FX Weekly Strategy: Asia, July 29th- August 2nd

BoJ meeting may lead to short lived JPY dip

JPY still likely to rise strongly through the year

GBP risks on the downside on MPC meeting

USD might blip briefly higher after FOMC

Strategy for the week ahead

BoJ meeting may lead to short lived JPY dip

JPY still likely to rise strongly through the year

GBP risks on the downside on MPC meeting

USD might blip briefly higher after FOMC

The main events of a busy week are the FOMC meeting, the BoJ meeting, the BoE MPC meeting and the US employment report, with the preliminary July HICP data from the Eurozone and the Sintra central banking conference also potentially having an impact.

The BoJ meeting will be one of the biggest focuses. The market is currently pricing in around a 70% chance of a 10bp hike from the BoJ, along with the announcement of a reduction of around JPY1trn in JGB buying. While it is a close call, we see a rate hike as being delayed until September, and even though the reduced JGB buying may be even greater than the JPY 1trn expected, this may well trigger some initial JPY weakness. But we doubt JPY losses will last long or go far.

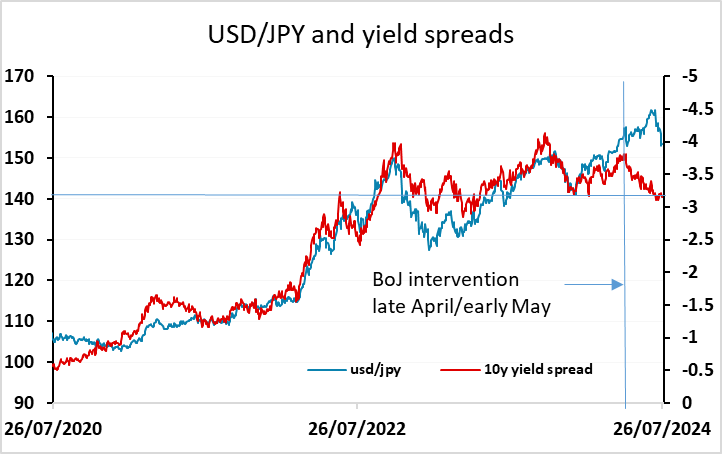

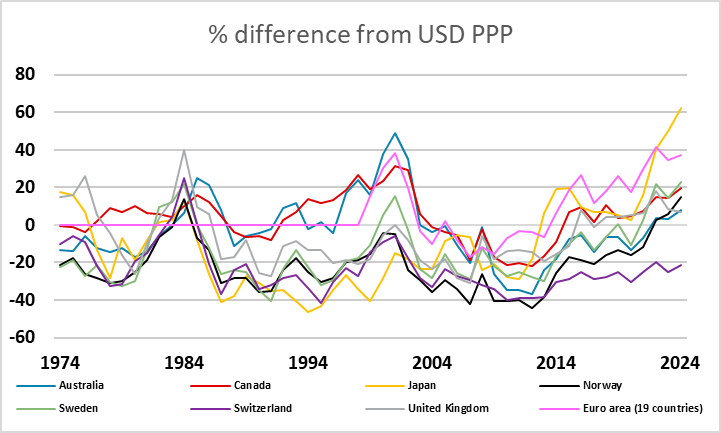

First of all, while widening yield spreads were the initial cause of the JPY decline over the last few years, thus year has seen the JPY weaken in spite of yield spreads moving in the JPY’s favour. This was particularly notable in May and June, and while the JPY’s recovery over the last few weeks has reversed the decline of the previous two months, the correlation with yield spreads still suggests further scope for JPY gains, and will continue to do so even if the BoJ leave rates unchanged. Secondly, relatively low Japanese inflation means that the JPY’s decline was even larger in real terms than in nominal terms. For USD/JPY to have stayed stable in real terms in the last 4 years, it would have to have fallen around 12% (to below 100) because of the larger rise in US prices over the period. Even after the recovery, the JPY remains the weakest any major currency has ever been relative to PPP against the USD.

So 10 bps or a couple of months here or there on the Japanese policy rate aren’t really significant in the greater scheme of things. The bigger picture JPY trend is turning, and although we may not see a more rapid JPY rise until we get a break of the 200 day moving averages in all the main JPY pairs (which held in the latest JPY rally), we expect there will be plenty of JPY buyers above 155 if there is a USD/JPY rally after the BoJ meeting. If the BoJ do hike, we may see a retest of the 152 area, but with a hike 70% priced in this may not be enough to break lower.

