FX Daily Strategy: N America, August 1st

UK BoE MPC meeting the main focus

Rate cut expected and risks for GBP on the downside

EUR/USD likely to stay in range

Still plenty of downside risk for USD/JPY

UK BoE MPC meeting the main focus

Rate cut expected and risks for GBP on the downside

EUR/USD likely to stay in range

Still plenty of downside risk for USD/JPY

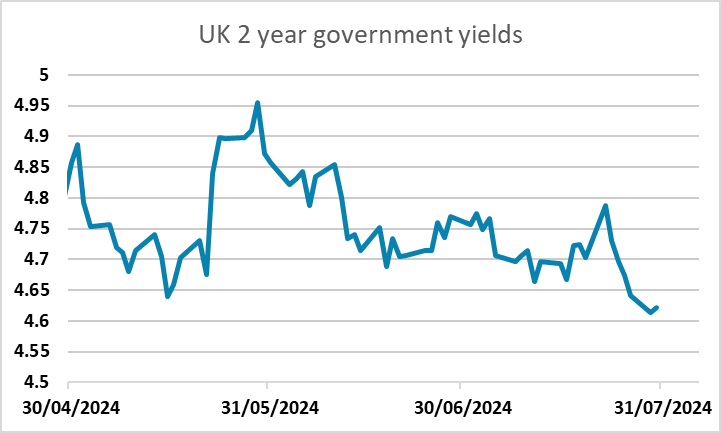

Thursday sees the August Bank of England MPC meeting, with the market currently pricing a cut in rates as a 65% chance, well up from only around 30% a couple of weeks ago. The increase in rate cut expectations doesn’t appear to have been triggered by any particular event, with UK data having been broadly in line with consensus, although the strength of GBP may have contributed, while the fact that 80% of economists surveyed by Reuters are forecasting a cut may also have had an impact.

We also think that the BoE will cut Bank Rate by 25 bp and that two further such cuts may arrive by end-year. We accept that stubborn services inflation may harden the hawks, despite softer wage pressures. But while the recent Bernanke Report recommended phasing out the so-called fan chart forecasts, their importance lingers, not least as they will again point to a clear undershoot of the 2% target on a sustained basis in the latter part of the forecast horizon. That such projected undershoots have not triggered rate cuts already is partly (to us) puzzling, not least as recent vintages have removed the projected upside risk to the undershoots. Instead, with the BoE underscoring that its allegiance to its target applies at all times, the fact that CPI inflation has been well above target has been the telling factor. But this is no longer the case and even amid modest upward revisions to growth projections, any rise from the current on-target inflation rate is still likely to be seen as temporary. Crucially in presentational terms, the move will be framed as making policy less restrictive.

