U.S. May Retail Sales suggest consumer spending losing momentum

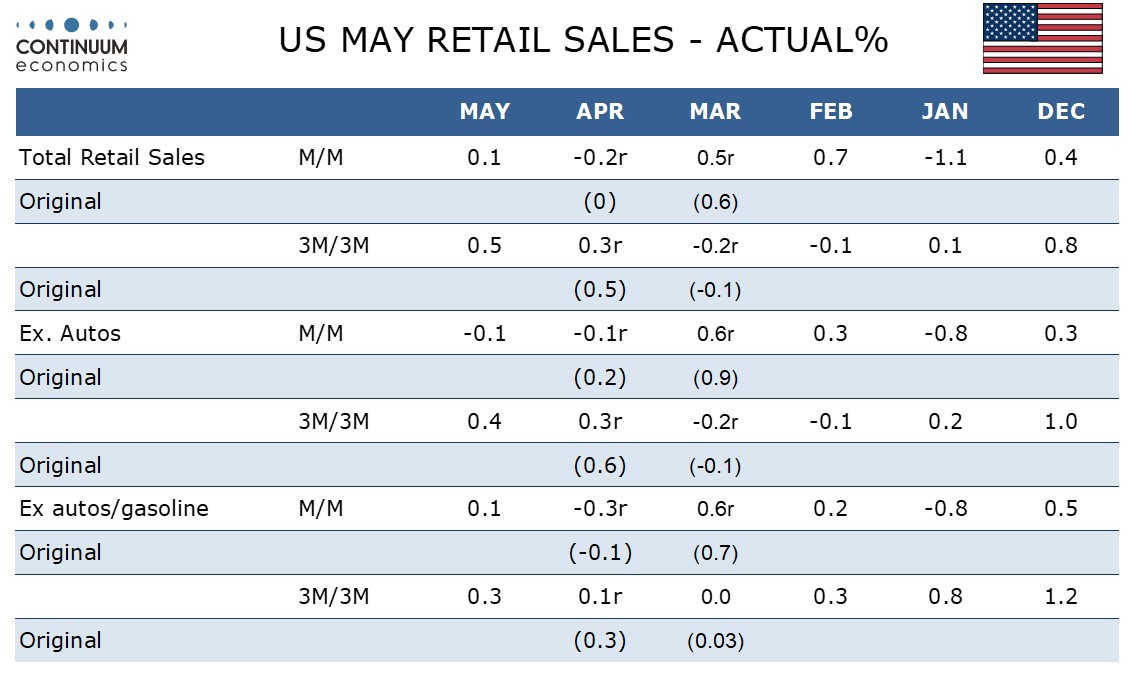

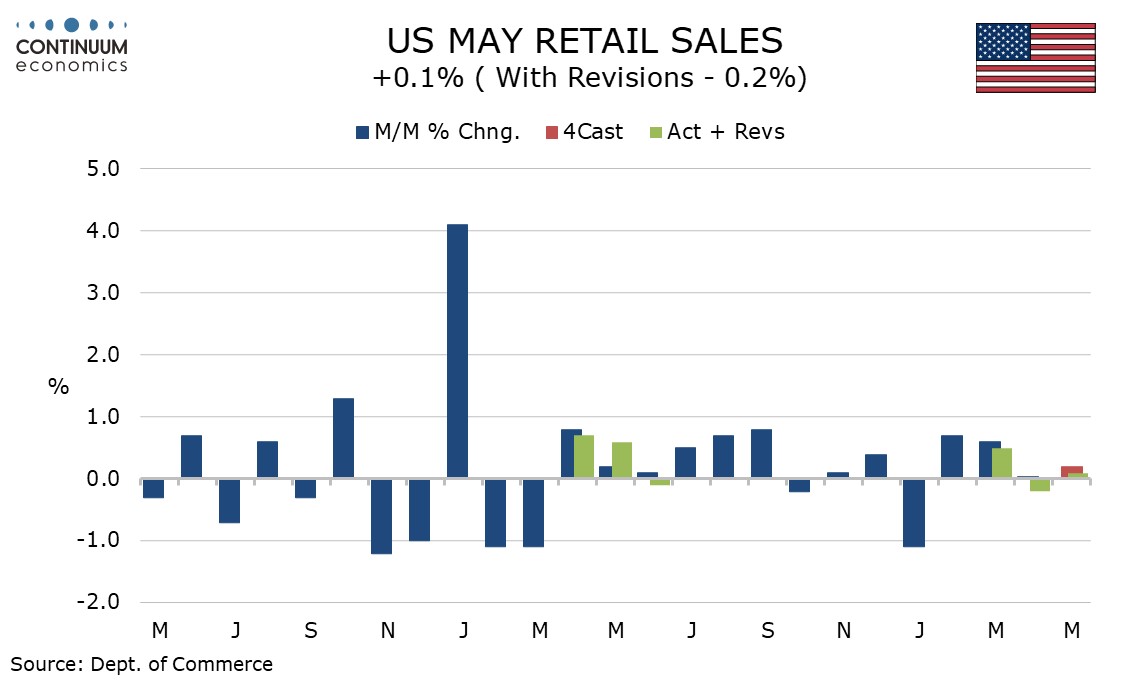

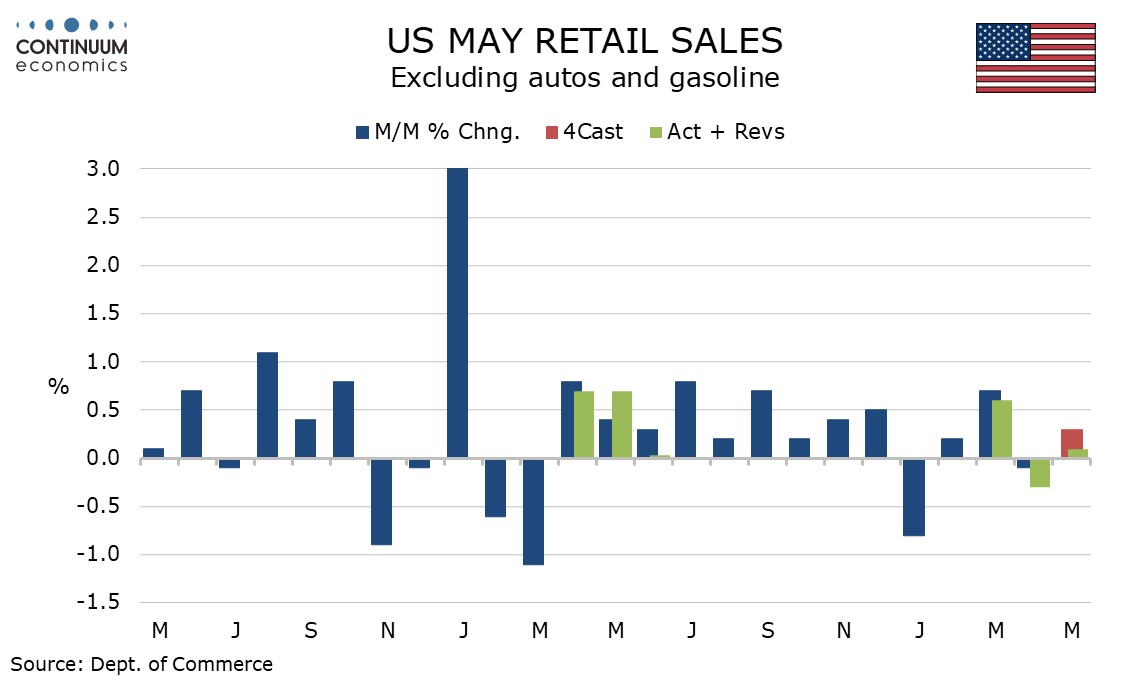

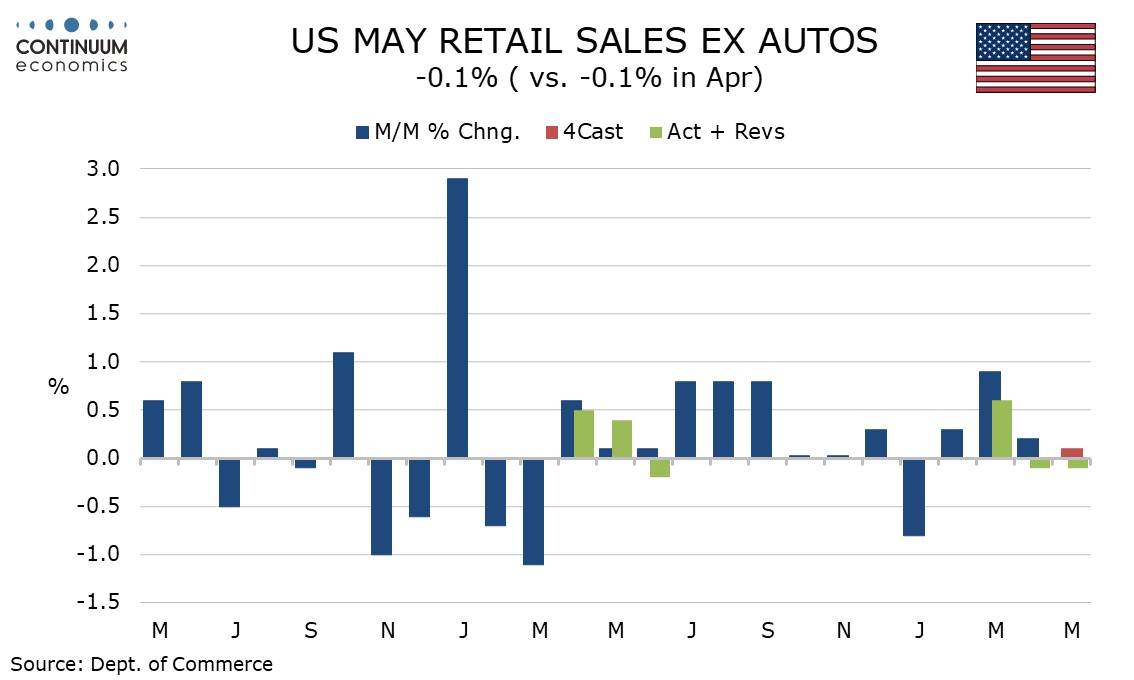

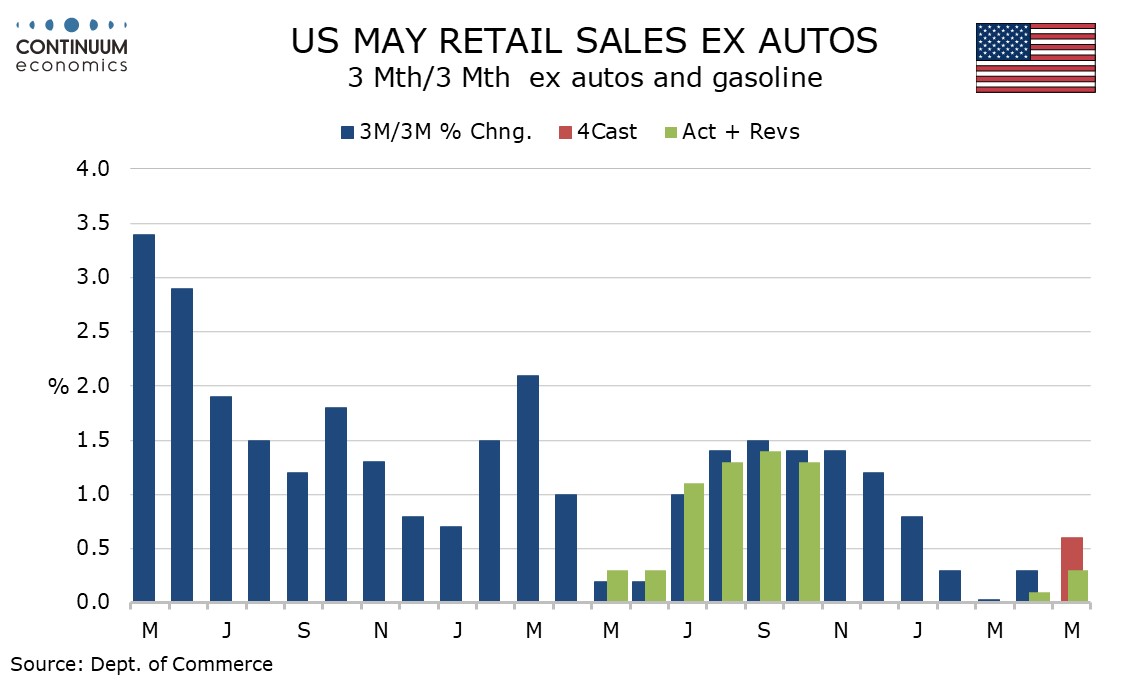

May retail sales with a 0.1% increase are weaker than expected and the downside surprise is larger when noting modest downward revisions to May and April. May sales fell by 0.1% ex autos and rose by only 0.1% ex autos and gasoline.

The control group, which contributes to GDP, is firmer with a rise of 0.4% but this comes after a revised 0.5% decline in March.

The net downward revision to overall sales is 0.3%, with April revised to -0.2% from unchanged and March revised to a 0.5% increase from 0.6%.

CPI showed commodity prices down by 0.4% but unchanged ex food and energy so retail sales appear to have put in a modest rise in real terms, though after a weak April the Q2 picture is still suggesting some loss of consumer momentum now that savings built up during the pandemic have been depleted.

Consumer spending surprised on the upside in the second half of 2023 but significantly outperformed real disposable income, and that does not appear to be continuing in 2024.

May’s breakdown was mostly subdued outside a rise in autos as had been signaled by industry data and a correction in clothing from a weak April. Gasoline fell particularly sharply but that was due to prices.