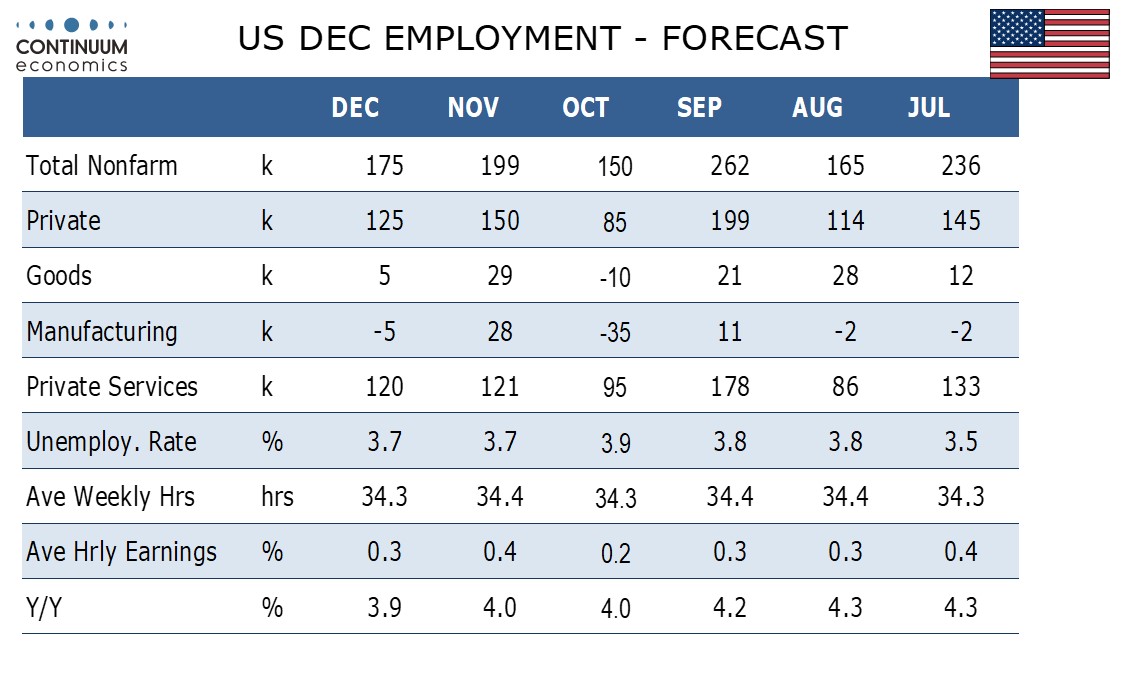

We expect a 175k increase in December’s non-farm payroll, with private payrolls up by 125k, which would be consistent with recent trend, though risk may lean to the upside. We expect an unchanged unemployment rate of 3.7% and a 0.3% increase in average hourly earnings.

A 175k payroll increase would be slower than November’s 199k though November was lifted by the return of strikers, 25k in autos and 16k in motion pictures. October’s 150k increase was restrained by the start of the auto strike. Government looks set to maintain a firm picture.

A 125k increase in private sector payrolls would compare to 150k in November and 85k and October but would be slightly stronger than both excluding the impact of strikes. Hinting at upside risk are a stalling of an upmove in initial claims, stronger ADP data, and more supportive seasonal adjustments.

