FX Weekly Strategy: November 17th-21st

Market focus on potential release of US data

Equities showing some nerves with Fed easing now seen as less likely

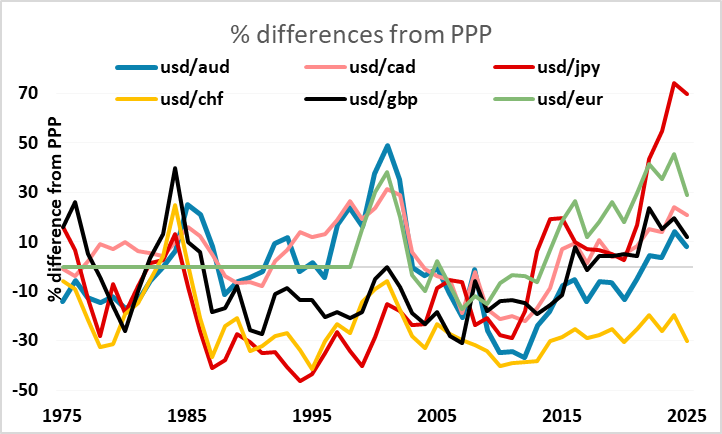

JPY weakness and CHF strength are extreme

GBP to remain under pressure

Strategy for the week ahead

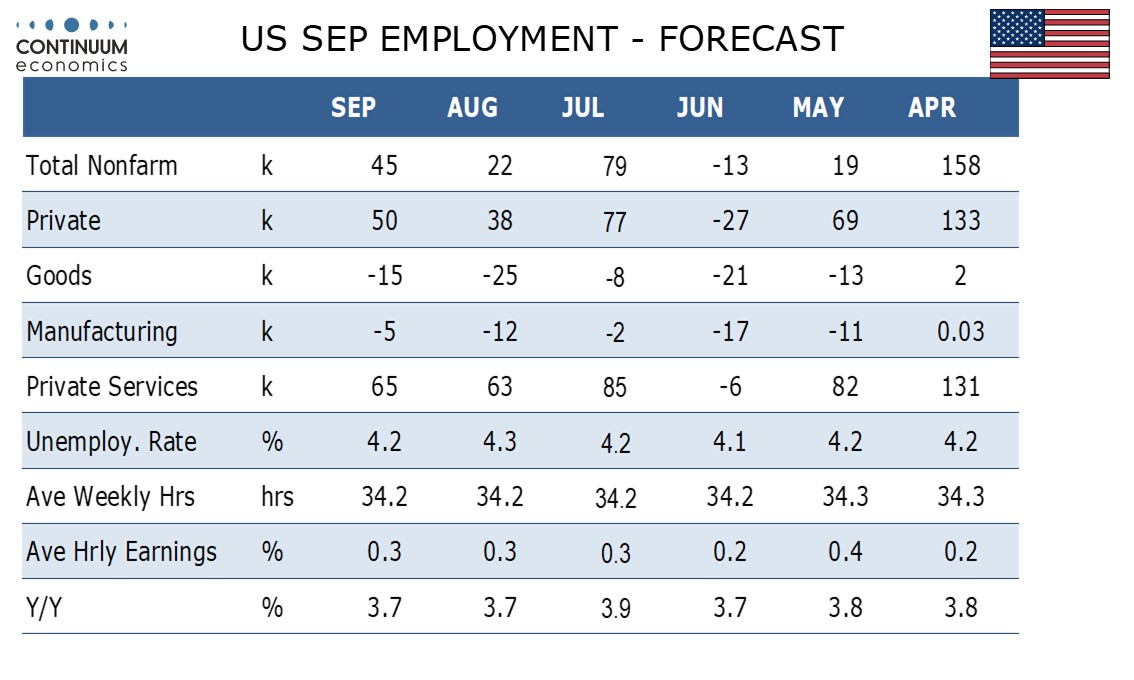

Equities came under some pressure at the end of last week as markets started to anticipate the release of the US data that has been delayed because of the government shutdown. The September employment report is widely expected to be one of the first pieces of delayed data to be released, and the worry is that the private sector surveys suggest some risk of weakness. We expect September’s non-farm payroll to show another subdued rise, of 45k, with 50k in the private sector, but marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while average hourly earnings maintain trend with a rise of 0.3%. This is broadly in line with consensus, although the median expectation is for the unemployment rate to stay at 4.3%. This doesn’t look weak enough to maintain hopes of a December Fed ease, especially given the hawkish tone to Fed comments over the last week. The market now prices the chances of a December Fed ease at slightly below 50%, and a further decline in easing hopes may put further downward pressure on equities.

