GBP flows: GBP slightly weaker after BoE rate cut

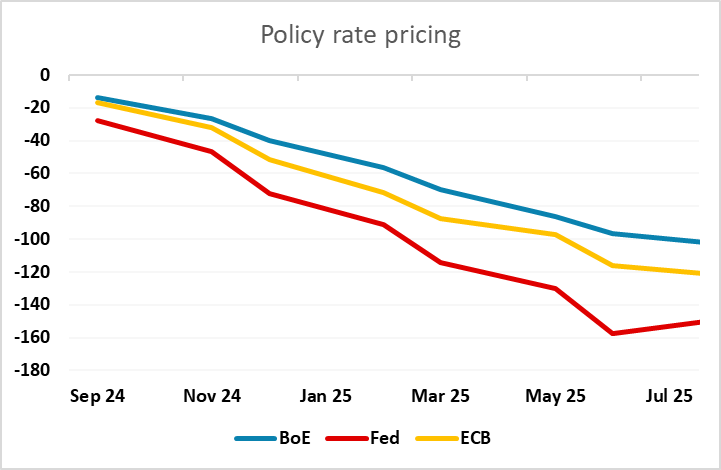

Boe cut rates as expected, but vote was close and statement and forecasts suggest pace of rate cuts will be similar to that priced in the market.

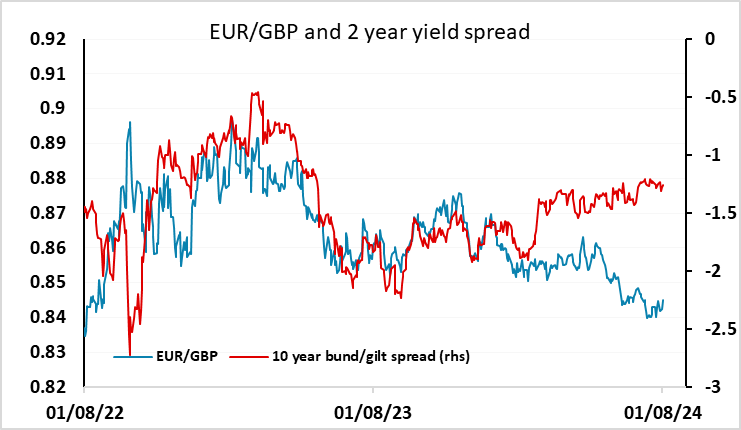

The BoE cut rates as expected by 25bps to 5%, but the vote was close at 5-4, and the impact on GBP has been modest, with EUR/GBP only just breaking the day’s high, rising around 10 pips on the news. The BoE forecasts suggest they broadly endorse the rate path priced in by the market, with the forecast inflation rates broadly on target for 2 years’ time and not dramatically changed from the May meeting, but suggesting a further decline in the 3 year of the forecast. As we have noted, GBP is trading on the strong side from a valuation perspective, and positioning looks significantly long, but sentiment seems positive since the election and some weaker UK data may be needed if we are to see a reversion towards longer term fair value which is likely several figures higher in EUR/GBP. As it stands, the relatively slow rate f UK rate cuts priced in by the market suggests GBP will remain well supported near term.