FX Weekly Strategy: August 5th-9th

Market to focus more on last week’s news than this

Scope for further USD losses

Risk currencies in particular depend in equity market performance

Strategy for the week ahead

Market to focus more on last week’s news than this

Scope for further USD losses

Risk currencies in particular depend in equity market performance

It’s a week of relatively little scheduled data, and the market will be more concerned with dealing with the reverberations from last week’s weak US employment report and the sharp declines in yields and equities that we have seen over the last couple of weeks.

July’s non-farm payroll was clearly weaker than expected with a 114k rise overall, 29k in net negative revisions, a 0.2% rise in average hourly earnings, a lower workweek and a surprisingly sharp rise in unemployment, to 4.3% from 4.1%. This triggered declines in US yields and equities, with the market now pricing in 40bps of easing in September – or a 60% probability of a 50bp cut against a 40% chance of a 25bp cut. We believe a 25bps move is still the most likely FOMC September action, but more weak data could put 50bps on the table, and CPI data would have to be alarmingly strong to keep the FOMC on hold.

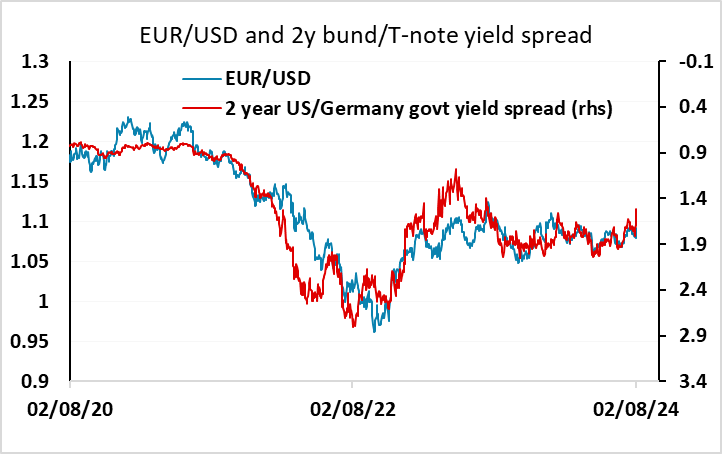

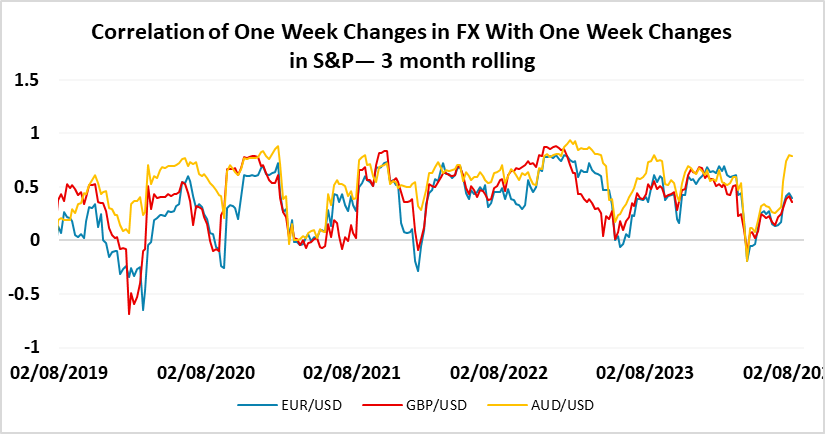

The USD fell back against the safe havens, notably the JPY, but was also weaker against the EUR, which moved above 1.09. From a pure yield spread perspective, EUR/USD has more upside potential, with the US/Germany 2 year spread having narrowed by around 30bps in the last week. However, the USD also tends to be resilient in periods of declining risk appetite, with EUR/USD having some positive correlation to equities. Yield spreads may move against the EUR from current levels, as there is scope for the market to price in more ECB easing, or reduce expectations of Fed easing, but even so, if equities stabilise there should be scope for the EUR to extend recent gains to 1.10.

