This week's five highlights

U.S. Government Reopens After Long Shutdown

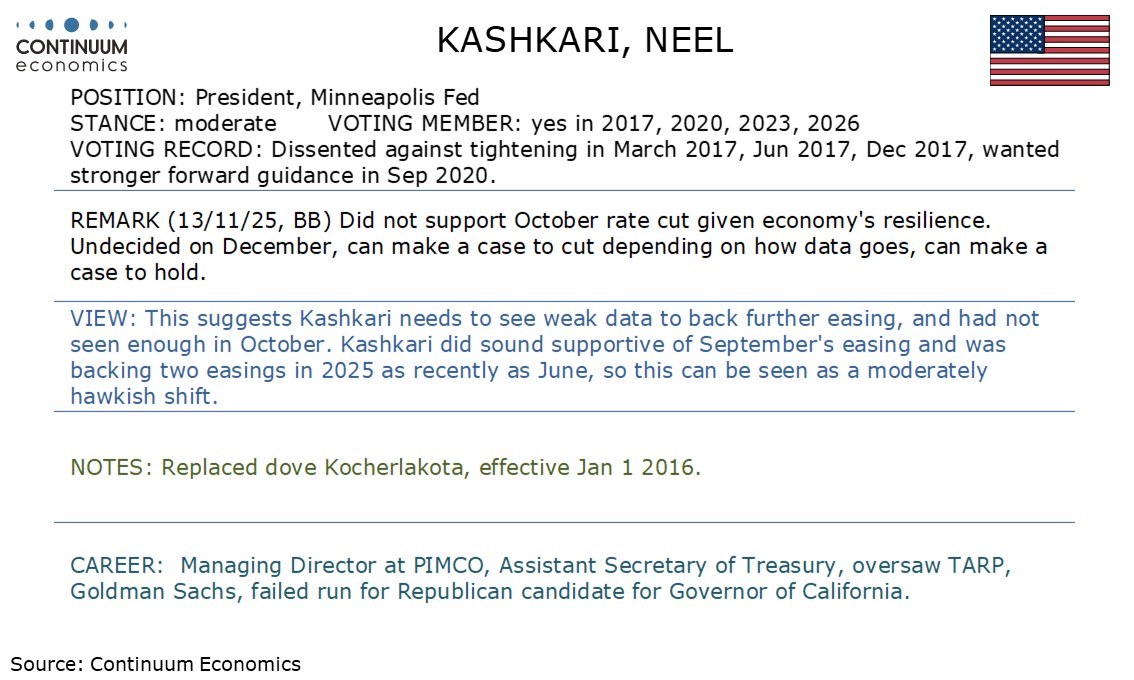

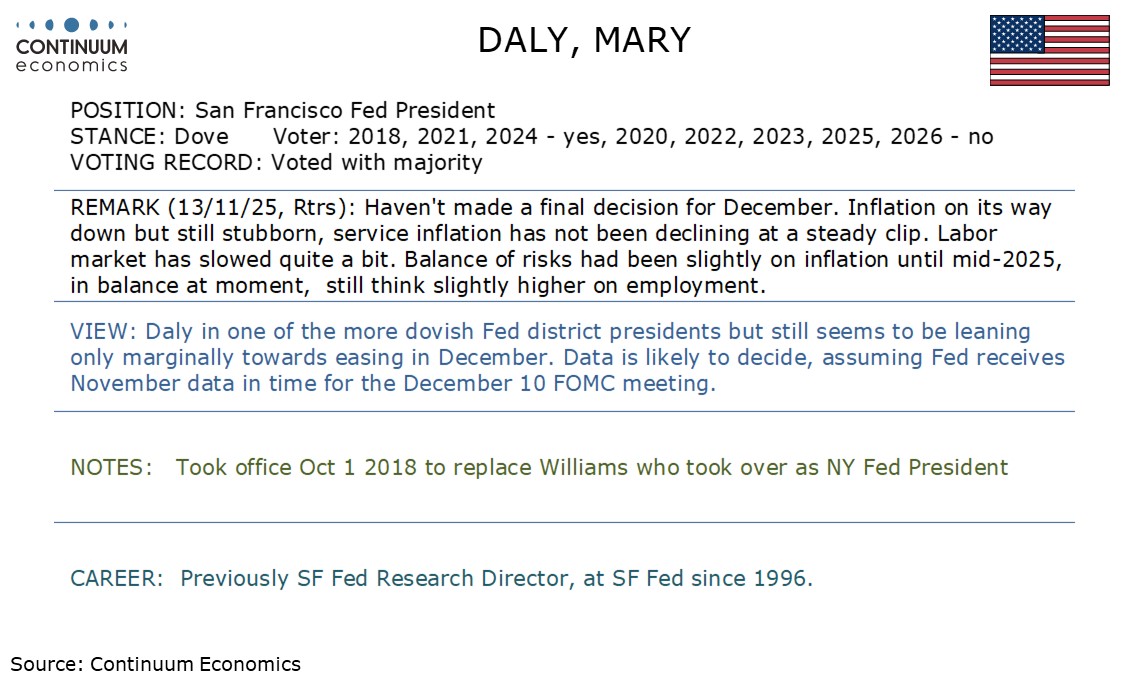

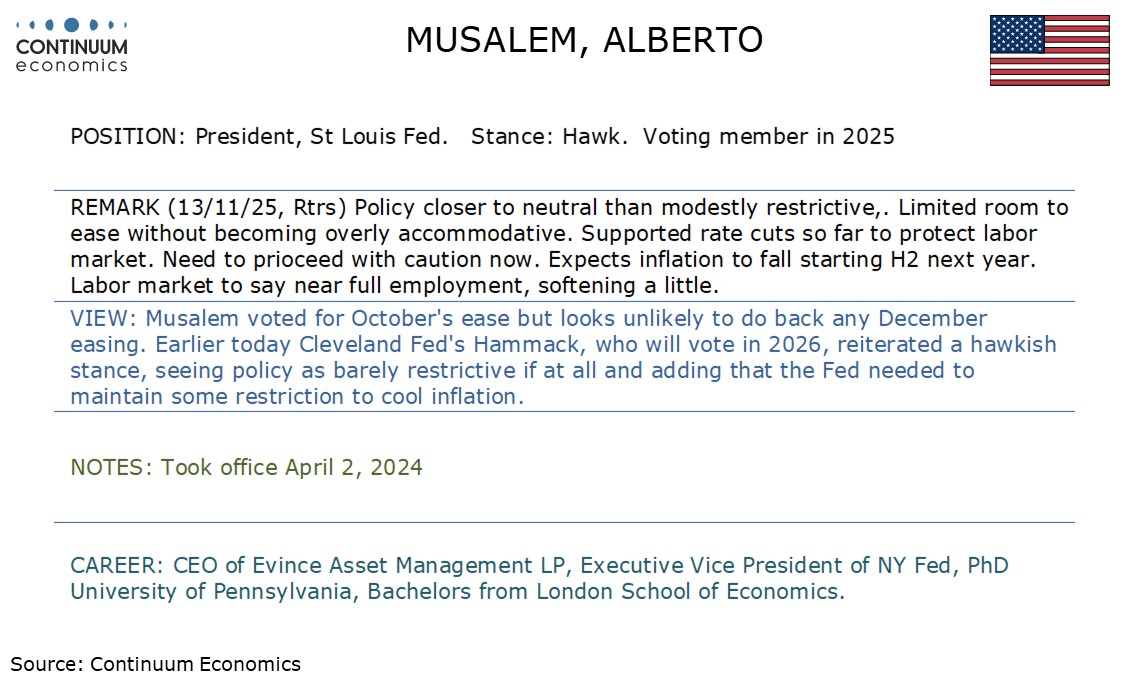

This Week's Fed Speakers

UK GDP Shows Underlying Economy Listless

Japan/China Tensions Over Taiwan

Chinese CPI Rises Helped By Government Pressure

The longest U.S. government shutdown has ended this week as several democrats shifted to support reopening. Both votes in the Senate and Houses are passed with close to double digit margin. The deal approved by both sides of lawmakers have guaranteed the reversal of layoffs and furlough pay during the shutdown.

It is unclear at this point whether both delayed releases will be published or if we will simply get a published change over two months. It is likely key releases, such as non-farm payrolls, will see both releases published, but less significant data may see one release covering two months.

