EUR, JPY flows: EUR downside risks on GDP, JPY has upside scope

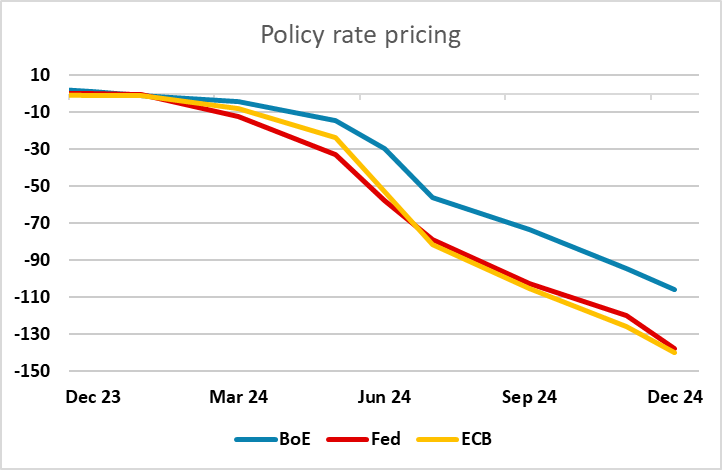

Eurozone GDP numbers to set the tone for the EUR, but limited scope for declines in EUR yields. JPY should benefit from Kishida calls for higher Japanese wages and decline in yields in the US and Europe on geopolitical tension.

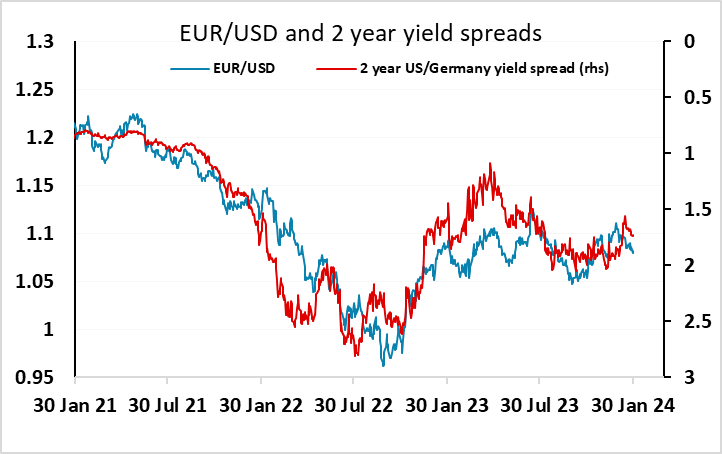

The French Q4 GDP numbers have come out in line with expectations at flat on the quarter, which may have given the EUR some mild support as it leaves the possibility open that the Eurozone avoided recession in Q4, although the market consensus is still for a 0.1% decline in Eurozone GDP. German numbers at 09:00 will be key, with the expected 0.3% q/q decline still likely to tip the Eurozone into recession. If so, the risks are on the downside for the EUR, which tested 1.08 yesterday. However, we still don’t see substantial downside risk today, as the market is already fully pricing a 25bp rate cut in April, and it will be hard to exceed that given that the ECB is still suggesting the first cut will be in the summer. Chief economist Lane speaks today, but it seems unlikely he will commit to anything earlier after Lagarde’s comments last week.

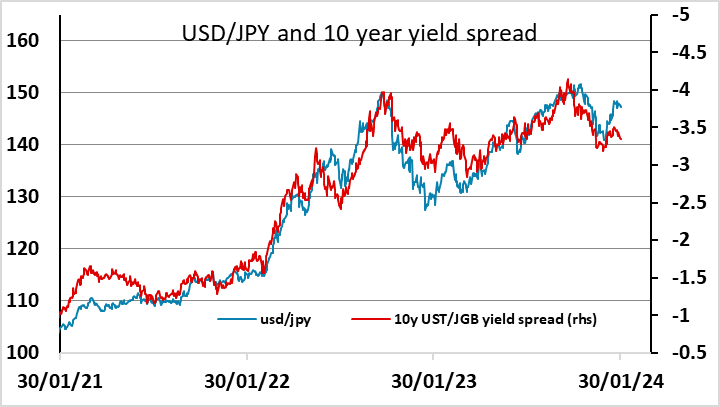

Overnight, the JPY has managed to make some general gains as yields continued to fall in the US and Europe, helped by continuing geopolitical tension. Comments from Japanese PM Kishida may also have been supportive for the JPY, as he emphasised the need for wage hikes in the spring wage round. This is a key factor for the BoJ, with higher wages necessary for them to justify monetary tightening. The support of Kishida makes such wage hikes more likely, and should consequently be JPY supportive. In any case, the lower yields seen so far this week suggest there should be significant downside for USD/JPY, which now looks substantially out of line with the 10 year yield spread.