EUR, JPY, AUD: Mild risk recovery continues

EUR firmer but upside limited. AUD supported by hawkish RBA. JPY weakness extends but one way market looks unsustainable.

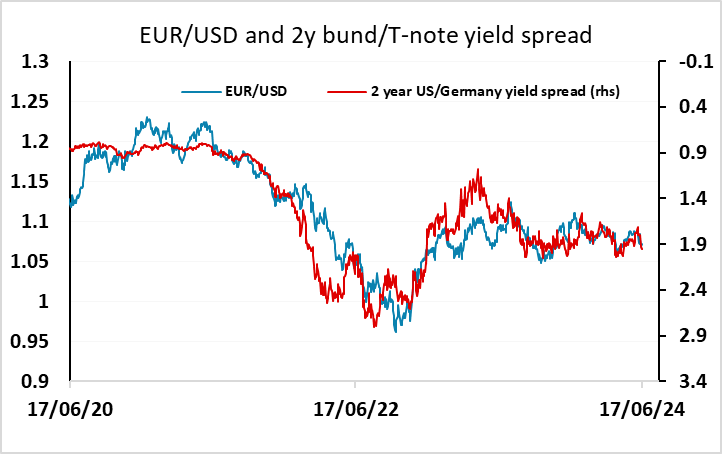

A fairly quiet overnight session has given way to mildly risk positive trading in early Europe, with USD/JPY pressing back up towards 158 and EUR/CHF also moving up from the lows. European equity futures have extended Monday’s mild recovery and this is helping support EUR/JPY. However, EUR/USD still looks unlikely to progress far above 1.07, with US/Germany yield spreads still pointing to stability, and while there is some scope for carry trading if markets remain quiet, the upcoming elections in France make it hard to take a clear positive view.

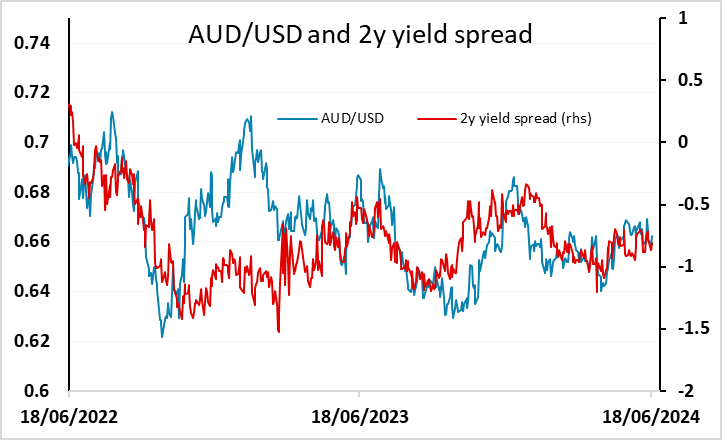

Better value may be found in the AUD, with AUD yields edging higher overnight after the RBA meeting, after which RBA governor Bullock said that a rate hike was considered and a rate cut was not. While the market continues to price the risk of lower rates over the year, the implied probability of a cut by year end has fallen below 50% after the meeting and AUD 2 year yields are up around 5bps after the meeting. If Bullock was taken at his word, the market would be pricing in more than the mild 10% chance of a hike at the next meeting, and there would be further upside risks for AUD rate and the AUD.

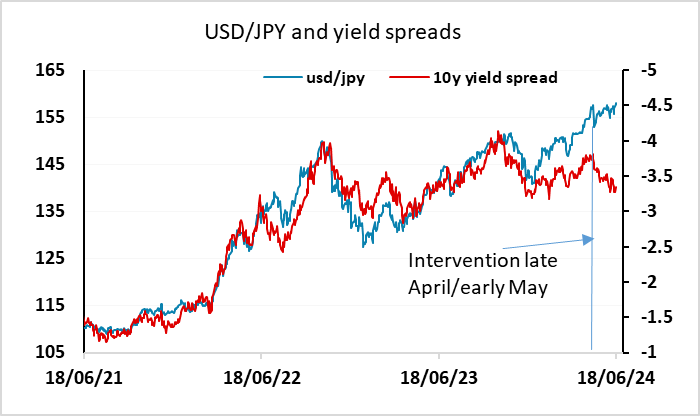

There is little on the calendar of note today, but USD/JPY should remain a focus with the market seemingly immune to all JPY positive news and intervention kevels approaching. Since the intervention in late April/early May, yield spreads have moved considerably in the JPY’s favour but USD/JPY has moved in the opposite direction, breaking the correlation seen in recent years. Even the comments from BoJ governor Ueda overnight indicating the possibility of a rate hike in July failed to have any impact. This one way market I not sustainable, and seems likely to mean more BoJ intervention sooner or later, but an organic USD/JPY decline likely needs a trigger of generally weaker risk sentiment.