FOMC eases by 50bps but otherwise not strikingly dovish

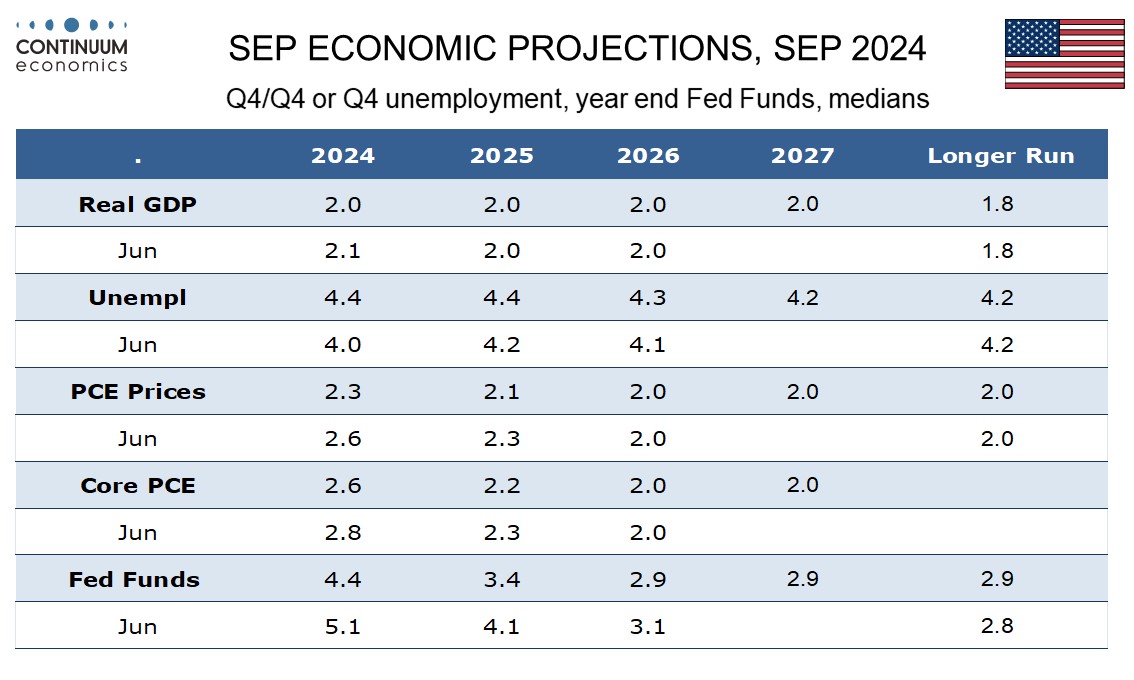

The FOMC has eased by 50bps with the dots looking for another 50bps this year (meaning 25bps at each remaining meeting) and a total of 100bps in 2025 (meaning only four 25bps moves). This would leave end 2025 rates at 3.25%-3.50%, still above a marginally upwardly adjusted neutral rate of 2.875%, which the dots assume will be reached in 2026.

The GDP view has hardly changed, seen at 2.0% through 2027 which is marginally above the longer run pace of 1.8%, and while the end 2024 unemployment rate has been raised to 4.4% from 4.0% (it is now 4.2%) no further increases are seen. PCE price forecasts have been revised down but not by much, with the core rate seen at 2.2% rather than 2.3% at end 2025 with the 2.0% target still seen being reached in 2026.

The statement is not notably dovish, making only modest adjustments to the economic view and seeing risks to employment and inflation as roughly in balance. There was one hawkish dissent, from Governor Michelle Bowman who backed amore cautious easing of 25bps. The skew to the 2024 dots is upwards, with two seeing no more easing and seven seeing only 25bps, with nine on the median of 50bps and only one looking for 75bps (with none looking for two further 50bps moves).