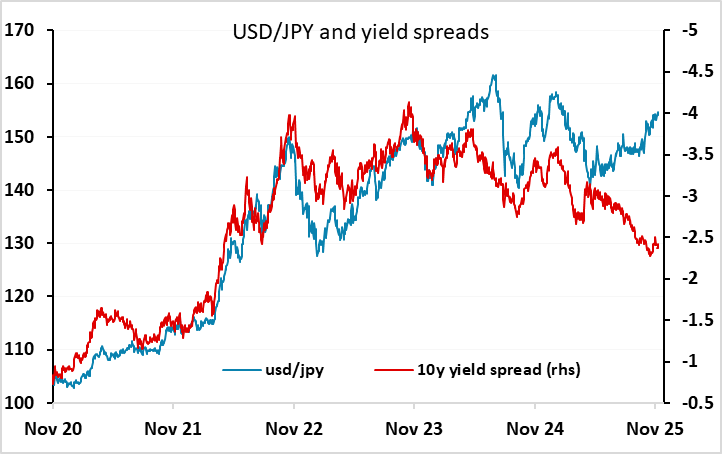

The USD was mixed in response to weakening equities last week, losing a little ground against the JPY and CHF but gaining against the riskier currencies, while EUR/USD was marginally firmer. The impact of any equity decline on the USD might depend in the cause. If it is due to declining Fed easing expectations, the USD may well gain in general, particularly against the riskier currencies, while if it results from weaker US data the USD could eb expected to fall back.

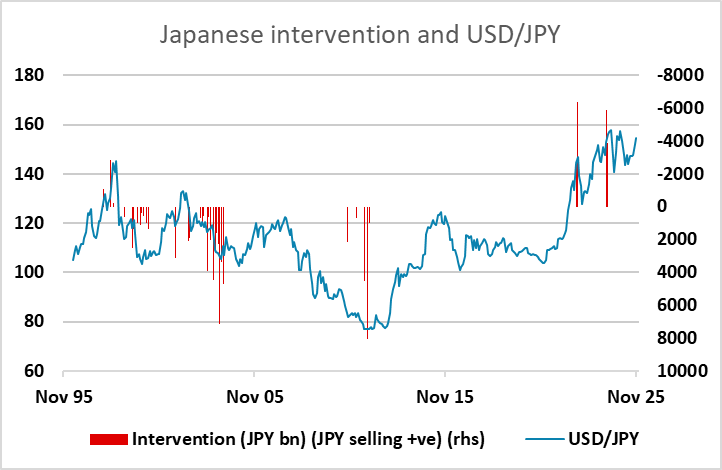

In general, the risk picture looks fragile, with equity valuations implying a lot of good news is priced in. Normally, this would suggests upside risks for the safe havens, but the background for the JPY and CHF is complex. The JPY is close to record lows on a trade-weighted basis, while the CHF is close to record highs. Both gained a little on the weaker equity market on Friday, but the CHF was the better performer, making another new all time high against the JPY. The rationale for extreme CHF strength and extreme JPY weakness is mysterious, since supposed concerns about a lack of BoJ tightening have undermined the JPY, but actual SNB easing has failed to undermine the CHF. The only metric that seems to favour the CHF is the low level of (gross) Swiss government debt compared to the high level of Japanese government debt. However, the interest bill on Japanese debt is tiny compared to almost all other major countries, so it’s hard to argue that this is the real concern. In the end, the trend strength of the CHF and the trend weakness of the JPY are both hard to oppose, and may require central bank intervention to halt them. Current levels are extreme enough to suggest that both the BoJ and the SNB could get involved if there were any further significant extensions in JPY weakness or CHF strength. Japanese GDP on Monday could be a trigger for the next JPY move.

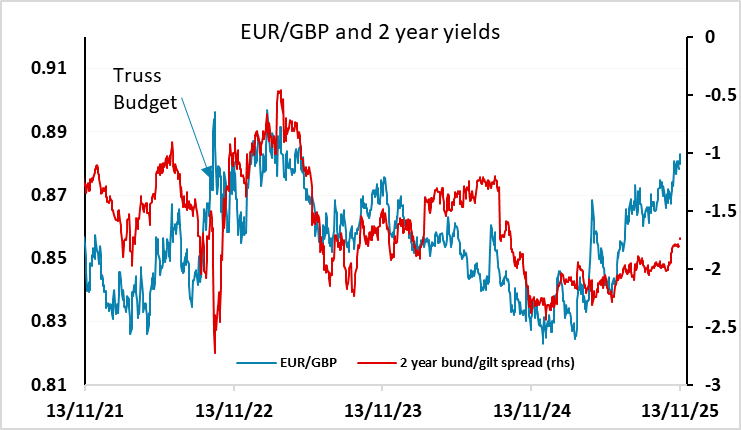

GBP also saw some significant weakness in the last week as concerns rose about the upcoming UK Budget on November 26, with reports suggesting that Chancellor Reeves had abandoned plans to raise income tax to plug the £20bn+ hole in her revenue. Other revenue raising measures are likely instead, but the gilt market expressed a lack of confidence in the UK fiscal picture by selling off aggressively on Friday. While GBP broadly held it own after initially falling to new lows for the year against the EUR, sentiment is clearly negative, and risks looks to still be on the GBP downside for now. UK CPI and public borrowing numbers this week will consequently be a focus, but we would see the GBP reaction to be biased to the downside.

