FX Daily Strategy: N America, May 15th

US CPI the focus, soft USD tone may persist on neutral data

JPY weakness likely now close to limits

Still upside scope for NOK/SEK after Swedish CPI

US CPI the focus, soft USD tone may persist on neutral data

JPY weakness likely now close to limits

Still upside scope for NOK/SEK after Swedish CPI

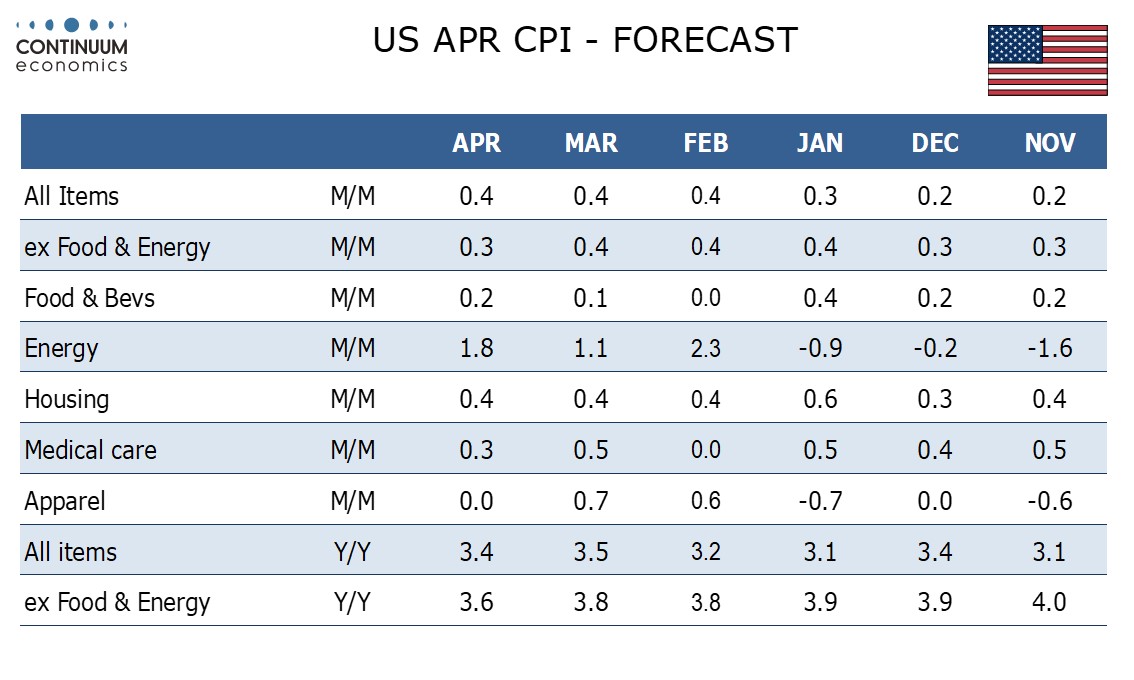

Wednesday has the main data of the week in the form of US CPI and retail sales. We expect April CPI to rise by 0.4% overall for a third straight month but see the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though April PPI strength was disappointing and inflationary pressures will still look quite significant in April. Our forecasts are in line with the market consensus, so impact should be modest. With the market not fully pricing a Fed cut until the November meeting, there may be more downside than upside risk for the USD, especially after Powell’s comments yesterday. Although Powell acknowledged the lack of progress on inflation in Q1, he isn’t talking about a reacceleration, and at this stage a weak CPI number may be enough to bring the market back to fully pricing a September cut.

