Fed SLOOS on Bank Lending mostly less negative

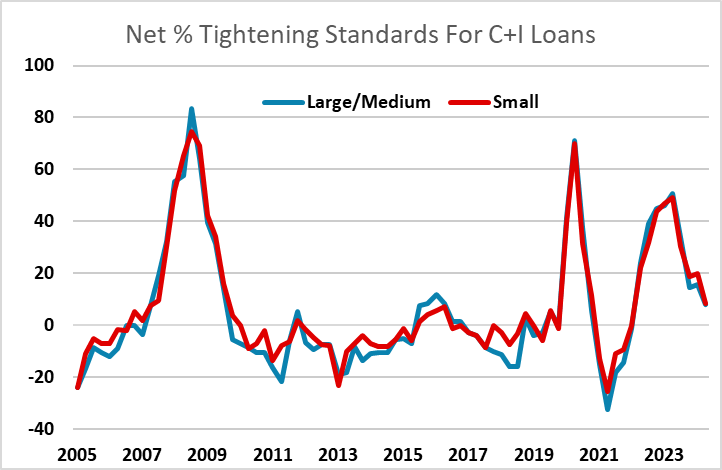

The Fed’s Q3 Senior Loan Officer Opinion Survey of bank lending practices has a less negative tone in terms of both supply and demand, suggesting limited downside risk to business investment. The year to date showed a less negative tone in Q1 relative to 2023, and while Q2’s findings were similar to those of Q1 the Q3 data is clearly less negative than Q2’s.

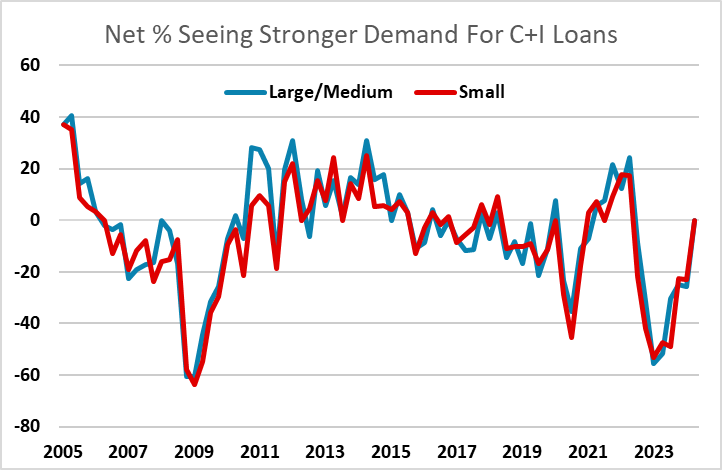

The net percentages tightening standards on C+I loans of 7.9% for medium and large businesses and 8.2% for small, compares with 15.6% and 19.7% in Q2 respectively. For both categories the net percentages reporting stronger demand were neutral at 0.0, compared to -26.6% for medium and large firms and -23.0% for small firms in Q2, breaking a string of seven straight negative quarters.

For commercial real estate the percentage tightening standards declined only modestly and the percentages reporting stronger demand remained negative if a little less so. For mortgage rates there was a marginal easing in standards though the proportion reporting stronger demand remained negative, if a little less so. For consumer loans standards continued to tighten at a similar pace to Q2 though demand was less negative, and even marginally positive for credit cards.

For commercial real estate the percentage tightening standards declined only modestly and the percentages reporting stronger demand remained negative if a little less so. For mortgage rates there was a marginal easing in standards though the proportion reporting stronger demand remained negative, if a little less so. For consumer loans standards continued to tighten at a similar pace to Q2 though demand was less negative, and even marginally positive for credit cards.