The BoE decision is priced as essentially a 50-50 call. It will certainly be a close call, with at least three of the nine MPC members (Mann, Haskel and Greene) near certain to vote against a cut, while two (Dhingra and Ramsden) look certain to vote for it. Chief economist Pill, deputy governor Broadbent and governor Bailey are consequently the uncertainties. Pill’s latest speech was seen by many as hawkish, and led some to conclude he would oppose a cut, but in our view his comments left his options open. The strength of GBP since the last meeting and the fact that the CPI central forecast was already below target in the May inflation report leads us to expect a cut.

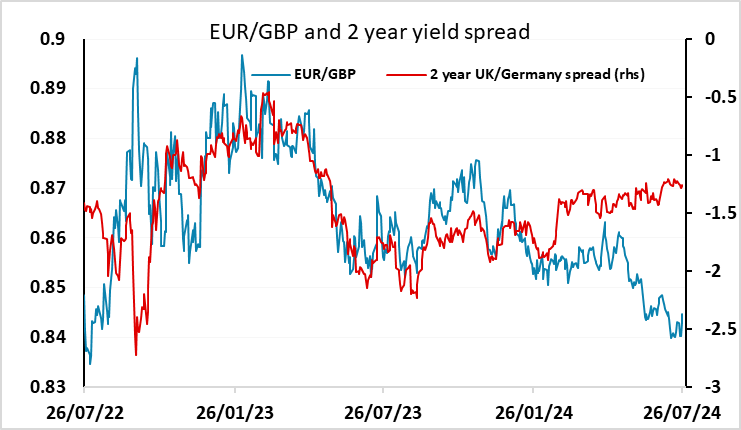

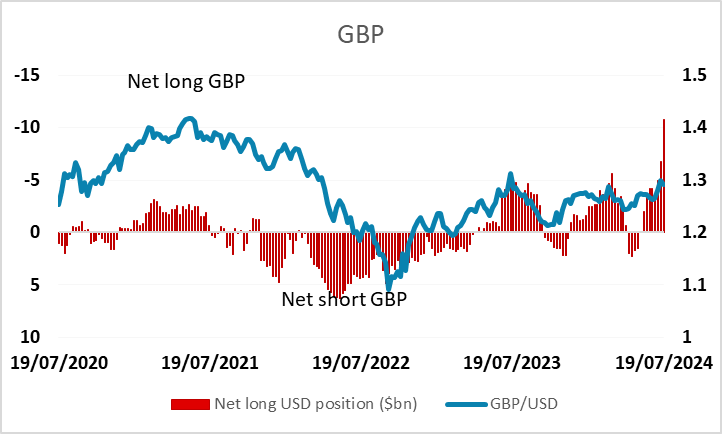

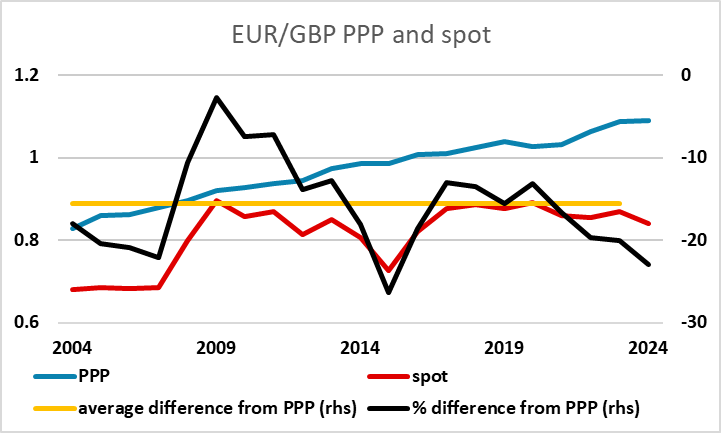

Recent strength in GBP suggests to us that there is more potential for GBP weakness on a cut than strength on a hike. CFTC positions data from COB on July 16 showed record net long speculative GBP positions in the US futures market, and EUR/GBP is both some way below the level already suggested by yield spreads and at the lowest level in real terms since 2015. A cut should see EUR/GBP back above 0.85, while no change in rates might only see a dip to test the recent lows below 0.84.