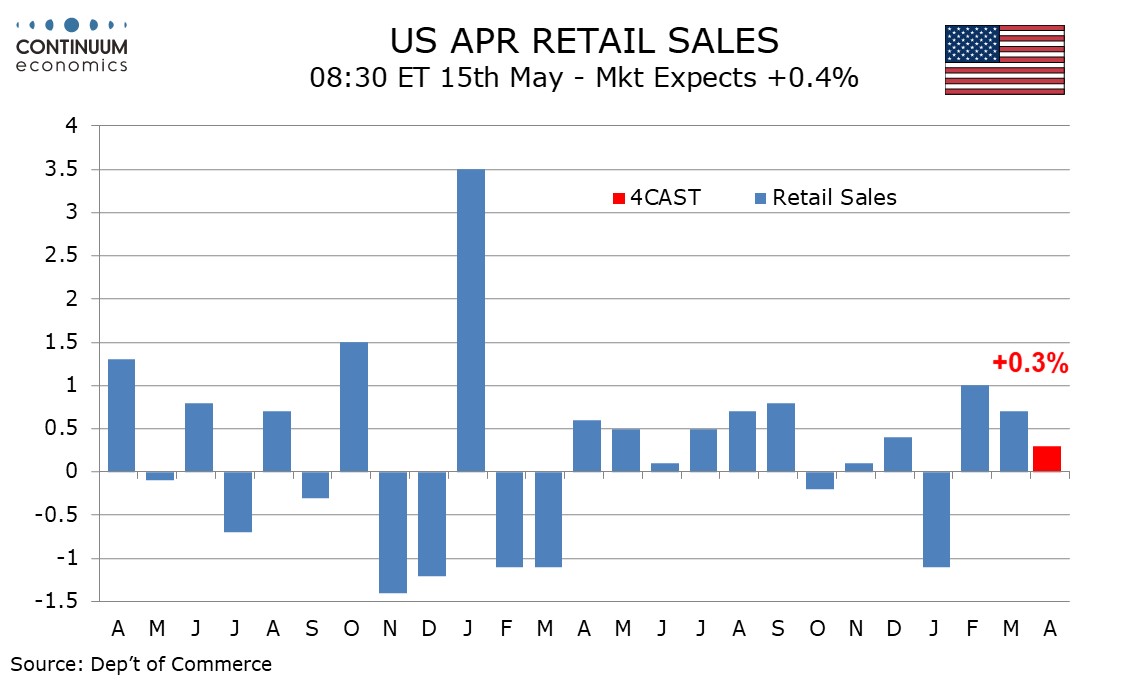

CPI should dominate, but there will also be some interest in the retail sales data, particularly given a run of softer US real sector data in the last couple of weeks. After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022. Our forecasts are marginally below market consensus, and may support the perception of somewhat softer US data, but are still not materially weak.

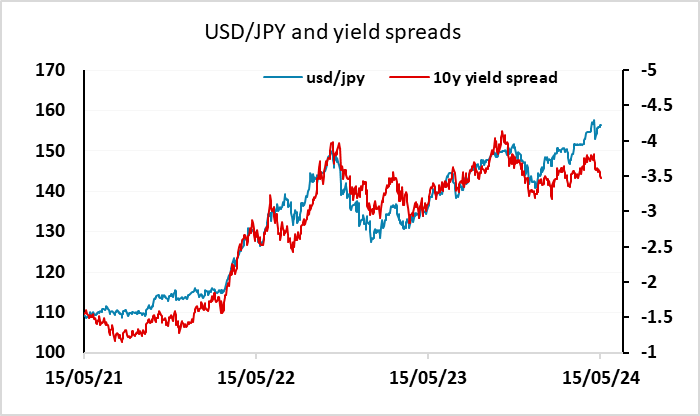

For the USD, there has been some softness against the riskier currencies in the last week or so, in part due to some softer US data, in part due to some slightly stronger data out of Europe. Our feel is that the USD can weaken some more on neutral numbers, with the riskier currencies still benefiting from resilient equities. The underperformer in the last week has been the JPY, with EUR/JPY now up 7 days in a row by more than 5 figures. USD/JPY, which was moving with yield spreads for the last few years has risen well beyond the levels suggested by these spreads, and in the last few days has continued to rise despite spreads moving in the JPY’s favour. It’s hard to see this continuing without some opposition from the Japanese authorities, and if USD/JPY fails to come down organically after the US data, the BoJ may give it some help.

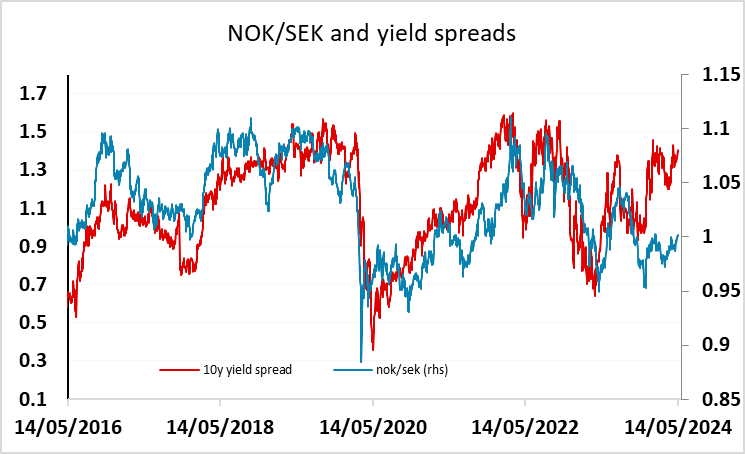

Swedish April CPI has come in slightly weaker than expected, triggering a small SEK decline. With the Riksbank having already cut rates, this probably doesn’t make a lot of difference for market expectations of Riksbank policy, but the SEK continues to look vulnerable to losses against the NOK. NOK/SEK has recovered in the last couple of months, and now may form a base at parity, with yield spreads suggesting scope for a move up as far as 1.05.