FX Daily Strategy: Europe, August 13th

US PPI risks slightly on the downside

USD therefore has downside risks across the board

UK to see weakening in earnings data

GBP vulnerable against EUR

US PPI risks slightly on the downside

USD therefore has downside risks across the board

UK to see weakening in earnings data

GBP vulnerable against EUR

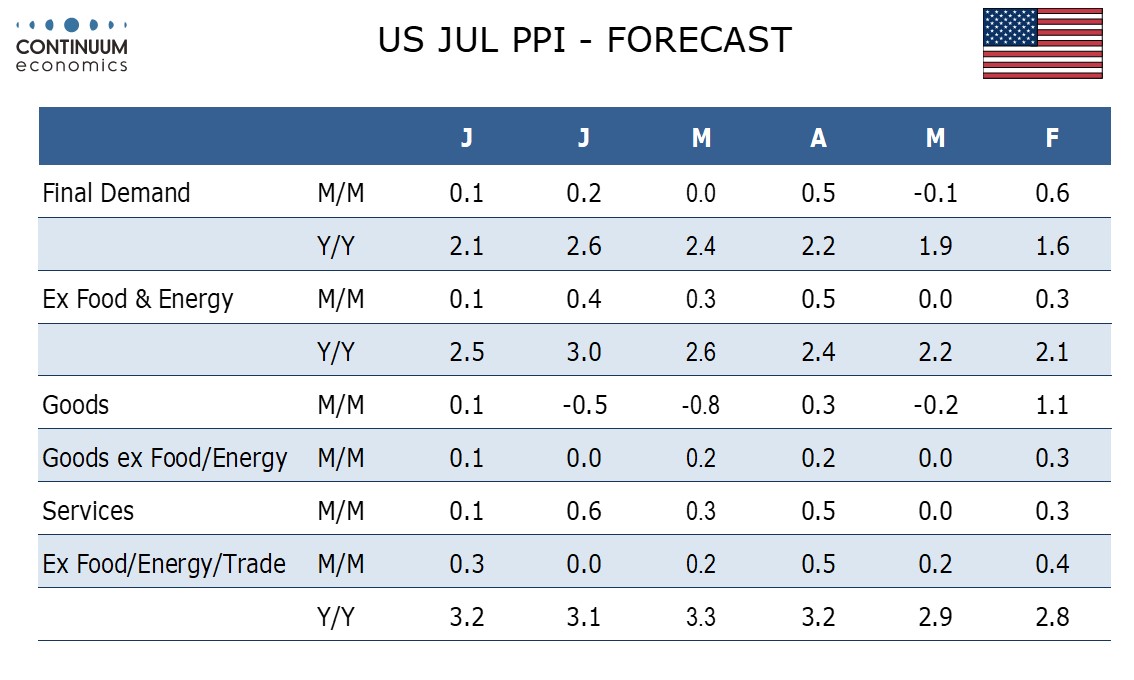

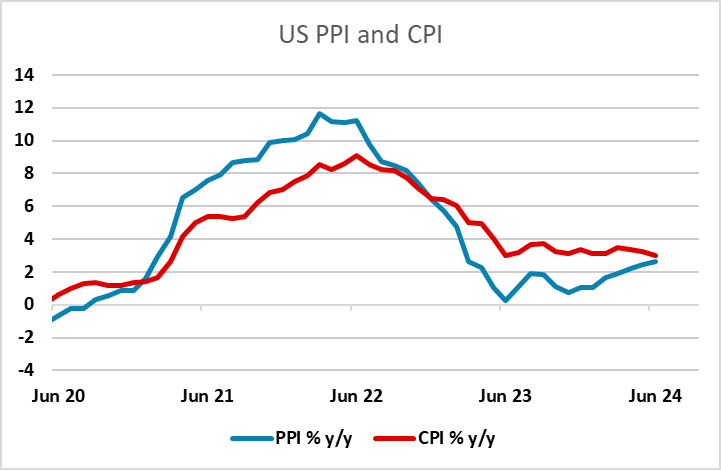

Tuesday sees UK labour market data and US PPI. The PPI data will be the main focus for global markets, as probably the main danger to the equity market at the moment comes if the Fed is unable to cut rates because inflation is too persistent. CPI is obviously much more important, but it has been notable that PPI has been trending higher in y/y terms in recent months, while CPI has been close to flat. However, this month we expect a subdued July PPI, with gains of only 0.1% overall and ex food and energy, restrained by a correction lower in trade after a strong June. Ex food, energy and trade however we expect an increase of 0.3%, rebounding from a below trend unchanged outcome in June. Market consensus is for 0.2% for both headline and core, so a number in line with our forecast would likely be seen as soft and supportive of lower yields, although reaction is unlikely to be large ahead of the more important CPI data on Wednesday.

