FX Weekly Strategy: August 12th-16th

Stabilisation in risk appetite should allow some focus on relative fundamentals

JPY still has scope for gains, CHF gains look overdone

AUD and NOK both look relatively cheap

Scope for GBP recovery with risk sentiment looks quite small

Strategy for the week ahead

Stabilisation in risk appetite should allow some focus on relative fundamentals

JPY still has scope for gains, CHF gains look overdone

AUD and NOK both look relatively cheap

Scope for GBP recovery with risk sentiment looks quite small

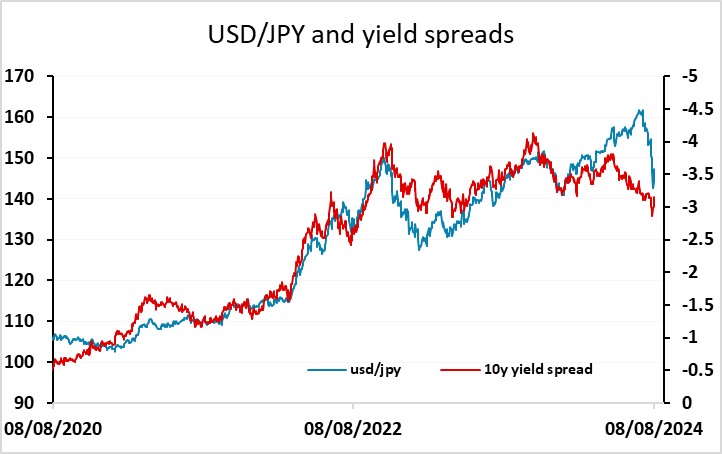

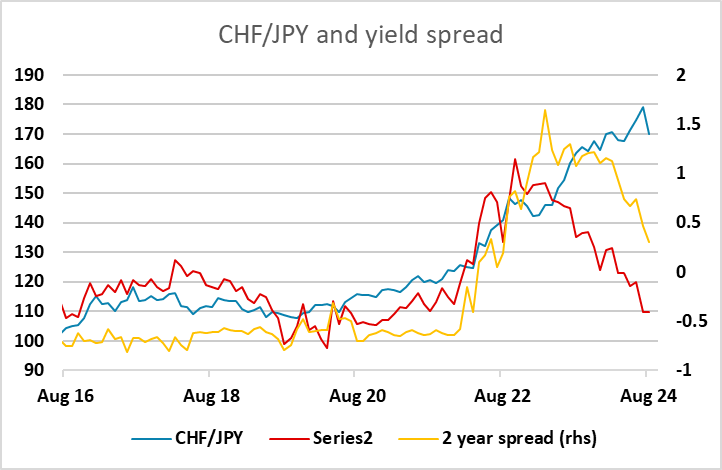

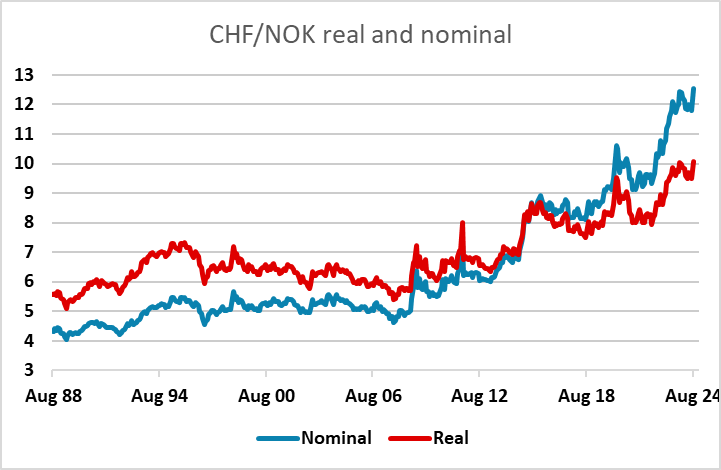

For the FX market, risk sentiment has been very much the focus for the last couple of weeks, with currencies categorized by their risk characteristics rather than by domestic economic performance, value, or policy stance. The JPY and CHF have consequently both strengthened, while the riskier currencies have weakened, although they managed a modest recovery in the second half of last week. Unless we see renewed equity market volatility, this week should see the market move away from a pure risk view of the world and take into account other factors. Thus, while the JPY and CHF are both seen as safe havens, the JPY is cheap while the CHF is expensive, Japanese monetary policy is tightening with the SNB are easing, and the BoJ are opposing JPY weakness while the SNB are opposing CHF strength. All these factors suggest that the CHF ought to weaken in more normal risk conditions, while the JPY can continue to strengthen. Nevertheless, a risk recovery could still propel USD/JPY as high as 150, but we would expect this to be an effective cap, and still see a move below 140 in the coming months. For EUR/CHF, we would expect a move back up above 0.95 as risk sentiment stabilizes.