The FOMC meeting ought not to be too significant for the USD, but the risk may be that a lack of a clear commitment to cut rates in September will lead to some USD gains. The market is fully pricing a September rate cut, and it is unlikely the Fed will give a 100% clear signal that they will cut. If they could do that, it would be hard to see why they would not cut in July, as the recent article form former New York Fed president Bill Dudley suggested they should. The US employment report will obviously be significant as usual, and downside risks have increased not only because of some evidence of rising jobless claims but because Hurricane Beryl may have an impact. So any USD rally after the FOMC may not last into Friday’s data.

Data and events for the week ahead

USA

The key events for the US week ahead are Wednesday’s FOMC meeting and July’s non-farm payroll on Friday. Particularly after the healthy Q2 GDP gain, a change in rates from the Fed looks unlikely, but the statement is likely to contain adjustments in a dovish direction that leave the door open for easing in September. Powell at the press conference will however stress that any easing will be data dependent, particularly on inflation, but with employment reports also being eyed for signs of weakness.

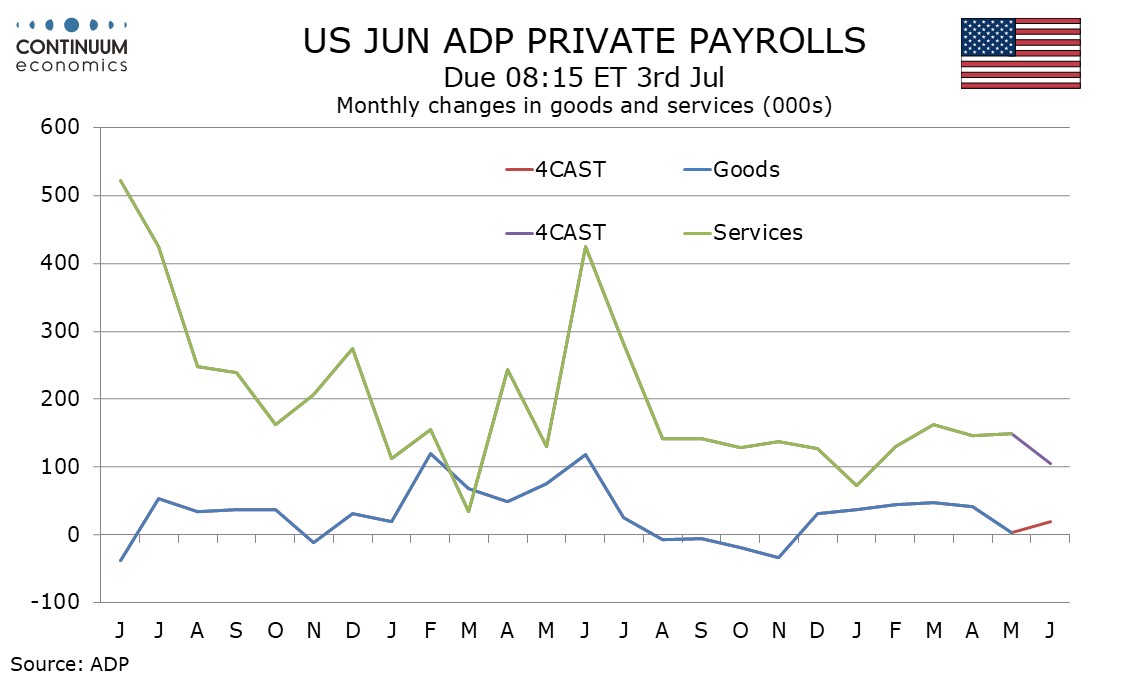

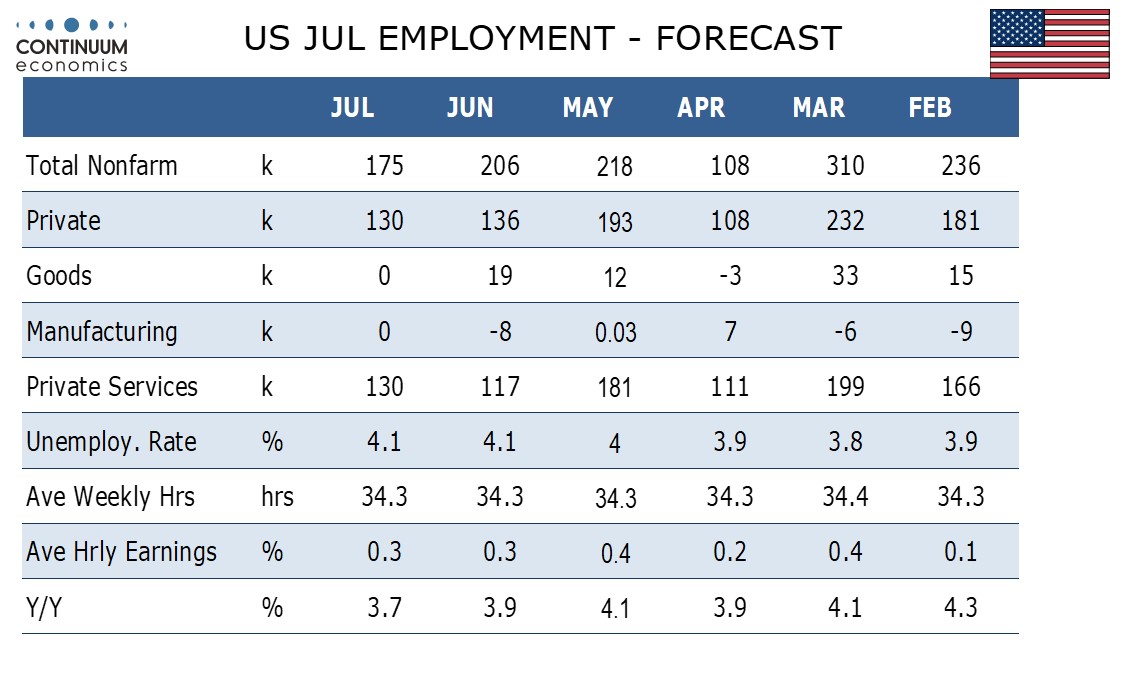

We expect a slightly slower 175k increase in the non-farm payroll, with the private sector adding 130k, with Hurricane Beryl adding to downside risk. We expect the unemployment rate to remain at 4.1% after three straight gains and average hourly earnings to increase by 0.3% for a second straight month. Ahead of the payroll we will see labor market signals in July consumer confidence and June’s JOLTS report on labor turnover on Tuesday. Wednesday sees July’s ADP report on private sector job growth, which we expect to rise by 130k, matching our private sector payroll forecast. Weekly jobless claims are due on Thursday.

