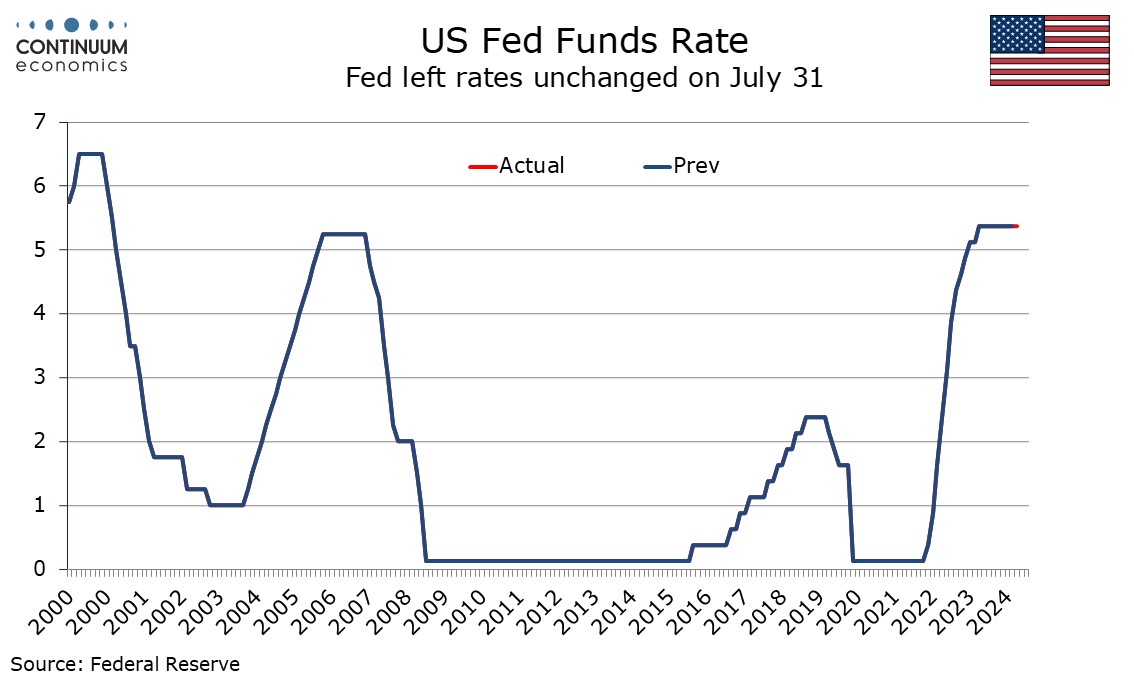

FOMC leaves rates unchanged, but statement gives more attention to employment risks

The FOMC has made some adjustments to its statement to signal that it is closer to cutting rates, but the key sentence that “the Committee does not expect it will be appropriate to reduce the target rate until it has gained greater confidence that inflation is moving sustainably toward 2%” remains intact. The most notable changes in the statement were signaling greater concern over risks to employment.

The statement does signal a more dovish line on employment. Instead of saying that job gains have remained strong and the unemployment rate has remained low it now says that job gains have moderated and the unemployment rate has moved up, though it still states the rate remains low. The adjustment on inflation is subtle, describing it as somewhat elevated rather than elevated, and states there has been some further progress toward the 2% inflation objective rather than modest further progress. It states that risks have continued to move into better balance rather than have moved. Consistent with the greater concern placed on employment, the FOMC now states that it is attentive to risks on both sides of its duel mandate rather than highly attentive to inflation risks.

The vote to leave rates unchanged was unanimous.