FX Daily Strategy: N America, August 13th

US PPI risks slightly on the downside

USD therefore has downside risks across the board

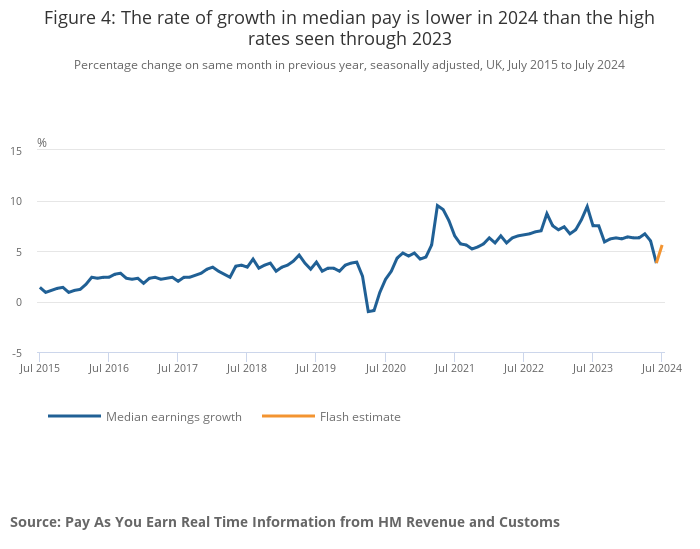

UK to see weakening in earnings data

GBP vulnerable against EUR

US PPI risks slightly on the downside

USD therefore has downside risks across the board

UK to see weakening in earnings data

GBP vulnerable against EUR

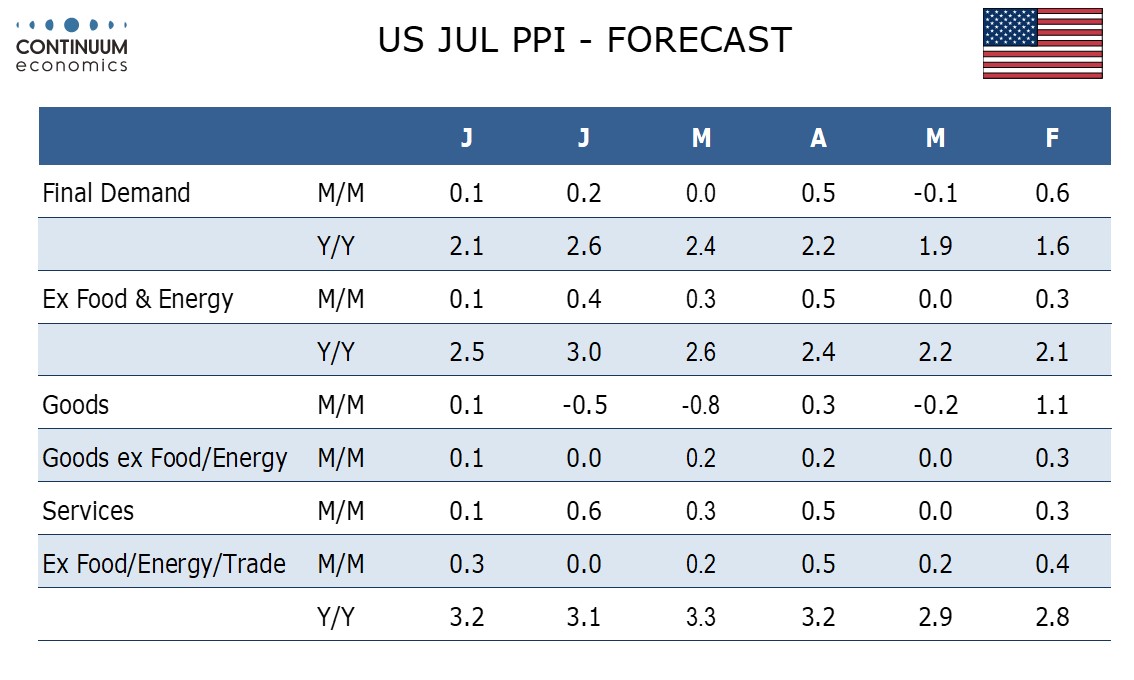

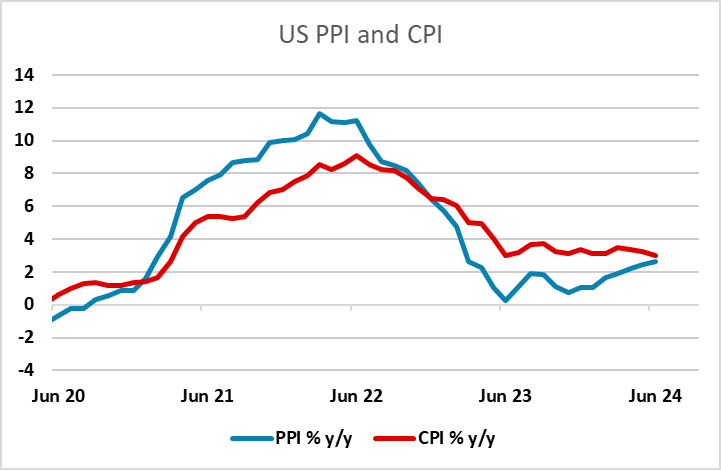

Tuesday sees UK labour market data and US PPI. The PPI data will be the main focus for global markets, as probably the main danger to the equity market at the moment comes if the Fed is unable to cut rates because inflation is too persistent. CPI is obviously much more important, but it has been notable that PPI has been trending higher in y/y terms in recent months, while CPI has been close to flat. However, this month we expect a subdued July PPI, with gains of only 0.1% overall and ex food and energy, restrained by a correction lower in trade after a strong June. Ex food, energy and trade however we expect an increase of 0.3%, rebounding from a below trend unchanged outcome in June. Market consensus is for 0.2% for both headline and core, so a number in line with our forecast would likely be seen as soft and supportive of lower yields, although reaction is unlikely to be large ahead of the more important CPI data on Wednesday.

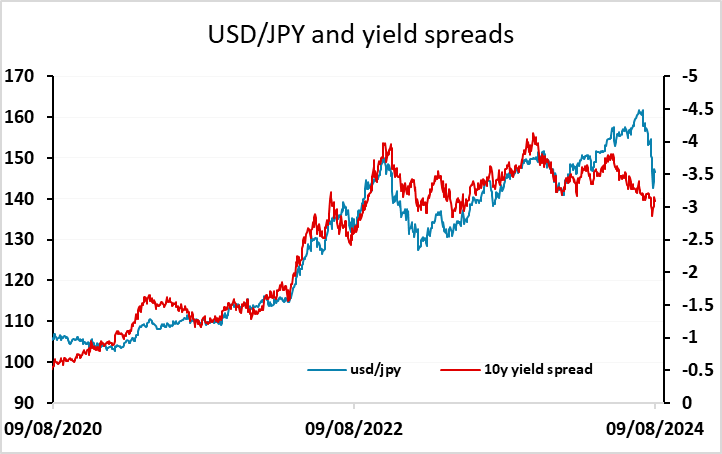

From an FX perspective, softer PPI should be USD negative in general, with lower yield spreads having a direct negative USD impact, and any boost to equities also helping higher yielders indirectly. Inasmuch as softer data leads to a more risk positive market, the higher yielders may slightly outperform, although it is often the case that lower yields actually lead to higher equity risk premia, as equities don’t rise enough for equity