GBP, USD flows: GBP little changed after UK data

GBP unchanged after UK labour market data in line with consensus

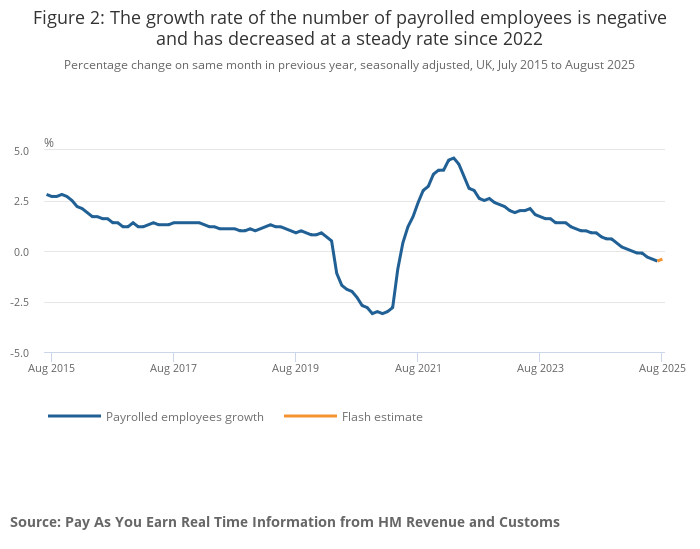

GBP is very little changed after a very much as expected UK labour market report. This showed average earnings growth for July in line with consensus at 4.7% including bonuses (up from 4.6% in June) and 4.8% excluding bonuses (down from 5.0% in June). The employment data from HMRC for August showed a small decline in payrolled employment in August and a small rise in earnings growth. The data is all in line with consensus but suggests a slight stabilisation in employment and earnings growth after the decline seen in recent months, perhaps reflecting the modest pick up in GDP growth seen at the start of the year. EUR/GBP is likely to remain in the centre of the 0.86-0.87 range ahead of the BoE meeting on Thursday.

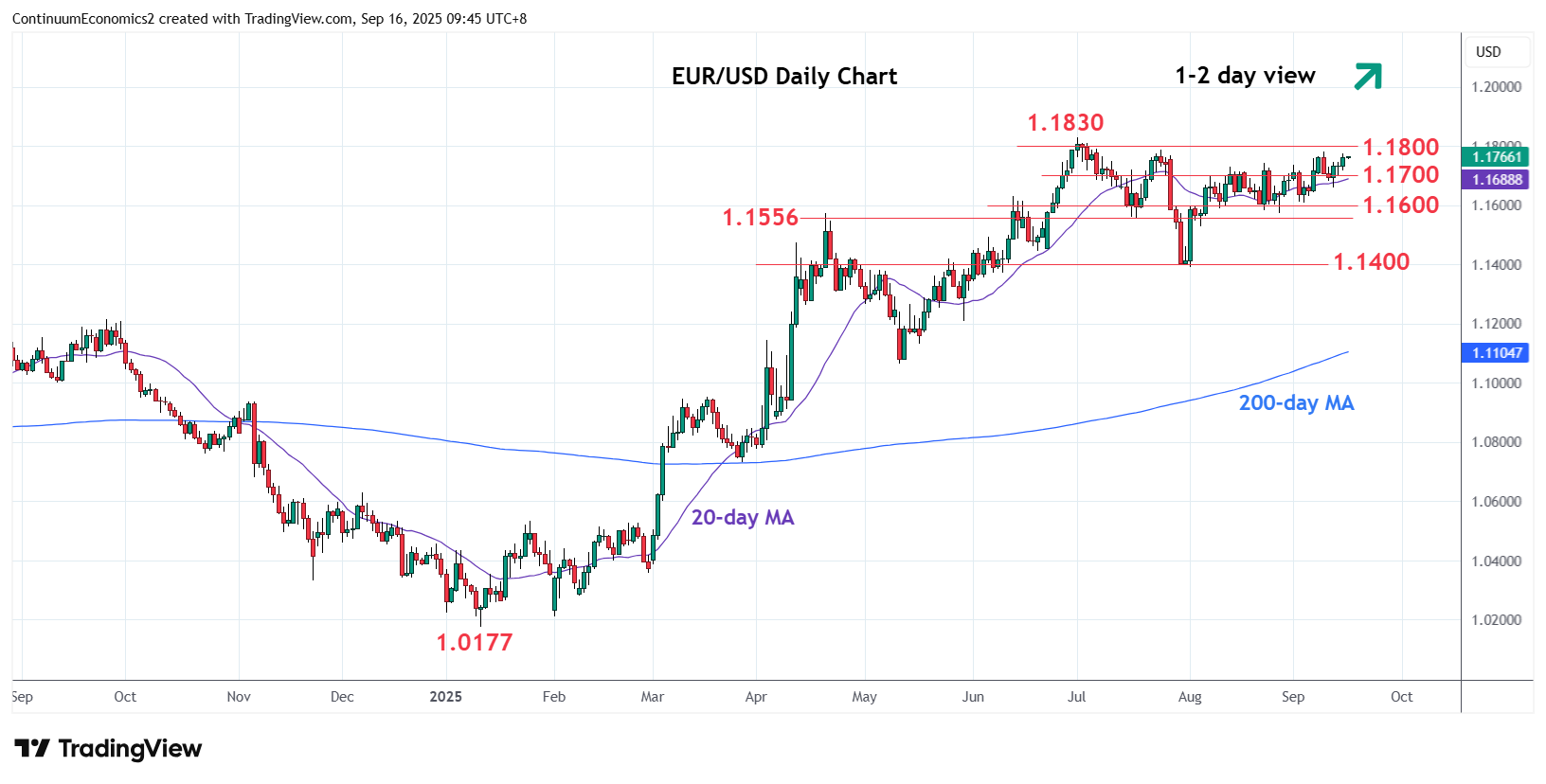

On a broader front the USD remains under pressure overnight, with EUR/USD at its highest since the end of June and threatening the 1.18 level, while USD/JPY is slipping towards the bottom of its recent range. Even so, clear breaks look unlikely to happen ahead of the FOMC meeting tomorrow.