Preview: Due May 30 - U.S. April Personal Income and Spending - Core PCE Prices to underperform Core CPI

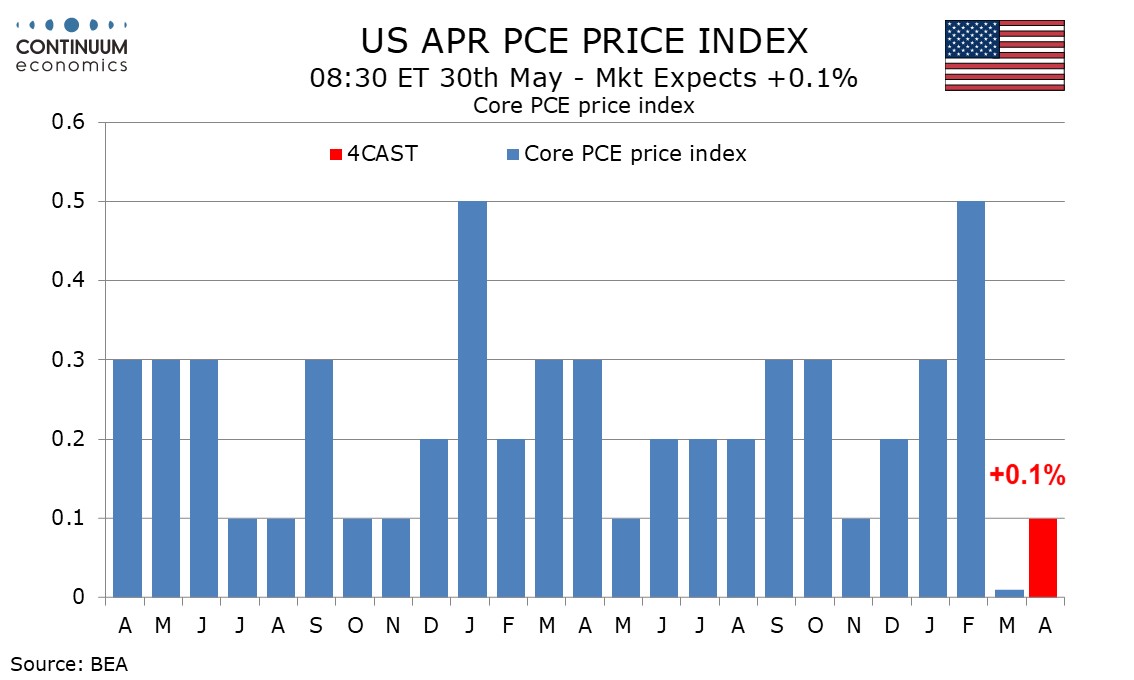

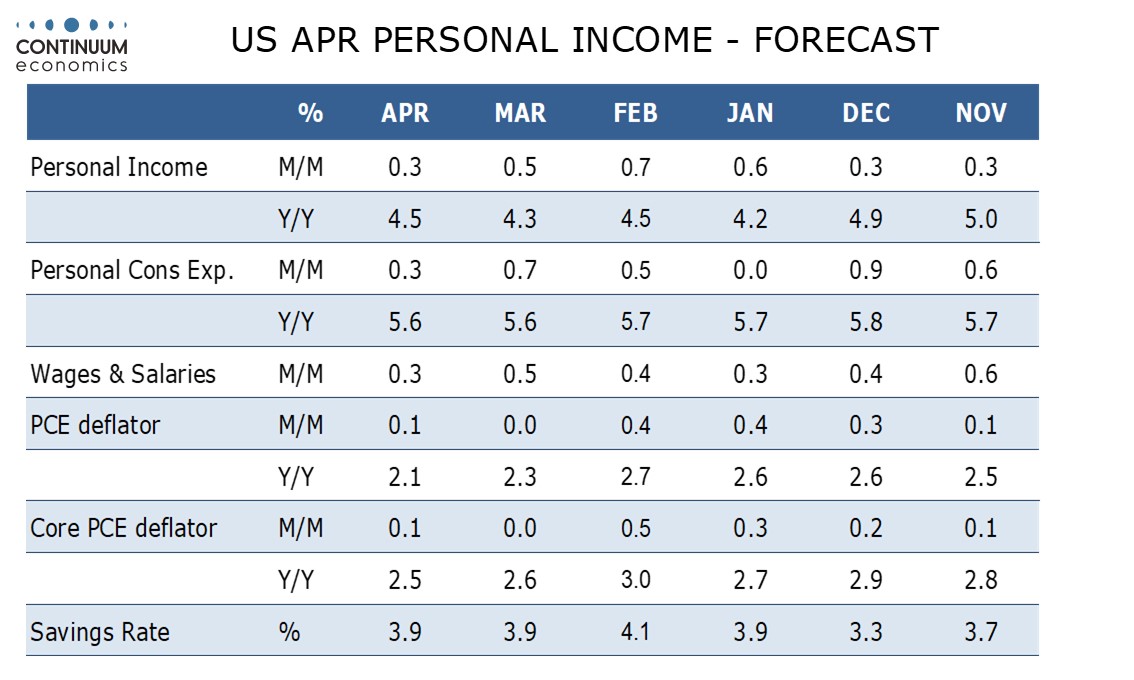

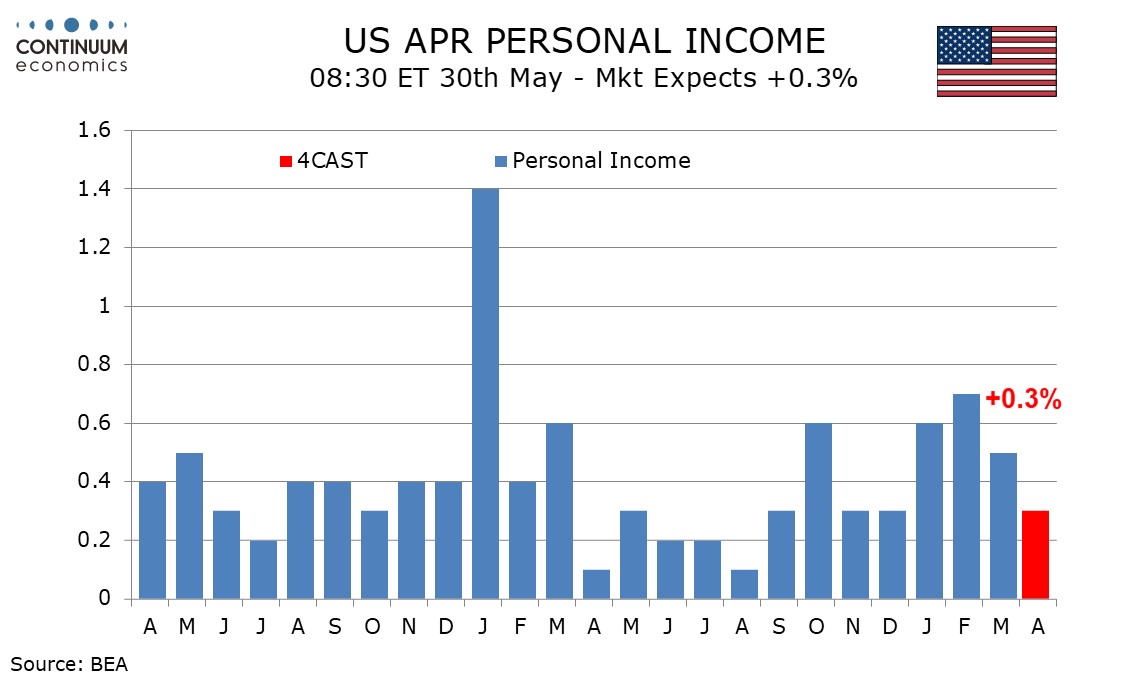

We expect a 0.1% rise in April’s core PCE price index, even softer than a 0.2% core CPI, though risk of a boost from tariffs persists in the coming months. We expect modest 0.3% gains in personal income and spending, which would imply gains of 0.2% in real terms, still some way off a recessionary warning.