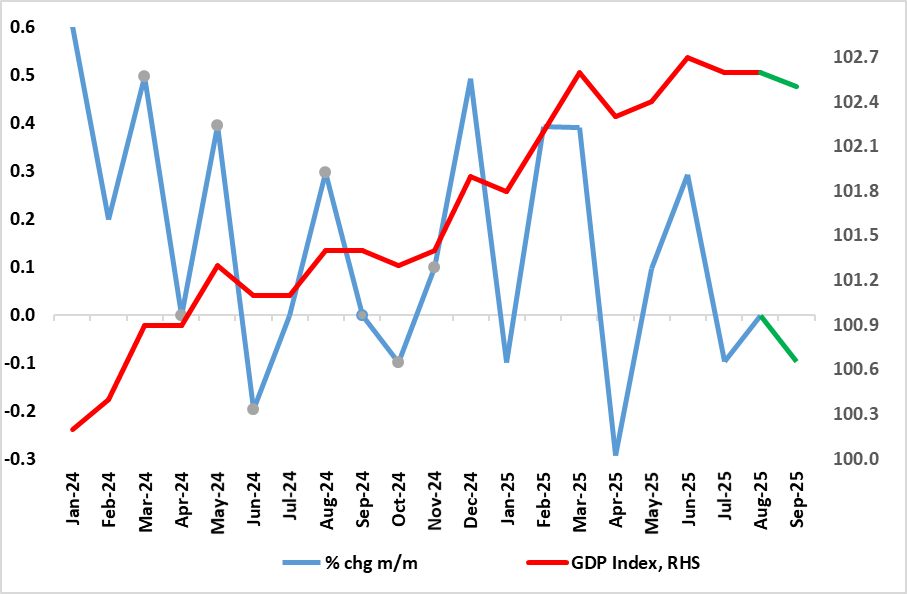

Figure: GDP Growth Flatlining?

As we have underlined, GDP has hardly moved since March and, again, the latest update undershot consensus thinking. Indeed, GDP has fallen in two of the last three months (Figure), albeit where some recovery should be in store for the current quarter as these September numbers were hit (temporarily) by the cyber-attack at JLR vehicle manufacturing and by weather swings. As a result, and largely as we expected, September GDP dropped 0.1% m/m and with downward revisions evident. All of which meant Q3 GDP growth slowed to 0.1% q/q partly due to a slightly perkier consumer performance but also a reflection of an inventory build which may prove involuntary and thus temper any current quarter recovery (which we see matching the Q3 result at 0.1% q/q). But as surveys still suggest, the economy is at best moving sideways, and maybe contracting based on labor market swings. GDP data is weaker than BoE thinking, thus adding to an already clear array of numbers undershooting MPC expectations, thereby encouraging easing speculation further.

China wants to make Japan cautious about helping the U.S. in future military scenarios. With PM Takaichi tougher stance, China could decide to escalate tensions to reduce the risk of Japan becoming involved in future years. This could be restrictions of some critical minerals from China to Japan or threats to stop some Japan’s exports to China. However, we do not see any China escalation, as a signal that the near-term risk of naval blockade or invasion is close. We still only attach a 10% risk to a blockade or invasion in 2027.

Japan is under diplomatic pressure from China for PM Takaichi to back down over her comments on the scenario of China navel blockade on Taiwan or any China military action to prevent the arrival of U.S. forces. Takaichi went further than previous Japanese PM’s by indicating such a scenario could mean a survival-threatening situation in which Japan could use military force for defense.

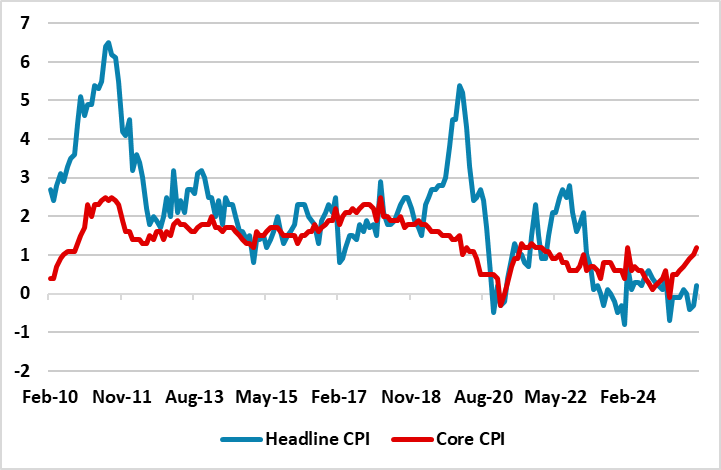

Figure: China Headline and Core CPI Yr/Yr (%)

Less food price decline, plus government pressure to curtail price wars, helped headline and core CPI move higher. However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. The imbalance of supply and domestic demand will remain into 2026 leading to ongoing disinflation.

The October CPI rose to +0.2% Yr/Yr helped by less food price deflation, with food prices falling 2.9% on the year rather than the -4.4% seen in September. Meanwhile, core inflation pushed up from 1.0% to 1.2% (Figure), while PPI declined -2.1% v -2.3% Yr/Yr seen in September. Government pressure to curtail price wars in a number of sectors appears to be leading to less price discounting, which is for now causing less disinflationary pressures.