FOMC Minutes Preview and Data Outlook Before the Next Meeting

After a less than dovish speech from Fed Chairman Jerome Powell to the NABE on Monday, it is likely that the minutes from the September 18 meeting due on October 9 will show a similar tone. However the next FOMC decision on November 7 will be data-dependent, and the minutes may highlight the significance of employment. We expect a solid payroll for September on October 4, but October’s payroll on November 1 may look weak, if largely on the temporary effects of strikes.

Minutes unlikely to look dovish

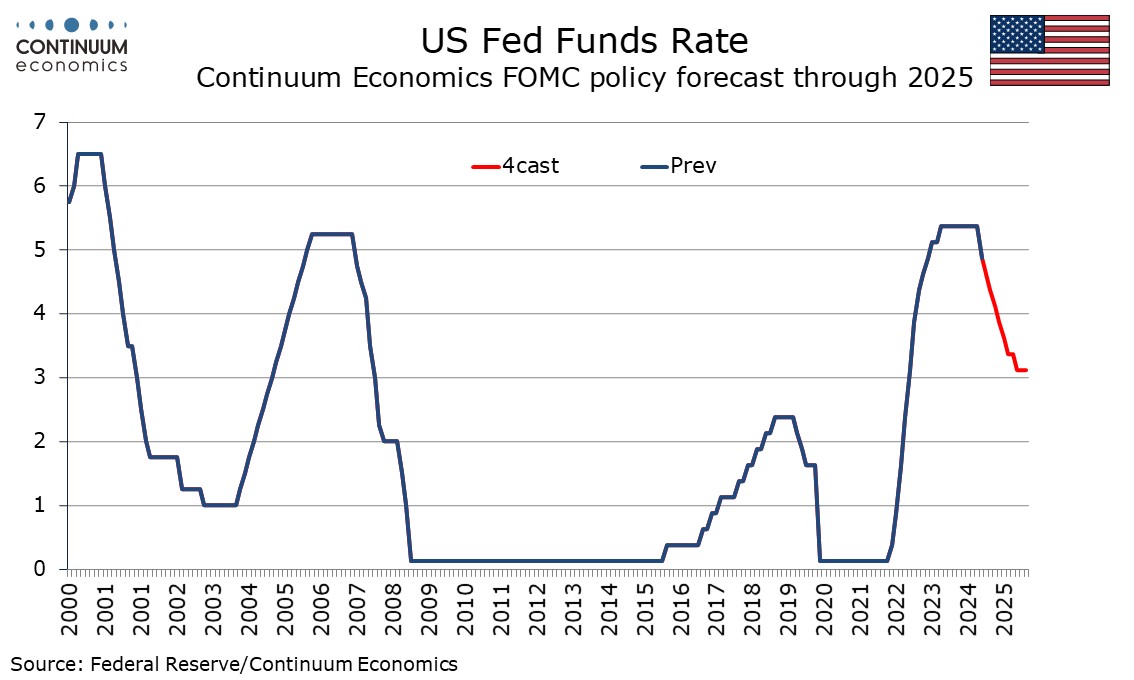

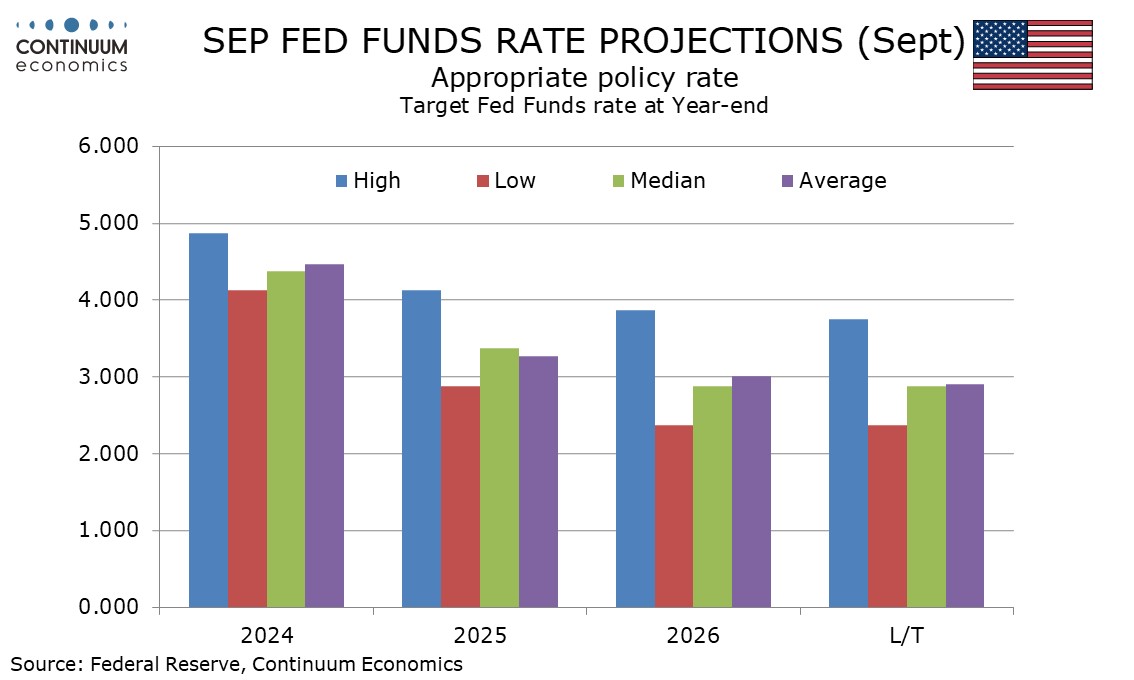

The September 18 decision to ease by 50bps saw only one dissenting vote, from Governor Michelle Bowman who favored a smaller move of 25bps. However we expect the minutes will show that there was a serious debate between 25bps and 50bps, with several of those who backed 50bps probably having gone into the meeting leaning towards 25bps. Nine of the nineteen dots favored no more than one 25bps easing in the rest of the year following the 50bps that was delivered. Several of these probably assumed a 25bps easing in September followed by two more 25bps moves in November and December, but decided not to dissent from the majority view when it came to a vote.