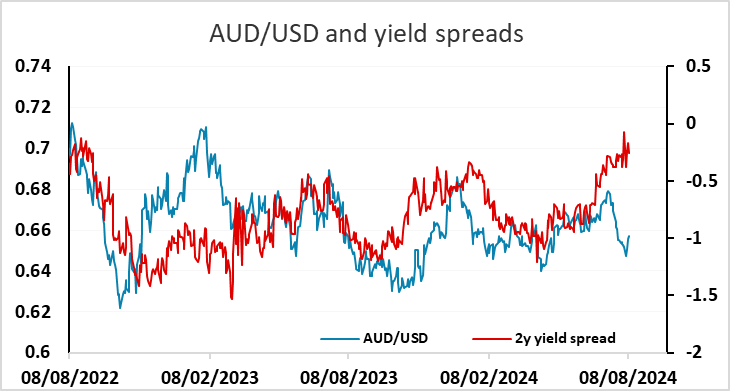

For the higher yielders, yield spreads look supportive for most currencies against the USD, but the NOK looks to have weakened the most relative to domestic economic performance and yield spreads. A more neutral risk tone ought to allow EUR/NOK to move back towards 11.50 in the near term. AUD/USD has also substantially underperformed moves in yield spreads recently, and there should be scope for it to move above 0.66 into the top half of the range for the year. We have the Norges Bank monetary policy meeting this week, and given its recent rhetoric and currency concerns, and in spite of current stock market gyrations, the Norges Bank is very likely to leave its policy rate at 4.5% for a fifth successive meeting, the last hike to the current 4.5% policy rate occurring last December. This underlines the relaitvely hawkish Norges Bank stace, and while there might be some easing in this stance in coming months, it should support a NOK rally.

