FOMC: September Easing on the Table but not a Commitment

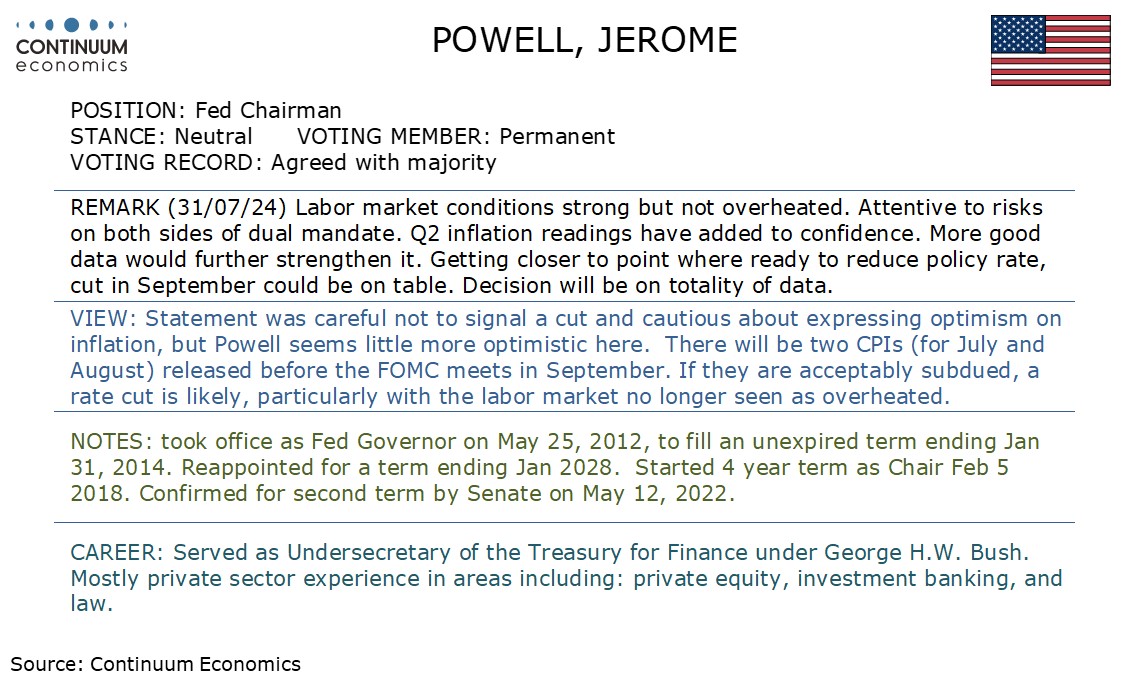

The FOMC statement made fairly subtle changes to the language on inflation, with more significant dovish shifts made in the language on employment. The Fed is not willing to signal that a September easing is a done deal. However the tone of Fed Chairman Jerome Powell’s press conference was generally optimistic, suggesting a September move is likely provided data does not surprise on the upside.

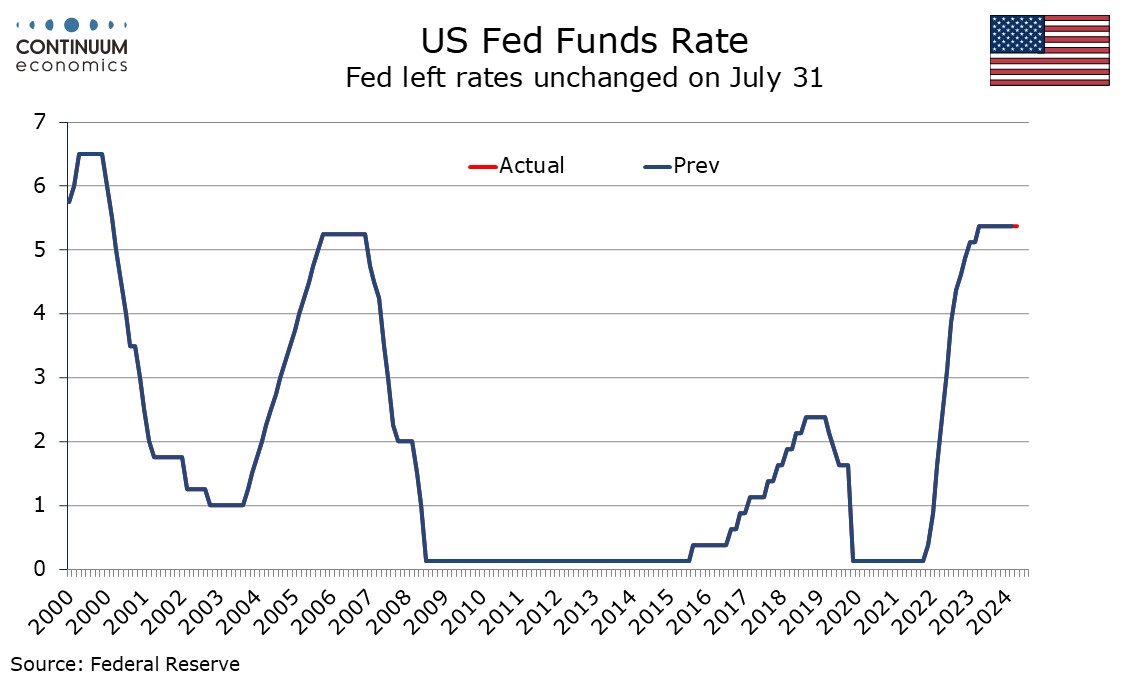

On employment, the FOMC statement changed its wording to state that job gains have moderated and that the unemployment rate has moved up, and went on to state that the Committee is attentive to risks on both sides of its dual mandate rather than highly attentive to inflation risks. On inflation however the adjustments were cautious, seeing it as somewhat elevated rather than simply elevated, and seeing some further progress toward the 2% rather rather than modest further progress. Most significantly, there was no change to the view that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. The decision to hold rates steady was unanimous.

Powell at his press conference saw the labor market as strong but not overheated, seeing conditions as similar to those before the pandemic which was not a time of problematic inflation. He stated that Q2 data had added to confidence on inflation and that more good readings would further strengthen it. He stressed that no decision had been taken on September’s meeting but a rate cut could be on the table. He also saw the progress on inflation as getting broader, no longer dependent on unsustainable disinflation on goods but with progress now being seen on services, both housing and elsewhere.

Powell at his press conference saw the labor market as strong but not overheated, seeing conditions as similar to those before the pandemic which was not a time of problematic inflation. He stated that Q2 data had added to confidence on inflation and that more good readings would further strengthen it. He stressed that no decision had been taken on September’s meeting but a rate cut could be on the table. He also saw the progress on inflation as getting broader, no longer dependent on unsustainable disinflation on goods but with progress now being seen on services, both housing and elsewhere.