FOMC leaves rates unchanged, economic assessment more hawkish

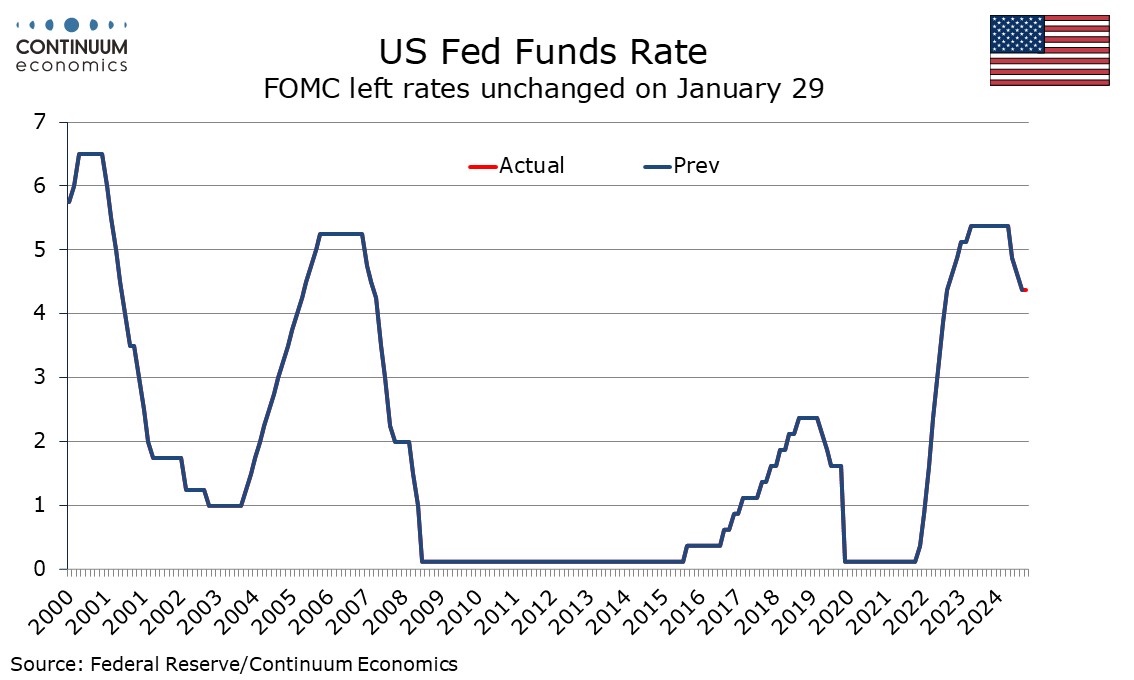

The FOMC has left rates unchanged at 4.25-4.5% as expected. The statement has seen hawkish adjustments in its assessments of labor market conditions and inflation.

The latest statement states the unemployment rate has stabilized at a low level in recent months and labor market conditions remain solid. In December the FOMC stated that since earlier in the year labor market conditions have generally eased and the unemployment rate has moved up but remains low. Thus, the FOMC is describing a stable labor market rather than a modestly easing one.

On inflation the FOMC simply states that inflation remains somewhat elevated, removing a reference to it making progress towards the 2% objective. The statement repeats December’s view that recent indicators suggest that the economy has continued to expand at a solid pace. Other than that, the statement is little changed from December’s, other than this time delivering a unanimous vote to leave rates unchanged rather than easing by 25bps (with one hawkish dissent) as was the case in December. Risks are still seen as roughly in balance.