EUR, JPY flows: EUR edges lower, JPY decline overdone

Slight EUR weakness after German orders data unlikely to extend far. JPY decline this week looks overdone

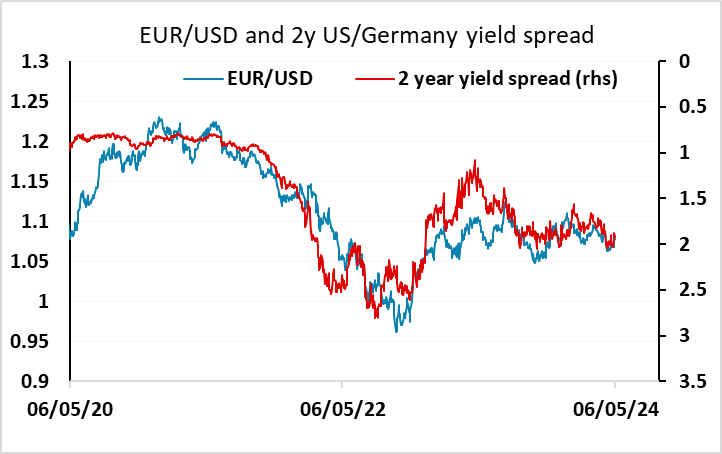

The calendar is quiet with no significant US numbers today. German factory orders were mildly weaker than expected and have helped push EUR/USD a touch lower, but given the volatility of this data the 0.4% decline in April is modest and we doubt here will be any followthrough. EUR/USD continues to hold closely to the correlation with 2 year yield spreads, and this is unlikely to change much today unless we see some revelatory statements from central bankers. There are speeches later from Bundesbank president Nagel and the Fed’s Kashkari, but we wouldn’t anticipate these leading to any significant changes in rate expectations.

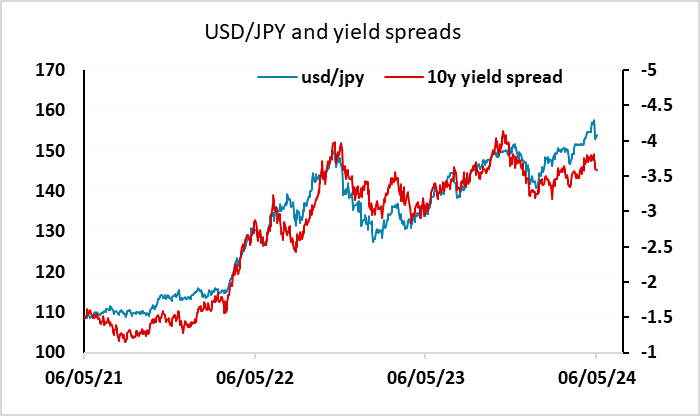

The JPY has started the week on the soft side, in spite of some weakening in US yields, in what looks to be corrective activity after last week’s sharp gains. But there is unlikely to be much enthusiasm for short JPY positions as we approach 155. As of close of business last Tuesday, after the first round of BoJ intervention, the CFTC data still showed substantial net short JPY positioning. While some of this may have been unwound after the BoJ raid in NZ time last Thursday morning, the medium term trend following spec positioning (which is generally what is picked up by the CFTC data) is still likely to be holding some short JPY positions. Yield spreads and risk premia don’t suggest Monday’s and this morning’s gains have much support, and we favour JPY upside from here.