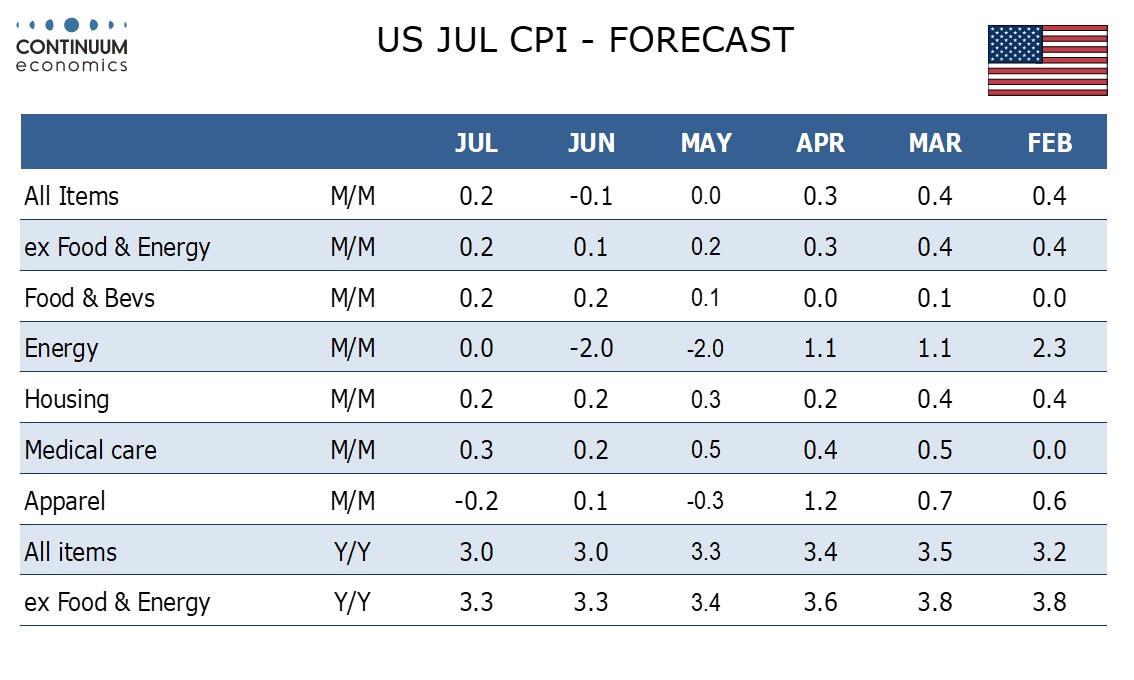

Whether we see a continuation of the stabilization in risk sentiment seen thorough last week will depend to some extent on the data. CPI data in the US and UK will be the main data focus. Our forecast for the US numbers is in line with the consensus of 0.2% m/m for both headline and core, so we wouldn’t expect a major impact from the US data. From an FX perspective, the volatility would likely be greater on stronger rather than weaker data, as stronger data would be more likely to undermine the equity market due to fears that the Fed might not be able to cut rates as much as required to stabilize the economy. As it stands, the decline in US yields and the increased expectation of Fed easing this year has helped to stabilise the equity market after the post-employment report sell off. But equity risk premia are still very low by historic standards, so the equity market remains vulnerable if markets start to see recession risks or even a significant slowdown, as US equities remain priced for very robust earnings growth. So as well as the CPI data, there will be interest in the real sector US data. However, it seem unlikely that retail sales, initial claims and housing starts data will provide a clear enough signal to trigger a clear directional move for risk assets.

