Published: 2024-09-05T15:32:36.000Z

Preview: Due September 17 - U.S. August Retail Sales - Autos to slip, ex autos to pause after a strong July

12

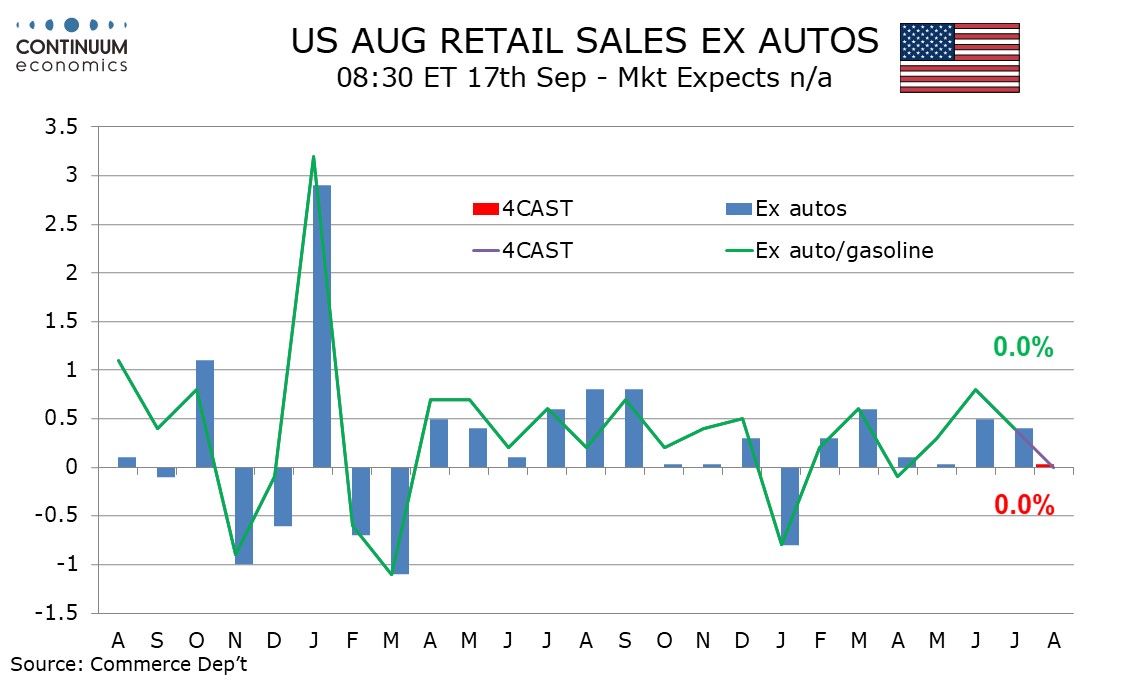

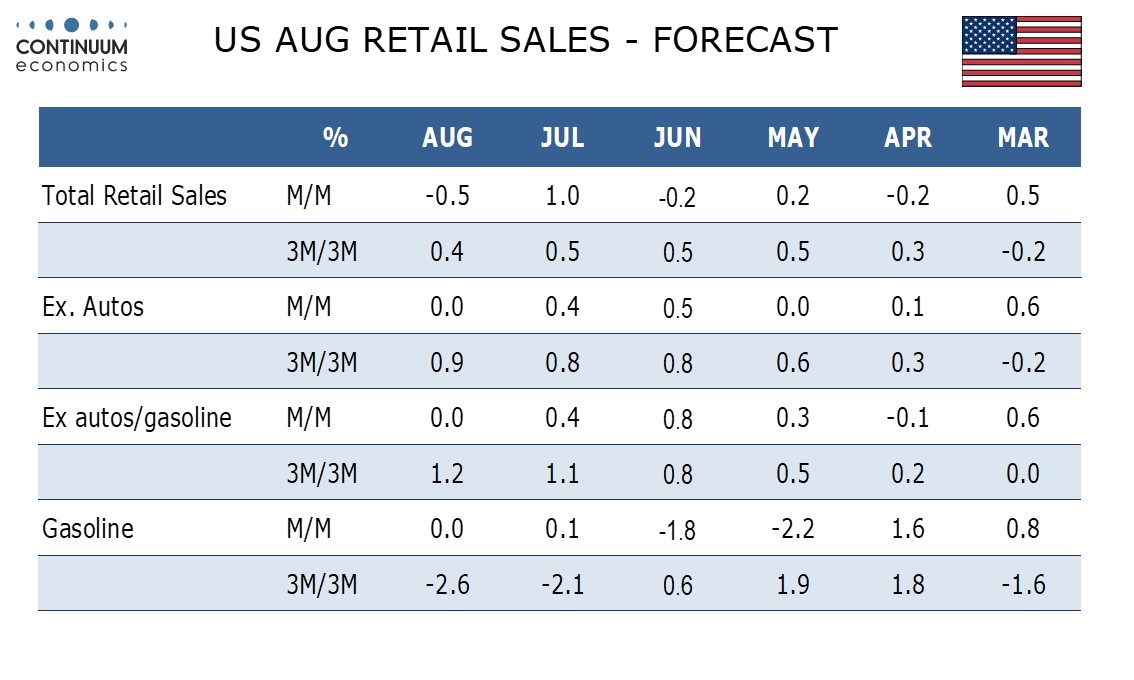

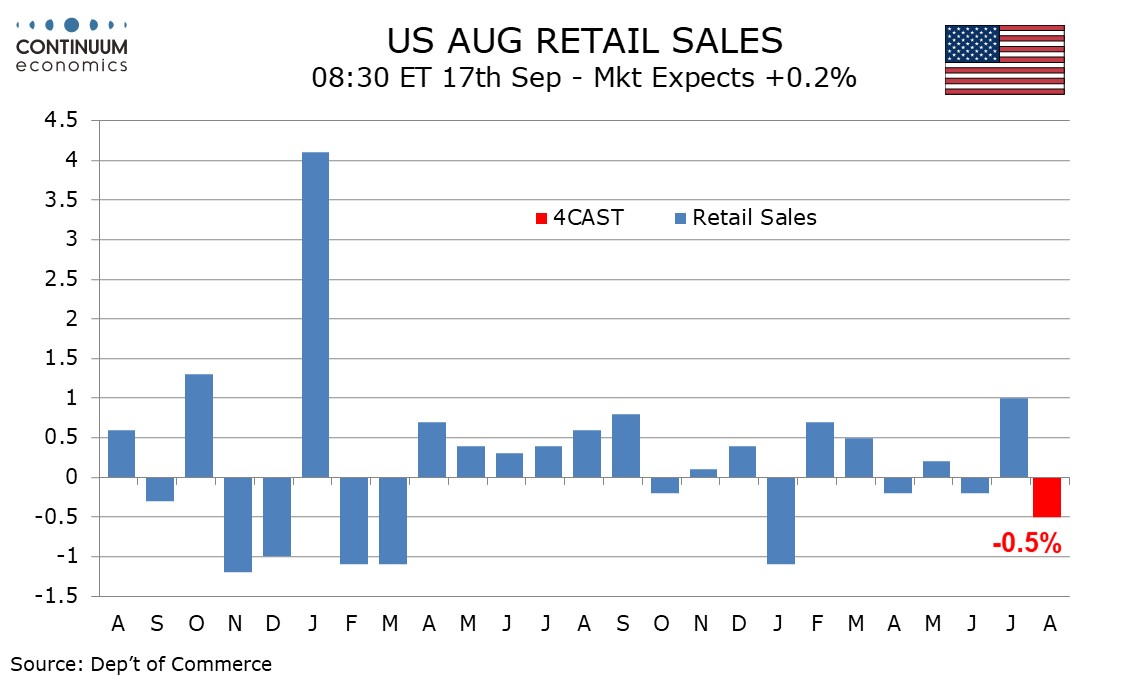

We expect a 0.5% decline in August retail sales due to a dip in autos, though we expect sales to be unhanged both ex autos and ex autos and gasoline after two straight above trend months.

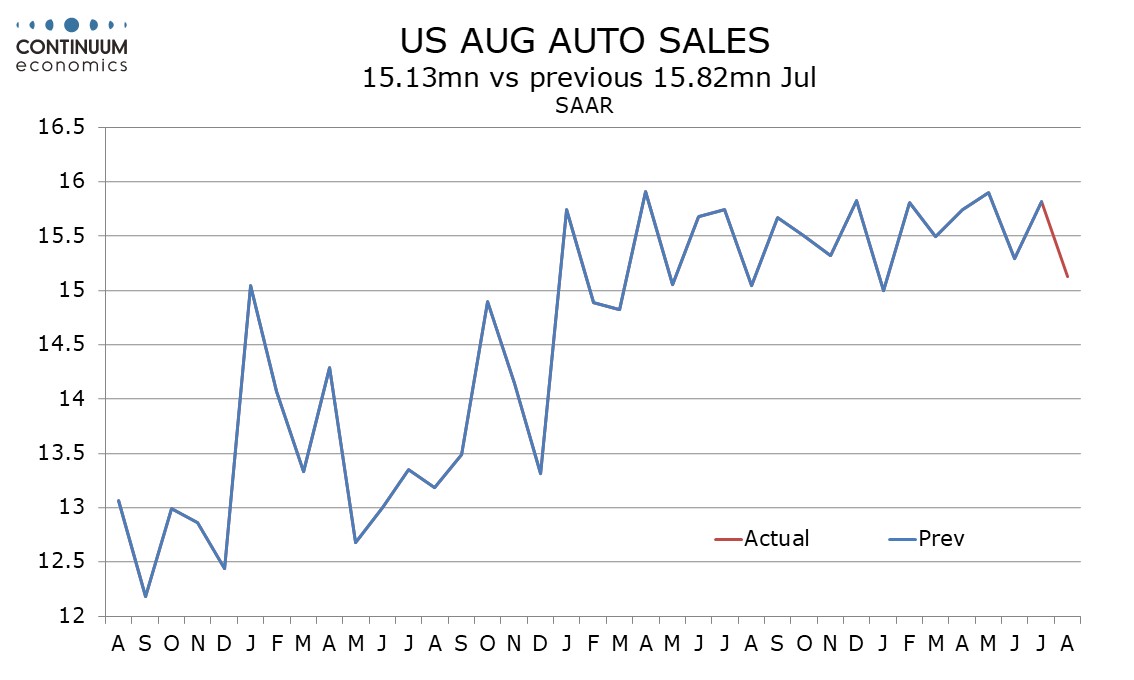

Auto sales slipped in June due to temporary problems with computer software but bounced back in July. Industry data shows a weak month from August auto sales which could be a sign of easing demand now that the temporary distortions have faded.

Unchanged sales ex auto and ex auto and gasoline would be similar to the outcomes seen in April and May before the stronger data seen in June and July.

Unchanged sales ex auto and ex auto and gasoline would be similar to the outcomes seen in April and May before the stronger data seen in June and July.