Preview: Due August 14 - U.S. July CPI - Subdued, if stronger than in May and June

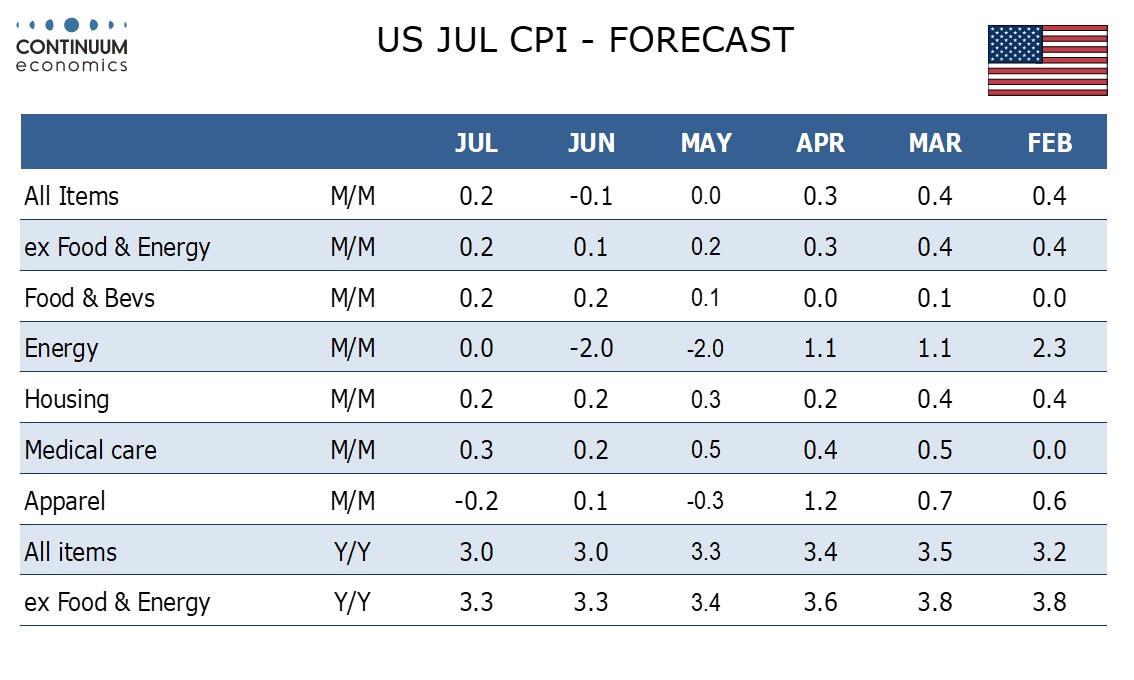

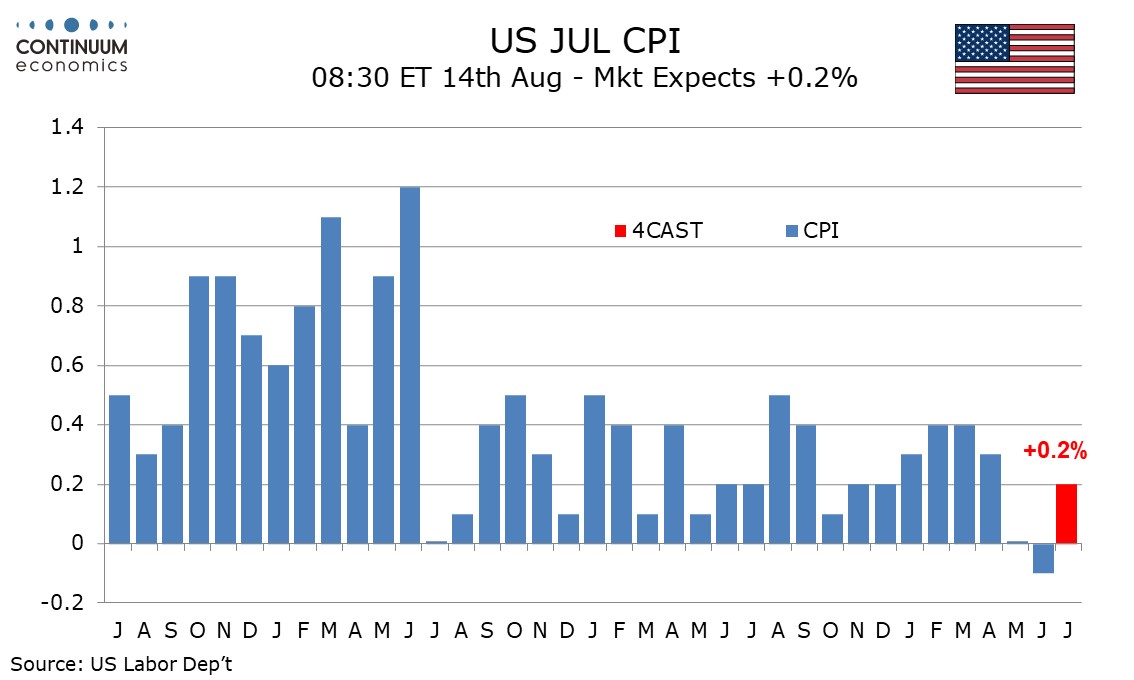

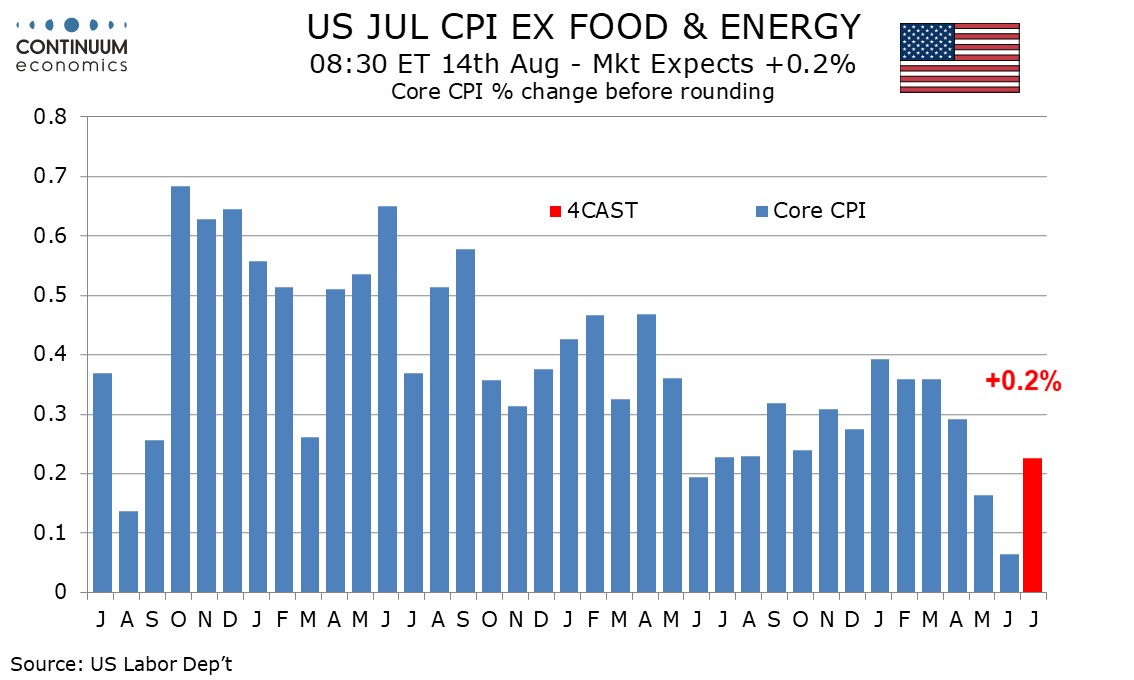

We expect July’s CPI to be acceptably subdued, but a little stronger than the preceding two months with gains of 0.2% both overall and ex food and energy. We expect the core rate to rise by 0.23% before rounding, up from 0.065% in June and 0.163% in May

June data was particularly soft with some of the more volatile components, used autos, hotels and air fares all seeing unusually sharp declines which we do not expect to be repeated in July.

That gasoline prices have stabilized after declines in May and June reduces downside risks on the core rate too, with air fares in particular sensitive to energy. However we expect a generally subdued picture across the board, with the heavily weighted owners’ equivalent rent likely to sustain a June slowing to 0.3%, after four straight months at 0.4%.

Strength in the first four months of the year and a subsequent slowing looks similar in 2024 to what was seen in 2023, suggesting some residual seasonality even after seasonal adjustment. The softest month in 2023 for core CPI came in June and June is likely to prove below trend in 2024 too. Our monthly forecasts for July 2024 are very similar to the outcomes seen in July 2023. That means we are looking for yr/yr rates to remain unchanged, at 3.0% overall and 3.3% ex food and energy.