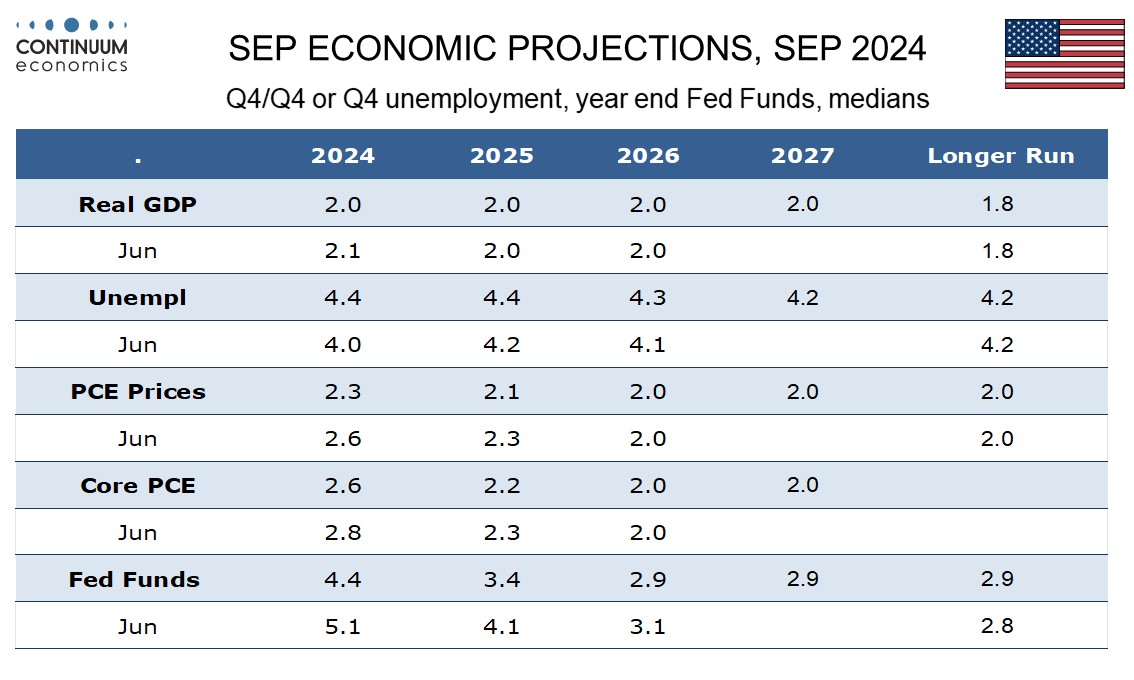

The minutes are likely to see, as Powell did on Monday, risks as reasonably balanced, which means that consideration will be given to upside risks to inflation as well as downside risks to employment. Some are likely to caution that easing too quickly will reignite inflationary pressures, while others will caution easing too cautiously will risk undesirable weakening of the labor market. With Powell on September 18 having stated that Q3 GDP was looking similar to Q2’s 3.0% there are likely to be limited worries on growth. Some may express worries about incomes underperforming consumer spending as a downside risk to consumption, but upward revisions to income with the GDP revisions on September 26 will have reduced any such concern. Powell saw this as significant when he spoke on Monday.

Two more non-farm payrolls due before the FOMC next meets…

Powell stated that he had been concerned about the possibility GDP could have been revised downwards. A significant downward revision to the March 2024 non-farm payroll benchmark of 818k had been announced on August 21 and this, combined with softer payroll growth in the three months to August, and a rising unemployment rate, was probably significant in persuading the FOMC to ease by 50bps. The dots, and subsequent comments by several FOMC officials, show that a string of successive 50bps is not expected, but the Fed is clearly sensitive to employment data. There are two more non-farm payrolls to be released before the FOMC’s next decision on November 7. Lower initial claims have us expecting a solid 180k increase in September’s non-farm payroll due on October 4.

October’s non-farm payroll due on November 1 could however look very different. A strike of 33k workers at Boeing started just too late to be captured by September’s non-farm payroll but if not settled soon will impact October’s. More significant is a strike by 45k workers that recently started in the East Coast ports, which could have feed through effects elsewhere. The total hit from strikes in October could be close to 100k. We expect the Fed will look through the strike impact, and ease by only 25bps in November, particularly as the ports strike carries inflationary risks as supply chains are disrupted, but only the labor market impact will be visible in the data by November’s FOMC meeting.

…as well as September’s CPI and Q3 GDP

Other key data due before November’s meeting are September CPI on October 10, which we expect to rise by 0.1% overall as gasoline prices slip with a moderate 0.2% increase in the core rate, and Q3 GDP on October 30. Powell’s suggestion that it would look similar to Q2’s 3.0% exceeds our current 1.8% estimate, with the Atlanta Fed nowcast in between at 2.5%. With consumer spending looking solid our predicted slowing assumes slower business investment after surprising strength in Q3. The approach of the ports strike could see some inventory strength in September, though Hurricane Helene is a downside risk for September data that Powell probably did not consider on September 18. Hurricane Helene came after September’s non-farm payroll was surveyed and October’s non-farm payroll survey is likely to be too late to see a significant impact