yields to drop as much as bond yields. So we remain positive on the JPY, which is likely to benefit against the USD from lower yield spreads, and is starting from a level that is already too low relative to current yield spreads. On the crosses, the JPY tends to move more with equity risk premia, so should still hold its own unless equities surge sharply.

GBP is higher after mixed but generally slightly stronger UK labour market data. The official average earnings data for the April-June period showed the expected y/y fall to 4.5% y/y due to base effects, while the ex-bonuses number was also as expected, falling slightly to 5.4% y/y. But the HMRC numbers for payrolled employees for July showed a modest increase to 5.6% y/y, although the rise was again largely due to the base effect in June. But there was an unexpected sharp fall in the unemployment rate to 4.2% in the 3 months to June, from 4.4% in the 3 months to May. Against this, the claimant count for July rose sharply by 135k – the largest rise since the pandemic. The ONS employment data was also on the strong side, showing a 97k rise in the 3 months to June, but the HMRC version was more subdued, with a 24k rise in July.

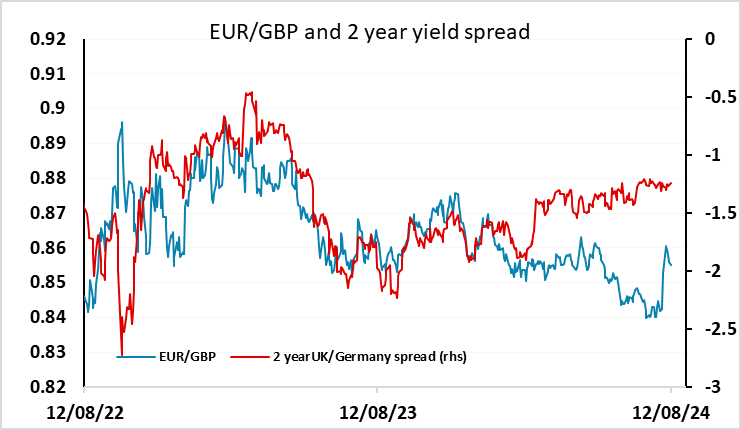

All in all, the decline in the unemployment rate may be seen as the most significant aspect of this data, but in practice it is unlikely to make a lot of difference to BoE MPC thinking at this point, with the labour market data seen as a little unreliable. EUR/GBP has dropped 20 pips to 0.8540, but the CPI data due tomorrow will likely be more relevant to near term policy thinking with the labour market data inconclusive at this stage. However, the big public sector wage increases planned by the new government could maintain strong wage growth and limit the scope for rate cuts. For today, GBP looks likely to hold onto these gains and EUR/GBP may push towards 0.85.