USD flows: USD higher after data

Slightly higher GDP helps the USD, but upside limited

US GDP has been revised up modestly, with real consumer spending showing the most notable increase from 2.3% to 2.9% annualised in Q2. But the modest upward revision in GDP to 3.0% from 2.8% and the downward revision in core PCE prices to 2.8% from 2.9% don’t suggest anything other than a 25bp cut from the Fed in September. Jobless claims remained steady and subdued. However, the trade deficit rose again to the highest for more than 2 years. There is still the August employment report to come next week, and another CPI number, but it’s hard to see anything on the data front deflecting the Fed from a 25bp cut in September. Only an external event that caused major risk aversion looks to have potential to make the Fed cut 50bps.

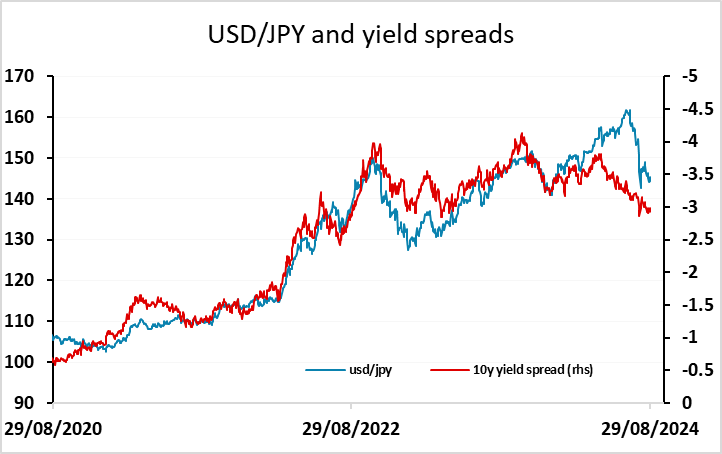

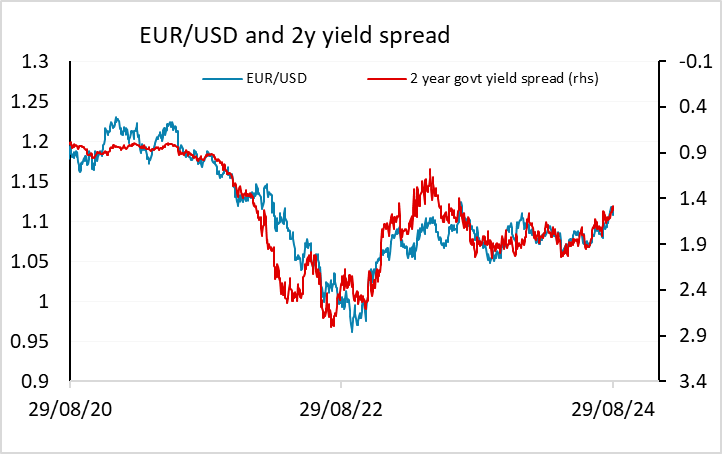

That being the case, the market pricing of a 30% chance of a 50bp cut looks excessive and we see scope for front end US yields to rise from here, but there is little reason to change the market view of the terminal rate being in the order of 3%, so yields beyond the front end probably won’t move very far. There is nevertheless some scope for EUR/USD to extend the decline seen his morning, perhaps getting as far as testing 1.1050. The USD has risen more against the JPY after the data than anything else, gaining half a figure, but this looks a little overdone, given that USD/JPY tends to correlate more with longer term yields.