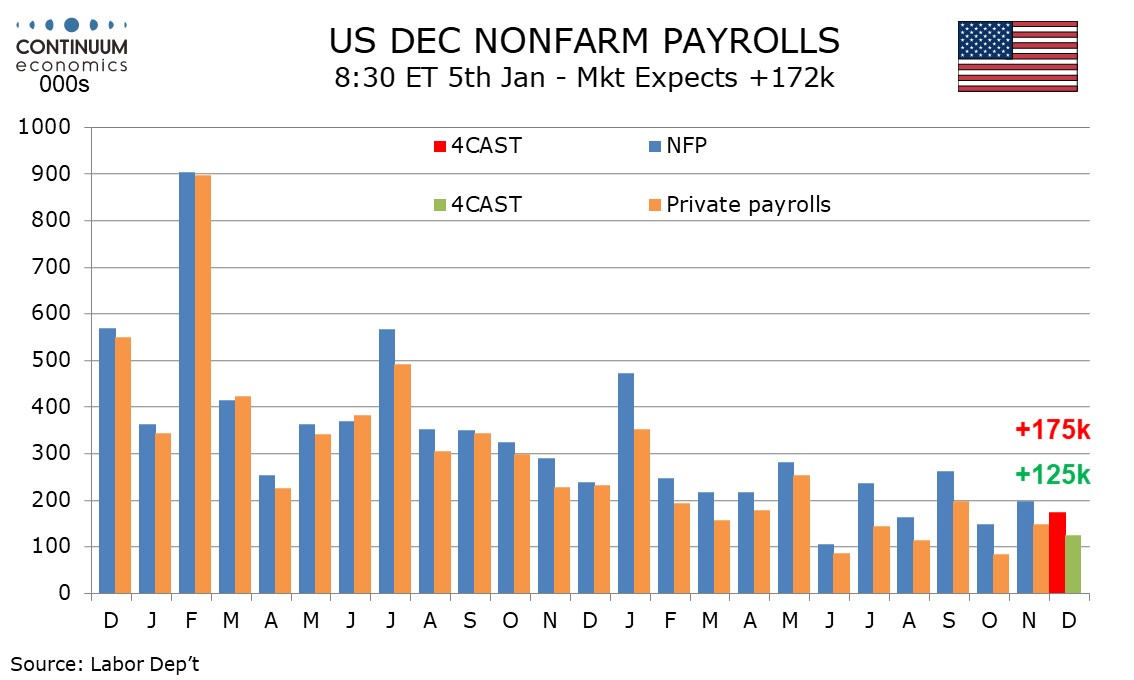

Average hourly earnings trend has been gradually losing momentum with trend now on the low side of 0.3%, and we expect a rise of 0.26% in December before rounding. This would follow an above trend 0.35% in November which was resumed up to 0.4%, which corrected a below trend 0.21% increase in October. Yr/yr growth would then slip to 3.9% from 4.0%.

