FX Daily Strategy: Europe, August 7th

More choppy risk sensitive trading seen

JPY downside looks very limited given low level and still low risk premia

CHF strength may be overdone unless there is stronger evidence of recession risk

AUD and NOK weakness may be overdone; GBP more vulnerable

More choppy risk sensitive trading seen

JPY downside looks very limited given low level and still low risk premia

CHF strength may be overdone unless there is stronger evidence of recession risk

AUD and NOK weakness may be overdone; GBP more vulnerable

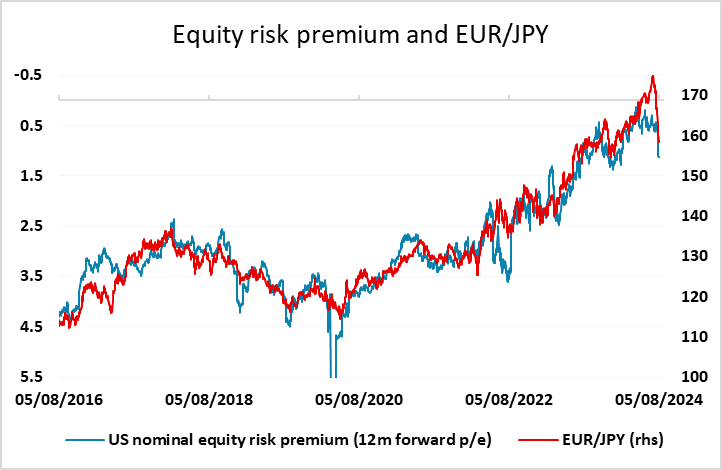

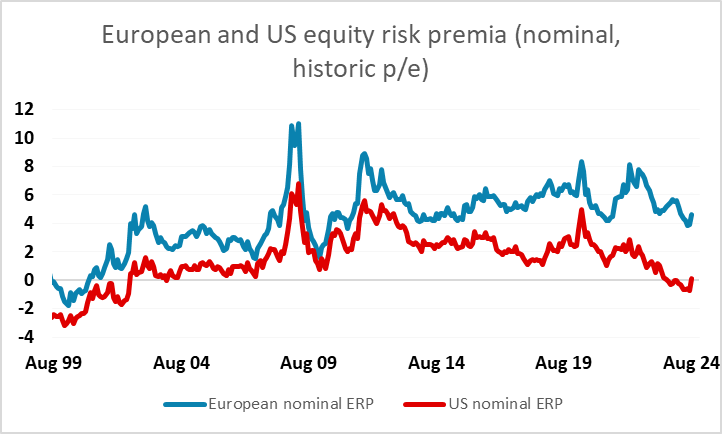

There is relatively little on Wednesday’s calendar, and certainly nothing that looks market moving, so the choppy tone that prevailed through Tuesday looks likely to continue. We continue to see the risks as being mainly towards a further deterioration in risk sentiment, not because the news has been particularly bad, but because the markets were starting from a position of significantly over-optimistic valuation. This is reflected in the low level of the US equity risk premium, and in the FX market, the extremely low level of the JPY.

