FX Daily Strategy: N America, August 9th

NOK weakness looks out of line with yield spreads…

…so there may be scope for a sharp recovery

CAD weakness more in line with spread moves…

…but positioning suggests a strong employment report could trigger a squeeze

NOK weakness looks out of line with yield spreads…

…so there may be scope for a sharp recovery

CAD weakness more in line with spread moves…

…but positioning suggests a strong employment report could trigger a squeeze

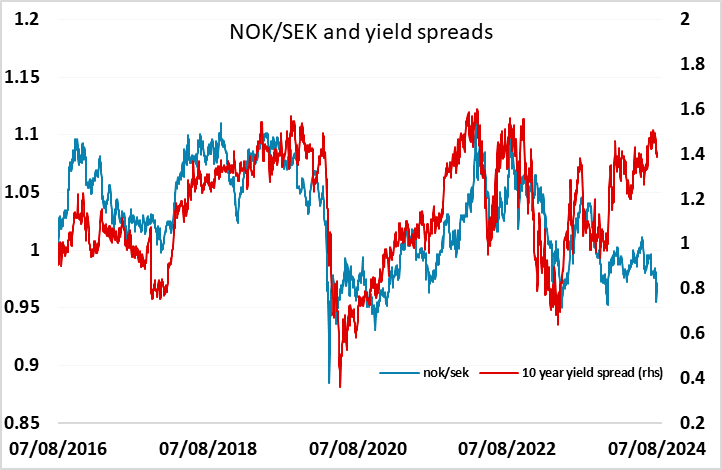

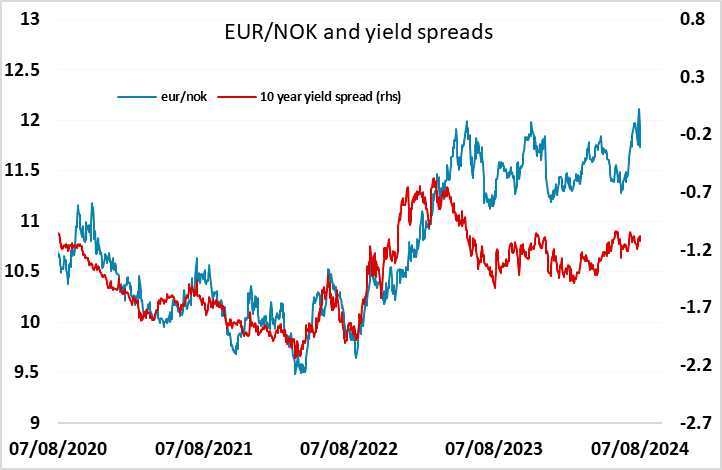

The NOK has been the weakest European currency through the last few weeks of risk aversion, but has been trading weak all year relative to the normal relationship with yield spreads. There had been a very strong and consistent correlation between NOK/SEK and yield spreads since 2016, but this has broken down, and NOK/SEK has been trading sub-parity through the year. The historic correlation of the NOK with the oil price broke down around the time of the pandemic, and EUR/NOK has also tended to move with yield spreads in the past couple of years, but made a new all time high this week (excluding the brief pandemic related spike in March 2020), even though yield spreads remain well above the lows of late 2023.

