Preview: Due February 10 - U.S. December Retail Sales - Maintaining momentum

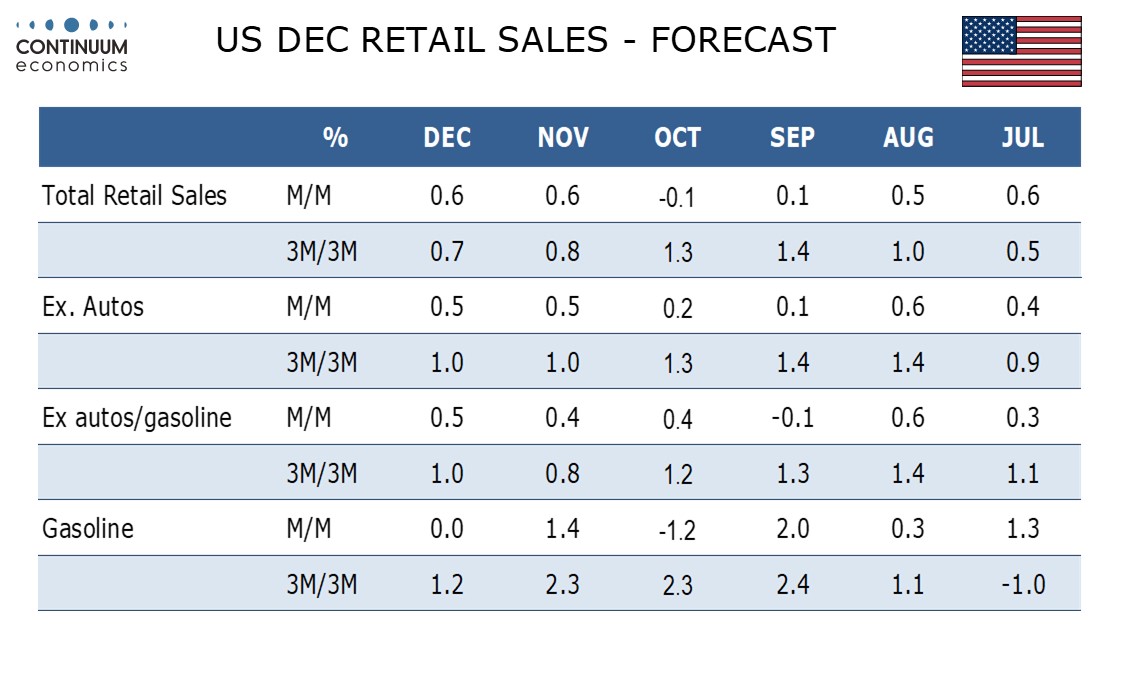

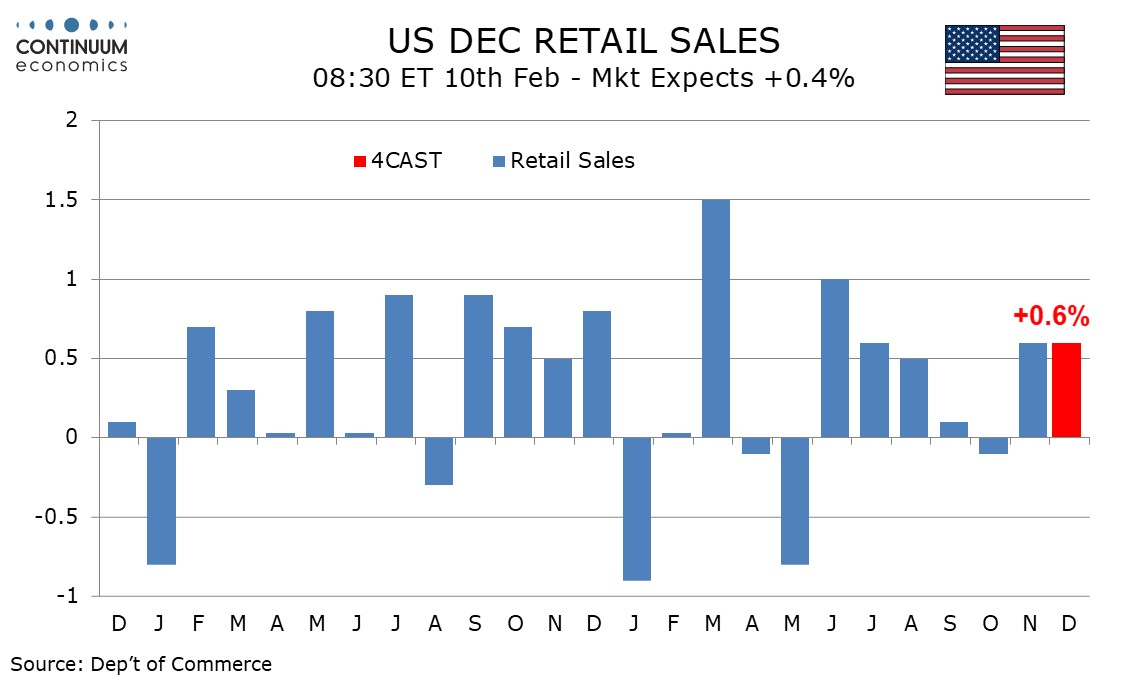

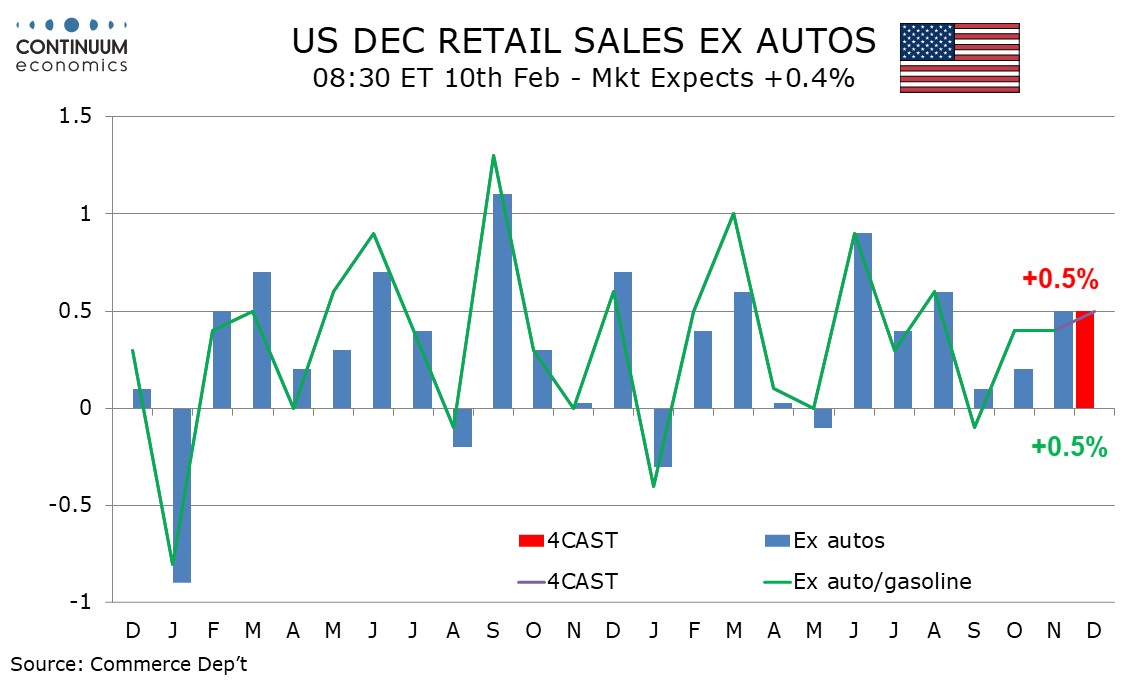

We expect retail sales to maintain momentum in December, rising by 0.6% overall and by 0.5% ex auto, both matching their November increases. Ex autos and gasoline we expect a 0.5% increase, a modest pick-up from two straight gains of 0.4%.

While consumer spending is running head of real disposable income, and is led by consumption at the upper end of the income scale, holiday shopping suggested continued momentum.

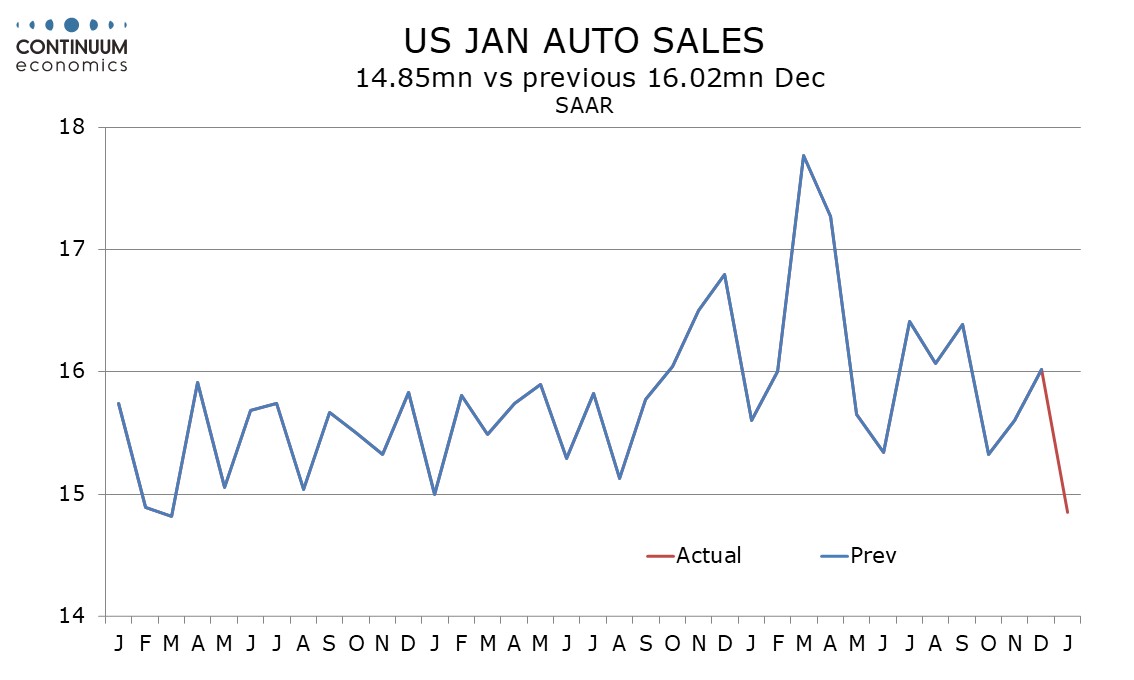

Industry data suggests a modest positive from auto sales, though January industry data suggests a significant dip in auto sales, more so that can be explained by bad weather late in the month. Gasoline prices look set to be a neutral in December retail sales but food prices picked up in December’s CPI.

The monthly CARTS survey from the Chicago Fed predicts a 0.6% increase in December retail sales ex auto, with a 0.3% increase in real terms. This is marginally stronger than our 0.5% forecast ex autos.

Q4 data, overall and ex autos. will see some slowing from Q3 but will look similar to growth rates seen in Q2 and stronger than seen in Q1.