FX Weekly Strategy: May 12th-16th

US CPI the focus but probably too early for much tariff impact

USD still likely to be favoured if CPI on the high side

GBP can extend recent recovery against the EUR

AUD needs positive US/China news to restore bullish tone

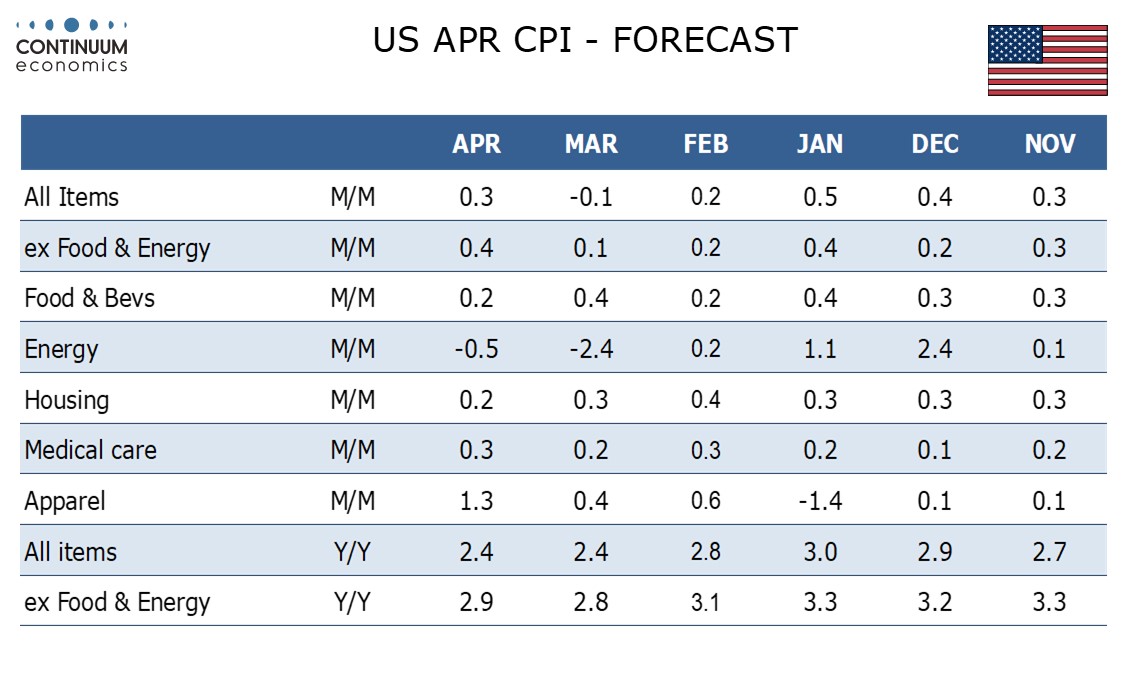

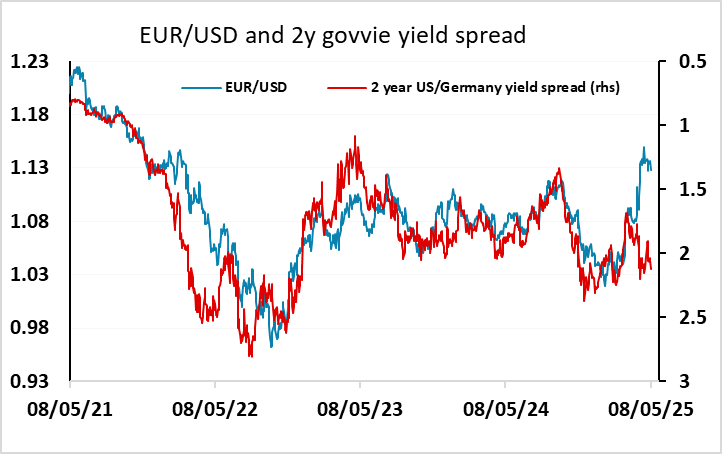

The US April CPI data will be the main focus this week. Although most do not expect to see much impact from tariffs at this stage, there is a risk of a higher number than the 0.3% we and the market expect for the headline. We see a 0.4% core rise, which is slightly higher than the market consensus. However, we don’t necessarily expect a traditional market reaction if the data is stronger than expected. In recent times, higher inflation numbers have tended to support currencies, as the market has anticipated monetary tightening in response. But this time around any rise in inflation is not expected to generate any immediate response from the Fed, as there is concern that higher prices will quickly translate into lower real spending and lower growth. There is in any case now less of a clear correlation between yields and yield spreads and FX rates than there has been in the last few years. Even so, the firmer tone of the USD seen in the last week may persist if we see a higher than expected CPI.