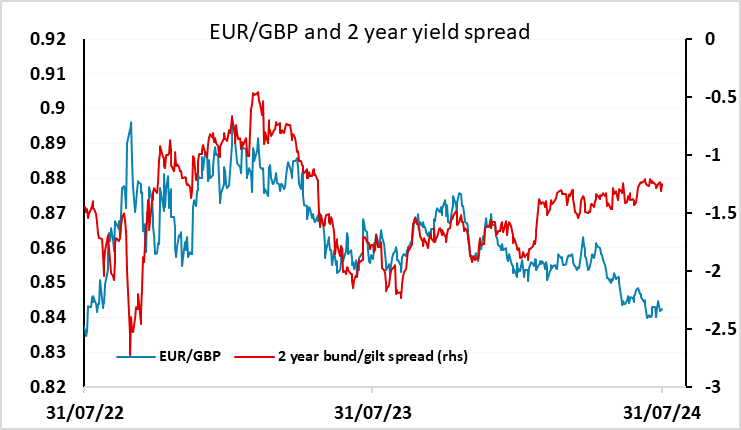

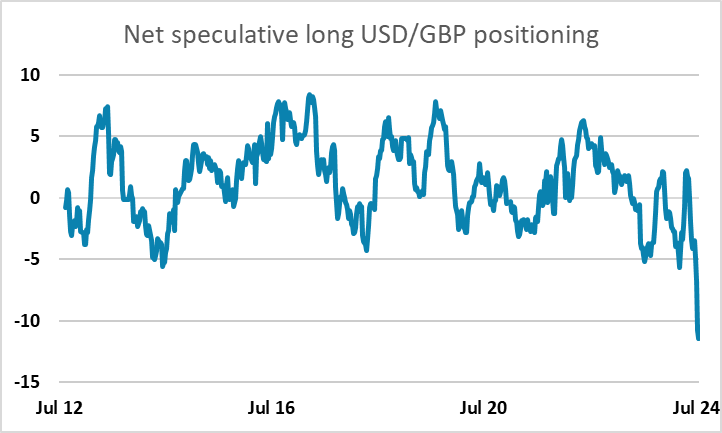

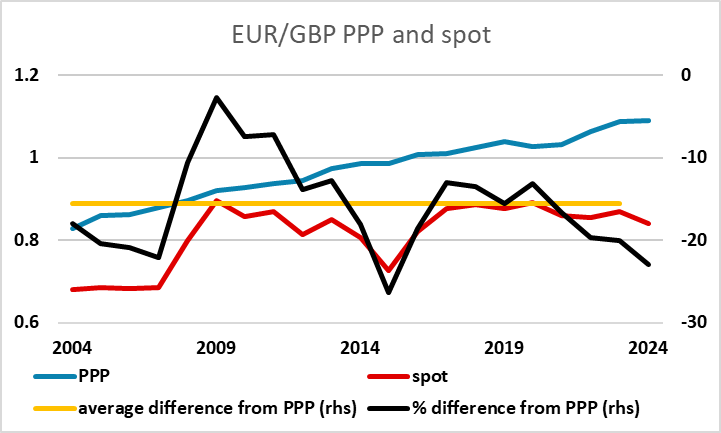

GBP looks a little vulnerable to a rate cut as the CFTC data shows net long speculative positioning in the futures market at record levels, while EUR/GBP has fallen in recent weeks even though yield spreads have, if anything, moved in favour of the EUR. Additionally, GBP is at its highest level against the EUR in real terms since before the Brexit referendum in 2015. Furthermore, if recent GBP strength is based on some optimism about growth prospects under the new Labour government, such optimism may have to be reined back given the indications that the government will be tightening fiscal policy more than expected. But with a rate cut seen as more likely than not, the knee-jerk negative GBP reaction will probably not be large, and we are unlikely to see pressure on 0.85 in the short term. A failure to cut rates might cause a knee jerk positive GBP reaction, but we suspect even this might be short lived as this will further curtail any optimism about the UK economy, and progress below 0.84 in EUR/GBP seems unlikely.

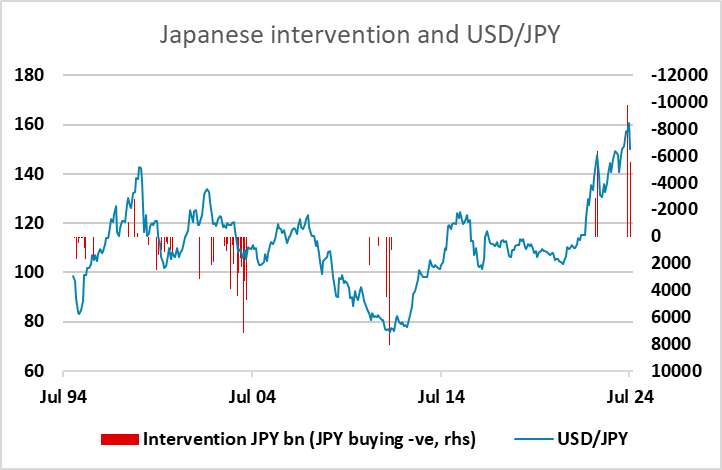

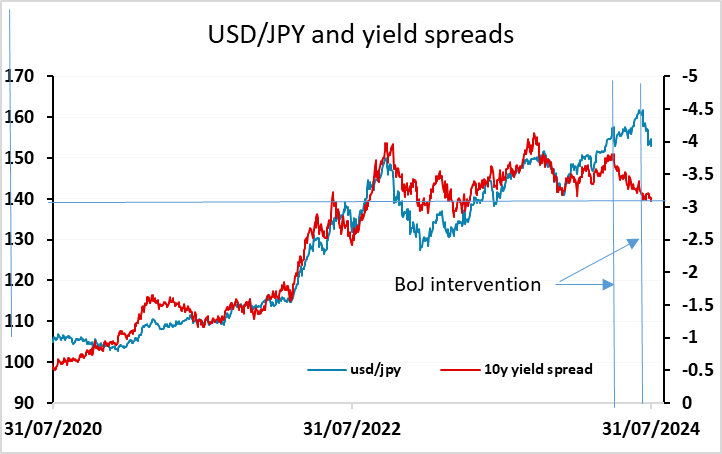

Otherwise, Thursday sees US ISM manufacturing survey, but the impact from this may be modest with the market more focused on the services sector and the employment report on Friday. Indeed, the focus on the labour market may mean there is as much interest in the weekly jobless claims numbers. We expect a July ISM manufacturing index of 49.0, slightly improved from 48.5 in June though still short of neutral. March’s 50.3 was the only reading to reach neutral since October 2022. From an FX perspective, EUR/USD still looks likely to remain fairly becalmed in the 1.08-1.09 area, with most of the potential for volatility in USD/JPY. We still see plenty of downside scope for USD/JPY after yesterday’s BoJ rate hike with indications of more to come and with rate cuts likely to come elsewhere, especially since yield spreads already suggest scope for USD/JPY down to 140, and real JPY weakness is even greater than the nominal USD/JPY level suggests. However, with USD/JPY down to the area where the BoJ first intervened back in 2022, we may see a pause.

Thursday being end of month means there are potentially significant flows to be seen around fixing times, but most models suggest little clear direction. However, this is not always predictable.