FOMC Minutes Preview: Considering Increasingly Balanced Risks

FOMC minutes from the July 31 meeting are due on August 21. We expect the minutes will show a cautious tone on inflation, needing to see more data before easing, but increasing signs of concern over rising unemployment, which July non-farm payroll data will have increased. Still, the tone on inflation is likely to be cautious enough to suggest that a 50bps move in September remains unlikely.

The last minutes from the June 12 meeting saw risks moving into better balance, but those cited on activity were mostly on the downside while risks cited on the inflation outlook were mostly on the upside. Between the June and July meetings we saw a June CPI that was significantly below consensus but a June employment report that was only marginally below consensus. Still, the July 31 statement made more adjustments to its assessment on employment, noting a moderation in job gains and a rise in unemployment, but made only subtle adjustments to the inflation view, seeing it as somewhat elevated rather than elevated. The statement was also changed to signal that the FOMC was attentive to risks on both sides of the dual mandate rather than highly attentive to inflation risks.

The statement made no adjustment to the view that the FOMC did not expect it would be appropriate to reduce the target rate until it has gained greater confidence that inflation was moving sustainably towards 2%. At the press conference however Chairman Jerome Powell did state that Q2 inflation readings had increased confidence, more good data would strengthen it, and a rate cut could be on the table in September. While we still have to see key data for August, such a move looks increasingly likely. While the July decision to hold rates was unanimous, there may be some divide visible in the minutes between those still concerned about persistence in inflation and those increasingly concerned about rising unemployment.