Data and events for the week ahead

USA

The US calendar highlight is likely to be minutes from the October 29 FOMC meeting on Wednesday, a meeting which Chairman Powell stated saw strongly differing views on December. The minutes are likely to show significant debate over the decision to ease, even if there was only one hawkish dissent, and most cautious over a further move in December, which will be dependent on data. Fed speakers include Kashkari on Monday, Williams on Wednesday, Hammack and Goolsbee on Thursday, with Williams again and Logan due on Friday.

Private sector economic releases scheduled include November’s Empire State manufacturing survey on Monday, November’s NAHB homebuilders’ index on Tuesday, November’s Philly Fed manufacturing survey on Thursday, followed by October existing home sales, for which we expect a rise of 1.0% to 4.10m.

Delayed government releases may start to be released as the week progresses. One of the first likely to appear will be September’s non-farm payroll, which we expect to rise by 45k. We may also see a string of weekly initial claims releases, which state data suggest have not changed much from before the shutdown.

Canada

Canada’s data highlight is October CPI on Monday, which we expect to slow to 2.2% yr/yr from September’s surprisingly strong 2.4%, with modest slowings also in the Bank of Canada’s core rates. October existing home sales and housing starts are also due on Monday. Thursday sees Octobers IPPI and RMPI, and Friday September retail sales, for which the preliminary estimate was for a decline of 0.7%.

UK

The coming week sees several important economic updates looming, most notably the CPI (Wed). After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July and stayed there for the two following months, but with the September outcome having been lower-than-expected outcome in what we (and the BoE) think will end up being the inflation peak. Indeed, we see that the October figure will drop a notch more than BoE thinking, to 3.5%, helped by favourable energy base effects, with the core rate seen dropping 0.1 ppt to a ten-month low of 3.3%. Other base effects may mean food inflation being stable after a clear and belated fall in September.

Friday sees monthly public borrowing numbers which in the first six months of 2025-26 totalled £99.8 billion, ie £11.5 billion above the same period last FY and £7.2 billion above the OBR’s monthly profile consistent with our March forecast. Borrowing remains higher largely because of higher estimated borrowing by local authorities and public corporations. Friday also sees September retail sales data where a (belated?) m/m correction is seen with it unclear if wetter and warmer than average weather may have affected spending adversely as may apprehension ahead of the Budget. Earlier that day, GfK consumer confidence data may show still subdued sentiment as may CBI industry numbers (Thu). But as far as survey numbers are concerned, the PMI flashes (Fri) take precedence at least in market eyes, especially after the better outcome last time around which we think will be corrected in this November update. Indeed, in October, the Composite Output Index rose to 52.2 from 50.1 in September and above the 50.0 no-change value for the sixth successive month, albeit this failing to take account of weak construction activity.

Eurozone

More updated Q3 GDP and employment numbers appear on Thursday. But with some eyes on the French INSEE update (Thu), the focus will be on the flash PMI data (Fri). In October, the Composite PMI increased to 52.5, its highest level since May 2023 and seemingly indicating a breakout from the generally subdued growth trend seen throughout 2025 so far. But this ignores what still looks like recession bound construction and where we see a small correction to the composite for November. Additionally, there was a cooling of selling price pressures as output charges increased to the weakest extent since May. And thus may extend into November too

Rest of Western Europe

There are no key events in Sweden while Norway sees the Norges Bank published its regular expectations survey (Thu).

Japan

Preliminary Q3 GDP will be released on Monday and market is expectation a pessimistic result. The details would be more important rather than headline. If we could see a steadily positive private consumption, the picture would not be too ugly and vice versa. We also have trade balance on Wednesday but the more important National CPI will only be released on Friday. Headline number is expected to be around 3% with ex fresh food & energy likely stubborn. However, it may not be as impactful towards the JPY as usual with the new PM talking down reaching sustainable inflation target.

Australia

There is the critical wage price index on Wednesday. While market has pushed back expectation of any imminent cut from the RBA, a strong number would cement it while a dovish number still unlikely to change the RBA’s direction. PMIs on Friday would be less impactful.

NZ

Mostly tier two data. Kick starting with Business PSI and Food Price Index on Monday, PPI on Wednesday and Trade Balance on Friday.