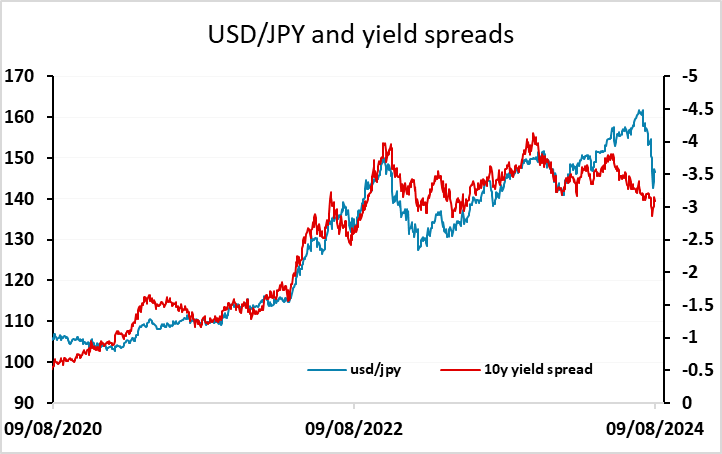

From an FX perspective, softer PPI should be USD negative in general, with lower yield spreads having a direct negative USD impact, and any boost to equities also helping higher yielders indirectly. Inasmuch as softer data leads to a more risk positive market, the higher yielders may slightly outperform, although it is often the case that lower yields actually lead to higher equity risk premia, as equities don’t rise enough for equity yields to drop as much as bond yields. So we remain positive on the JPY, which is likely to benefit against the USD from lower yield spreads, and is starting from a level that is already too low relative to current yield spreads. On the crosses, the JPY tends to move more with equity risk premia, so should still hold its own unless equities surge sharply.

In the UK, the labour market data remains second only to the CPI data in importance for the MPC, but reaction is still unlikely to be large ahead of the CPI data on Wednesday unless the numbers are well away from expectations. The market does expect a very large drop in the ONS measure of average earnings, which covers the 3 months to June, to 4.6% from 5.7% y/y, and we could see an even larger decline, but this is due almost entirely to base effects. As usual, more attention may be paid to the more up to date PAYE pay data where a clear(er) slowing may be on the cards.

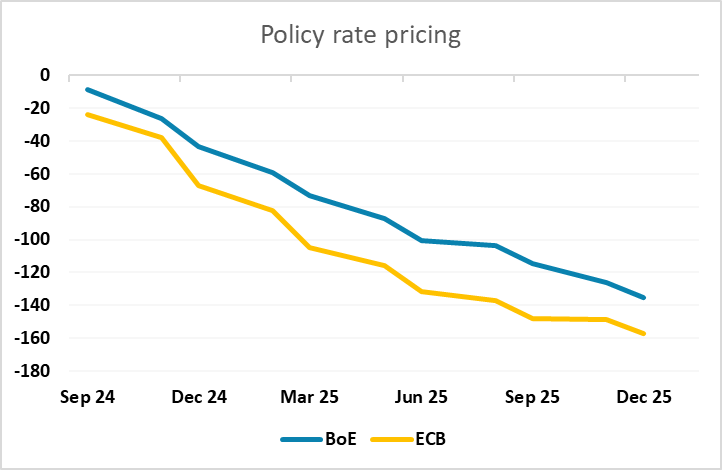

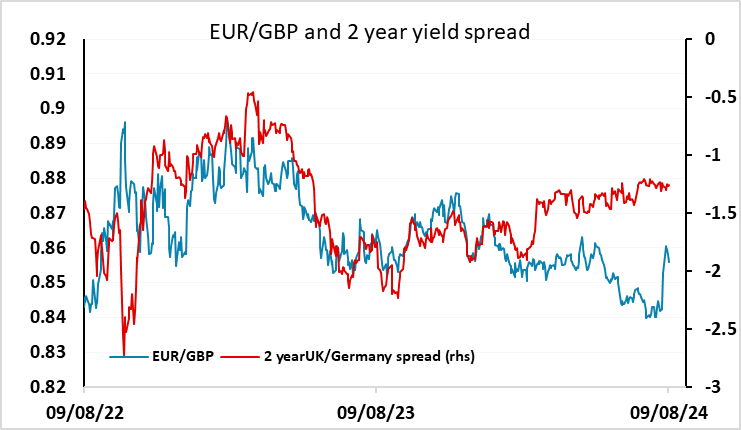

We still see GBP as overvalued from a long term perspective, and the EUR/GBP decline on Monday back to 0.8550 may be seen as a buying opportunity, with EUR/GBP still looking a little low relative to yield spreads, and the market still pricing less BoE easing in the next couple of years than easing from the ECB.