Bank of Canada Preview for July 24: A Pause Between Easings

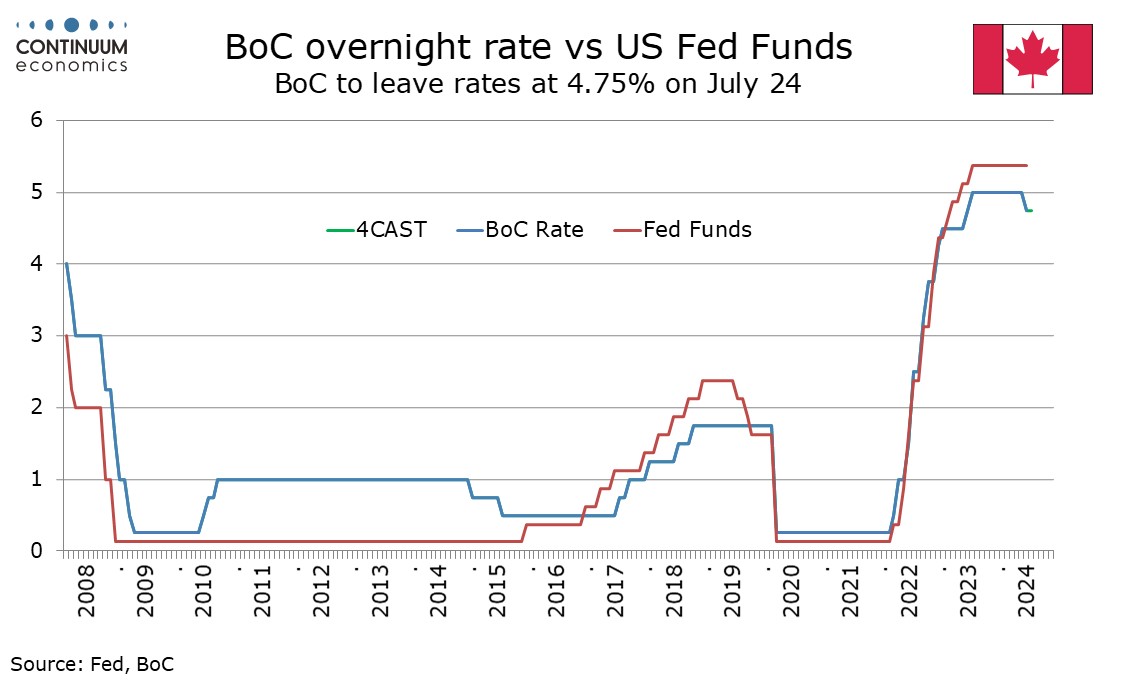

The Bank of Canada meets on July 24 and the decision will be close call between a second straight 25bps easing to follow the move seen on June 5 or leaving rates unchanged at 4.75%. We lean towards the latter option due to caution over inflation, though forecasts in the accompanying Monetary Policy report are likely to look for renewed progress on inflation, and sustain hopes for further easing later in the year.