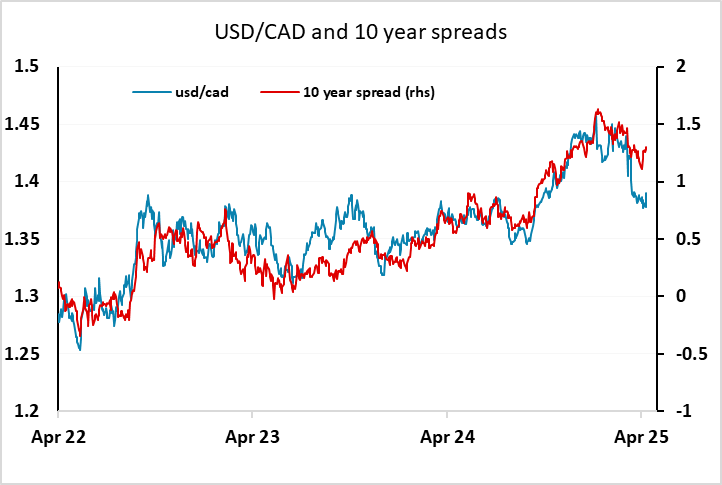

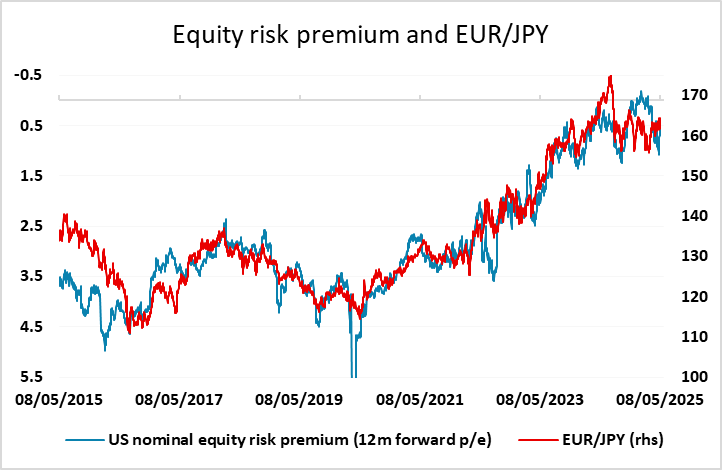

We still see USD/JPY as the most likely pair to see sharp USD declines if there is any weakness in equity markets, but it is also the most likely to rise if US yields rise and equity markets stay solid, as this will imply a further decline in US equity risk premia, which remain highly (inversely) correlated with JPY crosses. The recovery in equities since the announcement of tariffs at the beginning of April looks overdone, with the S&P 500 now higher than it was at the time of the announcement, so we see equities as more vulnerable to negative news than they are likely to benefit from positive news. So any rise in yields should see equities decline, and if we see a firmer USD on the back of higher US yields, the riskier currencies may suffer the most. USD/CAD may have the most scope for gains, as the April Canadian employment numbers on Friday underlined that the labour market is weakening, and yields spreads suggest USD/CAD has upside scope. There is similar scope for EUR/USD on the downside, but the EUR may get more support from a general loss of appetite for the USD as it is seen as the alternative reserve currency. Nevertheless, the risks may be more on the USD upside than downside this week across the board.

