FOMC Preview For March 20: More Confidence on Inflation Still Needed

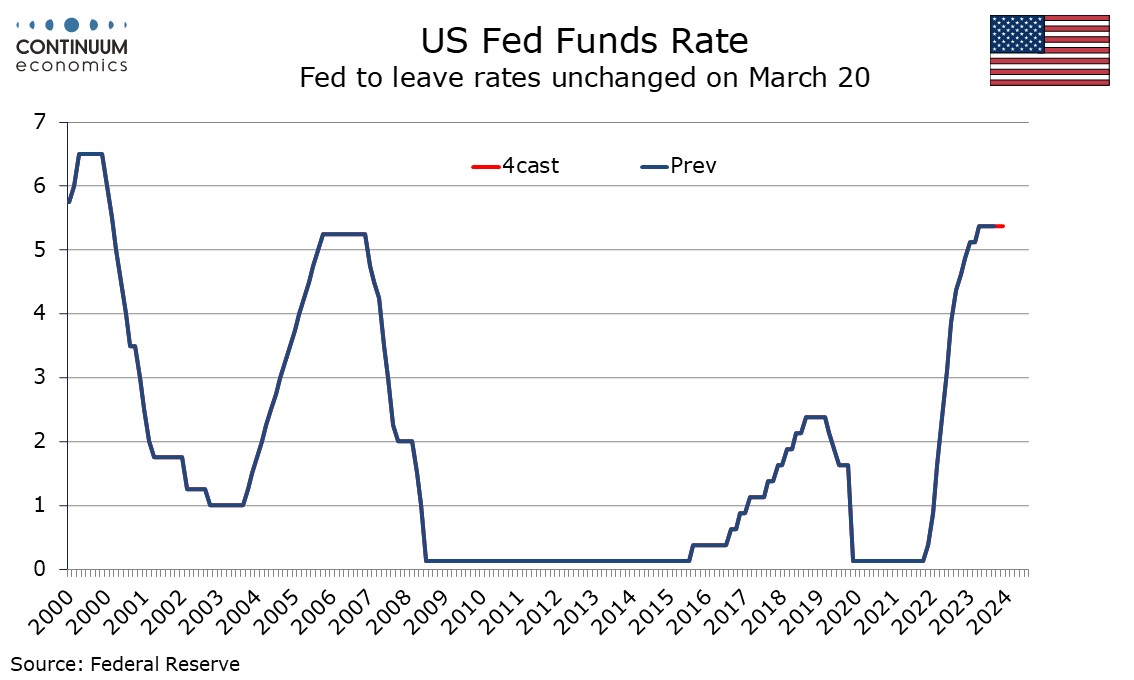

Bottom Line: The FOMC meets on March 20 and a change in rates from the current 5.25%-5.50% target range looks highly unlikely. Given recent disappointment on inflation the statement is likely to repeat that more confidence on inflation moving towards target is needed before easing. The dots may even become marginally more hawkish, seeing 50bps of easing in 2024 rather than the 75bps projected in December.

Statement seen little changed

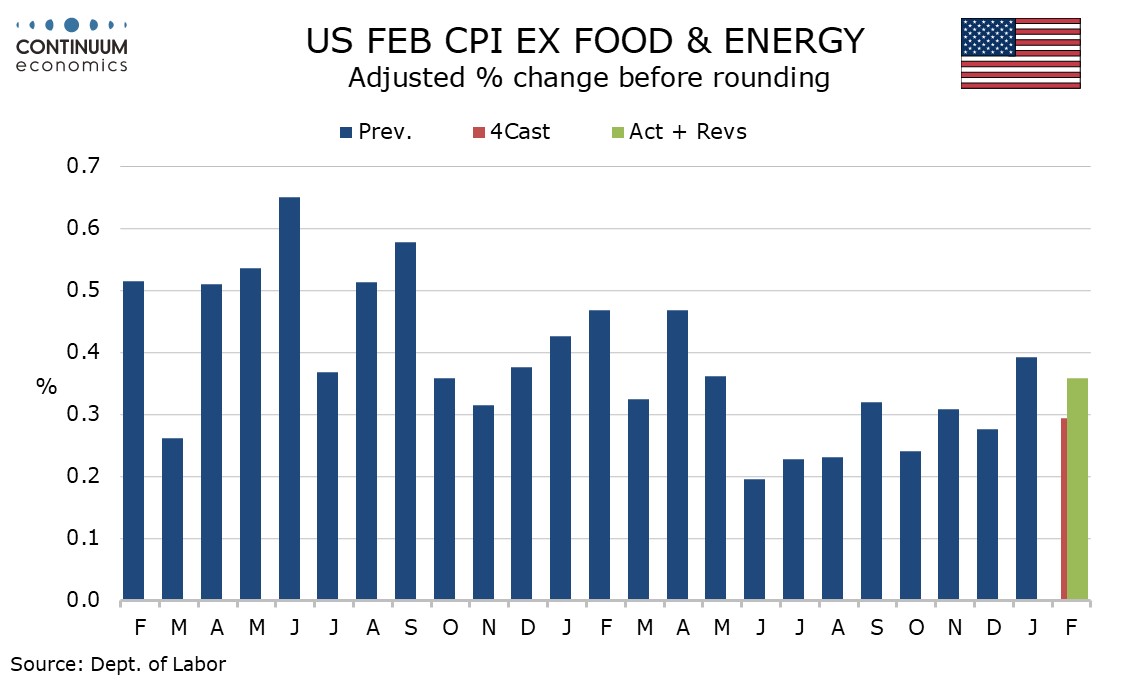

At the last meeting on January 31 Chairman Jerome Powell stated that easing in March was unlikely and with activity data still looking resilient and inflation data having disappointed on the upside in both January and February, Fed caution is likely to have been reinforced. The Fed tone has been cautious rather than hawkish, with Powell’s recent testimony to Congress expecting that rates would be cut this year, and even stating that the Fed is not far from the necessary confidence in falling inflation to ease. However, a disappointing January CPI which most Fed speakers had downplayed given that most preceding months were acceptably subdued has been followed by another disappointment in February. The key wording of January’s statement, that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%, is likely to be repeated.