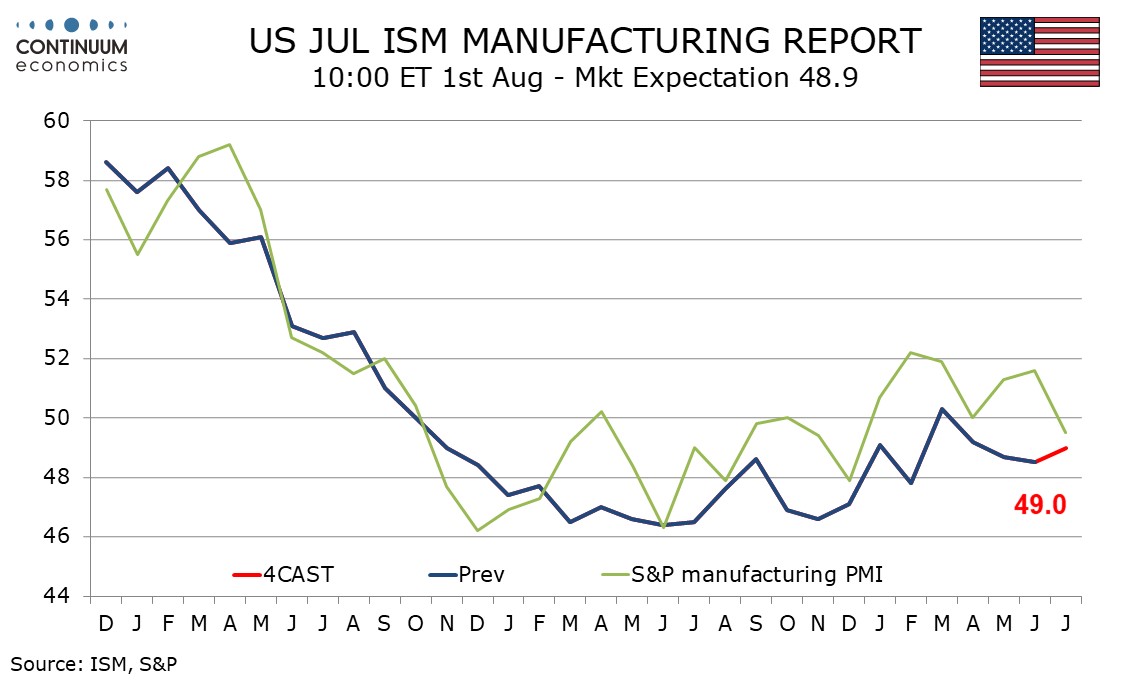

Wednesday sees Q2 employment cost data, where we expect a 1.0% rise, slower than Q1’s 1.2% but still above the pre-pandemic trend. Wednesday also sees July pending home sales, which were very weak in June. On Thursday we expect July’s ISM manufacturing index to increase to 49.0 from 48.5. June construction spending is also due. In addition to the non-farm payroll, Friday also sees June factory orders.

Canada

Canada’s most significant release comes from May GDP on Wednesday, where we expect a rise of 0.1%, in line with a preliminary estimate made with April data. On Friday July’s S and P manufacturing PMI is due.

UK

Having stressed that an assessment of the fiscal backdrop will be presented to parliament before the summer recess, Chancellor Reeves is expected to make this statement on Monday, also outlining the timing of the Budget and the next Spending Review. But the main event is monetary, with the BoE verdict due on Thursday. The May Monetary Policy Report (MPR) using market expectations of a 4.00% Bank Rate in 2 years produced clearly below-target CPI forecast both two and three years out. Admittedly this did not persuade the BoE to ease at that juncture, but we see a similar message being delivered in the looming August MPR, even amid an upgrade to the growth outlook. With this in mind we think this will result in a25 bp rate cut, but it will be a close vote with three dissents for definite, they more mindful for still resilience services inflation! The BoE also releases survey data from its so-called Decision Makers (Thu).

Otherwise, on Monday fresh BoE-compiled money and credit data that may be of increasing importance. Firstly, they will show the extent to which cash-strapped households are still turning to borrowing to fund everyday spending. Secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that has occurred of late, the question being to what extent is this adding to downward pressure on private sector credit.

Eurozone

Datawise, it is a very busy week for yet more high-profile survey numbers, GDP figures and inflation updates, the former two due Tuesday. PMI numbers point to a clear loss of GDP momentum being signaled into the Q3 and we think this will be corroborated in those survey numbers to be offered by the European Commission. As for GDP, with the ECB suggesting a pick-up to 0.4% q/q in Q2, we think that this is too high and doubt whether it will persist. Indeed, amid the 0.1% pace we envisage will be more national divergence with various country by country data also due the same day) and to a degree that downside real activity risks may be both increasing and materializing.