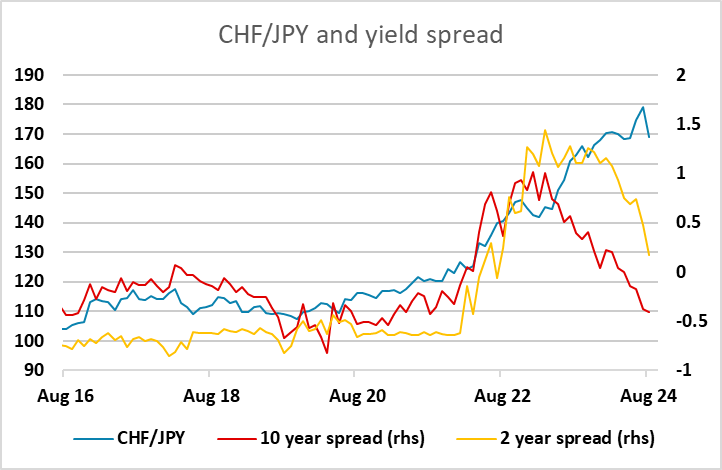

JPY weakness on the crosses has been highly correlated with the decline in equity risk premia, and in the last few weeks, the rise of the JPY has been highly correlated with the rise in risk premia. JPY overvaluation is more extreme than equity market valuation, as the correlation with equity risk premia doesn’t take account of the real depreciation of the JPY in recent years due to relatively low Japanese inflation. For now, the nominal correlation is a reasonable guide to the likely JPY path, but the real weakness of the JPY is a factor that makes it hard to see a significant JPY decline from here, even if we do see a recovery in risk sentiment. This is best illustrated by the extreme valuation in CHF/JPY, which isn’t distorted by differing inflation as Swiss and Japanese inflation have been similar. CHF/JPY is still up 45% in the last four years, even after the recent JPY rally, and has little support from yield spreads.

As far as the equity risk premium is concerned, we were always sceptical that such a low risk premium was justified when the US was at full employment, and consequently unlikely to see above trend profit growth. While there might have been some scope for profit growth to be boosted by earnings from outside the US, it still looks a stretch to justify such a low risk premium. The risks therefore should be towards further declines in the risk premium and further strength in the JPY.

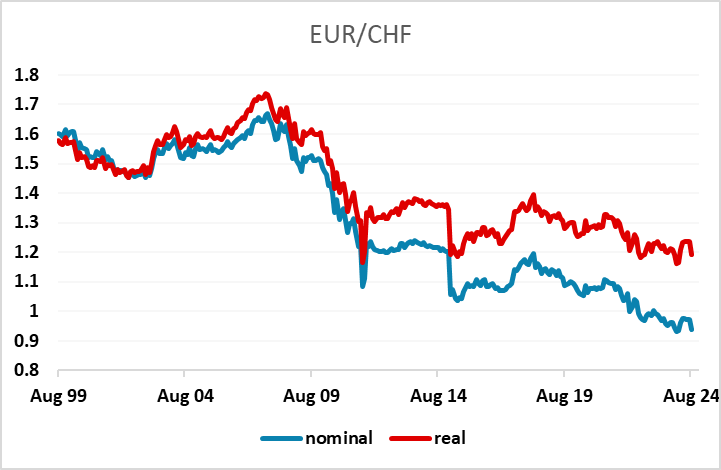

However, the case for other safe havens to benefit, and for riskier currencies to weaken, is less clear. JPY valuation is extremely weak and the JPY correlation with risk premia is clear, but not all risky currencies are highly valued, not all safe havens are cheap, and the correlation with risk premia is not as strong in other currencies as it is in the JPY. AUD/USD, for instance, tends to move with equity prices more than risk premia, which means that if risk premia fall because of lower US yields, the AUD can still make gains if lower yields prove supportive for equity prices. The CHF, as mentioned above, remains very strong, even in real terms, and is pressing all time highs against the EUR. Unless we see an actual recession, the case for further substantial CHF gains looks weak, especially since the SNB are clearly opposed to significant CHF strength.

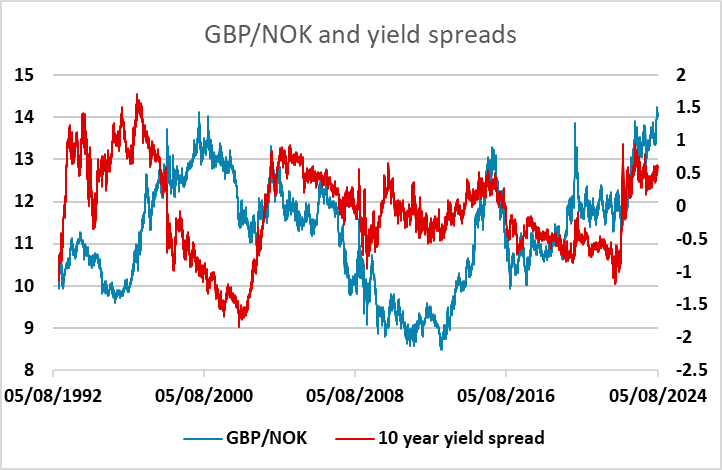

Among other currencies, the NOK is the highest yielder in Europe other than GBP, but is already at or close to all time lows against the EUR, GBP and CHF (excluding the pandemic spike). Given strong Norwegian fundamentals, it’s hard to argue for significant further weakness in the NOK, which is now lower relative to PPP than GBP, which is hard to justify given the relative fundamentals.