Core CPI was up by 0.24% before rounding, but a weak PPI adds to the risk of core PCE prices underperforming the CPI, as is usually the case. PPI was particularly soft in services, which are not facing tariffs. An upward revision to March’s PPI could however see the flat March core PCE price index revised slightly higher.

We expect a 0.2% rise in overall PCE prices. April’s overall CPI matched the 0.2% rise in the core, with the gain being 0.22% before rounding. This would see overall PCE prices slow to 2.1% yr/yr from 2.3%, with the core rate at 2.5% from 2.6%, which would be the slowest since March 2021.

We expect a 0.3% rise in personal income, slower than the three preceding months. The non-farm payroll saw a below trend rise in average hourly earnings, implying a moderate 0.3% rise in wages and salaries. We expect overall personal income to keep pace with wages and salaries, though some slowing from Q1 strength is likely in the non-wage components of personal income. January and February saw one-time gains in government benefits, and March was supported by a strong rise in farm income.

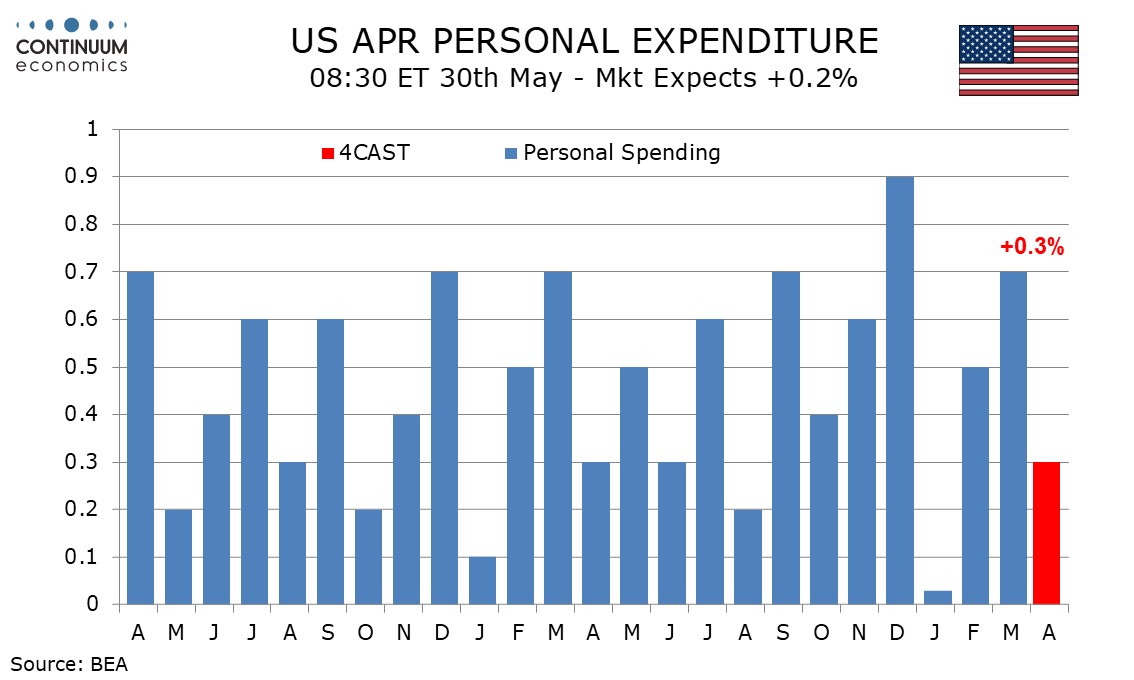

We also expect a 0.3% rise in personal spending, though GDP revisions show Q1 data will be revised down. Retail and food services rose by 0.1% but retail sales fell by 0.1%, and retail data in the income and spending report may be weaker than this with industry auto sales slipping by more than the retail auto data. However strength in food services hints at resilience in services overall, where we expect a rise of 0.5%.