FOMC Preview: Restraining Easing Speculation

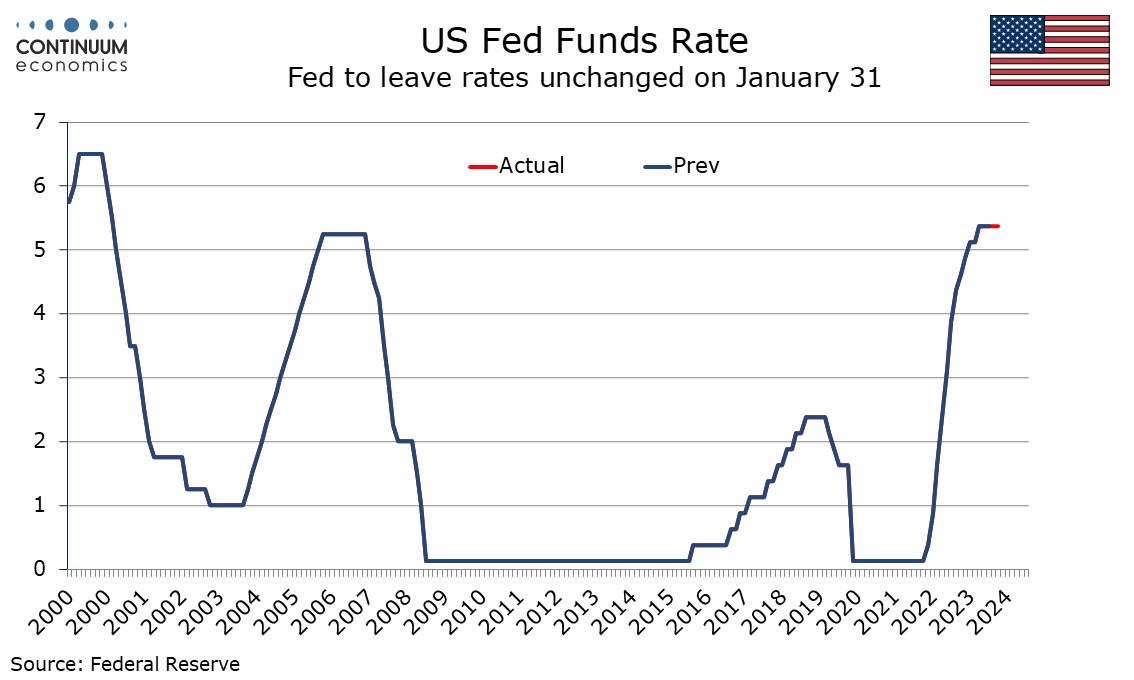

The FOMC meets on January 31 and rates look set to remain at 5.25-5.50%. After having raised expectations for 2024 easing in December the FOMC is likely to adopt a cautious tone at this meeting, changing little in the statement other than to note recent resilience in the economy. Progress in reducing inflation will be noted but the Fed is not ready to declare victory. We expect the statement to maintain a reference to potential further tightening.

Statement unlikely to see a dovish shift

Perhaps the key section of the statement to watch will be whether the Fed alters the language from December’s “in determining the extent of any additional policy firming that may be appropriate” before going in to list what the Fed will be watching. Further tightening now looks unlikely, with none of December’s dots projecting such a move. The Bank of Canada’s statement on January 24 removed a reference to potential further tightening and the Fed will consider some fine tuning, though we expect they will decide against making a change at this meeting. The U.S. data picture is very different from Canada’s, where the economy looks weaker but inflation has been more stubborn.

