AUD, JPY flows: Mildly corrective risk tone

Some correction seen in recent risk positive moves as equities edge lower

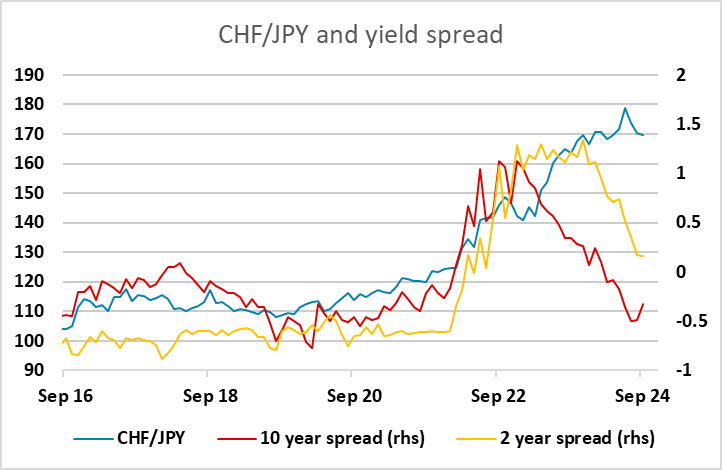

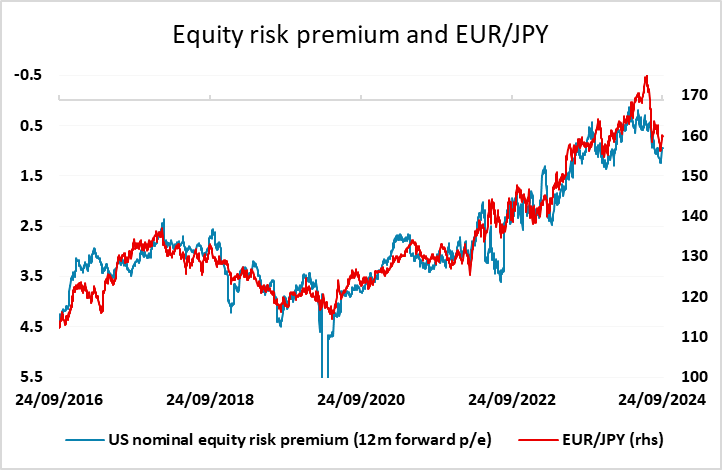

Although the PBOC cut the MLF from 2.3% to 2.0% overnight, this was expected after yesterday’s announcements and equity indices tracked lower through the Asian session, taking the riskier currencies with them. AUD/USD breached 0.69 to make a new high for the year early in Asia, but has slipped lower with the equity indices through the session. There is little on the calendar today of global significance, although the Swedish Riksbank meeting is of local importance. We see scope for some further modest correction to the recent risk positive market moves. JPY weakness looks a little overdone, particularly relative to the better performance of the much more highly valued CHF. EUR/JPY and USD/JPY also look to be trading above the levels suggested by correlations with yield spreads and risk premia.