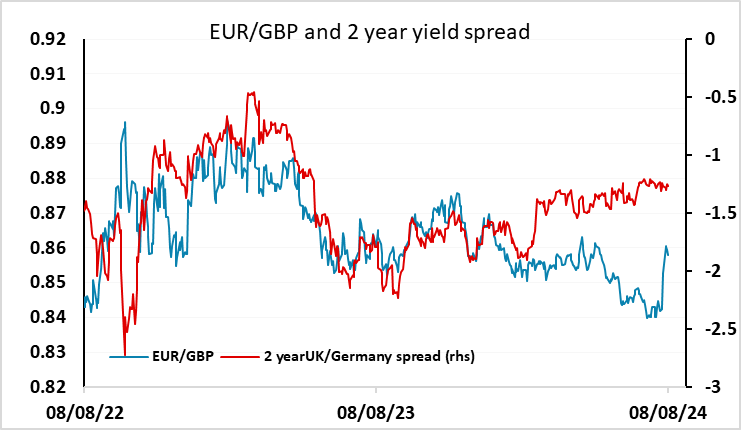

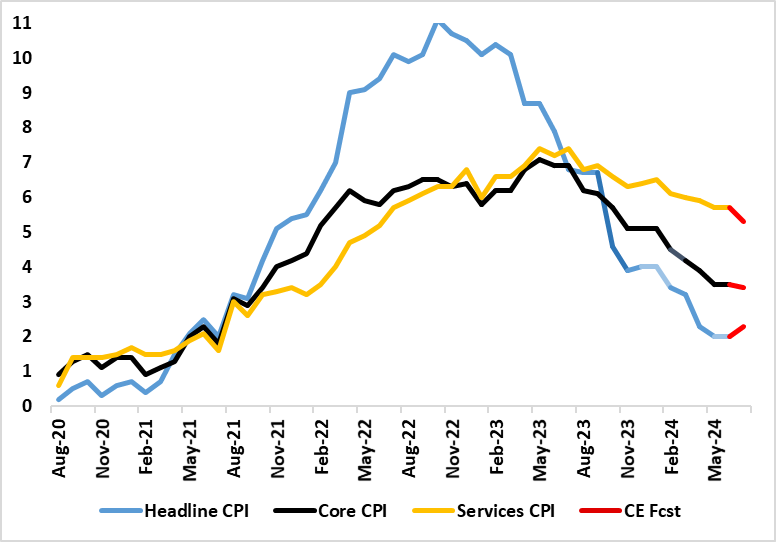

In the UK, CPI inflation’s flirt with the 2% target is likely to be short-lived. We see the rate rising back up to 2.3% in July from 2.0% in June, this projection being a notch below BoE thinking, but in line with the market consensus, with the core edging down to 3.4%. The rise is solely due to energy base effects related to the Ofgem price cap changes. Regardless, this underlines that headline CPI inflation having dropped back to the 2% target in May (for the first time in just over three years) and stayed there in June was important but far from definitive. GBP fell back against the EUR on the back of the general risk sell off in the last couple of weeks, but started the make a recovery at the end of the week. But unlike the NOK and AUD, yield spreads don’t really support a GBP recovery at this point, with EUR/GBP still above levels suggested by short term spreads, and still relatively cheap in real terms from a long term perspective. So while there might be scope for UK yields to edge back up if risk sentiment stabilises and the market starts to price less sharp UK rate cuts this year, we would look for EUR/GBP to hold above 0.85.

Data and events for the week ahead

USA

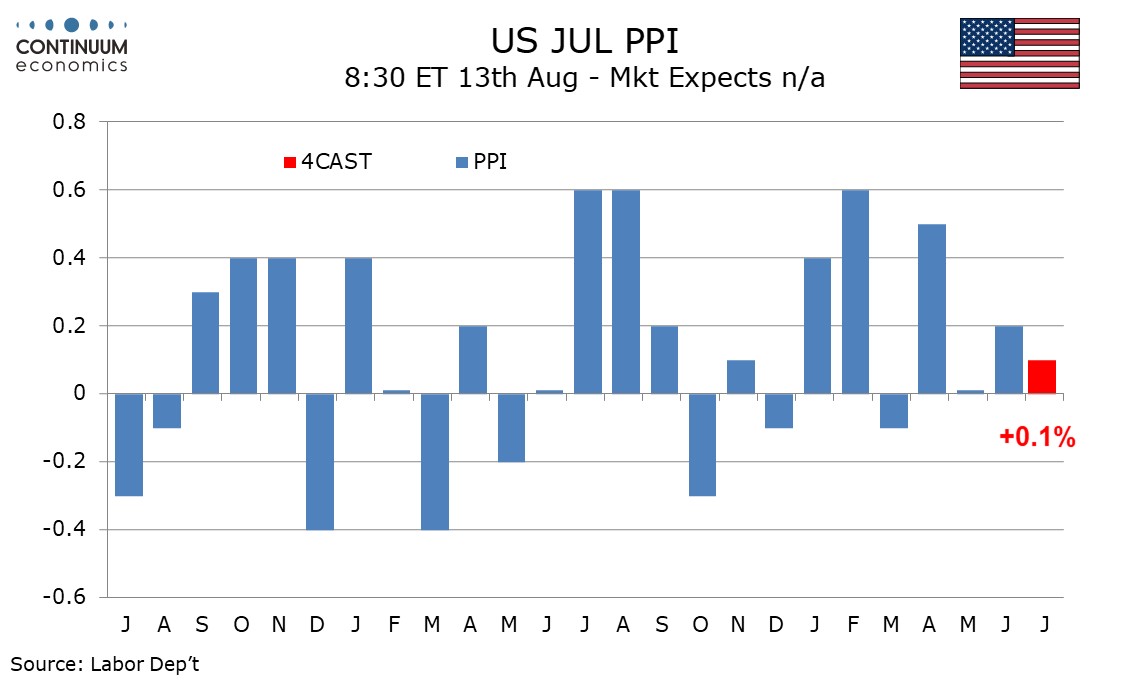

In the US, Monday sees July budget data. Tuesday sees July’s NFIB survey of small businesses, and July’s PPI, where we expect subdued gains of 0.1% both overall and ex food and energy. Fed’s Bostic also speaks on Tuesday. The week’s most significant release will be July CPI on Wednesday. We expect acceptably subdued data with gains of 0.2% overall and ex food and energy, though not as weak as seen in June.

Thursday sees a heavy data schedule, with the highlight being July retail sales. We expect a 0.2% rise overall as autos recover from a weak June, but 0.2% declines both ex autos and ex autos and gasoline to follow surprising strength in June. Due alongside retail sales are weekly initial claims, August’s Philly Fed and Empire manufacturing surveys and July import prices. July industrial production follows, and we expect a weak month to follow a strong June with a 0.7% decline overall and a 0.4% decline in manufacturing. Also due on Thursday are June business inventories and August’s NAHB homebuilders’ survey, while Fed’s Musalem and Harker are due to speak.