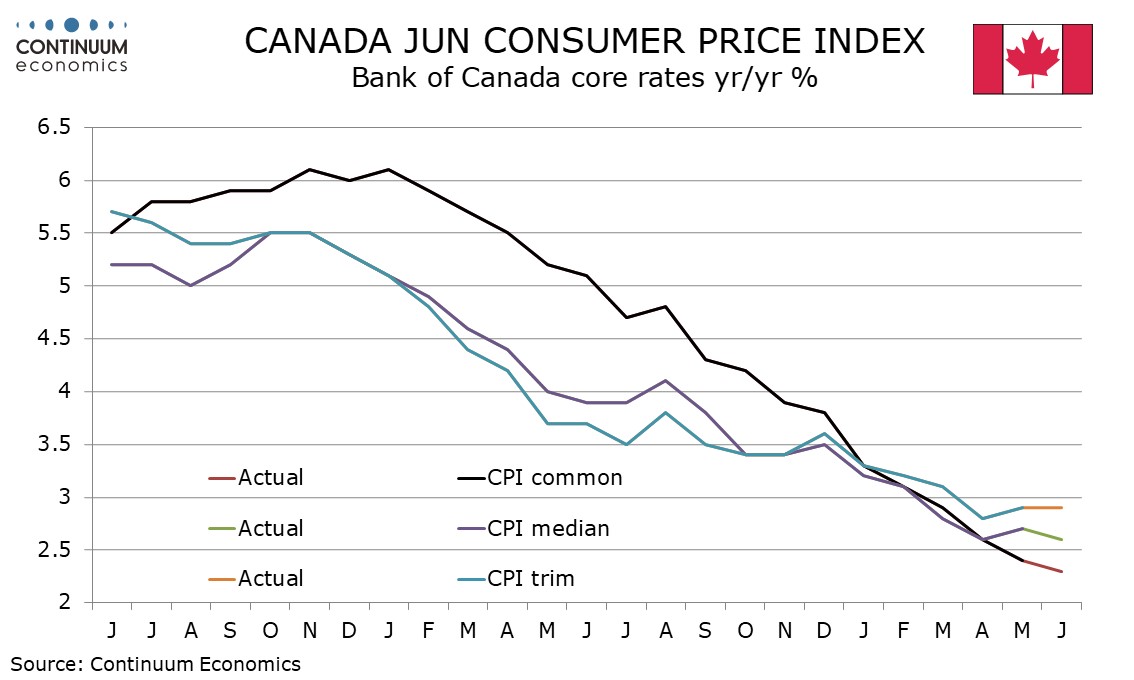

June’s easing followed subdued inflation data being released in the first four months of the year. Since then we saw a modest disappointment in the May CPI, when the headline and even two of the three Bank of Canada core rates picked up, before a subdued but not surprisingly soft June. Progress on inflation has been modest since June’s BoC meeting. In fact, three-month annualized rates for CPI-median and CPI-trim, which were running below the BoC’s 2.0% target in April, have moved back above.

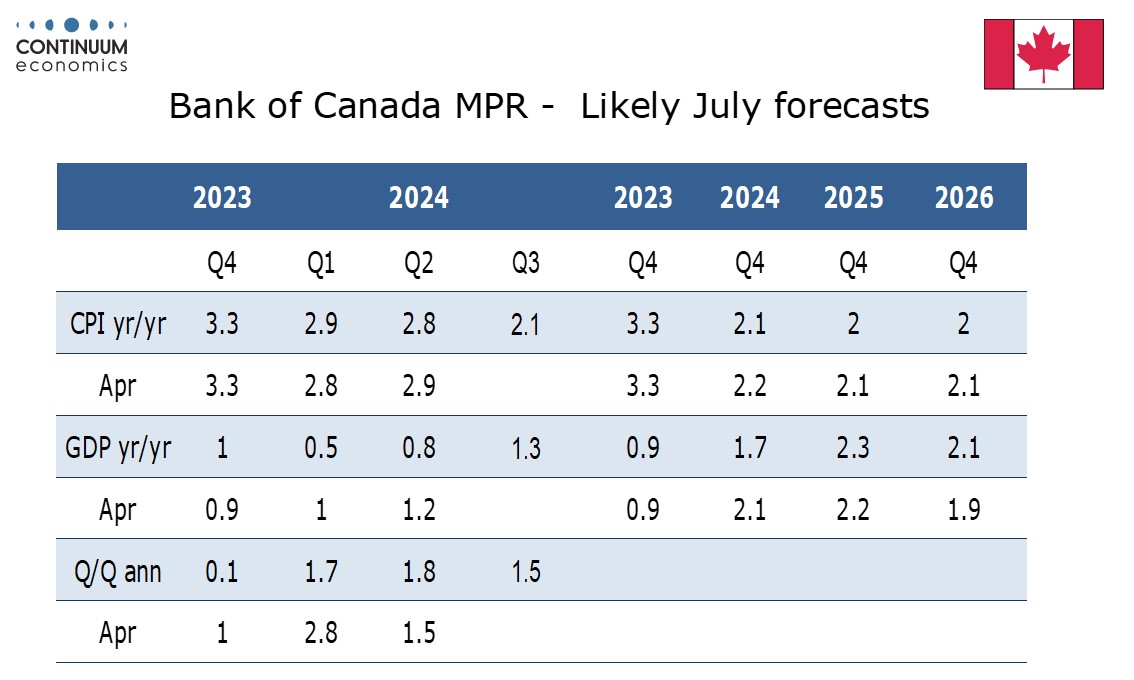

Still, inflation is set to fall significantly on a yr/yr basis in July and August as strong year ago data drops out, and the BoC’s quarterly forecast in the Monetary Policy Report is likely to see inflation getting close to target by the end of the year, and may even be revised down from the 2.2% seen for Q4 2024 when the forecasts were last updated in April. We expect they will project 2025 and 2026 CPI on the 2.0% target, rather than marginally above at 2.1% as was the case in April.

Still, inflation is set to fall significantly on a yr/yr basis in July and August as strong year ago data drops out, and the BoC’s quarterly forecast in the Monetary Policy Report is likely to see inflation getting close to target by the end of the year, and may even be revised down from the 2.2% seen for Q4 2024 when the forecasts were last updated in April. We expect they will project 2025 and 2026 CPI on the 2.0% target, rather than marginally above at 2.1% as was the case in April.