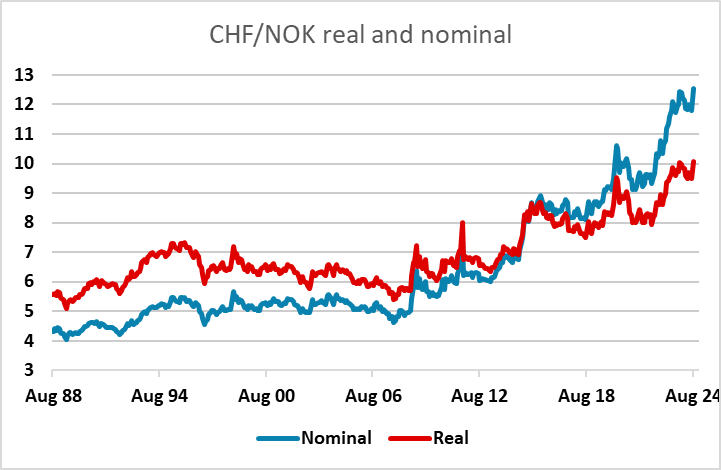

So while some of the weakness in the NOK in the last week appears to be related to risk aversion, its weakness over the last year is harder to explain. It may be that some of the decline is a reflection of previous strength. The NOK was the most expensive currency in the world in 2012, and has been declining since, and even now it is above PPP against the EUR and SEK, so this year’s weakness may be a valuation correction. But if so, it is strange that here hasn’t been a similar correction in the CHF, which has also been historically very highly valued. Both currencies have historically benefited from very large current account surpluses, and this is still the case. But the flow into the NOK from this surplus has for some years been mitigated by the government pension fund channelling most of its budget surplus into foreign assets. The same is not true of the CHF, but the SNB has been intervening to weaken the CHF in the last couple of years, and has indicated a willingness to do so again.

Norwegian CPI has come in very marginally softer than expected, with the 0.5% m/m gain in the headline slightly below the 0.6% consensus, but the y/y rate and the core m/m rate all in line with market expectations. EUR/NOK initially dipped a couple of figures in response but has quickly returned to pre-data levels. However, the mildly risk positive tone seen overnight suggests that there is some upside scope for the NOK after its recent weakness, with CHF/NOK still looking the most clear-cut candidate for declines.

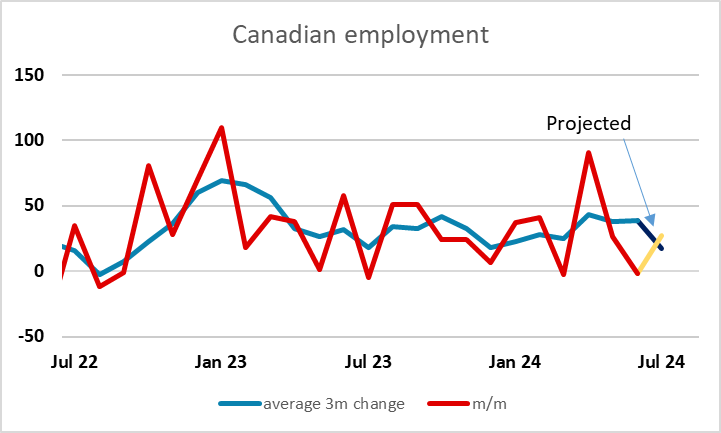

The Canadian employment report has been choppy on a m/m basis, but has been fairly consistent on a 3 month average basis, showing a steady rise of around 35-40k, while the unemployment rate has also been showing a slow but steady increase. The market consensus of a 26.9k rise in July would mean a somewhat weaker 3 month average of 17k, while the consensus for another rise in the unemployment rate to 6.4% would represent a mild acceleration in the pace of increase. We would therefore see the risks as slightly to the strong side of consensus.

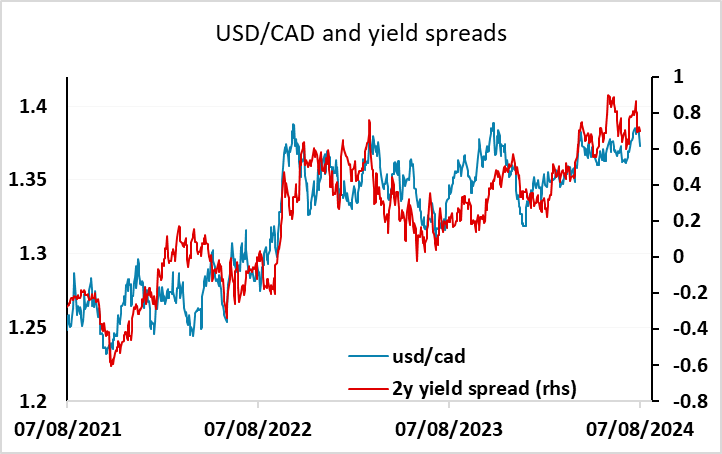

The CAD has managed a recovery through the week, after USD/CAD reached its highest since October 2022 at 1.3947 on Monday. Unlike the NOK, the decline of the CAD this year has broadly tracked the rise in yield spreads in favour of the USD, so there may not be much CAD upside on mildly stronger data. However, the CFTC data indicate record speculative net short CAD positions in the futures market, so there may be scope for a sharp rise if we see a combination of positive risk sentiment and stronger employment trigger a position squeeze.