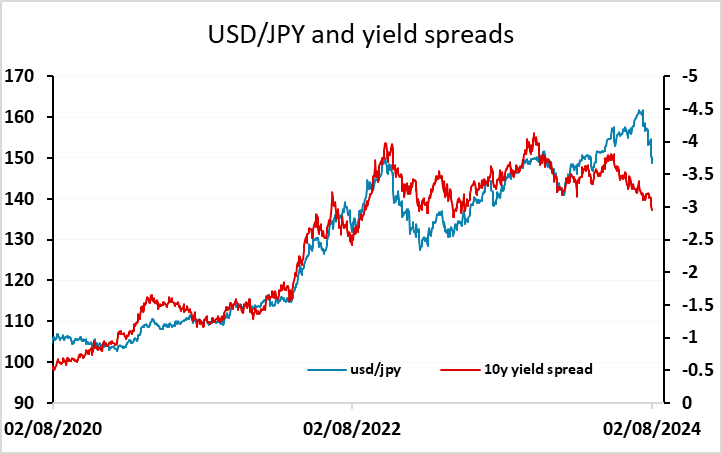

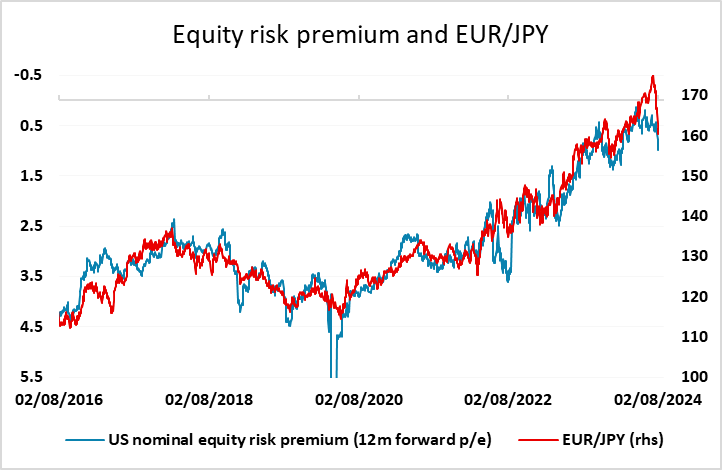

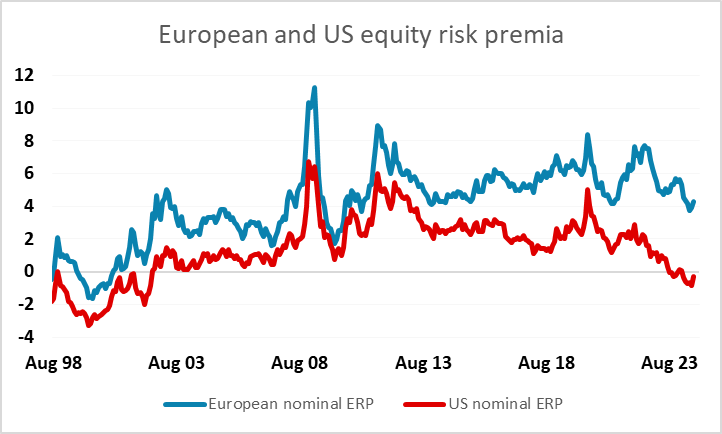

Yield spreads still suggest plenty of downside risk for USD/JPY, and rising risk premia also indicate scope for EUR/JPY to fall further, so the JPY would still be our preferred currency. Of course, there may be a correction to recent JPY strength if we get some stabilisation in equities, but JPY valuation is still extremely low against any fair value measure, so it’s hard to see any reversal of the JPY uptrend, and there are likely to be plenty of JPY buyers on any dip.

The commodity currencies have suffered most from the decline in risk appetite in the last week, but also have most potential to recover if we see some stabilization in equities. Yield spreads still look favourable for AUD/USD, and the NOK’s weakness against the EUR and SEK also looks hard to justify given current yield spreads. We see value in both the AUD and NOK, but whether it emerges this week will depend to a large extent on the performance of equity markets. It is important to realise that even with the decline in equities seen in the last week, US valuations remain very high, and there is plenty of scope for further declines if markets start to price in a less favourable earnings outlook. This is less true in Europe, where valuations are more normal, and this provides some support for a negative USD view.

