Published: 2024-09-13T06:44:30.000Z

USD flows: USD down as risk of a 50bp Fed cut increases

Senior FX Strategist

1

Press reports that the decision on whether to cut rates 25bps or 50bps is a close call have pushed the USD lower overnight. Scope for further losses

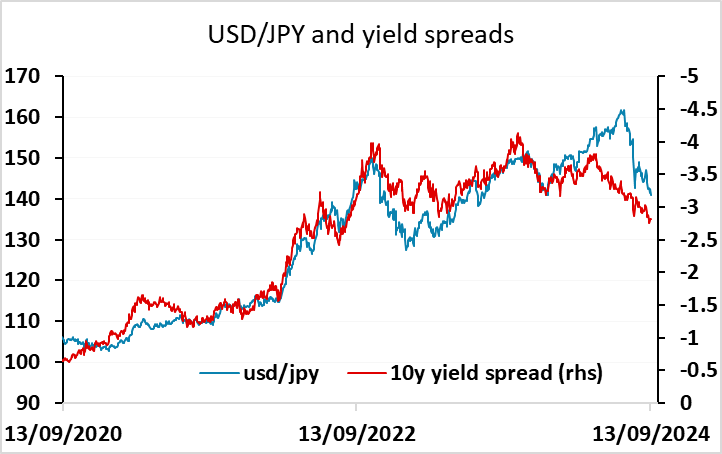

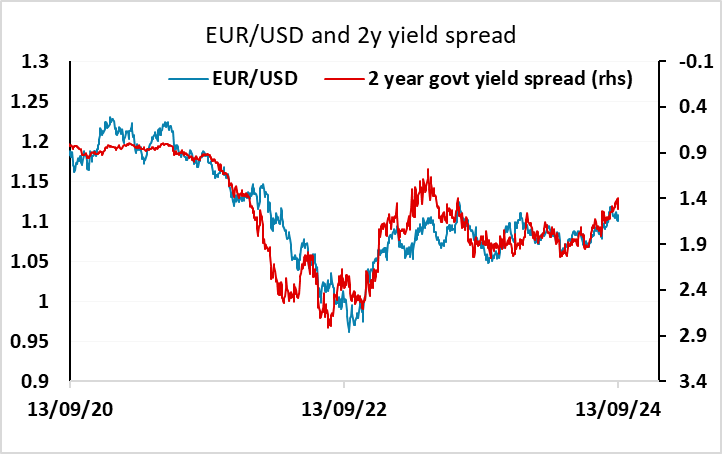

The USD was generally weaker with the JPY making the most pronounced gains overnight. The trigger looks to have been the WSJ and FT stories indicating that next week’s FOMC decision will be a close call between a 25bp and a 50bp rate cut, after the risk of a 50bp cut had been largely priced out following the stronger than expected CPI data on Wednesday. The market priced the probability of a 50bp cut as less than 20% after the CPI data, but it is now back up to 43%. The decline in US yields that has resulted has put the USD under pressure across the board, although the risks always looked to be on the USD downside as yield spreads were suggesting scope for USD weakness even before the increase in the probability of a 50bp cut. There may now be scope for some further USD losses in Europe and the US into the end of the week.