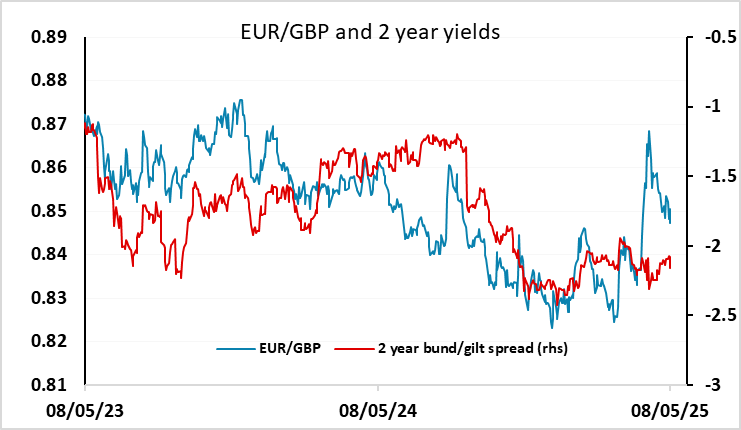

Elsewhere, UK labour market numbers will be a focus for the MPC, who showed themselves to be split 3 ways at last week’s meeting. However, we expect the labour market to provide some support for the doves, with some clear weakening in the wage trends. This may mean some more BoE easing gets priced in, but we wouldn’t necessarily see this as GBP negative. The pound has underperformed yield spreads in the last few weeks, and may benefit from confidence effects if there is evidence that underlying inflation pressures are easing. The UK/US trade deal, limited though it is, may also support GBP sentiment, and we could see EUR/GBP edge back below 0.8450.

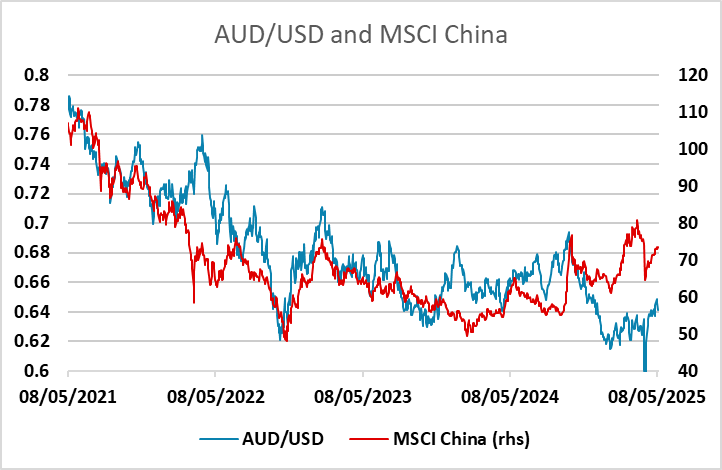

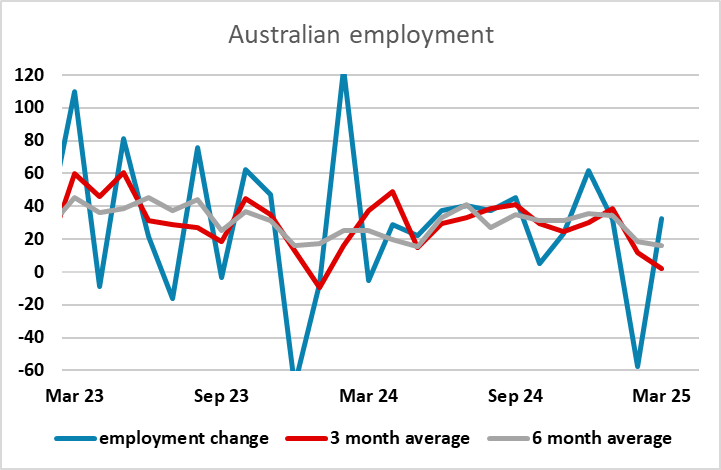

The prospect of trade deals will remain a central focus, particularly between the US and China. This will have a general impact on risk sentiment, and from a G10 FX perspective will be most important for AUD/USD. AUD/USD managed to break above the key resistance area around 0.64 in the last week, but had lost all those gain by the end of the week as the USD recovered. However, any increased hopes of some rapprochement between the US and China would allow AUD/USD to rally anew. We still see longer term upside scope to the high 0.60s if regional risk appetite improves. But this week’s labour market data will also be important, after choppy data in recent months.