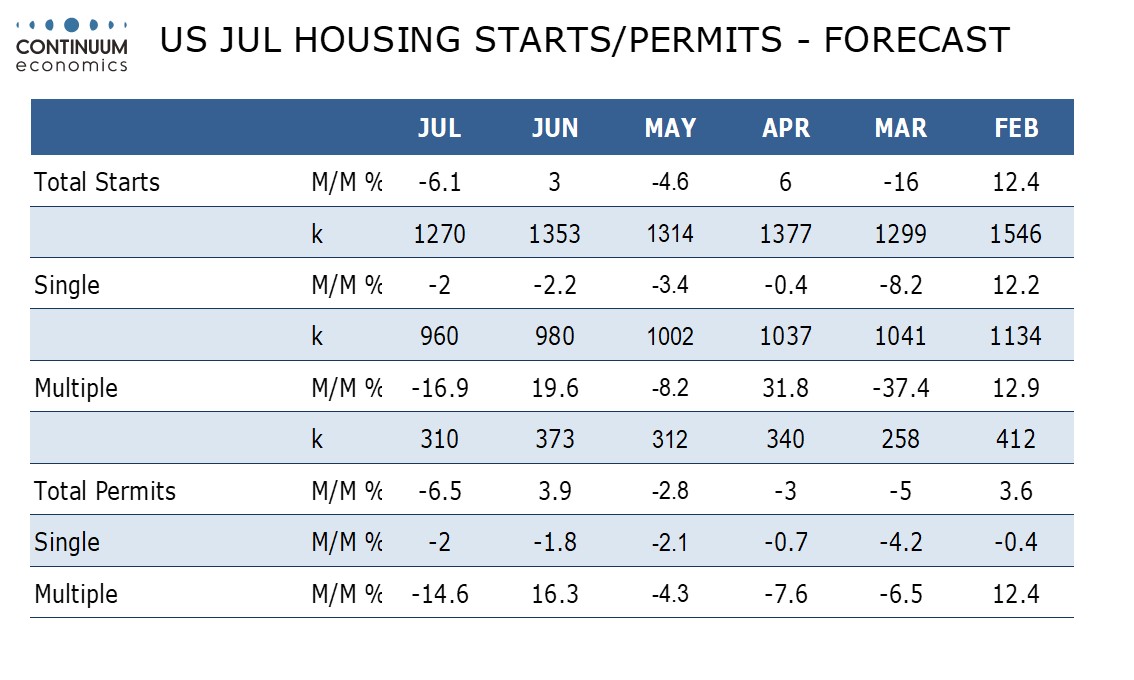

On Friday we expect July housing starts to fall by 6.1% to 1270k while permits fall by 6.5% to 1360k, both more than fully reversing June gains and providing further evidence that July was a softer month than June for activity. The preliminary August Michigan CSI follows, and will merit more attention than usual given recent volatility in equities after the weaker July employment report. Fed’s Goolsbee is also due to speak.

Canada

Canada releases June building permits on Monday, July existing home sales on Thursday and July housing starts on Friday. June wholesale sales are due on Thursday and June manufacturing shipments follow on Friday. Preliminary estimates were for declines of 0.6% and 2.6% respectively.

UK

Major data awaits with the July CPI (Wed). CPI inflation’s flirtation with the 2% target is likely to be short-lived. We see the rate rising back up to 2.3% in July from 2.0%, this projection being a notch below BoE thinking, but with the core edging down to 3.4% (Figure 1). The rise is solely due to energy base effects related to the Ofgem price cap changes. The day before sees key labor market data which may show a further rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested clearer slowing in private sector employment, if not an actual contraction. However, the average earnings figures will be the most closely watched. We see a more discernible slowing in both regular pay growth (3 mth mov avg) down to 5.3% and the headline rate down to around 4% on base effects. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing may be on the cards. Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Indeed, the jobs data conflict with the headline pick-up in recent GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted.

Headline and Core Inflation to Diverge Afresh?