Economy has outperformed expectations

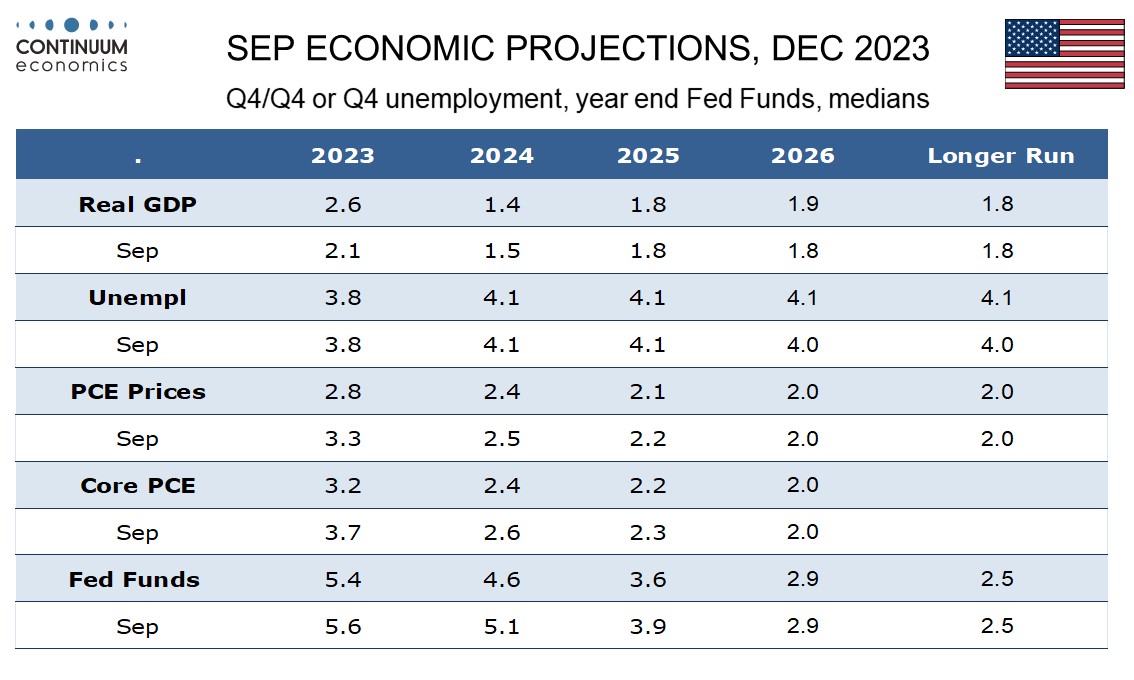

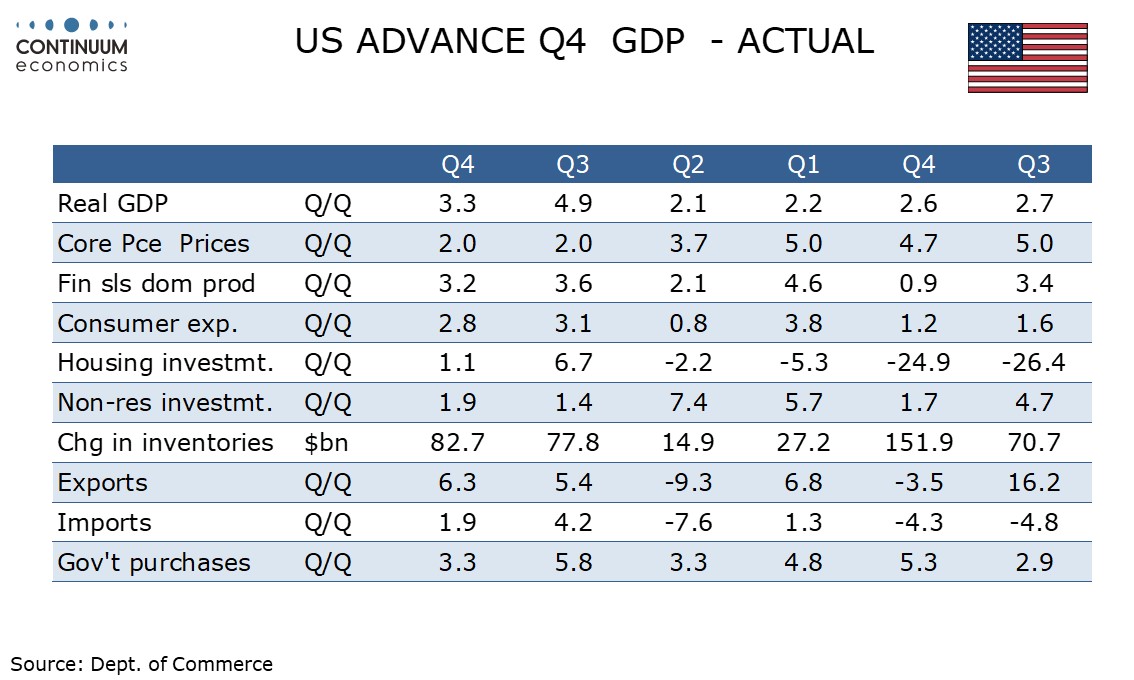

The U.S. economy been impressively resilient with a 3.3% annualized GDP increase recently released for Q4 which put yr/yr growth at 3.1%, significantly above The Fed’s December forecast of 2.6%, which implied annualized growth of only 1.2% in Q4. While Q4 still saw a slowing from Q3’s 4.9%, the resilience of Q4 will have come as a surprise that the statement will have to note. There are even some signals that the economy is gaining some momentum entering 2024, with housing sector and consumer sentiment surveys having picked up. This was almost certainly fueled by rising expectations for easing in 2024. The Fed is likely to want to avoid further fueling such sentiment this time.

Inflation has fallen, but Fed will want to see more data

Inflation has been making encouraging progress, with the annualized increase in core PCE prices in both Q3 and Q4O spot on the Fed’s 2.0% target, meaning that matching gains in Q1 and Q2 or 2024 would see the target reached. The yr/yr pace in Q4 2023 of 3.2% however matched the FOMC’s December forecast and the Fed has good reasons to be cautious at this point. On January 15 Fed Governor Christopher Waller stated they would be watching annual CPI revisions on due on February 9. These only see seasonal adjustments updated, but if, as was the case a year ago, strong data earlier in the year is revised down and slower data later in the year is revised up the recent progress may look less impressive. We do not expect any dramatic revisions, but the Fed will want to see this confirmed. January CPI due on February 13 is also a key release as January data often reflects pricing decisions taken at the start of the year, and is more prone to surprises than most months. With two non-farm payroll and CPI reports due between this meeting and the next one on March 21 the FOMC is likely to be wary over expressing too much optimism over inflation, though the statement may be fine-tuned to note recent progress, providing some balance to the likely noting of resilience in activity.

Powell’s press conference

If, as we expect, the statement makes no significant moves in a dovish direction, and with the dots not due for an update until March’s meeting, the focus will turn to Chairman Jerome Powell’s press conference. In December the dots looked for 75bps of easing in 2024, and Powell is unlikely to suggest anything different should now be expected, though the economy exceeding expectations more than inflation has surprised on the downside could argue for less rather than more. In December we projected 125bps of easing in 2024, starting in Q2, though unless the Fed is more dovish than we now expect at the upcoming meeting less with a later start will look increasingly likely. Powell is likely to leave the option of further tightening open should data surprise to the upside, but his key message is likely to be that with the economy resilient and more data still needed to confirm inflation is on track to return to the 2% target, the Fed is not contemplating a near term easing. Still, he is unlikely to be sufficiently hawkish to extinguish are hopes that a more dovish tone could be seen in March, data permitting.