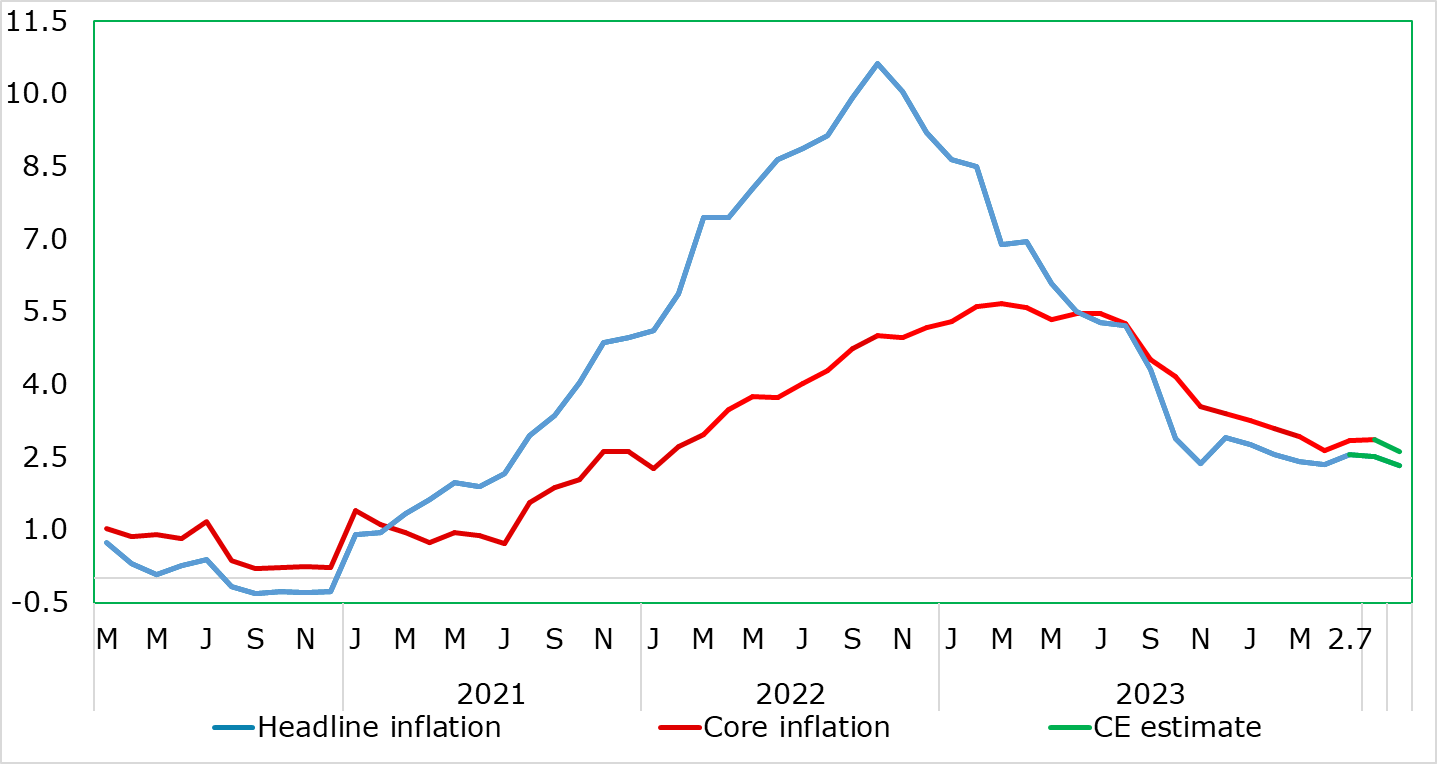

Headline and Core Falls Further?

Source: Eurostat, CE

Wednesday sees the HICP flash where more reassuring numbers and on a broad basis should emerge). Indeed, we see a 0.2 ppt drop in the headline to a three-year low of 2.3%, alongside a same-sized fall in the core to 2.7%, a 29-mth low. Instrumental in this will be some slowing in services inflation back to(ward) the April low of 3.7%. German HICP arrives the day before; headline inflation is seen stable at 2.5%. The week ends with EZ unemployment numbers on Friday where a small rise is envisaged amid still rising labor supply,

There is much ECB wise. Not only is there the minutes/account of this month’s rate-cutting Council meeting but there is also the annual and often-influential central banking conference in Sintra (Mon to Wed). This will include appearances from ECB Lagarde, Lane and Fed Chair Powell.

Rest of Western Europe

There are key events in Sweden, with (expected again to be weak but still slightly positive) monthly GDP indicator data (Fri). More notable will be survey data (Tue) with the Economic Tendency numbers. Switzerland sees CPI data (Fri) with a stable 1.3% headline reading envisaged and a result consistent with a possible undershoot of SNB thinking.

Japan

The BoJ meeting will be concluded on Wednesday. Our central forecast is the reduction in bond purchase to be around one trillion JPY and being accelerated to at most three trillion JPY in two years. We do not see a rate change in this meeting as the current inflationary picture does not allow the BoJ to take such an aggressive step. Else, retail trade on the same day will attract less interest but remain important to gauge consumer activity.

Australia

A busy calendar for Australia next week. Kicking off with retail sales on Tuesday, followed by CPI on Wednesday, Trade balance on Thursday and PPI on Friday. CPI would carry the most weight and would be tilting the current rhetoric of RBA which pushes back cutting expectations to at least the end of year. We believe there is a chance for CPI to moderate less or even a rebound in Q2, along with energy prices. Retail sales are also important if the consumption in Australia has shown signs of weakness and would be further confirmation.

NZ

Only tier two data, not of much relevance.