USD flows: Softer after weaker PPI

USD generally softer after weaker than expected PPI

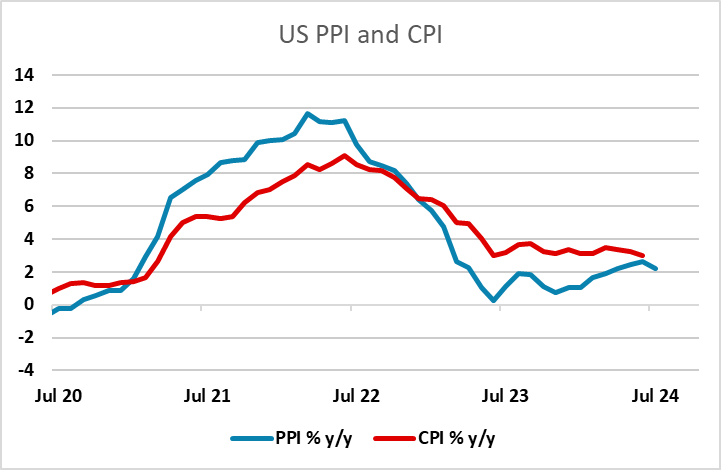

US PPI significantly softer than expected at 0.1% headline and flat core on a m/m basis. The steady rise in the y/y rate in recent months has consequently been reversed. US yields generally slightly lower in response, and the USD is also softer, with the JPY leading the way but the higher yielders also benefiting, with equities rising. PPI on its own won’t have much impact on Fed policy, but the data suggests downside risks for CPI tomorrow, and importantly reduces the risk of a renewed rise in inflation going forward which might derail the prospect of Fed easing.

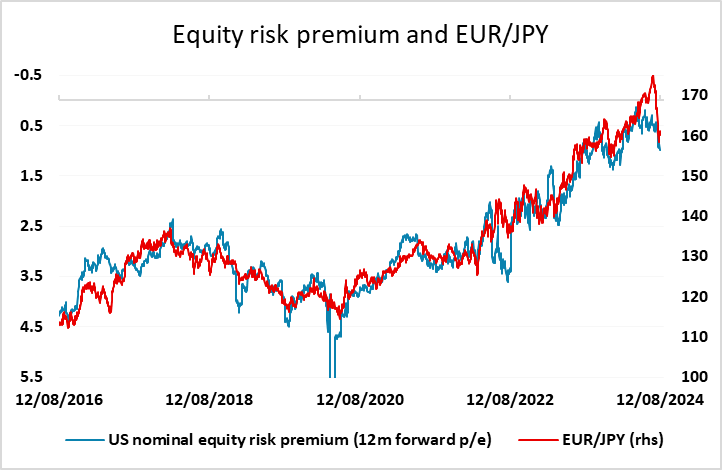

The data is consequently supportive for equities, and generally negative for the USD, but not necessarily negative for the JPY on the crosses, as equity risk premia don’t tend to fall when yields fall, and the JPY crosses tend to move with equity risk premia.

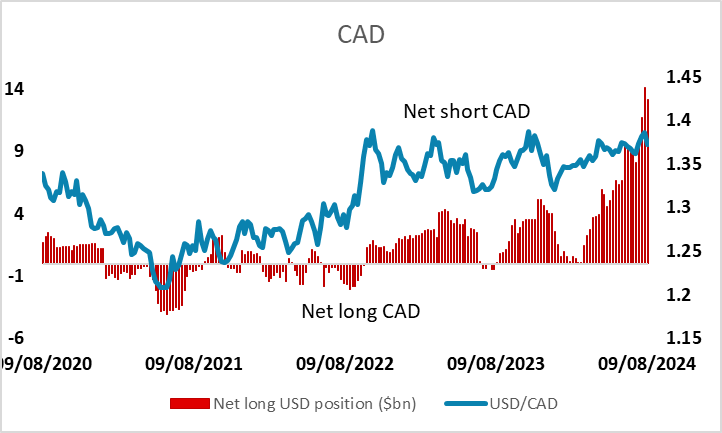

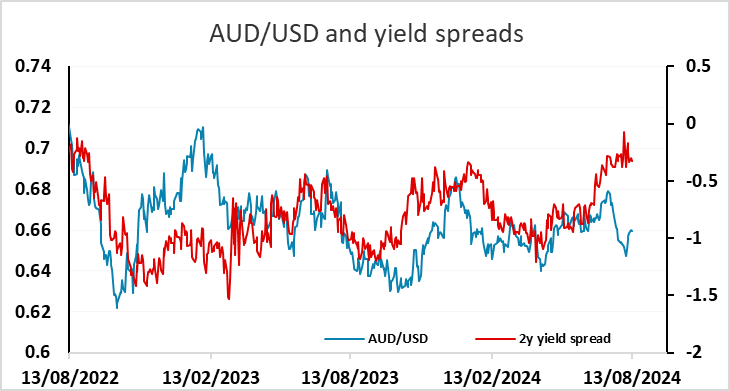

USD/JPY has had a few attempts to break above 148, but this is now looking like effective resistance near term. EUR/USD should be biased higher from 1.09, but with little movement in yield spreads it’s hard to see it gaining sufficient momentum to break above 1.10. There may be better prospects for the higher yielders, with the AUD looking cheap relative to yield spreads, and positioning very short CAD according to the CFTC data.