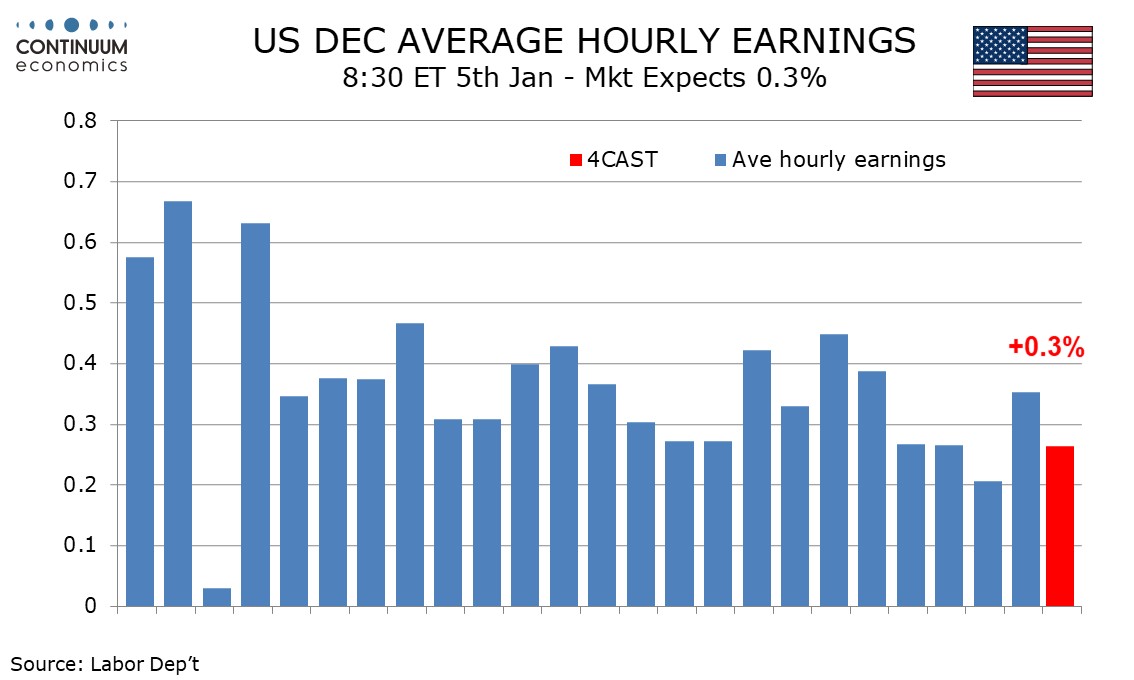

There is extra uncertainty on unemployment in December with historical revisions due, though we expect any changes to be marginal. Historical revisions for non-farm payrolls data come with January’s report. We expect an unchanged rate of 3.7% assuming November is unrevised, with employment and the workforce seen delivering similar moderate gains, contrasting sharp bounced in both in November which corrected declines in October.

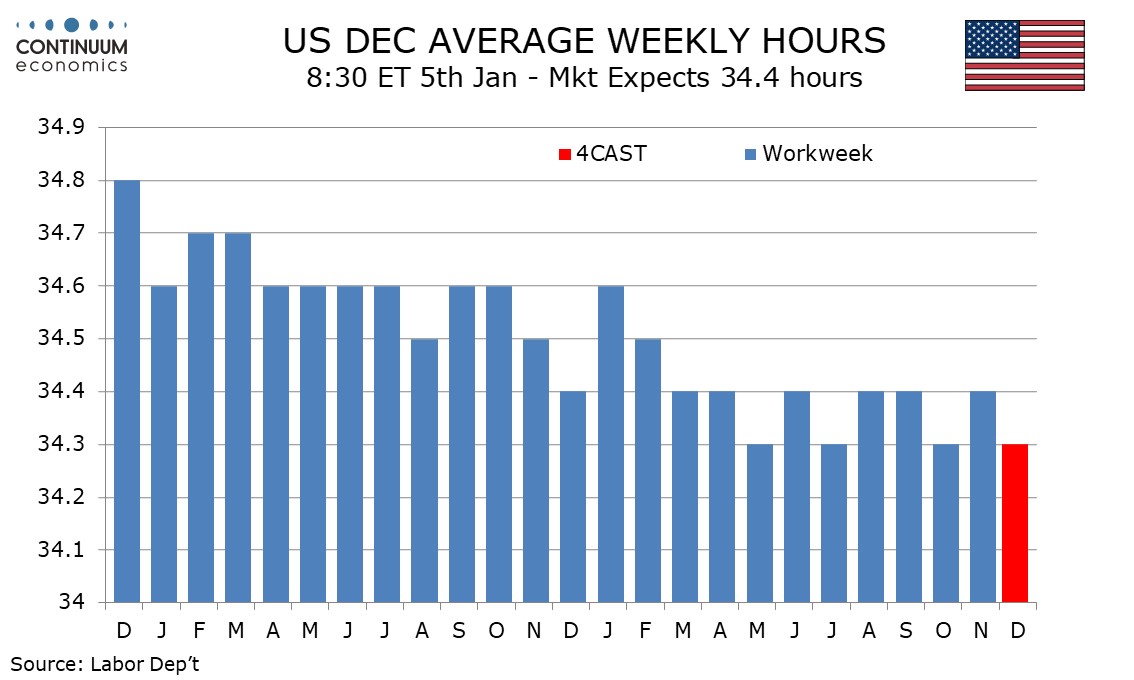

In the last nine months we have seen six months with the workweek at 34.4 and three at 34.3. In December we expect slippage to 34.3 after November increased to 34.4, with the leaning being that trend continues to edge slowly lower. This would leave aggregate hours worked down by 0.2% in December but up by 0.9% annualized in Q4, a modest slowing from 1.3% in Q3.