Data and events for the week ahead

USA

On Monday Fed’s Kugler will speak, but the only data release is the budget statement for April, a key month for revenues. Tuesday sees April’s NFIB survey on small business optimism, and then the key release of the week, April CPI. We expect a 0.3% rise overall with a stronger 0.4% rise ex food and energy, reflecting a bounce from a below trend March as well as some impact from tariffs, though the latter is likely to be only modest at this point. Fed’s Daly speaks on Wednesday, a quiet day for data.

We expect April PPI on Thursday to look similar to the CPI, with a 0.3% rise overall and a 0.4% increase ex food and energy. Due alongside the PPI is April retail sales, which we expect to rise by 0.1% overall and 0.4% ex autos. Weekly initial claims are also due. April industrial production follows, where we expect a 0.5% rise overall led by utilities but a 0.3% decline in manufacturing. March business inventories and May’s NAHB homebuilders’ index are also due. Fed’s Powell is due to deliver opening remarks on Thursday, but may reveal little. On Friday we expect April housing starts to rise by 5.7% to 1400k while permits fall by a marginal 0.5% to 1460k. April import prices are also due. The preliminary May Michigan CSI follows, and may correct higher from recent weakness, but inflation expectations are likely to remain elevated. Friday will also see Fed’s Barkin speak.

Canada

In Canada, March building permits are due on Wednesday and April housing starts and existing home sales follow on Thursday. Thursday also sees March manufacturing and wholesale sales, for which preliminary releases saw declines of 1.9% and 0.3% respectively.

UK

Tuesday sees the next set of labor market numbers where the apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data) is likely to see clear drops in the official earnings data of up to 0.5 ppt in both headline and regular pay. Otherwise the HMRC numbers are likely to show that employment is continuing to contract. Tuesday also sees the BoE Watchers Conference where several MPC members will attend and speak and where MPC members Breeden and Dhingra speak on Wednesday and Thursday respectively.

Thursday also sees GDP data for both March and Q1. We see the surprise and sizeable February GDP jump consolidating in the March GDP release with a flat m/m reading, this coming after a 0.5% jump. Without what may be clear revisions, this implies a Q1 outcome of around 0.6% q/q which we think will also be what consumer spending may have risen last quarter. The March data may see a reversal of February’s manufacturing strength, offset by a surge in real estate reflecting what was then imminent stamp duty changes in the housing market.

Eurozone

There is little data wise this week, EZ industrial production may rise further on an update due Thursday, this coming alongside flash Q1 GDP and employment numbers for Q1. Meanwhile ZEW survey numbers may be all over the place depending on when the results were taken.

Rest of Western Europe

There are few key events in Sweden, most notably the Riksbank decision minutes (Wed) as well as the April CPI details arriving the same day. Elsewhere, Thursday sees flash (non-sporting) Q1 GDP data from Switzerland while Q1 GDP data are due from Norway too on the same day and where we see an undershoot of the Norges Bank’s projection of 0.5% q/q.

Japan

Preliminary Q1 GDP for Japan will be released on Thursday. Consensus mostly hold a pessimistic view and we see a similar picture on soft household consumption despite stronger wage hike as real wage dips occasionally. The only surprise lies in trade balance. Q4 2024 trade balance has been stellar and could see a softer Q1 2025. However, if oversea buyers continue to hoard inventory before Trump’s tariff, a strong trade balance could keep GDP afloat. Else, PPI on Tuesday could capture some eyeballs yet unlikely to move the market.

Australia

Thursday’s Labor data will be interesting as the Australian labor market has been choppy and the RBA seems to see more downside than upside in the coming quarters. Wage price index on Wednesday would be reflective of the choppy Q1 and could see it tread lower. There are also consumer confidence and business confidence on Tuesday.

NZ

RBNZ Inflation Expectation On Friday would be the only meaningful data for NZ next week.