Data and events for the week ahead

USA

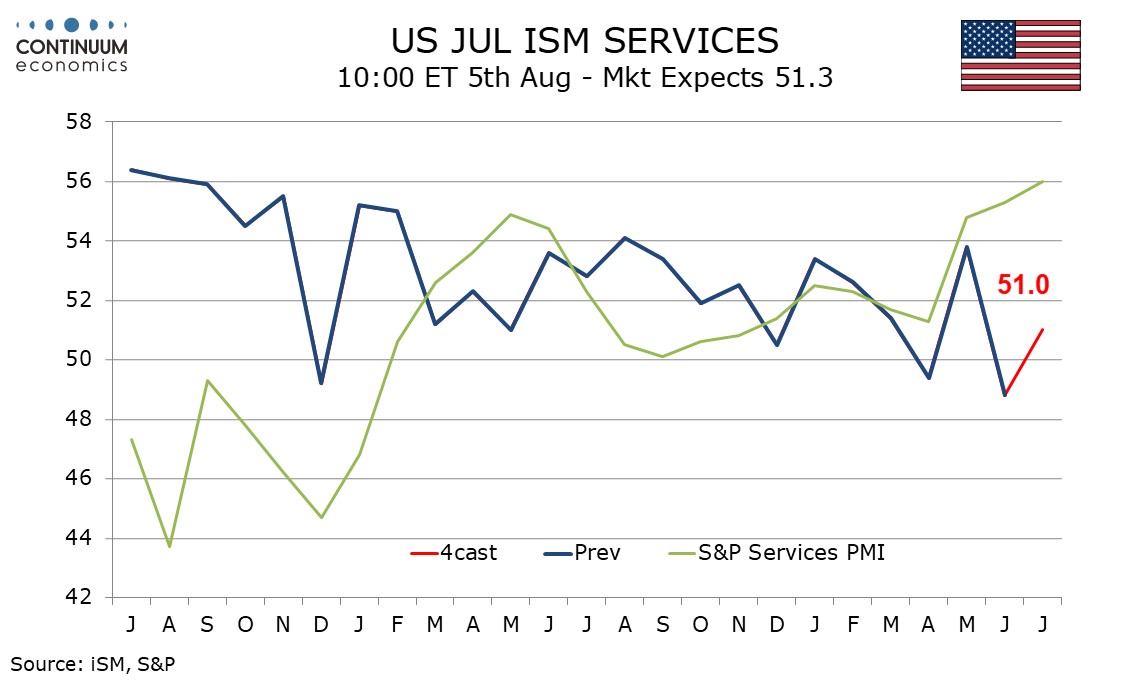

It is a quiet week for US data. On Monday we expect July’s ISM services index to see a modest increase to 51.0 from June’s weak 48.8. The Fed will release its quarterly Senior Loan Officer Opinion Survey, which will give a useful signal on business investment, which was surprisingly strong in Q2. Fed’s Daly will also speak on Monday. On Tuesday we expect June’s trade deficit to fall to $73.4bn from $75.1bn. Wednesday sees June consumer credit data. Thursday sees weekly jobless claims and June wholesale trade, while Fed’s Barkin will speak. Friday sees no significant US releases.

Canada

Canada releases June trade data and July’s S and P services PMI on Tuesday. July’s Ivey manufacturing PMI is due on Wednesday, as well as minutes from the July 24 Bank of Canada meeting which delivered a 25bps easing. The week’s most important Canadian release will come on Friday with the July employment report, which will be following subdued data for June.

UK

There is precious little for markets to digest this week save for the RICS housing survey (Thu) which will be examined for any more signs of recovery. Otherwise, the BoE issues a report on its APF (Tue).

Eurozone

Datawise, it is not a very busy week for more high-profile survey numbers, Admittedly, there may be more weak retail sales (Tue) and PPI (Mon) numbers which may be followed by more construction sector weakness in the sector PMI numbers, these coming on Tuesday, ie after final PMI services survey data arrive (Mon). German industrial production (Wed) is likely to see perhaps a consolidation/bounce as may manufacturing orders numbers due two days earlier, both having plunged in the last set of data. Otherwise, we will be looking at official services production data, to see if they chime with the softer signal see in survey data for the sector.

Rest of Western Europe

There are key data in Sweden, production and orders numbers (Fri) which may give better insight into real economy trends. Finally, CPI data in Norway (Fri) should may see these July numbers remain below the Norges Bank’s projections which envisaging a rise to 3.7%% for CPI-ATE.

Japan

After the hawkish tilt from BoJ, inflationary data would carry more weight, especially with wage. We will have the labor cash earning on Tuesday, Aug 6, along with household spending which is critical on determining the recovery of consumption sentiment. Else, BoJ summary will be on Thursday and may help clarify the hawkish tilt from the July BoJ meeting.

Australia

The RBA decision will be out on Tuesday and we are forecasting no change to rate. The market has been hyping for a hike as higher CPI lingers which is quite unrealistic given the inflationary dynamics seems to be pointing towards more transitionary factors. Else, private inflation data is on Monday and some PMIs on Thursday.

NZ

The labor data will be out on Wednesday but we do not view it to be able to sway RBNZ’s decision. Relatively, RBNZ’s inflation expectation on Thursday may carry more weight yet we doubt it would be revised higher.