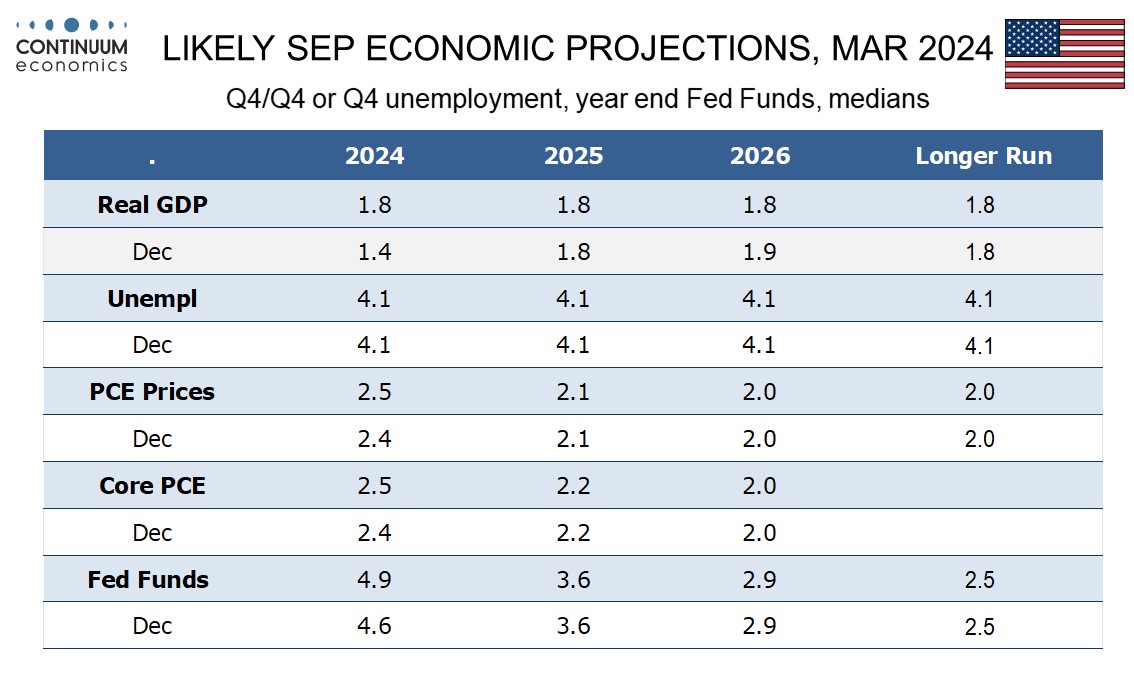

The dots will be closely watched. Ahead of the February CPI, most Fed speakers had been suggesting the dots had probably not changed much since December, when the median looked for 75bps of easing in 2024. December’s dots showed six participants on the median, eight above and only five below, meaning that only two of the six on the median need to shift higher to deliver a median for 50bps. It will be close, but we lean towards this being the case, putting the end 2024 rate at 4.875% from 4.625%. Three participants would need to shift to lift the median dots for 2025, from 3.625%, and 2026, from 2.875%, and we lean towards those dots being left unchanged. Continued resilience in activity data may bring a significant upward revision to the 2024 GDP forecast, we expect to 1.8% from 1.4%, which would put it on the long-run potential where 2025 was seen in December and probably will continue to be so. We expect a marginal upward revisions to the 2024 core PCE price forecasts too, to 2.5% from 2.4%, but we see 2025 and 2026 being left unchanged, at 2.2% and 2.0% respectively.

The Fed has signaled this meeting will contain detailed discussions on the balance sheet. With the FOMC unlikely to sound ready to ease, we doubt the discussions will lead to any decision on when quantitative tightening will start to slow down. However, it seems likely the QT pace will start to be reduced by summer/autumn as the Fed starts easing, and QT may be completed before rates return to the neutral rate of 2.5%, which may well prove to be an under-estimate of where neutral actually lies. There is probably no urgent need to start tapering QT, with Governor Christopher Waller having stated on March 1 that current overnight repo usage suggests it can be continued for some time, though there may be some debate about how long this can continue, as excess reserves continue to shrink. Waller also suggested the Fed should shift to greater holdings of short term securities, a view that Powell has echoed, but this is really a 2025 issue as the key focus in the pace of overall QT.

The above suggests markets are likely to interpret the FOMC’s signals as hawkish, though when Powell delivers his press conference, he may downplay any hawkish signals, reiterating that the Fed still expects to cut later in the year. Any shift in the dots is likely to be marginal and not a plan, with the timing of easing depending on data. Powell is likely to state that the Fed expects forthcoming data on inflation to show renewed signs of progress, and that is likely to lead to easing, though should the data provide further upside surprises, the FOMC may need to keep policy restrictive for longer.