FX Daily Strategy: APAC, August 8th

Light Thursday calendar with US jobless claims the highlight

JPY still undervalued

NOK and CAD have potential to extend gains

Light Thursday calendar with US jobless claims the highlight

JPY still undervalued

NOK and CAD have potential to extend gains

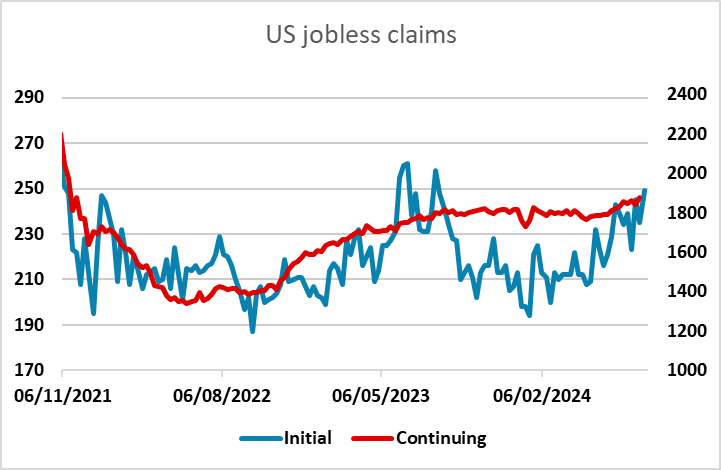

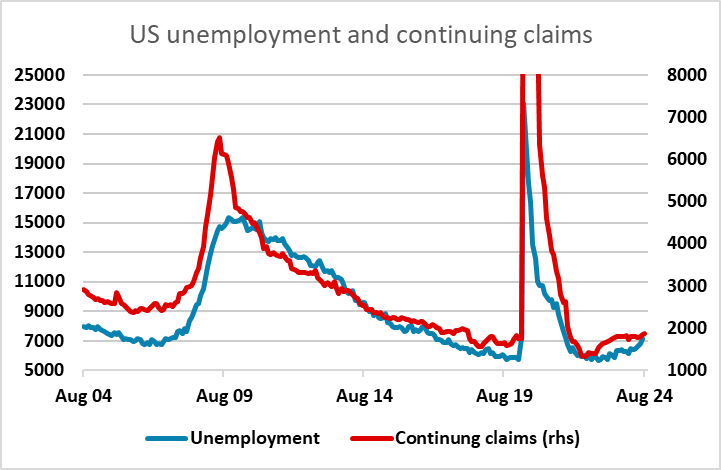

Thursday has another light calendar, with just the jobless claims numbers in the US and not much elsewhere. The jobless claims numbers will, however, be of interest given the weaker than expected employment data last week (and the lack of anything else to focus on). It’s certainly clear that the trend in claims has been deteriorating for some time, with continuing claims the highest since late 2021, and initial claims the most for a year. But the deterioration has nevertheless been quite modest, and something more dramatic may be necessary if the recession talk is to be taken seriously. Even so, the equity market is at levels that price in quite a robust rate of earnings growth, so the risks may still be on the equity market downside if we see the recent uptrend continuing, even modestly.

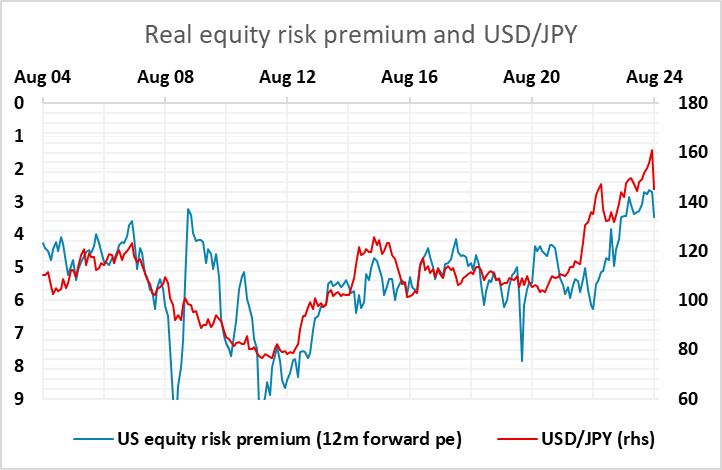

There was a risk recovery on Wednesday, due mainly to the comments from the BoJ deputy governor Uchida, who indicated that the BoJ wouldn’t tighten policy in unstable markets. We don’t see his comments as particularly significant in the longer term scheme of things, as the sort of sharp decline seen at the beginning of the week is not going to be seen very often, and we are very likely to have a more stable market by the September BoJ meeting. In any case, BoJ policy is only one factor in the recent risk sell off. The unexpectedly large tightening certainly contributed to triggering the sell off, as did the softer US employment numbers, but the impact was due more to the initial market pricing. Very high equity valuation and the (related) huge JPY undervaluation were always subject to correction. The JPY remains at very low levels, and the US equity market remains expensive, even after the moves of the last month, so we continue to favour further weakness in equities and further strength in the JPY medium term.

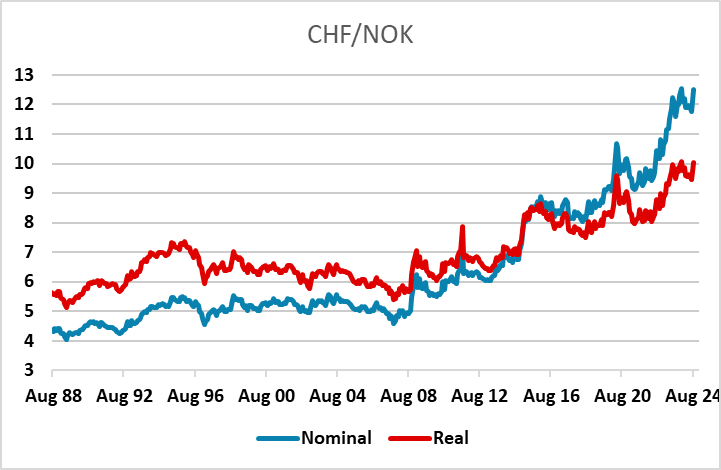

However, while the JPY remains extremely cheap, it is unusual because other safe havens are not cheap, and it is mostly the higher yielders that look undervalued. The NOK is the currency that looks the most out of line, having gone from being one of the most expensive currencies in the world in 2012 to hitting new all time lows against the EUR and CHF yesterday (excluding the brief pandemic spike). Wednesday saw some correction to this NOK weakness, but there looks to be scope for much more NOK strength, particularly against the CHF, if we see some stabilisation in risk sentiment.

The CAD also performed well on Wednesday, and may have potential for an extended recovery given the current high level of speculative net short positions evident in the CFTC futures data. While CAD weakness is to some extent justified by the moves in yield spreads we have seen in the USD’s favour, levels near 1.40 look extended from a long term valuation perspective.