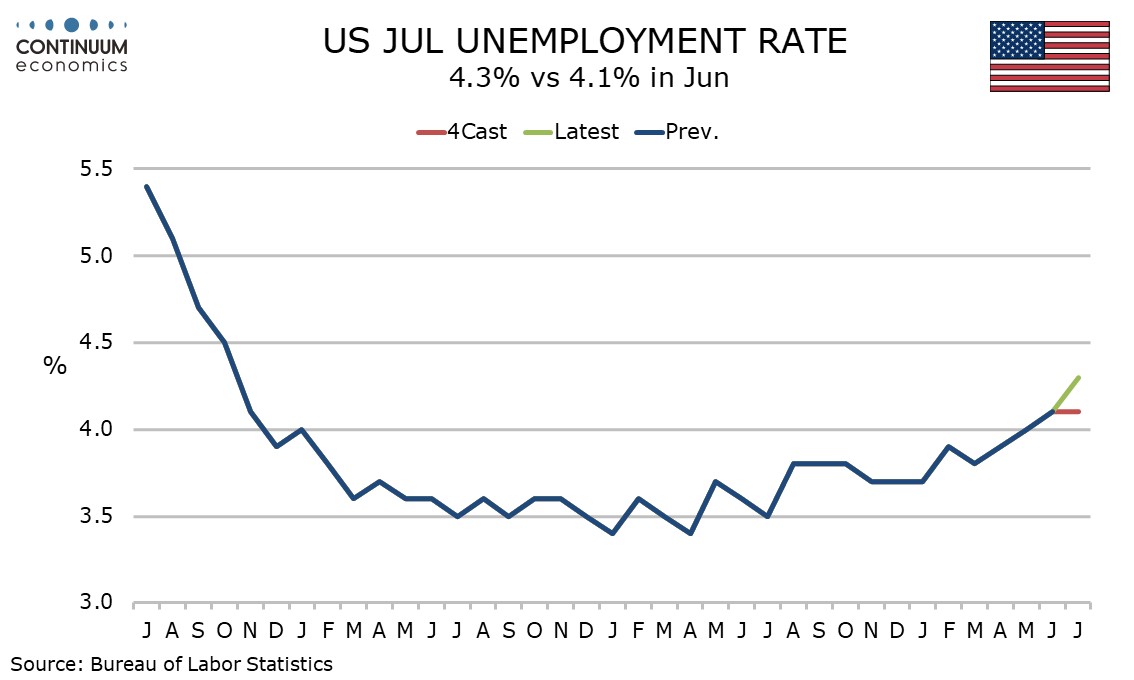

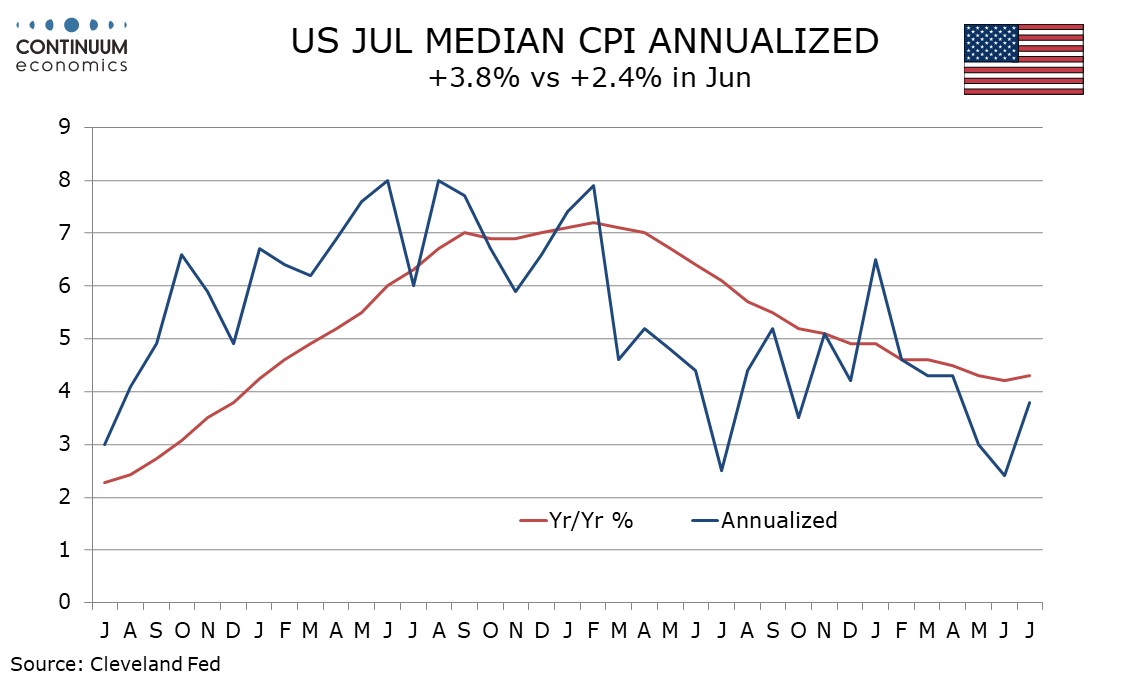

July’s increase in unemployment to 4.3% from 4.1% will have raised concerns, though the Fed may have had some feel for that release at the meeting which came only two days before the employment report. July’s CPI, which saw the core rate up by less than 0.2% before rounding for a third straight month, will be welcomed, but hawks may point out that the Cleveland Fed’s Median CPI rose by a stronger 3.8% annualized and yr/yr growth there looks stable near 4.0%. The Cleveland Fed also releases a median PCE price index, which rose by 0.3% on the month in each of the five months to June, while yr/yr growth remains above 3.0%.

July’s increase in unemployment to 4.3% from 4.1% will have raised concerns, though the Fed may have had some feel for that release at the meeting which came only two days before the employment report. July’s CPI, which saw the core rate up by less than 0.2% before rounding for a third straight month, will be welcomed, but hawks may point out that the Cleveland Fed’s Median CPI rose by a stronger 3.8% annualized and yr/yr growth there looks stable near 4.0%. The Cleveland Fed also releases a median PCE price index, which rose by 0.3% on the month in each of the five months to June, while yr/yr growth remains above 3.0%.

Easing based on rising concerns over unemployment while inflation concerns are easing but not gone away would probably be presented as making policy less restrictive rather than targeting normalization of policy. That would suggest a cautious pace of easing, in increments of 25bps, though we do expect such a move at each of the three remaining meetings of this year. For 2025 we expect only 25bps of easing in each quarter, though risk is that they will move more rapidly than that should unemployment continue to rise and inflation risks continue to decline. Still, as long as the economy avoids a hard landing, as we expect it will, moves are likely to be in 25bps increments.