Source: ONS, Continuum Economics

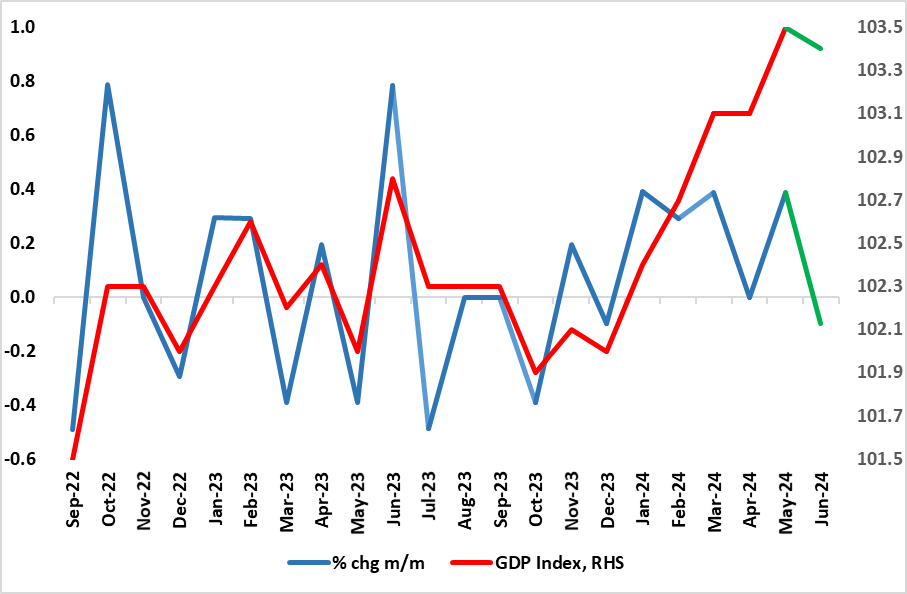

Thursday sees fresh GDP updates. Amid weaker retail sales, property transactions and car production data, we see a 0.1% m/m correction in the monthly June GDP data. But this will still leave Q2 GDP numbers (released alongside the monthly data) showing a 0.6% q/q rise after the 0.7% gain in Q1.

Clearer Recovery to Date?

Source: ONS, Markit CE, green is CE estimate

Finally, retail sales data (also Fri) may recover despite poor weather which was unsettled, wet and dull through July, with a circa-1% m/m reading. Otherwise, more consumer insight will come from GfK consumer survey numbers.

Eurozone

Datawise, the main interest will be the EZ industrial production data (Wed) which are likely to show some recovery for June but still imply a negative Q2. These will come alongside update flash GDP and employment numbers which we see being unrevised. EZ trade data may show more import weakness while the ZEW data may reflect recent soft data news already seen of late in Germany as well as stick market ructions.

Rest of Western Europe

There are some major data and policy events in the coming week. In Norway, the Norges Bank gives its latest verdict (Thu). It was always the very high likelihood that the thrust of then data and the Board’s clear caution would mean that the Norges Bank would leave its policy rate at 4.5% for a fourth successive meeting and this is what duly occurred in June. Perhaps more notable was that the it was more explicit in stressing ‘policy to stay on hold for some time ahead’, this rhetoric backed up formally with an updated policy outlook that sees no rate cut until early 2025, some three months later than hitherto. Another stable policy decision is likely this time, the question being whether stick market ruction and recent softer inflation data change the Bank’s tune.

Otherwise, flash GDP data for Q2 are due in Switzerland, with a likely sharp slowing to around 0.1% from the above-trend 0.5% Q1 outcome. Finally, in Sweden, Wednesday sees important CPI data, made all the more interesting by the below- expectation and below-target 1.3% outcome in June for CPI-ATE. We see a small rebound to around 1.5% in the July update.

Japan

GDP and PPI head the Japanese calendar next week. Q2 GDP will be released on Thursday, we expect a modest rebound in the second quarter as consumption is slowly picking up on stronger wage. PPI will likely linger below 1%.

Australia

The critical wage price index will be released on Tuesday. There was hawkish expectations for the RBA to further tighten and if wage ticks higher it may prompt a short term market reaction but that policy change is not our central forecast. We also have the employment data on Thursday. The Australian labor market has been steadily strong and we do not see any sign such would change.

NZ

The RBNZ decision will be out on Wednesday. Our central forecast remain no change to the policy decision with the current inflationary dynamics does not allow the RBNZ to change rate. The market is almost 50-50 on hold or cut and we only favour a cut in the next meeting.